Understanding Liquidity Preference: A Comprehensive Guide

In the world of economics, liquidity preference plays a crucial role in shaping interest rates and influencing investment decisions. It refers to the demand for holding money in its most liquid form – cash. This article delves into the intricacies of liquidity preference, exploring its underlying motivations, its impact on the economy, and its relevance in today’s financial landscape. Understanding liquidity preference is essential for investors, policymakers, and anyone seeking to grasp the dynamics of monetary policy and financial markets.

What is Liquidity Preference?

Liquidity preference, a concept developed by John Maynard Keynes, describes the desire of individuals and businesses to hold cash rather than other forms of assets that are less readily convertible into cash. This preference stems from the perceived advantages of having immediate access to funds, allowing for flexibility in unforeseen circumstances or the ability to capitalize on unexpected opportunities. In essence, liquidity preference is the willingness to forgo potential returns from investments in exchange for the security and convenience of holding cash. The strength of this preference influences interest rates, as lenders demand higher compensation for parting with their liquid assets.

Motivations Behind Liquidity Preference

Several key motivations drive liquidity preference:

Transaction Motive

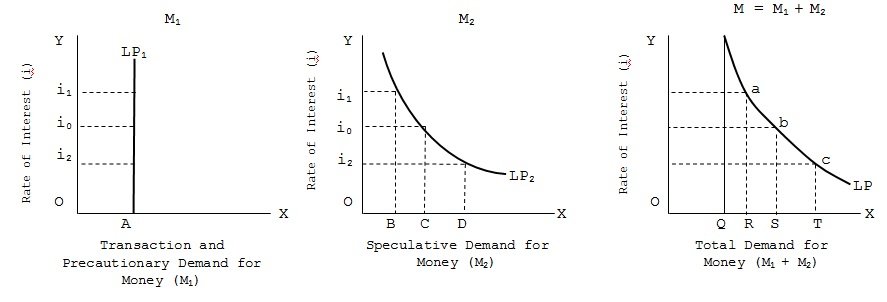

The transaction motive is perhaps the most straightforward. Individuals and businesses need cash to cover their day-to-day expenses, such as paying bills, purchasing goods and services, and meeting payroll obligations. The amount of cash held for transaction purposes typically correlates with income levels and the frequency of payments. For example, a business with high sales volume will likely maintain a larger cash balance to facilitate its transactions.

Precautionary Motive

Uncertainty is a constant in economic life. The precautionary motive reflects the desire to hold cash as a buffer against unexpected events, such as job loss, medical emergencies, or unforeseen business expenses. This motive is particularly strong during times of economic instability or heightened uncertainty. Individuals and businesses may choose to hold larger cash reserves as a safety net, even if it means foregoing potential investment returns. The precautionary demand for money is influenced by factors like risk aversion and the perceived likelihood of adverse events.

Speculative Motive

The speculative motive is driven by expectations about future interest rates and asset prices. Investors may choose to hold cash if they believe that interest rates are likely to rise or that asset prices are likely to fall. By holding cash, they can avoid potential losses from investing in assets that may decline in value and be ready to invest when prices are more favorable. This motive is closely linked to market sentiment and investor confidence. When investors are pessimistic about the future, they may prefer to hold cash, driving up liquidity preference. Conversely, when investors are optimistic, they may be more willing to invest in assets, reducing liquidity preference. [See also: Understanding Market Sentiment]

The Impact of Liquidity Preference on Interest Rates

Liquidity preference plays a crucial role in determining interest rates. According to Keynesian economics, the interest rate is the price of money, determined by the supply and demand for money. When liquidity preference increases, the demand for money rises, putting upward pressure on interest rates. Conversely, when liquidity preference decreases, the demand for money falls, leading to lower interest rates. Central banks can influence interest rates by managing the money supply. By increasing the money supply, they can lower interest rates, stimulating borrowing and investment. Conversely, by decreasing the money supply, they can raise interest rates, curbing inflation. The effectiveness of monetary policy depends on the responsiveness of liquidity preference to changes in interest rates. If liquidity preference is highly elastic (i.e., sensitive to changes in interest rates), monetary policy will be more effective. However, if liquidity preference is inelastic, monetary policy may have a limited impact.

Liquidity Preference and the Liquidity Trap

A liquidity trap is a situation in which monetary policy becomes ineffective because interest rates are already near zero, and further increases in the money supply fail to stimulate economic activity. In a liquidity trap, individuals and businesses are unwilling to invest or spend, even with lower interest rates, because they expect deflation or economic stagnation. They prefer to hold cash, regardless of how low interest rates fall, leading to a sharp increase in liquidity preference. This phenomenon can paralyze an economy, making it difficult for policymakers to stimulate growth. To escape a liquidity trap, governments may need to resort to fiscal policy, such as increased government spending or tax cuts, to boost aggregate demand. [See also: Fiscal Policy Explained]

Liquidity Preference in the Modern Economy

In today’s interconnected and rapidly evolving financial landscape, liquidity preference remains a relevant and important concept. Technological advancements, such as online banking and mobile payments, have made it easier for individuals and businesses to manage their cash balances and access funds quickly. This has potentially reduced the transaction demand for money, as people can easily transfer funds electronically. However, other factors, such as increased economic uncertainty and geopolitical risks, may have increased the precautionary demand for money. The rise of cryptocurrencies and other digital assets has also added a new dimension to liquidity preference. While these assets offer potential benefits, such as faster transactions and greater privacy, they also carry risks, such as volatility and regulatory uncertainty. Investors may choose to hold cash rather than cryptocurrencies if they perceive the risks to be too high. Understanding how these factors influence liquidity preference is crucial for policymakers seeking to manage the economy and maintain financial stability.

Factors Affecting Liquidity Preference

Several factors can influence liquidity preference, including:

- Interest Rates: As mentioned earlier, interest rates have an inverse relationship with liquidity preference. Higher interest rates make holding cash less attractive, as individuals and businesses forgo potential returns.

- Inflation: High inflation erodes the purchasing power of cash, reducing its attractiveness as a store of value. This can lead to a decrease in liquidity preference as people seek to invest in assets that can outpace inflation.

- Economic Uncertainty: During times of economic uncertainty, liquidity preference tends to increase as individuals and businesses seek the safety and flexibility of cash.

- Market Sentiment: Positive market sentiment can reduce liquidity preference as investors become more willing to take on risk and invest in assets.

- Financial Innovation: New financial products and technologies can impact liquidity preference by providing alternative ways to manage cash and make payments.

The Role of Central Banks

Central banks play a vital role in managing liquidity preference through monetary policy. By adjusting interest rates and the money supply, central banks can influence the demand for money and steer the economy towards its desired goals. For example, during a recession, a central bank may lower interest rates to encourage borrowing and investment, reducing liquidity preference and stimulating economic activity. Conversely, during periods of high inflation, a central bank may raise interest rates to curb spending and investment, increasing liquidity preference and cooling down the economy. The effectiveness of monetary policy depends on the central bank’s ability to accurately assess the factors influencing liquidity preference and to respond appropriately. [See also: Central Banking in the 21st Century]

Conclusion

Liquidity preference is a fundamental concept in economics that helps explain the demand for money and its impact on interest rates and economic activity. Understanding the motivations behind liquidity preference, such as the transaction, precautionary, and speculative motives, is crucial for comprehending how individuals and businesses make decisions about holding cash. By managing the money supply and influencing interest rates, central banks can influence liquidity preference and steer the economy towards its desired goals. In today’s complex and rapidly changing financial landscape, liquidity preference remains a relevant and important concept for investors, policymakers, and anyone seeking to understand the dynamics of monetary policy and financial markets. The interplay of these motives shapes the overall demand for liquidity and, consequently, influences the broader economic environment. Recognizing the significance of liquidity preference allows for better informed decision-making in investment strategies and economic policy formulation.