The Rise of the Trading Boss: Mastering the Markets and Leading the Way

In the dynamic world of finance, the term “trading boss” evokes images of seasoned professionals navigating complex market landscapes with confidence and authority. But what exactly does it mean to be a trading boss? It’s more than just executing trades; it’s about strategic thinking, risk management, leadership, and a relentless pursuit of knowledge. This article delves into the key attributes and skills that define a successful trading boss, exploring how they master the markets and inspire others along the way.

What Defines a Trading Boss?

A trading boss isn’t simply someone who makes profitable trades. They possess a holistic understanding of the financial markets, combined with exceptional analytical and decision-making abilities. Several key characteristics distinguish them:

- Strategic Vision: A trading boss develops comprehensive trading strategies aligned with their financial goals. They understand market trends, economic indicators, and geopolitical events, using this knowledge to formulate informed trading plans.

- Risk Management Expertise: Prudent risk management is paramount. A trading boss meticulously assesses and manages risk, employing tools like stop-loss orders and position sizing to protect their capital. They understand that preserving capital is as important as generating profits.

- Discipline and Emotional Control: The ability to remain disciplined and control emotions is crucial. A trading boss adheres to their trading plan, avoiding impulsive decisions driven by fear or greed. They understand that emotional trading often leads to losses.

- Analytical Prowess: Strong analytical skills are essential for interpreting market data and identifying trading opportunities. A trading boss uses technical analysis, fundamental analysis, and other analytical tools to make informed trading decisions.

- Leadership and Mentorship: A true trading boss inspires and mentors others. They share their knowledge and experience, guiding aspiring traders and fostering a culture of continuous learning.

- Adaptability: The financial markets are constantly evolving. A trading boss remains adaptable, adjusting their strategies to changing market conditions and embracing new technologies.

Essential Skills for Aspiring Trading Bosses

Becoming a trading boss requires a combination of hard and soft skills. Here are some essential skills to cultivate:

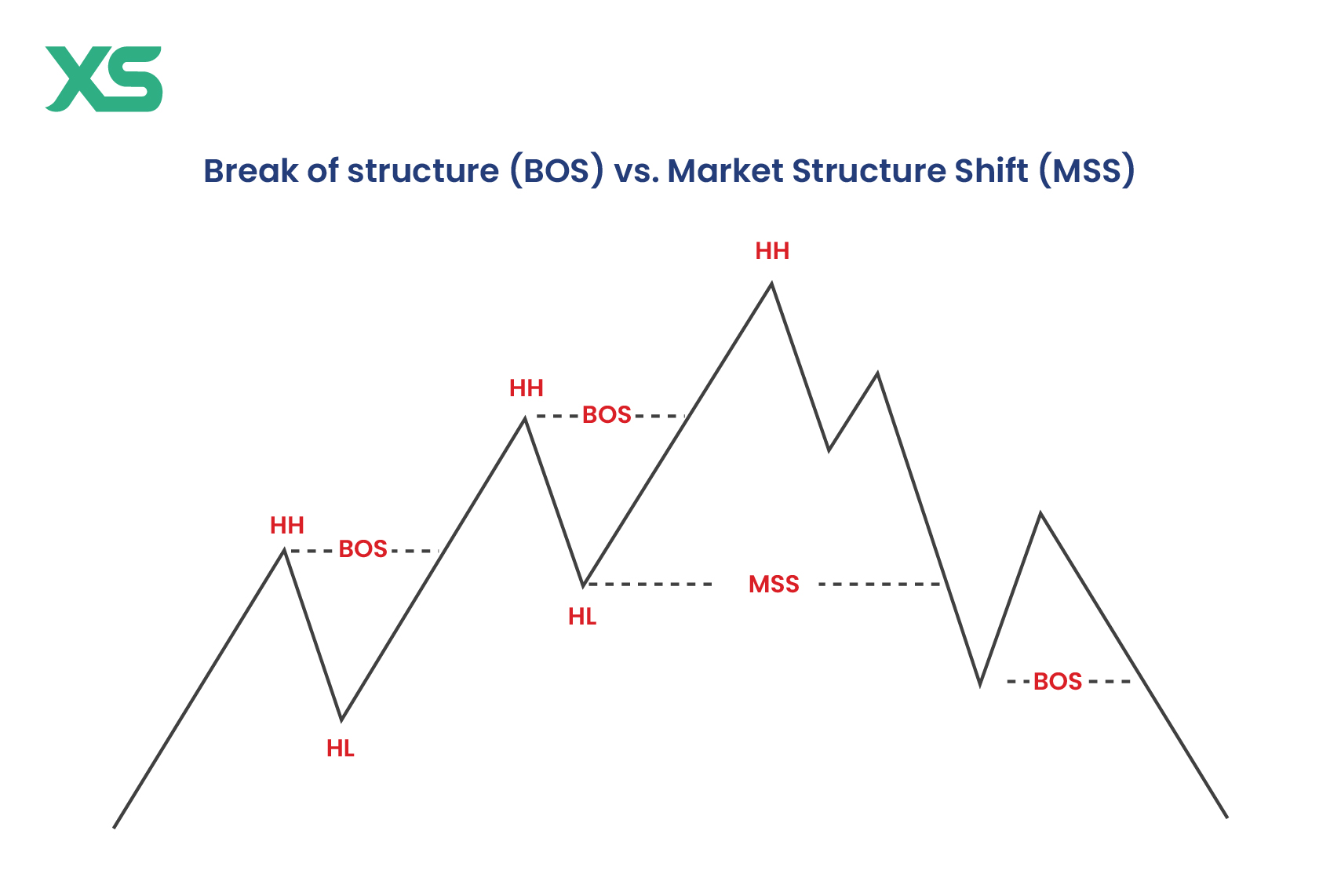

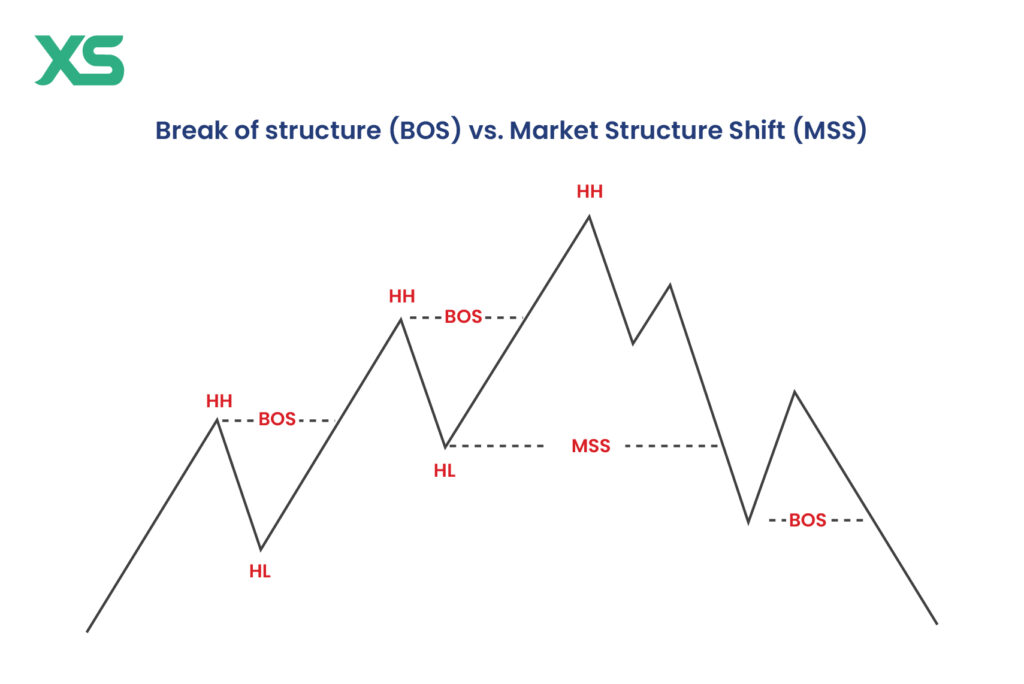

Technical Analysis

Technical analysis involves studying historical price charts and trading volume to identify patterns and predict future price movements. A trading boss uses technical indicators, chart patterns, and other technical tools to identify potential entry and exit points.

Fundamental Analysis

Fundamental analysis involves evaluating the intrinsic value of an asset by examining economic and financial factors. A trading boss analyzes financial statements, industry trends, and macroeconomic data to assess the long-term prospects of an investment.

Risk Management

Effective risk management is crucial for protecting capital and minimizing losses. A trading boss uses various risk management techniques, such as setting stop-loss orders, diversifying their portfolio, and managing position sizes.

Trading Psychology

Understanding trading psychology is essential for controlling emotions and making rational decisions. A trading boss develops strategies for managing fear, greed, and other emotions that can negatively impact trading performance.

Market Knowledge

A deep understanding of the financial markets is essential for identifying trading opportunities and managing risk. A trading boss stays informed about market trends, economic indicators, and geopolitical events that can impact asset prices.

Strategies Employed by Successful Trading Bosses

Successful trading bosses employ a variety of strategies to achieve their financial goals. These strategies often involve a combination of technical analysis, fundamental analysis, and risk management techniques.

Trend Following

Trend following involves identifying and trading in the direction of the prevailing market trend. A trading boss uses technical indicators and chart patterns to identify trends and enter trades when the trend is likely to continue.

Swing Trading

Swing trading involves holding positions for a few days or weeks to profit from short-term price swings. A trading boss uses technical analysis to identify potential swing trades and manage risk by setting stop-loss orders.

Day Trading

Day trading involves opening and closing positions within the same trading day to profit from small price movements. Day trading requires a high level of skill and discipline, as well as access to real-time market data and fast execution platforms. A trading boss who day trades has mastered these elements.

Position Trading

Position trading involves holding positions for several weeks or months to profit from long-term market trends. A trading boss uses fundamental analysis to identify long-term investment opportunities and manages risk by diversifying their portfolio.

The Importance of Continuous Learning for a Trading Boss

The financial markets are constantly evolving, so continuous learning is essential for staying ahead of the curve. A trading boss invests time in reading books, attending seminars, and following market news to stay informed about market trends and new trading strategies. They understand the importance of adapting to change and continuously improving their skills. The best trading boss is always learning.

Building a Trading Team: The Trading Boss as a Leader

Many trading bosses eventually build and lead their own trading teams. This requires strong leadership skills, including the ability to communicate effectively, motivate team members, and foster a collaborative environment. A successful trading boss creates a culture of continuous learning and encourages team members to share their knowledge and ideas.

Technology and the Modern Trading Boss

Technology plays a crucial role in modern trading. A trading boss leverages technology to access real-time market data, analyze market trends, and execute trades efficiently. They are proficient in using trading platforms, charting software, and other technological tools.

Ethical Considerations for a Trading Boss

Ethical behavior is paramount in the financial industry. A trading boss adheres to the highest ethical standards, avoiding insider trading, market manipulation, and other unethical practices. They understand that trust and integrity are essential for long-term success.

The Future of the Trading Boss

The role of the trading boss is likely to continue evolving as technology and the financial markets become more complex. The future trading boss will need to be even more adaptable, analytical, and technologically savvy. They will also need to be strong leaders and mentors, capable of building and managing high-performing trading teams. The essence of a trading boss remains constant, regardless of the market environment.

Conclusion: Becoming a True Trading Boss

Becoming a trading boss is a challenging but rewarding journey. It requires a combination of skill, knowledge, discipline, and leadership. By cultivating the essential skills, employing effective strategies, and embracing continuous learning, aspiring traders can rise to the challenge and become true trading bosses, mastering the markets and leading the way to financial success. Remember, a trading boss is not just a trader; they are a leader, a strategist, and a master of their craft. [See also: Risk Management for Traders] [See also: Mastering Technical Analysis] [See also: The Psychology of Successful Trading]