Understanding the Liquidity Preference Theory: A Comprehensive Guide

The liquidity preference theory, a cornerstone of Keynesian economics, explains how individuals and entities choose to hold their wealth in the form of cash versus other, less liquid assets. It posits that interest rates are determined by the supply and demand for money, with the demand for money being driven by the desire to hold liquid assets. This article will delve into the intricacies of the liquidity preference theory, its underlying motivations, its impact on monetary policy, and its criticisms.

What is Liquidity Preference?

Liquidity preference, in essence, is the demand for money to be held in liquid form rather than invested in assets that offer returns but are less readily available for immediate transactions. John Maynard Keynes introduced this concept in his seminal work, “The General Theory of Employment, Interest and Money,” arguing that people prefer liquidity for various reasons. This preference influences the equilibrium interest rate in the market.

The liquidity preference theory states that there are three primary motives that drive the demand for liquidity:

- Transaction Motive: This is the most straightforward motive. Individuals and businesses need money to conduct day-to-day transactions. The level of transactions directly correlates with income; higher income typically leads to a higher demand for money for transactions.

- Precautionary Motive: People hold money as a buffer against unforeseen circumstances or unexpected expenses. The level of precautionary demand depends on individuals’ risk aversion and their assessment of future uncertainties.

- Speculative Motive: This is the most nuanced of the three. The speculative motive arises from the belief that holding money can be advantageous when interest rates are expected to rise or asset prices are expected to fall. In such scenarios, individuals prefer to hold onto cash rather than invest in bonds or other assets, anticipating the opportunity to buy them at a lower price or to avoid capital losses.

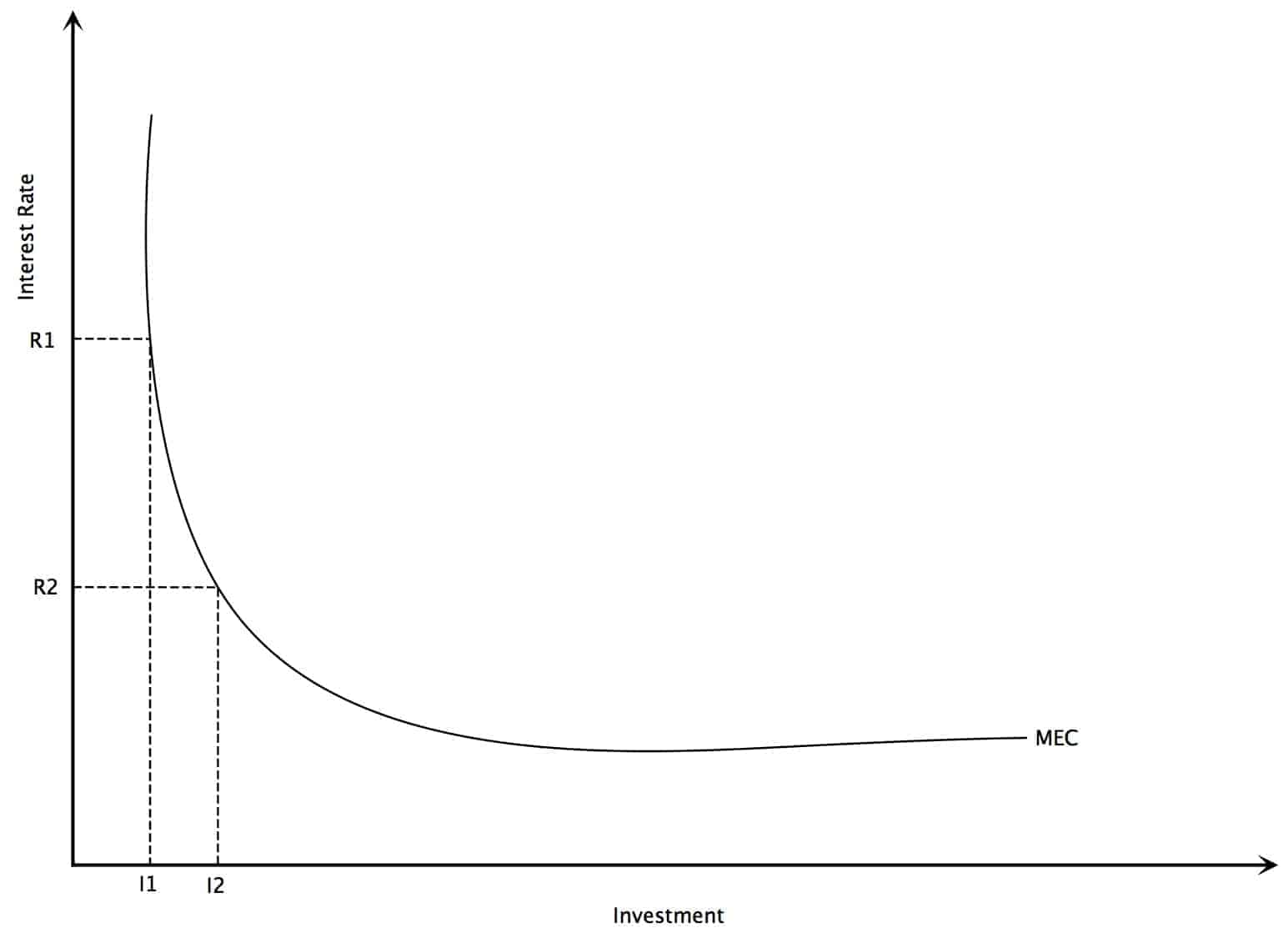

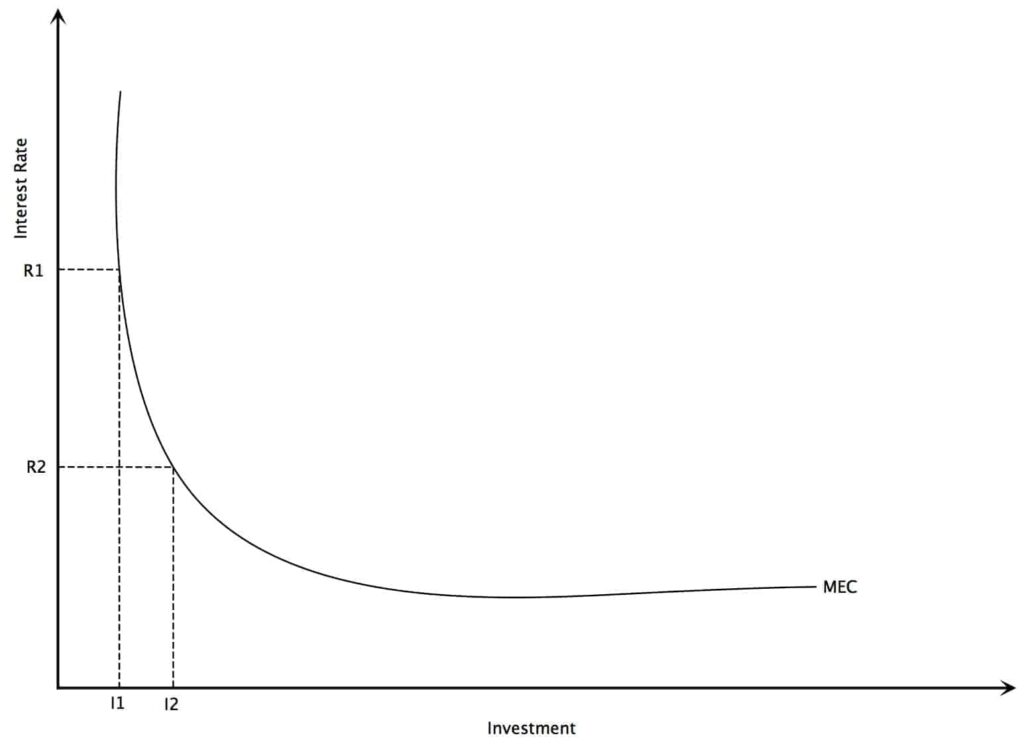

The Role of Interest Rates

According to the liquidity preference theory, interest rates are the price of money. They represent the compensation required to induce individuals to part with their liquidity. When the demand for money is high, interest rates tend to rise, as lenders can command a higher premium for relinquishing their liquid assets. Conversely, when the demand for money is low, interest rates tend to fall.

The equilibrium interest rate is determined where the supply of money equals the demand for money. The money supply is typically controlled by a central bank, such as the Federal Reserve in the United States or the European Central Bank in the Eurozone. Changes in the money supply can shift the supply curve, influencing the equilibrium interest rate. For example, if the central bank increases the money supply, the supply curve shifts to the right, potentially lowering interest rates, assuming demand remains constant.

Factors Influencing Liquidity Preference

Several factors can influence liquidity preference and, consequently, interest rates. These include:

- Income Levels: Higher income generally leads to a greater demand for money for transaction purposes. As people earn more, they tend to spend more, requiring more liquid funds.

- Inflation Expectations: If individuals expect inflation to rise, they may increase their demand for money to make purchases before prices increase further. This can drive up interest rates.

- Economic Uncertainty: Periods of economic uncertainty, such as recessions or financial crises, often lead to a spike in liquidity preference. People become more risk-averse and prefer to hold onto cash as a safe haven.

- Interest Rate Expectations: As mentioned earlier, expectations about future interest rate movements play a significant role in the speculative motive. If investors believe that interest rates will rise, they may increase their demand for money, waiting for higher returns on future investments.

- Technological Advancements: The rise of digital payment systems and electronic banking can reduce the demand for physical cash, potentially impacting liquidity preference.

Liquidity Preference and Monetary Policy

Central banks utilize the principles of the liquidity preference theory to influence economic activity through monetary policy. By controlling the money supply, central banks can manipulate interest rates, which in turn affects borrowing costs, investment decisions, and overall economic growth.

For instance, during an economic downturn, a central bank might lower interest rates by increasing the money supply. This makes borrowing cheaper, encouraging businesses to invest and consumers to spend, thereby stimulating economic activity. Conversely, during periods of high inflation, a central bank might raise interest rates by reducing the money supply to curb spending and cool down the economy.

However, the effectiveness of monetary policy based on the liquidity preference theory is not without its limitations. The theory assumes a stable and predictable relationship between the money supply, interest rates, and economic activity. In reality, this relationship can be complex and influenced by numerous other factors, such as global economic conditions, fiscal policies, and consumer sentiment. [See also: How Central Banks Control Inflation]

Criticisms of the Liquidity Preference Theory

Despite its influence, the liquidity preference theory has faced criticism from various economists. Some of the main criticisms include:

- Oversimplification: Critics argue that the theory oversimplifies the complexities of financial markets and the factors that influence interest rates. It does not fully account for the role of credit markets, international capital flows, and other macroeconomic variables.

- Focus on Short-Term: The theory is often criticized for its short-term focus, neglecting the long-term effects of monetary policy and other economic factors. It primarily addresses immediate reactions to changes in the money supply and interest rates.

- Neglect of Inflation Expectations: While the theory acknowledges the role of inflation expectations, some critics argue that it does not adequately incorporate the impact of long-term inflation expectations on interest rates.

- Alternative Theories: Other theories, such as the loanable funds theory, offer alternative explanations for interest rate determination. The loanable funds theory emphasizes the supply and demand for loanable funds, rather than the supply and demand for money.

The Loanable Funds Theory vs. Liquidity Preference Theory

The loanable funds theory presents an alternative framework for understanding interest rate determination. It posits that interest rates are determined by the supply of and demand for loanable funds in the credit market. The supply of loanable funds comes from savings, while the demand for loanable funds comes from borrowers seeking funds for investment or consumption. [See also: Understanding the Loanable Funds Market]

While both theories aim to explain interest rate determination, they differ in their emphasis. The liquidity preference theory focuses on the demand for money and the role of liquidity, while the loanable funds theory focuses on the supply and demand for credit. Some economists argue that the two theories are complementary, with the liquidity preference theory being more relevant in the short run and the loanable funds theory being more relevant in the long run.

Real-World Examples

The impact of liquidity preference can be observed in various real-world scenarios. For example, during the 2008 financial crisis, there was a significant increase in liquidity preference as individuals and institutions sought the safety of cash. This led to a surge in demand for government bonds and other safe-haven assets, driving down interest rates on those assets.

Similarly, during periods of geopolitical uncertainty, such as during international conflicts or political instability, investors often flock to safe-haven currencies like the U.S. dollar, increasing the demand for liquidity and potentially affecting exchange rates and interest rates globally.

Conclusion

The liquidity preference theory provides valuable insights into the factors that influence interest rates and the demand for money. While it has its limitations and faces criticisms, it remains a fundamental concept in Keynesian economics and a crucial tool for understanding monetary policy. By understanding the motives behind liquidity preference and its impact on interest rates, policymakers and investors can make more informed decisions in an ever-changing economic landscape. Understanding the nuances of the liquidity preference theory allows for a more comprehensive view of economic mechanisms and their effects on financial markets.