Understanding Liquidity Sweep in Trading: A Comprehensive Guide

In the fast-paced world of financial markets, understanding complex trading strategies is crucial for success. One such strategy is the liquidity sweep, a technique that can significantly impact trade execution and price discovery. This article provides a comprehensive overview of what a liquidity sweep is, how it works, its advantages and disadvantages, and its role in the broader context of trading.

What is a Liquidity Sweep?

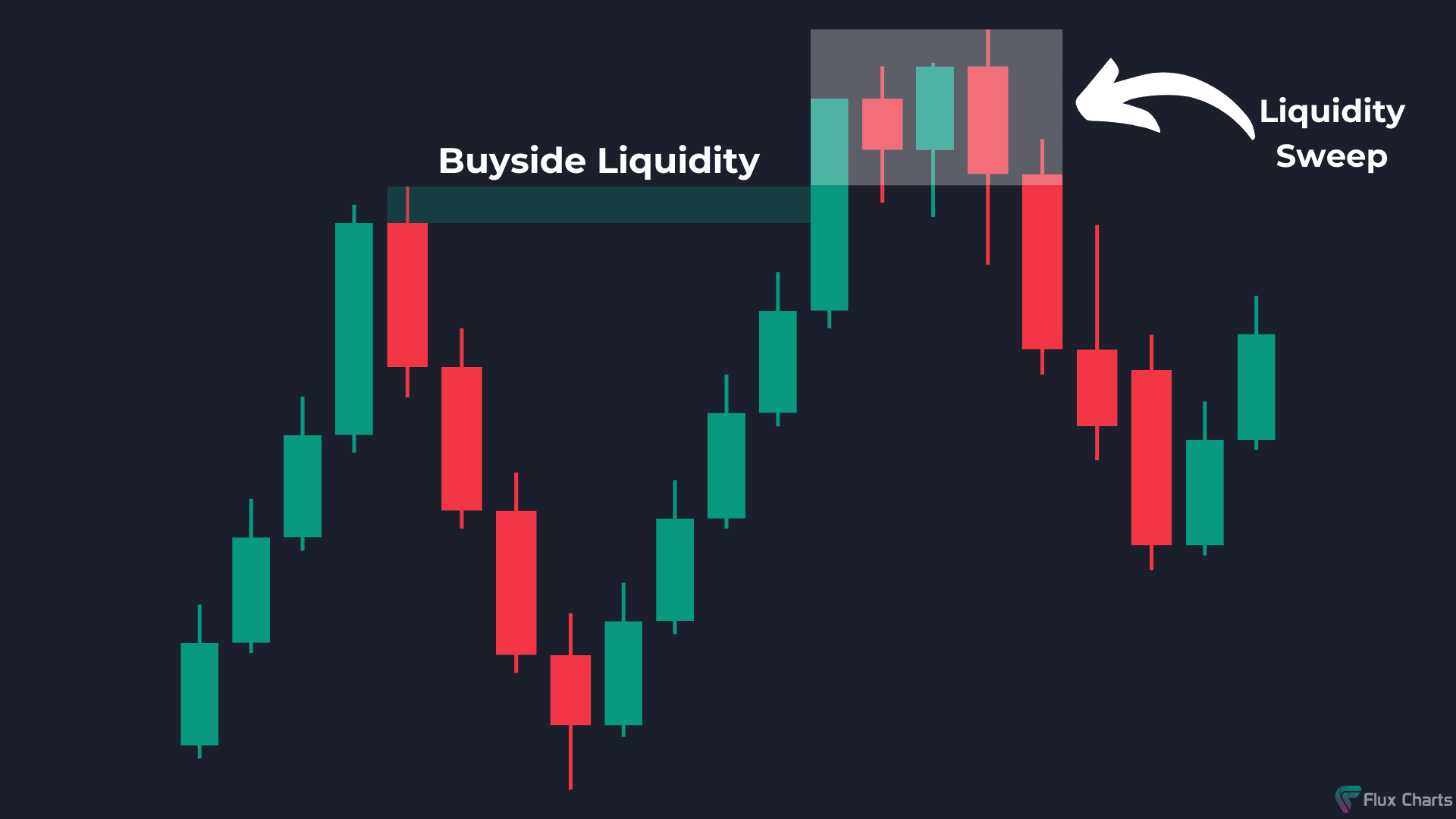

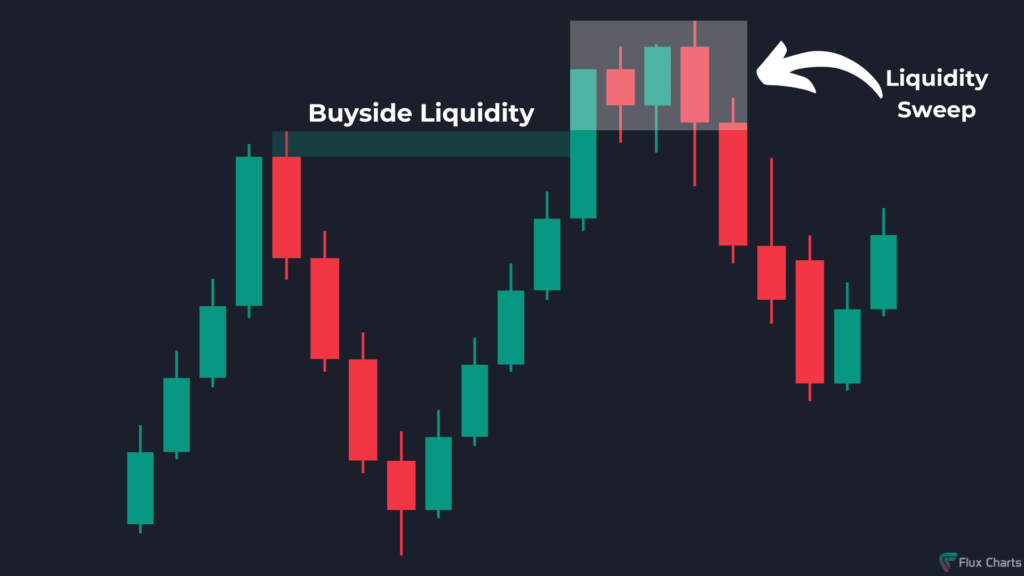

A liquidity sweep, also known as a market order or a sweep-to-fill order, is an order type that aggressively seeks to execute a trade by consuming all available liquidity at the best available prices in the order book. Unlike a limit order, which waits for a matching price, a liquidity sweep immediately fills the order by ‘sweeping’ through multiple price levels until the entire order is executed.

Essentially, a trader using a liquidity sweep prioritizes immediate execution over price. They are willing to accept slightly less favorable prices to ensure their order is filled quickly. This is particularly useful in volatile markets or when dealing with large order sizes.

How Does a Liquidity Sweep Work?

To understand how a liquidity sweep works, consider the following scenario:

Imagine an order book for a particular stock. The book displays various buy (bid) and sell (ask) orders at different price levels. A trader wants to buy 1,000 shares immediately. Instead of placing a limit order at a specific price, they use a liquidity sweep order.

The liquidity sweep order begins by filling the available shares at the lowest ask price. If there are only 300 shares available at that price, the order continues to the next best ask price, filling another portion of the order. This process continues until the entire 1,000 shares are purchased. The trader might end up paying slightly different prices for different portions of the order, but the entire order is filled quickly.

In essence, the liquidity sweep algorithm actively seeks out and consumes available liquidity at each price level until the entire order is fulfilled. This makes it a powerful tool for traders who need guaranteed execution, regardless of minor price fluctuations.

Advantages of Using a Liquidity Sweep

- Guaranteed Execution: The primary advantage of a liquidity sweep is the high probability of immediate execution. In fast-moving markets, this can be crucial to avoid missing opportunities or getting stuck with unfilled orders.

- Speed: Liquidity sweeps are designed for speed. They quickly consume available liquidity, ensuring rapid order fulfillment.

- Suitable for Large Orders: When dealing with substantial order sizes, a liquidity sweep can be more effective than limit orders, which may only partially fill or remain unfulfilled.

- Reduced Market Impact (Sometimes): While it might seem counterintuitive, in certain situations, a liquidity sweep can reduce market impact compared to repeatedly placing and canceling limit orders. By executing quickly, it avoids signaling intentions to other market participants.

Disadvantages of Using a Liquidity Sweep

- Price Uncertainty: The biggest drawback of a liquidity sweep is the lack of price control. Traders using this strategy may end up paying more than they initially anticipated, as the order fills at various price levels.

- Potential for Slippage: In highly volatile markets or when dealing with illiquid assets, a liquidity sweep can result in significant slippage, meaning the final execution price is substantially different from the expected price.

- Higher Transaction Costs: Filling orders at multiple price levels can lead to higher transaction costs, especially if the brokerage charges per-trade fees.

Liquidity Sweep vs. Other Order Types

Understanding how a liquidity sweep differs from other common order types is essential for making informed trading decisions.

Liquidity Sweep vs. Limit Order

A limit order specifies the maximum price a buyer is willing to pay or the minimum price a seller is willing to accept. The order will only be executed if the market price reaches that level. In contrast, a liquidity sweep doesn’t have a specific price limit and prioritizes immediate execution, even if it means paying a slightly higher price.

Liquidity Sweep vs. Market Order

While the terms are often used interchangeably, there can be subtle differences. A market order generally executes at the best available price in the order book. A liquidity sweep, however, might be programmed to consume liquidity across multiple price levels, ensuring the entire order is filled, even if a simple market order would only fill partially.

Liquidity Sweep vs. Stop Order

A stop order becomes a market order once a specific price (the stop price) is reached. It’s used to limit losses or protect profits. A liquidity sweep, on the other hand, is an order type in itself, designed for immediate execution regardless of the current market price (within the available liquidity).

Factors to Consider When Using a Liquidity Sweep

Several factors should be considered before using a liquidity sweep:

- Market Volatility: In highly volatile markets, the risk of slippage increases significantly with a liquidity sweep.

- Asset Liquidity: Liquidity sweeps are more suitable for liquid assets with deep order books. Illiquid assets can lead to unfavorable execution prices.

- Order Size: For small order sizes, the benefits of a liquidity sweep might not outweigh the potential price disadvantages.

- Transaction Costs: Consider the brokerage fees associated with filling orders at multiple price levels.

- Trading Strategy: Liquidity sweeps are best suited for trading strategies that prioritize speed and guaranteed execution over price precision.

Real-World Examples of Liquidity Sweep Usage

Example 1: High-Frequency Trading (HFT)

High-frequency traders often use liquidity sweeps to quickly execute large volumes of trades, capitalizing on fleeting arbitrage opportunities. The speed and guaranteed execution provided by liquidity sweeps are critical in this environment.

Example 2: Institutional Investors

Institutional investors, such as hedge funds and mutual funds, may use liquidity sweeps when they need to quickly enter or exit a large position. While price is important, ensuring the order is filled without significantly impacting the market is often a higher priority. [See also: Block Trading Strategies]

Example 3: News-Driven Trading

During periods of significant news announcements, markets can become extremely volatile. Traders may use liquidity sweeps to quickly react to the news and execute trades before prices move too drastically. The immediate execution offered by a liquidity sweep can be advantageous in capturing opportunities arising from the news event.

The Role of Liquidity Sweep in Market Efficiency

Liquidity sweeps play a crucial role in market efficiency by facilitating the rapid execution of trades and contributing to price discovery. By consuming available liquidity, they help to narrow the spread between bid and ask prices, making it easier for other market participants to trade. However, the aggressive nature of liquidity sweeps can also contribute to short-term price volatility.

Advanced Strategies Involving Liquidity Sweep

Experienced traders often combine liquidity sweeps with other strategies to optimize their trading performance. For instance, they might use a liquidity sweep to quickly establish a core position and then use limit orders to refine their entry price. [See also: Algorithmic Trading Strategies]

The Future of Liquidity Sweep

As financial markets continue to evolve, the role of liquidity sweeps is likely to become even more important. With the increasing prevalence of algorithmic trading and high-frequency trading, the ability to execute trades quickly and efficiently will become even more critical. Advancements in trading technology will likely lead to more sophisticated liquidity sweep algorithms that can optimize execution prices and minimize slippage.

Conclusion

A liquidity sweep is a powerful tool for traders who prioritize immediate execution over price precision. While it offers the advantage of guaranteed order fulfillment and speed, it also comes with the risk of price uncertainty and potential slippage. Understanding the nuances of liquidity sweeps and considering the factors discussed in this article is crucial for making informed trading decisions. Whether you are a high-frequency trader, an institutional investor, or a retail trader, mastering the art of using liquidity sweeps can significantly enhance your trading performance in today’s dynamic financial markets. The key is to weigh the benefits against the risks and use this strategy judiciously, based on your specific trading goals and risk tolerance. Always remember to analyze market conditions and asset liquidity before deploying a liquidity sweep order. Ultimately, informed decision-making is the cornerstone of successful trading.