Understanding Retainer Fees in Real Estate: A Comprehensive Guide

Navigating the real estate landscape can be complex, whether you’re buying, selling, or investing. One aspect that often raises questions is the concept of a retainer fee. In the realm of real estate, a retainer fee is a pre-paid fee paid to a real estate professional, such as an agent or attorney, to secure their services for a specific period or task. This guide aims to provide a comprehensive understanding of retainer fees in real estate, covering their purpose, benefits, how they work, and what to consider before paying one. Understanding the intricacies of a retainer fee will empower you to make informed decisions and protect your interests in your real estate endeavors. A retainer fee essentially guarantees that the professional will be available to assist you when you need them, offering peace of mind in a competitive market.

What is a Retainer Fee?

A retainer fee is essentially an advance payment for future services. It’s a common practice in various professional fields, including law, consulting, and, increasingly, real estate. Unlike a commission or a standard fee-for-service arrangement, a retainer fee secures the professional’s availability and commitment to your case or project. It’s not necessarily payment for services already rendered, but rather a commitment to be available to render services in the future. Think of it as reserving their time and expertise specifically for you.

Why Real Estate Professionals Charge Retainer Fees

Several reasons explain why real estate agents or attorneys might charge a retainer fee:

- Securing Commitment: In a competitive market, a retainer fee ensures the professional prioritizes your needs. It demonstrates your serious intent and secures their dedicated time and resources.

- Covering Initial Expenses: Some real estate transactions involve significant upfront costs, such as travel, document preparation, or market analysis. A retainer fee can help offset these initial expenses.

- Complex or Time-Consuming Transactions: If your real estate deal is particularly complex or requires extensive research and negotiation, a retainer fee compensates the professional for the additional time and effort involved.

- Dedicated Availability: In hot markets, top agents are in high demand. A retainer fee can ensure you have access to their expertise when you need it most.

- Protection Against Lost Time: Agents invest time and resources in clients. A retainer fee can compensate them for lost time if a client backs out or the deal falls through due to no fault of the agent.

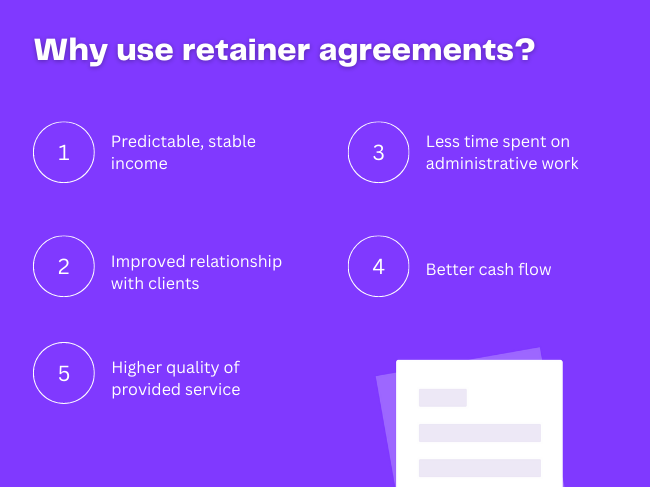

Benefits of Paying a Retainer Fee

While paying a retainer fee might seem like an added expense, it can offer several benefits:

- Guaranteed Availability: You’re essentially reserving the professional’s time and expertise, ensuring they’re available when you need them.

- Dedicated Focus: Knowing they’re being compensated upfront, the professional is more likely to dedicate their full attention to your case or project.

- Priority Service: You may receive priority service compared to clients who haven’t paid a retainer fee.

- Peace of Mind: You have the assurance that a qualified professional is committed to helping you achieve your real estate goals.

- Potentially Better Deals: With a dedicated and motivated professional on your side, you may be able to negotiate better deals or avoid costly mistakes.

How Retainer Fees Work in Real Estate

The specifics of how retainer fees work can vary depending on the professional, the nature of the transaction, and the terms of the retainer agreement. Here’s a general overview:

- Negotiation: The amount of the retainer fee is typically negotiated between you and the real estate professional.

- Retainer Agreement: A written retainer agreement outlines the scope of services, the amount of the retainer fee, how it will be applied (e.g., hourly rate, project-based), and any refund policy.

- Payment: You pay the retainer fee upfront, typically before any services are rendered.

- Application of Funds: The retainer fee may be applied to future services, such as hourly fees, commission, or specific project costs.

- Refunds: Depending on the retainer agreement, you may be entitled to a partial or full refund of the retainer fee if the services are not rendered or if you terminate the agreement.

Factors to Consider Before Paying a Retainer Fee

Before paying a retainer fee, carefully consider the following factors:

- Reputation and Experience: Research the professional’s reputation and experience. Read online reviews and ask for references.

- Scope of Services: Clearly define the scope of services to be provided. Ensure the retainer agreement specifies exactly what you’re paying for.

- Retainer Agreement: Carefully review the retainer agreement before signing. Pay close attention to the terms of payment, refund policy, and termination clause.

- Total Cost: Understand the total estimated cost of the services, including the retainer fee and any additional fees or expenses.

- Alternatives: Consider alternative fee arrangements, such as commission-based or hourly rates. Determine which option is most suitable for your needs and budget.

- Market Conditions: Assess the current real estate market. In a highly competitive market, a retainer fee might be more justifiable.

Common Misconceptions About Retainer Fees

Several misconceptions surround retainer fees in real estate. It’s important to be aware of these:

- Retainer Fee Guarantees Success: Paying a retainer fee doesn’t guarantee a successful outcome. It simply secures the professional’s commitment and expertise.

- Retainer Fee is Always Refundable: The refund policy depends on the retainer agreement. Not all retainer fees are fully refundable.

- All Real Estate Agents Charge Retainer Fees: Not all real estate agents charge retainer fees. It’s more common in complex transactions or competitive markets.

- Retainer Fee is the Same as a Commission: A retainer fee is separate from the commission. The commission is typically paid upon successful completion of the transaction.

When is a Retainer Fee Appropriate?

A retainer fee may be appropriate in the following situations:

- Complex Real Estate Transactions: Transactions involving multiple parties, legal disputes, or unique property characteristics.

- Competitive Markets: In a hot market, a retainer fee can help you secure the services of a top agent.

- High-Value Properties: For high-value properties, the potential benefits of having dedicated expertise may outweigh the cost of the retainer fee.

- Out-of-State Buyers/Sellers: If you’re buying or selling property from out of state, a retainer fee can ensure you have local representation and support.

- Investment Properties: Investors often benefit from the ongoing support and expertise of a real estate professional, making a retainer fee a worthwhile investment.

Alternatives to Retainer Fees

If you’re hesitant to pay a retainer fee, consider these alternatives:

- Commission-Based Agreements: Pay the professional a commission upon successful completion of the transaction.

- Hourly Rates: Pay the professional an hourly rate for their services.

- Project-Based Fees: Pay a fixed fee for specific tasks or projects.

- Performance-Based Bonuses: Offer a bonus for achieving specific goals or milestones.

Negotiating a Retainer Fee

If you decide to pay a retainer fee, be prepared to negotiate the terms. Here are some tips:

- Research Market Rates: Understand the typical retainer fees charged by real estate professionals in your area.

- Clearly Define Scope of Services: Ensure the retainer agreement clearly outlines the services to be provided.

- Negotiate the Amount: Don’t be afraid to negotiate the amount of the retainer fee.

- Request a Refund Policy: Ensure the retainer agreement includes a clear refund policy.

- Get it in Writing: Always get the retainer agreement in writing.

Legal Considerations

Retainer fees in real estate are subject to legal regulations. Consult with an attorney to ensure the retainer agreement complies with all applicable laws and regulations. Key legal considerations include:

- Disclosure Requirements: Ensure the professional discloses all fees and expenses upfront.

- Contract Law: The retainer agreement must comply with contract law principles.

- Real Estate Licensing Laws: Ensure the professional is properly licensed and authorized to provide real estate services.

- Trust Account Requirements: In some jurisdictions, retainer fees must be held in a trust account.

Conclusion

Understanding retainer fees in real estate is crucial for making informed decisions and protecting your interests. While a retainer fee can offer several benefits, it’s essential to carefully consider the factors discussed in this guide before paying one. Weigh the pros and cons, negotiate the terms, and consult with an attorney to ensure you’re making the right choice for your specific situation. By doing your due diligence, you can navigate the real estate landscape with confidence and achieve your desired outcomes.

[See also: Understanding Real Estate Commissions] [See also: How to Choose the Right Real Estate Agent] [See also: Negotiating Real Estate Contracts]