The Role of a Bond Bearer: Understanding Rights and Responsibilities

In the realm of finance, the term “bond bearer” refers to an individual or entity that possesses a bond certificate. Understanding the rights and responsibilities of a bond bearer is crucial for anyone involved in fixed-income investments. This article aims to provide a comprehensive overview of what it means to be a bond bearer, the associated privileges, and the obligations that come with it.

What is a Bond Bearer?

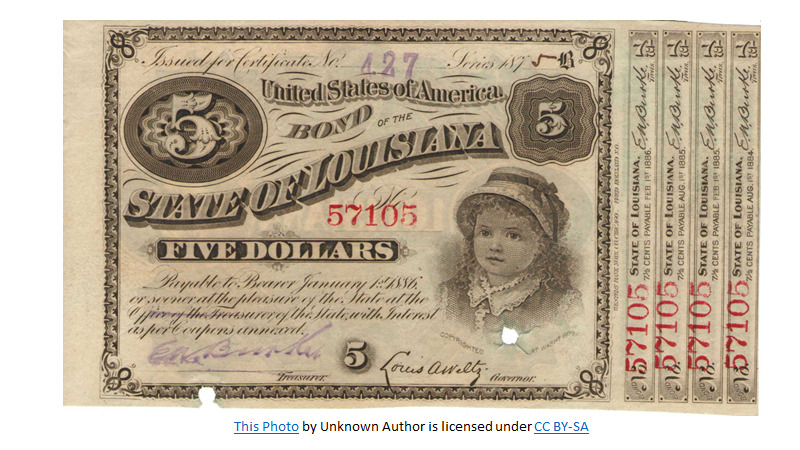

A bond bearer is the legal owner of a bond, evidenced by possessing the physical bond certificate, if it’s a bearer bond. Unlike registered bonds, where ownership is recorded by the issuer, bearer bonds confer ownership simply through possession. This means whoever holds the physical bond is considered the owner and is entitled to receive interest payments and the principal amount at maturity. Bearer bonds are less common today due to security concerns and regulatory requirements related to tracking ownership and preventing money laundering.

Types of Bonds

While the term “bond bearer” specifically applies to those holding bearer bonds, it’s helpful to understand the broader context of bond types:

- Bearer Bonds: As mentioned, ownership is determined by possession. Interest coupons are attached to the bond, which the bond bearer clips and presents for payment.

- Registered Bonds: Ownership is recorded with the issuer or a transfer agent. Interest payments are typically made directly to the registered owner.

- Zero-Coupon Bonds: These bonds are sold at a discount and do not pay periodic interest. The bond bearer (or registered owner) receives the face value at maturity.

- Corporate Bonds: Issued by corporations to raise capital. The rights of a bond bearer depend on the specific terms outlined in the bond indenture.

- Government Bonds: Issued by governments to finance public projects or manage debt. These are generally considered lower risk than corporate bonds.

- Municipal Bonds: Issued by state and local governments to fund public works. They often offer tax advantages to bond bearers.

Rights of a Bond Bearer

The primary rights of a bond bearer include:

Right to Interest Payments

The bond bearer is entitled to receive periodic interest payments as specified in the bond indenture. For bearer bonds, this involves clipping the interest coupons and presenting them for payment. For registered bonds, interest is typically paid directly to the registered owner.

Right to Principal Repayment

At maturity, the bond bearer has the right to receive the face value (principal) of the bond. This is the amount the issuer originally borrowed and promises to repay. The repayment process depends on whether the bond is a bearer bond or a registered bond.

Right to Transfer Ownership

One of the key features of bearer bonds is the ease of transfer. A bond bearer can transfer ownership simply by handing over the physical bond certificate. This contrasts with registered bonds, which require a formal transfer process.

Priority in Bankruptcy

In the event of the issuer’s bankruptcy, bond bearers typically have a higher claim on assets than stockholders. This is because bonds represent debt, while stocks represent equity. However, the actual recovery amount depends on the issuer’s assets and the terms of the bond indenture.

Responsibilities of a Bond Bearer

While being a bond bearer comes with certain rights, it also entails responsibilities:

Safeguarding the Bond Certificate

For bearer bonds, the bond bearer is responsible for safeguarding the physical bond certificate. Loss or theft of the certificate can result in financial loss, as possession is proof of ownership. Reissuing a lost bearer bond is often difficult or impossible.

Monitoring Issuer’s Financial Health

A prudent bond bearer should monitor the issuer’s financial health to assess the risk of default. This involves reviewing financial statements, news reports, and credit ratings. [See also: Understanding Credit Ratings for Bonds]

Understanding Bond Terms

The bond bearer should understand the terms of the bond indenture, including the interest rate, maturity date, any call provisions, and any covenants that restrict the issuer’s actions. This knowledge helps the bond bearer make informed investment decisions.

Tax Implications

Interest income from bonds is generally taxable. The bond bearer is responsible for reporting this income on their tax return. The tax treatment may vary depending on the type of bond and the jurisdiction.

Risks Associated with Bonds

Investing in bonds involves several risks that a bond bearer should be aware of:

Credit Risk

Credit risk is the risk that the issuer will default on its obligations to pay interest or principal. This risk is higher for bonds issued by companies with lower credit ratings. [See also: Assessing Credit Risk in Corporate Bonds]

Interest Rate Risk

Interest rate risk is the risk that bond prices will decline when interest rates rise. This is because rising interest rates make newly issued bonds more attractive to investors, causing the prices of existing bonds to fall. A bond bearer selling before maturity may experience a loss.

Inflation Risk

Inflation risk is the risk that inflation will erode the purchasing power of the bond’s interest payments and principal repayment. If inflation rises faster than the bond’s interest rate, the bond bearer will effectively earn a negative real return.

Liquidity Risk

Liquidity risk is the risk that the bond bearer will not be able to sell the bond quickly and easily without incurring a significant loss. This risk is higher for bonds that are not actively traded.

Call Risk

Call risk is the risk that the issuer will redeem the bond before its maturity date. This typically happens when interest rates fall, allowing the issuer to refinance its debt at a lower cost. A bond bearer facing a call may have to reinvest the proceeds at a lower interest rate.

The Decline of Bearer Bonds

Bearer bonds were once a popular investment vehicle, but their use has declined significantly in recent decades. This is primarily due to concerns about security and regulatory requirements. Bearer bonds are more susceptible to theft and fraud, and they make it easier to conceal ownership and evade taxes. As a result, many countries have phased out bearer bonds in favor of registered bonds.

Conclusion

Being a bond bearer involves both rights and responsibilities. The bond bearer is entitled to receive interest payments and principal repayment, but also bears the responsibility of safeguarding the bond certificate and monitoring the issuer’s financial health. Understanding the risks associated with bonds is crucial for making informed investment decisions. While bearer bonds have become less common, the fundamental principles of bond ownership remain relevant for anyone investing in fixed-income securities. A careful bond bearer understands the fine print and inherent risks.