Understanding the 1:100 Leverage Calculator: A Comprehensive Guide

In the world of trading and investment, leverage is a powerful tool that can amplify both profits and losses. A 1:100 leverage calculator is an essential instrument for traders, particularly those involved in forex, stocks, and other leveraged financial instruments. This guide aims to provide a comprehensive understanding of what a 1:100 leverage calculator is, how it works, its benefits, risks, and how to use it effectively to manage your trading strategy. The goal here is to arm you with the knowledge to make informed decisions when using leverage of 1:100.

What is Leverage?

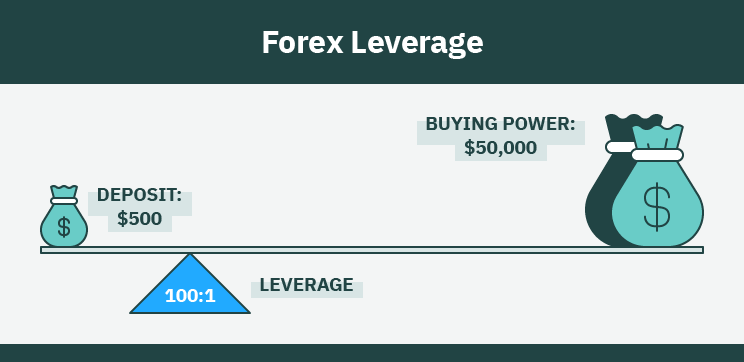

Leverage is essentially borrowing capital to increase the potential return on an investment. It allows traders to control a larger position with a smaller amount of their own capital. Expressed as a ratio, leverage indicates how much of your investment is being supplemented by borrowed funds. For example, 1:100 leverage means that for every $1 of your capital, you can control $100 worth of assets.

The 1:100 Leverage Explained

With 1:100 leverage, a trader can open a position worth 100 times their initial investment. While this magnifies potential gains, it also significantly increases the risk of substantial losses. Understanding how this leverage works is crucial for effective risk management. Using a 1:100 leverage calculator can help visualize the potential outcomes of your trades.

How Does a 1:100 Leverage Calculator Work?

A 1:100 leverage calculator is a tool designed to help traders determine the margin required to open a position, the potential profit or loss, and the impact of leverage on their trades. Here’s a breakdown of the key components and how they work:

- Position Size: The total value of the trade you want to open.

- Leverage Ratio: In this case, it’s 1:100.

- Margin Requirement: The amount of capital you need in your account to open and maintain the position. This is calculated as (Position Size / Leverage Ratio).

- Profit/Loss Calculation: Based on the position size, entry price, and exit price, the calculator estimates the potential profit or loss.

For example, if you want to open a position worth $10,000 with 1:100 leverage, your margin requirement would be $100 ($10,000 / 100). The 1:100 leverage calculator helps you quickly determine these figures, allowing you to assess the risk and potential reward before executing the trade.

Benefits of Using a 1:100 Leverage Calculator

Using a 1:100 leverage calculator offers several advantages for traders:

- Risk Management: By calculating the margin requirement and potential profit/loss, traders can better understand the risks associated with a leveraged trade.

- Capital Efficiency: Leverage allows traders to control larger positions with less capital, freeing up funds for other opportunities.

- Informed Decision-Making: The calculator provides clear and concise information, enabling traders to make more informed decisions based on potential outcomes.

- Strategic Planning: It helps in planning trading strategies by allowing traders to simulate different scenarios and assess their impact.

Risks Associated with High Leverage

While leverage can amplify profits, it also significantly increases the risk of losses. Some of the risks associated with high leverage, such as 1:100 leverage, include:

- Magnified Losses: Just as profits are magnified, so are losses. A small adverse price movement can result in substantial losses.

- Margin Calls: If the market moves against your position and your account balance falls below the required margin, your broker may issue a margin call, requiring you to deposit additional funds or risk having your position liquidated.

- Emotional Trading: The potential for rapid gains and losses can lead to emotional trading decisions, which can be detrimental to your trading strategy.

- Increased Volatility: Leveraged positions are more sensitive to market volatility, increasing the risk of unexpected losses.

How to Use a 1:100 Leverage Calculator Effectively

To maximize the benefits of a 1:100 leverage calculator and minimize the risks, consider the following tips:

- Understand Your Risk Tolerance: Before using leverage, assess your risk tolerance and determine how much capital you are willing to risk on a single trade.

- Start Small: If you are new to leverage, start with smaller positions to gain experience and confidence.

- Use Stop-Loss Orders: Implement stop-loss orders to limit potential losses and protect your capital.

- Monitor Your Positions: Regularly monitor your positions and be prepared to adjust your strategy if the market moves against you.

- Stay Informed: Keep up-to-date with market news and economic events that could impact your trades.

- Practice with a Demo Account: Before using real capital, practice with a demo account to familiarize yourself with the 1:100 leverage calculator and the effects of leverage.

Examples of Using a 1:100 Leverage Calculator

Let’s look at a few examples to illustrate how a 1:100 leverage calculator can be used in different scenarios:

Example 1: Forex Trading

Suppose you want to trade EUR/USD and believe the price will increase. You have $500 in your account and want to use 1:100 leverage. The current price of EUR/USD is 1.1000, and you decide to open a position of 10,000 EUR.

- Position Size: 10,000 EUR (approximately $11,000 USD at the current exchange rate)

- Leverage: 1:100

- Margin Requirement: $110 ($11,000 / 100)

Your $500 account balance is sufficient to cover the margin requirement. If the price of EUR/USD increases to 1.1050, your profit would be:

(1.1050 – 1.1000) * 10,000 = $50

However, if the price decreases to 1.0950, your loss would be:

(1.0950 – 1.1000) * 10,000 = -$50

Example 2: Stock Trading

Suppose you want to buy shares of a company trading at $50 per share. You have $1,000 in your account and want to use 1:100 leverage to maximize your potential profit. You decide to buy 200 shares.

- Position Size: 200 shares * $50 = $10,000

- Leverage: 1:100

- Margin Requirement: $100 ($10,000 / 100)

Your $1,000 account balance is sufficient to cover the margin requirement. If the stock price increases to $52 per share, your profit would be:

(52 – 50) * 200 = $400

However, if the stock price decreases to $48 per share, your loss would be:

(48 – 50) * 200 = -$400

Choosing the Right Leverage Ratio

While 1:100 leverage can be attractive, it’s essential to choose a leverage ratio that aligns with your risk tolerance and trading strategy. Lower leverage ratios, such as 1:10 or 1:20, offer less potential profit but also reduce the risk of significant losses. Consider the following factors when choosing a leverage ratio:

- Trading Experience: If you are new to trading, start with lower leverage ratios and gradually increase as you gain experience and confidence.

- Market Volatility: In highly volatile markets, lower leverage ratios are generally safer, as they reduce the impact of unexpected price movements.

- Trading Strategy: Different trading strategies may require different leverage ratios. For example, day traders may use higher leverage to capitalize on short-term price movements, while long-term investors may prefer lower leverage to minimize risk.

Advanced Strategies for Using Leverage

Experienced traders may employ advanced strategies to maximize the benefits of leverage while managing risk. Some of these strategies include:

- Hedging: Using leverage to open positions that offset potential losses in other investments.

- Scaling In and Out: Gradually increasing or decreasing your position size based on market conditions.

- Using Options: Combining leverage with options strategies to limit risk and enhance potential returns.

These strategies require a deep understanding of market dynamics and risk management principles. It’s crucial to thoroughly research and practice these strategies before implementing them with real capital.

The Future of Leverage in Trading

The use of leverage in trading is constantly evolving with advancements in technology and changes in regulatory frameworks. As online trading platforms become more sophisticated, traders have access to a wider range of tools and resources to manage leverage effectively. Regulatory bodies around the world are also implementing measures to protect retail traders from the risks of excessive leverage. Staying informed about these developments is crucial for navigating the dynamic landscape of leveraged trading.

Conclusion

A 1:100 leverage calculator is a valuable tool for traders looking to amplify their potential profits. However, it’s essential to understand the risks associated with high leverage and use the calculator responsibly. By carefully considering your risk tolerance, implementing risk management strategies, and staying informed about market conditions, you can leverage the power of 1:100 leverage to achieve your trading goals. Always remember that leverage is a double-edged sword, and responsible use is key to long-term success in the financial markets. Understanding how to use a 1:100 leverage calculator is fundamental to making informed trading decisions, and mitigating the inherent risks.

[See also: Understanding Forex Leverage] [See also: Risk Management in Forex Trading]