Understanding Liquidity Preference Theory: A Comprehensive Guide

In the world of economics, understanding how individuals and institutions manage their money is crucial. One key concept in this realm is the liquidity preference theory. This theory, developed by the renowned economist John Maynard Keynes, explains how people choose to hold their wealth in different forms, particularly cash versus other investments. This article will delve into the intricacies of liquidity preference theory, exploring its core principles, implications, and relevance in today’s financial landscape. The theory provides a framework for understanding interest rates and their impact on economic activity. The concept of liquidity preference theory is pivotal in understanding modern monetary policy.

What is Liquidity Preference Theory?

At its core, liquidity preference theory posits that individuals prefer to hold their wealth in the form of liquid assets, primarily cash. Liquidity, in this context, refers to the ease with which an asset can be converted into cash without significant loss of value. Cash is the most liquid asset, as it is readily available for spending and transactions. Keynes argued that this preference for liquidity influences interest rates, as individuals must be compensated for foregoing the convenience and security of holding cash.

The theory suggests that the interest rate is determined by the supply and demand for money. The supply of money is typically controlled by central banks, while the demand for money is driven by three primary motives:

- Transaction Motive: The need for cash to facilitate everyday transactions. People hold money to pay for goods and services.

- Precautionary Motive: The desire to hold cash as a buffer against unexpected expenses or emergencies. This is essentially a safety net.

- Speculative Motive: The decision to hold cash in anticipation of future investment opportunities or changes in asset prices. This motive is closely tied to expectations about interest rates and economic conditions.

The Three Motives Behind Liquidity Preference

Let’s examine each of these motives in more detail:

Transaction Motive

The transaction motive is perhaps the most straightforward. Individuals and businesses need money to conduct their daily affairs. The amount of money held for transaction purposes is generally proportional to income. As income increases, so does the demand for money to facilitate transactions. This is a fundamental aspect of liquidity preference theory.

Precautionary Motive

The precautionary motive reflects the inherent uncertainty of life. People hold cash as a safety net to cover unexpected expenses, such as medical bills, car repairs, or job loss. The level of precautionary demand for money is influenced by factors such as risk aversion and economic stability. In times of economic uncertainty, individuals tend to hold more cash as a precaution. This behavior directly impacts the demand side of liquidity preference theory.

Speculative Motive

The speculative motive is the most complex and arguably the most interesting. It arises from the belief that interest rates and asset prices are subject to change. Individuals who expect interest rates to rise or asset prices to fall may choose to hold cash in the short term, hoping to reinvest at a more favorable time. Conversely, if they expect interest rates to fall or asset prices to rise, they may be more inclined to invest their money. The speculative motive is heavily influenced by expectations and market sentiment. This motive is a key driver in the overall understanding of liquidity preference theory.

How Liquidity Preference Affects Interest Rates

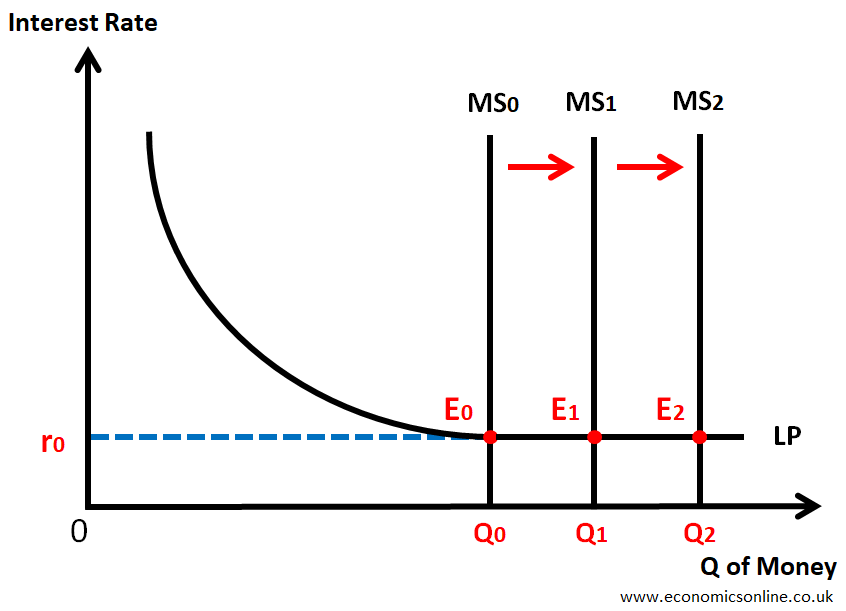

According to liquidity preference theory, the interaction of the supply and demand for money determines the equilibrium interest rate. If the demand for money exceeds the supply, interest rates will rise. This is because individuals and businesses are willing to pay a higher price (interest) to obtain the liquidity they desire. Conversely, if the supply of money exceeds the demand, interest rates will fall. This is because lenders must lower their rates to attract borrowers. The central bank plays a crucial role in managing the money supply and influencing interest rates. By increasing or decreasing the money supply, the central bank can impact the equilibrium interest rate and, consequently, economic activity.

The Role of Central Banks

Central banks, such as the Federal Reserve in the United States or the European Central Bank in the Eurozone, use various tools to manage the money supply and influence interest rates. These tools include:

- Open Market Operations: Buying or selling government securities to inject or withdraw money from the economy.

- Reserve Requirements: The percentage of deposits that banks are required to hold in reserve.

- Discount Rate: The interest rate at which commercial banks can borrow money directly from the central bank.

By adjusting these tools, central banks can influence the supply of money and, therefore, the interest rate. For example, if the central bank wants to lower interest rates, it can buy government securities, injecting money into the economy and increasing the money supply. This increase in supply will put downward pressure on interest rates. Understanding liquidity preference theory is crucial for central bankers when making these decisions.

Criticisms of Liquidity Preference Theory

While liquidity preference theory provides a valuable framework for understanding interest rates, it is not without its critics. Some economists argue that the theory overemphasizes the role of money in determining interest rates and neglects other important factors, such as investment demand and savings. Furthermore, the theory assumes that individuals are rational actors who make decisions based on perfect information, which is often not the case in the real world. Behavioral economics has highlighted the importance of psychological factors and biases in decision-making, which can influence the demand for money and interest rates. These criticisms do not invalidate the theory, but they highlight the need for a more nuanced and comprehensive understanding of interest rate determination. It’s important to consider the limitations of liquidity preference theory when applying it to real-world situations.

Liquidity Preference in Modern Finance

Despite the criticisms, liquidity preference theory remains a relevant and influential concept in modern finance. It provides a valuable framework for understanding how individuals and institutions manage their money and how interest rates are determined. The theory is particularly relevant in times of economic uncertainty, when individuals and businesses tend to increase their demand for liquidity. During the 2008 financial crisis, for example, there was a significant increase in the demand for cash as individuals and institutions sought safety and security. This surge in demand for liquidity put upward pressure on interest rates and contributed to the financial instability. Central banks responded by injecting massive amounts of liquidity into the financial system to stabilize markets and prevent a complete collapse. This response was in direct alignment with the principles outlined in liquidity preference theory. [See also: Understanding Quantitative Easing]

The theory also helps explain the phenomenon of “flight to safety,” where investors move their money from risky assets to safer assets, such as government bonds, during times of economic stress. This flight to safety increases the demand for liquid assets and puts downward pressure on interest rates on those assets. The liquidity preference theory helps explain this phenomenon.

Real-World Examples of Liquidity Preference

Several real-world scenarios illustrate the principles of liquidity preference theory:

- Recessions: During economic recessions, businesses often reduce their investment spending and increase their demand for cash. This is because they are uncertain about the future and want to have a buffer against potential losses.

- Financial Crises: As mentioned earlier, financial crises often lead to a surge in demand for liquidity as individuals and institutions seek safety and security.

- Interest Rate Hikes: When central banks raise interest rates, it becomes more attractive to hold interest-bearing assets rather than cash. This reduces the demand for liquidity and helps to curb inflation.

- Technological Advancements: The rise of digital payment systems and cryptocurrencies has the potential to alter the demand for liquidity. As these technologies become more widespread, individuals may become less reliant on cash for transactions.

The Future of Liquidity Preference Theory

Liquidity preference theory continues to evolve as the financial landscape changes. The rise of new technologies, the increasing globalization of financial markets, and the growing importance of behavioral economics are all factors that are shaping the future of the theory. As central banks grapple with new challenges, such as low inflation and negative interest rates, understanding the dynamics of liquidity preference will become even more critical. Future research may focus on incorporating behavioral insights into the theory to better understand how psychological factors influence the demand for money. Additionally, researchers may explore the implications of digital currencies and payment systems for liquidity preference. The fundamental principles of liquidity preference theory will likely remain relevant for years to come.

Conclusion

Liquidity preference theory provides a valuable framework for understanding how individuals and institutions manage their money and how interest rates are determined. While the theory has its limitations, it remains a relevant and influential concept in modern finance. By understanding the three motives behind liquidity preference—transaction, precautionary, and speculative—individuals and policymakers can make more informed decisions about money management and monetary policy. As the financial landscape continues to evolve, the principles of liquidity preference theory will remain essential for navigating the complexities of the global economy.