Understanding Micro Lot Forex Trading: A Beginner’s Guide

The world of Forex trading can seem daunting, especially for newcomers. Terms like leverage, pips, and lots can quickly become overwhelming. One of the most accessible entry points for beginners is trading with micro lot Forex accounts. This guide will demystify micro lot Forex trading, explaining its benefits, risks, and how to get started. We’ll cover everything from the basics of lot sizes to strategies for managing risk and maximizing potential profits with micro lots.

What is a Forex Lot Size?

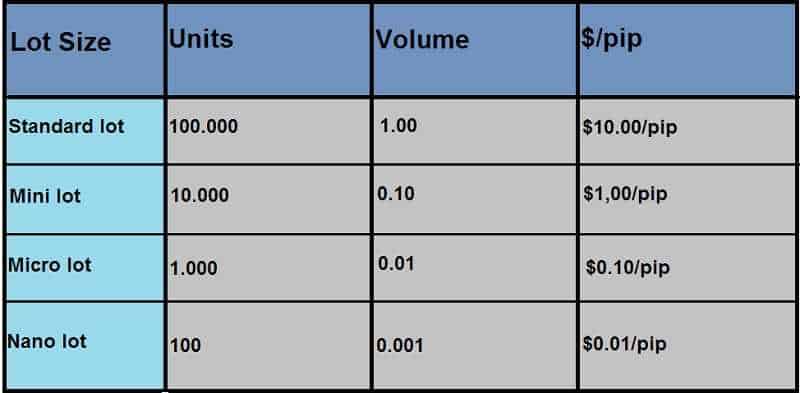

Before diving into micro lots, it’s crucial to understand the concept of a standard lot in Forex trading. A standard lot is 100,000 units of the base currency. Because most individual traders don’t have the capital to trade such large amounts, brokers offer leverage. Leverage allows traders to control larger positions with a smaller amount of capital. However, even with leverage, trading standard lots can be risky for beginners.

Introducing the Micro Lot

A micro lot is the smallest standardized lot size available in Forex trading. It represents 1,000 units of the base currency. This smaller size significantly reduces the capital required to open a position, making Forex trading more accessible to individuals with limited funds. Using micro lots allows you to test strategies and gain experience without risking a substantial amount of money.

Benefits of Trading with Micro Lots

There are several compelling reasons why beginners should consider starting with micro lot Forex trading:

- Reduced Risk: The primary benefit is the significantly lower risk. With smaller position sizes, potential losses are capped, protecting your capital.

- Accessibility: Trading micro lots requires less initial capital, making it accessible to a wider range of individuals. You can start trading with as little as $100, depending on the broker and leverage offered.

- Learning Opportunity: Micro lots provide a safe environment to learn the intricacies of Forex trading without risking substantial losses. You can experiment with different strategies, indicators, and currency pairs to find what works best for you.

- Emotional Control: Smaller position sizes can help you manage your emotions while trading. The fear of losing a large amount of money can lead to impulsive decisions. With micro lots, the emotional impact of losses is reduced, allowing for more rational decision-making.

Risks Associated with Micro Lot Trading

While micro lot Forex trading offers numerous advantages, it’s essential to be aware of the potential risks:

- Limited Profit Potential: Just as losses are capped, so are potential profits. The smaller position size means that even successful trades will generate smaller returns compared to larger lot sizes.

- Over-Leveraging: Even with micro lots, it’s crucial to avoid over-leveraging. Using excessive leverage can amplify both profits and losses, potentially wiping out your account quickly. Always use leverage responsibly and understand the associated risks.

- False Sense of Security: The reduced risk of micro lot trading can sometimes create a false sense of security. It’s important to remember that Forex trading always involves risk, regardless of the lot size. Continue to practice sound risk management techniques and avoid complacency.

How to Get Started with Micro Lot Forex Trading

Here’s a step-by-step guide to getting started with micro lot Forex trading:

- Choose a Reputable Broker: Select a Forex broker that offers micro lot trading and is regulated by a reputable financial authority. Look for brokers with a user-friendly platform, competitive spreads, and excellent customer support. Research different brokers and read reviews before making a decision.

- Open a Micro Account: Many brokers offer specific micro accounts designed for beginners. These accounts typically have lower minimum deposit requirements and allow you to trade in micro lots.

- Fund Your Account: Deposit funds into your account using a secure payment method. Start with a small amount that you are comfortable losing. Remember, Forex trading involves risk, so never invest more than you can afford to lose.

- Learn the Basics: Familiarize yourself with the fundamentals of Forex trading, including currency pairs, technical analysis, and fundamental analysis. There are numerous online resources, courses, and tutorials available to help you learn.

- Develop a Trading Strategy: Create a trading strategy that aligns with your risk tolerance and financial goals. This strategy should include entry and exit points, stop-loss orders, and take-profit targets.

- Practice on a Demo Account: Before trading with real money, practice your strategy on a demo account. This allows you to simulate real market conditions without risking any capital.

- Start Trading with Micro Lots: Once you are comfortable with your strategy and the trading platform, start trading with micro lots. Begin with small positions and gradually increase your position size as you gain experience and confidence.

- Manage Your Risk: Implement strict risk management techniques, such as setting stop-loss orders and limiting the amount of capital you risk on each trade. Avoid over-leveraging and always protect your capital.

Strategies for Trading with Micro Lots

While the basic principles of Forex trading apply to all lot sizes, here are some strategies that are particularly well-suited for micro lot trading:

- Scalping: Scalping involves making small profits from short-term price fluctuations. With micro lots, you can execute numerous trades throughout the day, capitalizing on small price movements.

- Trend Following: Identify and follow established trends in the market. Use technical indicators to confirm the trend and enter positions in the direction of the trend. With micro lots, you can ride the trend for longer periods without risking significant capital.

- Breakout Trading: Identify key support and resistance levels and trade breakouts when the price breaks through these levels. Breakout trading can be profitable with micro lots, as you can enter positions quickly and capitalize on sudden price movements.

- Range Trading: Identify currency pairs that are trading within a defined range and trade between the support and resistance levels. With micro lots, you can take advantage of small price fluctuations within the range.

The Psychology of Micro Lot Trading

Trading psychology plays a crucial role in Forex trading success. Micro lot trading can help you develop a more disciplined and rational approach to trading by reducing the emotional impact of losses. Here are some tips for managing your emotions while trading with micro lots:

- Set Realistic Expectations: Don’t expect to get rich quickly with micro lot trading. Focus on learning and improving your skills rather than making quick profits.

- Stay Disciplined: Stick to your trading strategy and avoid making impulsive decisions based on emotions.

- Manage Your Emotions: Recognize and manage your emotions, such as fear and greed. Avoid letting your emotions influence your trading decisions.

- Learn from Your Mistakes: Analyze your trades and learn from your mistakes. Use a trading journal to track your trades and identify areas for improvement.

- Take Breaks: Avoid overtrading and take breaks when you feel overwhelmed or stressed. Stepping away from the screen can help you clear your mind and make better decisions.

Advanced Techniques for Micro Lot Traders

Once you have a solid understanding of the basics, you can explore more advanced techniques to enhance your micro lot trading:

- Hedging: Use hedging techniques to protect your positions from adverse price movements. Hedging involves opening opposing positions to offset potential losses.

- Correlation Trading: Identify currency pairs that are correlated and trade them in tandem. Correlation trading can help you diversify your portfolio and reduce your overall risk.

- News Trading: Trade based on economic news releases and events. News trading requires a deep understanding of the market and the ability to react quickly to unexpected events. [See also: Forex News Trading Strategies]

- Automated Trading: Use automated trading systems (Expert Advisors) to execute trades automatically based on predefined rules. Automated trading can help you eliminate emotions from your trading and execute trades more efficiently.

Conclusion

Micro lot Forex trading offers a safe and accessible entry point into the world of Forex trading. By starting with smaller position sizes, you can learn the ropes, develop your skills, and manage your risk effectively. While the profit potential may be limited compared to larger lot sizes, the reduced risk and learning opportunities make micro lot trading an ideal choice for beginners. Remember to choose a reputable broker, develop a solid trading strategy, and manage your risk carefully. With patience, discipline, and a commitment to learning, you can build a successful Forex trading career starting with micro lots. Understanding micro lot Forex is crucial, and mastering it will set you on the right path. Consider practicing with a demo account to fully grasp the concepts before investing real capital in micro lot Forex. Good luck!