Understanding Oro Precio: A Comprehensive Guide to Gold Prices

The term “oro precio,” Spanish for “gold price,” is a crucial concept for investors, jewelers, and anyone interested in the precious metals market. Understanding the dynamics of oro precio is essential for making informed decisions about buying, selling, or investing in gold. This article provides a comprehensive overview of oro precio, covering its influencing factors, historical trends, and practical applications.

What is Oro Precio?

Oro precio simply refers to the price of gold. This price is not static; it fluctuates constantly based on various market forces. Unlike currencies backed by governments, gold has intrinsic value, making it a popular safe-haven asset during economic uncertainty. The price is typically quoted per troy ounce (approximately 31.1 grams) and can be expressed in different currencies, such as US dollars (USD), Euros (EUR), or other local currencies. Monitoring oro precio is important for anyone involved in trading gold or investing in gold-related assets.

Factors Influencing Oro Precio

Several factors impact the oro precio, creating a complex interplay of supply and demand. Understanding these factors is key to predicting potential price movements:

Economic Conditions

Economic downturns often lead to increased demand for gold as investors seek a safe haven. During periods of inflation, gold is seen as a hedge against the declining purchasing power of fiat currencies. Conversely, a strong economy may reduce demand for gold as investors shift to riskier assets like stocks. Therefore, the overall economic climate significantly affects oro precio. [See also: Investing in Gold During Economic Downturns]

Interest Rates

Interest rates and oro precio typically have an inverse relationship. When interest rates rise, bonds and other fixed-income investments become more attractive, reducing the appeal of gold, which doesn’t offer a yield. Lower interest rates, on the other hand, make gold more attractive as the opportunity cost of holding it decreases. The Federal Reserve and other central banks’ monetary policies play a critical role in determining interest rates, which in turn impacts the oro precio.

Currency Fluctuations

The oro precio is often quoted in US dollars, so fluctuations in the dollar’s value can significantly impact the price. A weaker dollar typically leads to a higher oro precio because it becomes cheaper for investors using other currencies to buy gold. Conversely, a stronger dollar can depress the oro precio. The relationship between currency values and the oro precio is a complex but vital consideration.

Geopolitical Events

Political instability, wars, and other geopolitical events often trigger a flight to safety, increasing demand for gold. Uncertainty drives investors towards safe-haven assets like gold, pushing the oro precio higher. Events such as elections, trade wars, or international conflicts can all influence the oro precio. Monitoring these events is crucial for understanding potential price volatility.

Supply and Demand

Like any commodity, the oro precio is influenced by the basic principles of supply and demand. Limited gold supply combined with high demand will drive the price up, while an oversupply can depress it. Factors affecting supply include mining production, recycling, and central bank sales. Demand is influenced by investment, jewelry fabrication, and industrial uses. The balance between supply and demand is a fundamental determinant of the oro precio.

Inflation

Gold is often viewed as a hedge against inflation. As the purchasing power of fiat currencies declines due to inflation, the oro precio tends to rise. Investors often turn to gold to preserve their wealth during inflationary periods. While the correlation isn’t always perfect, gold has historically maintained its value relative to other assets during times of inflation, making it a popular investment. The perceived role of gold as an inflation hedge influences the oro precio.

Historical Trends in Oro Precio

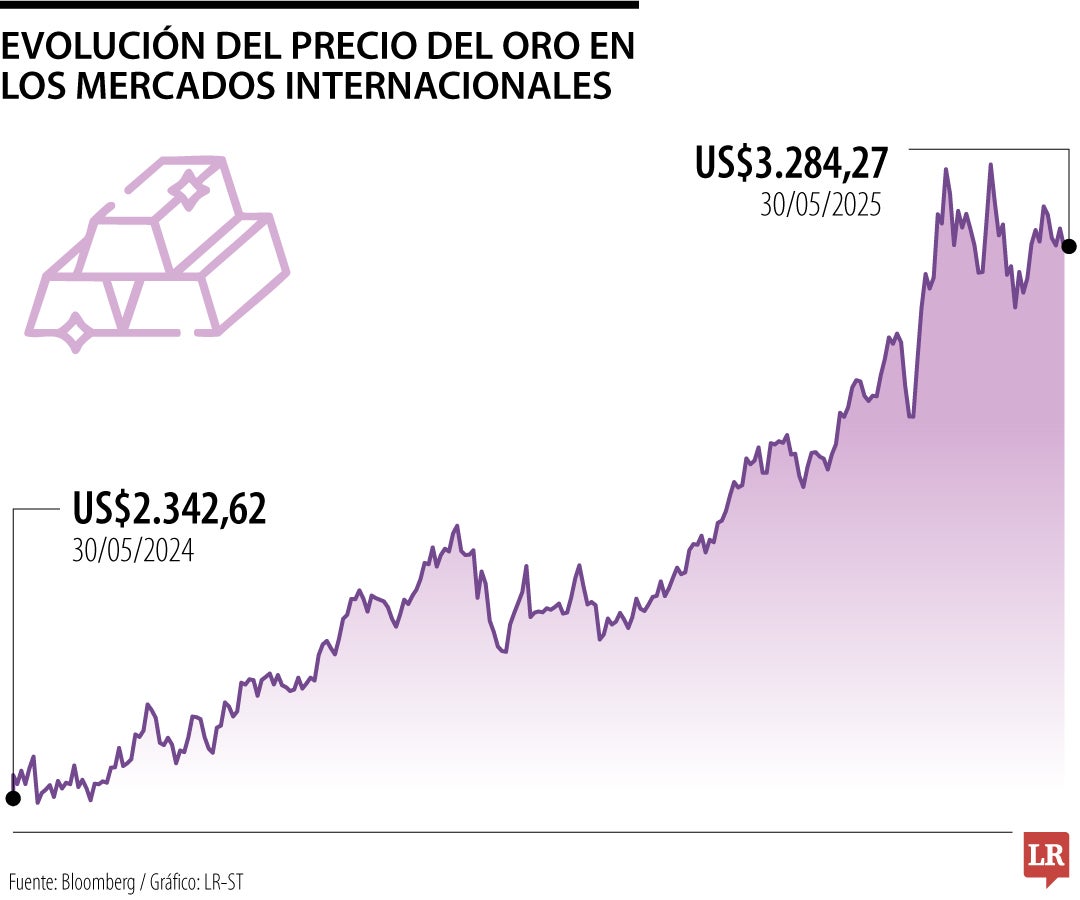

The oro precio has seen significant fluctuations throughout history. In the early 1970s, after the gold standard was abandoned, the price of gold began to float freely, leading to increased volatility. Major economic events, such as the oil crisis of the 1970s and the global financial crisis of 2008, caused significant spikes in the oro precio. Understanding these historical trends can provide valuable insights into how gold performs under different economic conditions. Analyzing historical oro precio data is a valuable tool for investors.

How to Track Oro Precio

Tracking the oro precio is relatively straightforward. Numerous websites and financial platforms provide real-time price updates. Some popular sources include:

- Financial News Websites: Bloomberg, Reuters, and MarketWatch provide up-to-date information on the oro precio.

- Precious Metals Dealers: Reputable dealers often have live price charts on their websites.

- Brokerage Platforms: Online brokerage platforms allow you to monitor the oro precio and trade gold-related assets.

When tracking oro precio, it’s essential to consider the currency in which it is quoted and any associated fees or premiums.

Investing in Gold: Understanding Oro Precio’s Role

Investing in gold can take various forms, including:

- Physical Gold: Buying gold coins, bars, or jewelry. This involves storage costs and potential security risks.

- Gold ETFs: Exchange-traded funds (ETFs) that track the oro precio. These offer a more liquid and convenient way to invest in gold.

- Gold Mining Stocks: Investing in companies that mine gold. The performance of these stocks is often correlated with the oro precio but can also be influenced by company-specific factors.

Before investing in gold, it’s crucial to understand your risk tolerance and investment goals. The oro precio can be volatile, and past performance is not indicative of future results. A thorough understanding of the market and your own financial situation is essential. [See also: Gold ETFs vs. Physical Gold: Which is Right for You?]

Oro Precio and Jewelry

The oro precio significantly impacts the cost of gold jewelry. When the oro precio rises, jewelers typically increase their prices to reflect the higher cost of raw materials. Consumers should be aware of the current oro precio when buying or selling gold jewelry. The purity of the gold (e.g., 14k, 18k, 24k) also affects its value. 24k gold is pure gold, while lower karat gold contains other metals. The oro precio is a key factor in determining the value of gold jewelry.

Conclusion

Understanding the oro precio is essential for anyone involved in the gold market, whether as an investor, jeweler, or consumer. By understanding the factors that influence the oro precio, tracking historical trends, and exploring different investment options, you can make more informed decisions about buying, selling, or investing in gold. The oro precio is a dynamic and complex metric, but with a clear understanding of its drivers and its role in the global economy, you can navigate the gold market with confidence. Keep in mind that the oro precio is constantly changing, so staying informed and conducting thorough research are key to success. Whether you’re looking to hedge against inflation, diversify your investment portfolio, or simply understand the value of your gold jewelry, knowledge of the oro precio is invaluable.