Understanding Liquidity Preference Theory: A Deep Dive

In the realm of economics, understanding how individuals and institutions make decisions about money is crucial. One foundational concept for this is the liquidity preference theory. Developed by John Maynard Keynes, this theory explains how people choose to hold money versus other assets. This article will explore the core principles of the liquidity preference theory, its implications, and its relevance in today’s economy.

What is Liquidity Preference?

Liquidity preference, in essence, refers to the demand for money as the most liquid asset. People prefer to have access to their funds quickly and easily, even if it means forgoing potential returns from investments. This preference stems from three primary motives:

- Transaction Motive: Holding money to facilitate everyday transactions, such as buying groceries or paying bills.

- Precautionary Motive: Keeping money on hand for unexpected expenses or emergencies.

- Speculative Motive: Holding money to take advantage of future investment opportunities when prices are favorable.

Key Components of the Liquidity Preference Theory

The Role of Interest Rates

The liquidity preference theory posits that interest rates play a critical role in determining the demand for money. According to Keynes, interest rates represent the opportunity cost of holding money. When interest rates are high, individuals are more likely to invest their money in interest-bearing assets, such as bonds, to earn a return. Conversely, when interest rates are low, the opportunity cost of holding money is lower, making it more attractive to keep funds readily available.

The Money Supply

The money supply, controlled by central banks, also influences interest rates. The interaction between the demand for money (liquidity preference) and the supply of money determines the equilibrium interest rate in the market. If the demand for money exceeds the supply, interest rates will rise. Conversely, if the supply of money exceeds the demand, interest rates will fall.

Graphical Representation

The liquidity preference theory can be visually represented using a simple graph. The demand for money is depicted as a downward-sloping curve, reflecting the inverse relationship between interest rates and the quantity of money demanded. The money supply is represented as a vertical line, as it is assumed to be fixed by the central bank at any given point in time. The intersection of these two curves determines the equilibrium interest rate.

Motives Behind Liquidity Preference

Transaction Motive in Detail

The transaction motive is perhaps the most straightforward reason for holding money. Individuals and businesses need money to conduct their day-to-day transactions. The amount of money held for this purpose depends on factors such as income levels, spending habits, and the frequency of payments. For example, someone who is paid monthly may hold more money for transaction purposes than someone who is paid weekly.

Precautionary Motive Explained

The precautionary motive reflects the desire to have a buffer against unforeseen circumstances. People hold money as a safety net to cover unexpected medical bills, car repairs, or job loss. The amount of money held for precautionary reasons depends on factors such as risk aversion, income stability, and the availability of credit. Individuals with a higher risk aversion and less stable income are likely to hold more money for precautionary purposes.

Speculative Motive and Investment Decisions

The speculative motive is perhaps the most intriguing aspect of the liquidity preference theory. It suggests that people hold money when they believe that other assets, such as bonds or stocks, are overvalued and likely to decline in price. By holding money, they can avoid potential losses and be ready to invest when prices become more attractive. This motive is closely tied to expectations about future interest rate movements. If investors expect interest rates to rise, they may hold money in anticipation of buying bonds at lower prices in the future. [See also: Bond Yields Explained]

Implications of Liquidity Preference Theory

Impact on Monetary Policy

The liquidity preference theory has significant implications for monetary policy. Central banks use various tools, such as adjusting the money supply and setting interest rates, to influence economic activity. Understanding the factors that drive liquidity preference is crucial for effective monetary policy implementation. For example, during times of economic uncertainty, people may increase their demand for money for precautionary reasons, leading to a decrease in spending and investment. In such situations, central banks may need to increase the money supply to lower interest rates and stimulate economic activity.

Influence on Investment Decisions

The theory also influences investment decisions. Investors constantly evaluate the trade-off between holding liquid assets and investing in potentially higher-yielding but less liquid assets. The speculative motive, in particular, highlights the role of expectations in shaping investment behavior. Investors who believe that asset prices are likely to decline may choose to hold money, waiting for more favorable investment opportunities. This can lead to periods of market volatility and uncertainty. [See also: Understanding Market Volatility]

Effects on Economic Stability

The liquidity preference theory also has implications for economic stability. A sudden increase in the demand for money, driven by factors such as fear or uncertainty, can lead to a decrease in spending and investment, potentially triggering a recession. Conversely, a decrease in the demand for money can lead to increased spending and investment, potentially fueling inflation. Central banks must carefully monitor liquidity preference to maintain economic stability.

Criticisms and Limitations of Liquidity Preference Theory

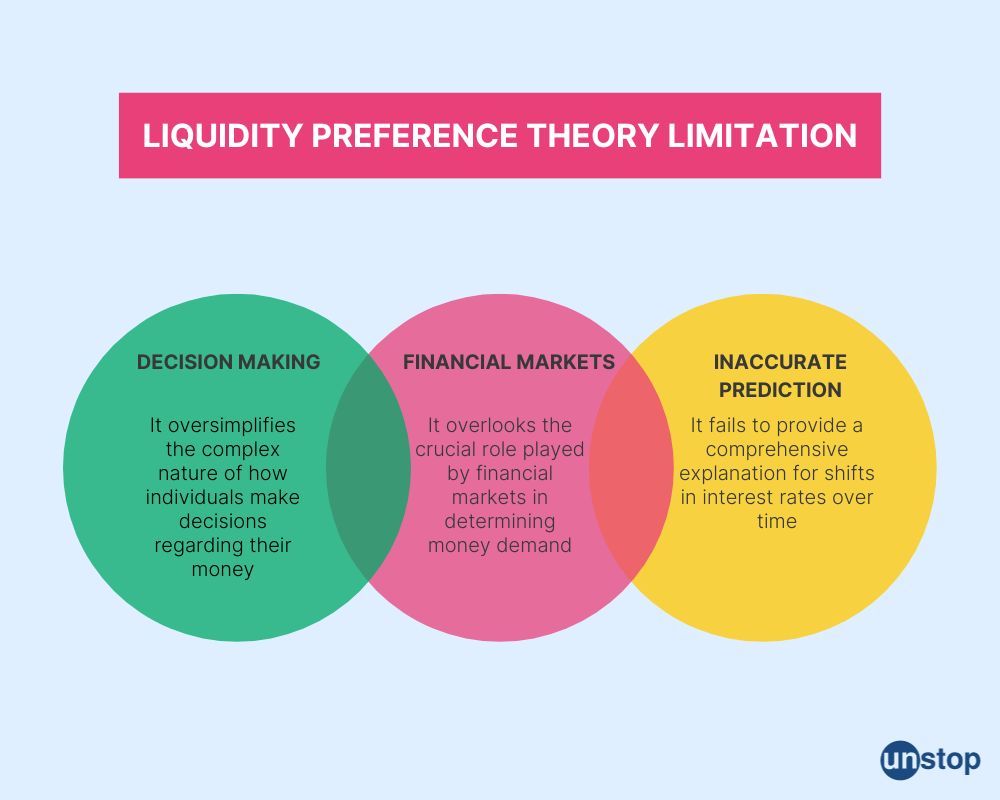

While the liquidity preference theory provides valuable insights into the demand for money, it is not without its criticisms and limitations. Some economists argue that the theory oversimplifies the complex factors that influence investment decisions. They contend that factors such as risk tolerance, investment horizons, and tax considerations also play a significant role.

Another criticism is that the theory does not adequately account for the role of financial innovation. The development of new financial instruments and technologies has made it easier for individuals and businesses to manage their liquidity, potentially reducing the demand for money. For example, the widespread use of credit cards and online banking has reduced the need to hold large amounts of cash for transaction purposes.

Furthermore, some economists argue that the theory’s focus on short-term interest rates is too narrow. They contend that long-term interest rates and other asset prices also play a crucial role in shaping economic activity. A more comprehensive understanding of the financial system requires considering a broader range of factors.

Liquidity Preference Theory in the Modern Economy

Despite its limitations, the liquidity preference theory remains a relevant framework for understanding the demand for money in the modern economy. The theory’s insights into the motives behind holding money, the role of interest rates, and the implications for monetary policy are still valuable for policymakers and investors alike.

In today’s rapidly changing financial landscape, understanding liquidity preference is more important than ever. Factors such as technological advancements, globalization, and demographic shifts are constantly reshaping the demand for money. By staying abreast of these trends, policymakers and investors can make more informed decisions and navigate the complexities of the modern economy.

Examples of Liquidity Preference in Action

Consider a scenario where there is a sudden economic downturn. People become worried about losing their jobs and decide to save more money as a precaution. This increased demand for money, driven by the precautionary motive, shifts the liquidity preference curve to the right. As a result, interest rates tend to rise, potentially further dampening economic activity. [See also: Economic Indicators Explained]

Another example can be seen during periods of high inflation. Investors may become concerned that the value of their investments will be eroded by rising prices. As a result, they may choose to hold money, waiting for inflation to subside before reinvesting. This increased demand for money, driven by the speculative motive, can put upward pressure on interest rates.

Conclusion

The liquidity preference theory provides a valuable framework for understanding the demand for money and its implications for economic activity. While the theory has its limitations, its core principles remain relevant in the modern economy. By understanding the motives behind holding money, the role of interest rates, and the influence of expectations, policymakers and investors can make more informed decisions and navigate the complexities of the financial system. Understanding liquidity preference is key to grasping how markets function and how economic actors respond to varying conditions. The theory helps explain why people hold cash even when other investment options are available and how these decisions impact the broader economy. The ongoing relevance of the liquidity preference theory underscores its importance in economic thought and policy-making.