The Three-Legged Retirement Stool: Is Your Retirement Strategy Stable?

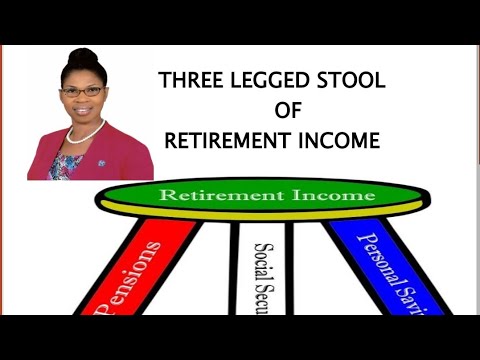

Planning for retirement can feel like navigating a complex maze. There are numerous factors to consider, from investment strategies to healthcare costs. A helpful framework for understanding retirement income sources is the concept of the “three-legged retirement stool.” This model traditionally represents Social Security, pensions, and personal savings as the three primary supports for a secure retirement. But in today’s evolving financial landscape, is this three-legged stool still a stable foundation for retirement security? Let’s delve into each leg and assess its current strength and reliability. Understanding the three-legged retirement stool is crucial for anyone planning their financial future.

Understanding the Traditional Three-Legged Stool

The three-legged retirement stool is a metaphor used to illustrate the primary sources of income for retirees. Each leg represents a different source of funds designed to support individuals throughout their retirement years.

Leg One: Social Security

Social Security is a government-sponsored program designed to provide a safety net for retirees. Workers contribute to the system throughout their careers, and upon retirement, they receive monthly benefits based on their earnings history. Social Security was initially intended to supplement other retirement income, not to be the sole source of support. However, for many Americans, it represents a significant portion of their retirement income.

The future of Social Security is a topic of ongoing debate. Demographic shifts, such as increasing life expectancies and declining birth rates, are putting pressure on the system. Potential changes to Social Security could include raising the retirement age, increasing payroll taxes, or reducing benefits. These possibilities highlight the need to consider other sources of retirement income.

Leg Two: Pensions

Pensions, also known as defined benefit plans, were once a cornerstone of retirement planning. In a traditional pension plan, employers guarantee a specific monthly payment to employees upon retirement, based on factors such as salary and years of service. However, the prevalence of pensions has declined significantly in recent decades. Many companies have shifted away from defined benefit plans to defined contribution plans, such as 401(k)s.

The decline of pensions has shifted more responsibility for retirement savings onto individuals. While defined contribution plans offer potential advantages, such as portability and investment flexibility, they also require employees to make informed investment decisions and manage their retirement savings effectively. The disappearance of pensions means the three-legged retirement stool is wobbling for many.

Leg Three: Personal Savings

Personal savings encompass a wide range of assets, including 401(k)s, IRAs, brokerage accounts, and other investments. This leg of the three-legged retirement stool is increasingly important as pensions become less common. The amount of personal savings needed for retirement depends on various factors, such as desired lifestyle, retirement age, and life expectancy.

Building adequate personal savings requires diligent planning and consistent saving habits. It also involves making informed investment decisions to grow savings over time. Diversification, risk management, and professional financial advice can all play a role in maximizing retirement savings. Relying solely on this leg of the three-legged retirement stool can be risky without proper planning.

The Evolving Retirement Landscape: Is a Three-Legged Stool Enough?

While the three-legged retirement stool provides a useful framework, the retirement landscape has changed considerably since the model was first developed. Factors such as longer life expectancies, rising healthcare costs, and economic uncertainty have made retirement planning more challenging. As a result, many experts argue that a three-legged stool may no longer be sufficient to provide a secure retirement. Some propose adding a fourth leg to the stool to account for these changes.

Adding a Fourth Leg: Healthcare Costs

Healthcare costs are a significant concern for retirees. Medical expenses can be unpredictable and substantial, potentially eroding retirement savings. A fourth leg of the retirement stool could represent strategies for managing healthcare costs, such as purchasing supplemental insurance, exploring long-term care options, and maintaining a healthy lifestyle. Ignoring healthcare costs can destabilize the entire three-legged retirement stool.

Other Considerations for a More Stable Retirement

Beyond the traditional three legs and the potential addition of healthcare, several other factors can contribute to a more stable retirement strategy:

- Working Longer: Delaying retirement can increase Social Security benefits, allow more time to save, and reduce the number of years retirement savings need to last.

- Downsizing: Reducing living expenses by downsizing a home or relocating to a more affordable area can free up additional funds for retirement.

- Part-Time Work: Engaging in part-time work during retirement can provide supplemental income and maintain social connections.

- Financial Planning: Working with a qualified financial advisor can help individuals develop a comprehensive retirement plan tailored to their specific needs and goals.

Strategies for Strengthening Your Retirement Stool

Regardless of whether you view retirement income as a three or four-legged stool, the key is to ensure each leg is strong and stable. Here are some strategies for strengthening each component of your retirement strategy:

Strengthening Social Security

- Understand Your Benefits: Review your Social Security statement to understand your estimated benefits at different retirement ages.

- Consider Delaying Benefits: Delaying Social Security benefits can increase your monthly payments.

- Coordinate with Your Spouse: If you are married, coordinate your Social Security claiming strategy with your spouse to maximize your combined benefits.

Strengthening Pensions (If Applicable)

- Understand Your Pension Plan: Review the terms of your pension plan to understand your benefits and options.

- Consider a Lump-Sum Distribution: Evaluate whether a lump-sum distribution or a monthly annuity is the best option for your situation.

- Seek Professional Advice: Consult with a financial advisor to understand the tax implications of your pension options.

Strengthening Personal Savings

- Save Early and Often: Start saving for retirement as early as possible and contribute consistently over time.

- Take Advantage of Employer Matching: If your employer offers a 401(k) match, contribute enough to receive the full match.

- Diversify Your Investments: Diversify your investment portfolio to reduce risk.

- Rebalance Your Portfolio: Periodically rebalance your portfolio to maintain your desired asset allocation.

- Consider Tax-Advantaged Accounts: Utilize tax-advantaged accounts, such as 401(k)s and IRAs, to reduce your tax burden.

Managing Healthcare Costs

- Research Medicare Options: Understand your Medicare options and choose a plan that meets your needs.

- Consider Supplemental Insurance: Explore supplemental insurance options, such as Medigap or Medicare Advantage, to cover expenses not covered by Medicare.

- Plan for Long-Term Care: Consider long-term care insurance or other strategies to finance potential long-term care needs.

- Maintain a Healthy Lifestyle: Maintaining a healthy lifestyle can help reduce healthcare costs in retirement.

Conclusion: Building a Resilient Retirement Strategy

The three-legged retirement stool remains a valuable framework for understanding retirement income sources. However, the evolving retirement landscape requires a more comprehensive and adaptable approach. By strengthening each leg of the stool, considering additional sources of income, and planning for potential challenges, individuals can build a more resilient retirement strategy and achieve financial security in their later years. Remember to regularly review and adjust your plan as your circumstances change. The goal is to create a retirement income strategy that can withstand market volatility, unexpected expenses, and the challenges of aging. Don’t let your three-legged retirement stool collapse. Plan wisely and secure your future.

[See also: Understanding Social Security Benefits]

[See also: Investing for Retirement: A Beginner’s Guide]

[See also: How to Calculate Your Retirement Needs]