Understanding the Liquidity Preference Theory: A Comprehensive Guide

The liquidity preference theory, a cornerstone of Keynesian economics, explains how individuals choose to hold money versus other assets. Developed by John Maynard Keynes, this theory posits that interest rates are determined by the supply and demand for money. In essence, it suggests that people prefer to have liquid assets (cash) available rather than tying up their wealth in less liquid investments. This preference influences interest rates and, consequently, economic activity.

The Core Principles of Liquidity Preference

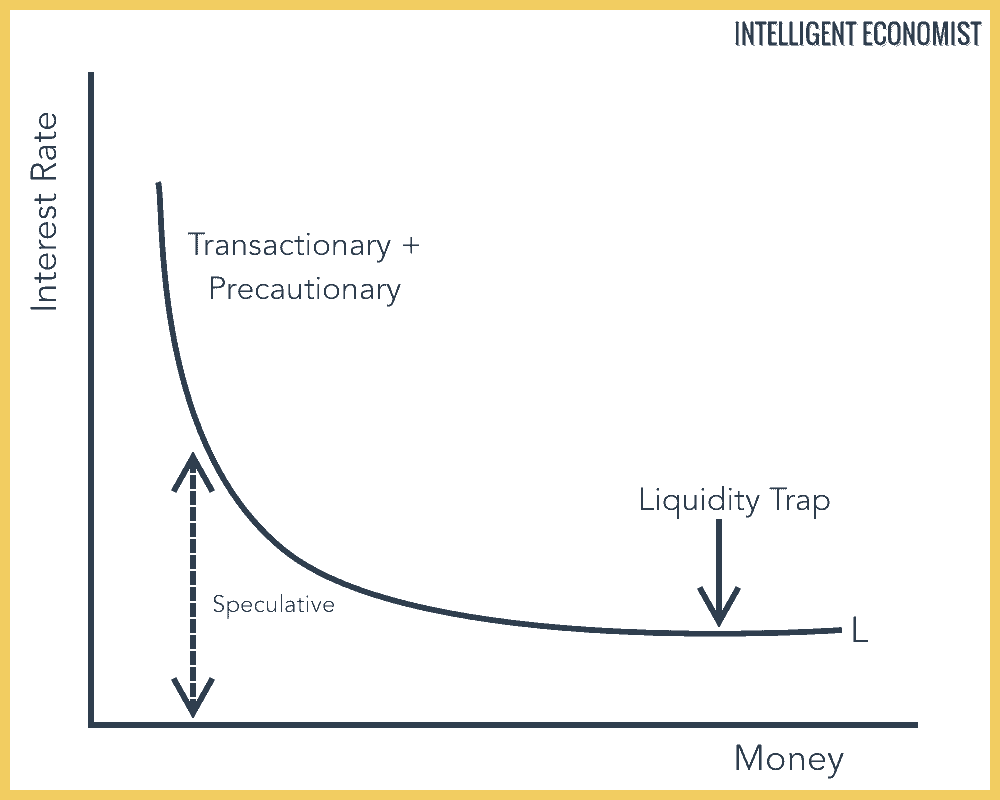

At its heart, the liquidity preference theory revolves around the idea that individuals have a natural inclination to hold onto cash. This inclination stems from several motives, which Keynes identified as transactionary, precautionary, and speculative.

Transactionary Motive

The transactionary motive is perhaps the most straightforward. People need money to conduct daily transactions – buying groceries, paying bills, and so on. The amount of money held for this purpose is directly related to an individual’s income and spending habits. Higher income generally leads to higher transactionary demand for money.

Precautionary Motive

The precautionary motive reflects the desire to hold money as a safety net against unforeseen circumstances. Unexpected expenses, such as medical bills or car repairs, can arise at any time. Holding cash provides a buffer to handle these emergencies without needing to liquidate other assets or take on debt. The level of precautionary demand is influenced by factors such as risk aversion and economic uncertainty.

Speculative Motive

The speculative motive is the most complex and arguably the most interesting. It involves holding money in anticipation of future changes in interest rates or asset prices. If individuals believe that interest rates are likely to rise (or bond prices are likely to fall), they may choose to hold cash rather than invest in bonds. Conversely, if they anticipate falling interest rates (or rising bond prices), they may be more inclined to invest. This speculative demand for money is inversely related to interest rates; higher interest rates reduce the demand for money, while lower interest rates increase it. Understanding the speculative motive is crucial to grasping the full implications of the liquidity preference theory.

The Relationship Between Money Supply, Money Demand, and Interest Rates

The liquidity preference theory asserts that interest rates are determined by the interaction of the supply and demand for money. The money supply is typically controlled by a central bank, while the demand for money is influenced by the transactionary, precautionary, and speculative motives discussed above. When the demand for money exceeds the supply, interest rates rise to equilibrate the market. Conversely, when the supply of money exceeds the demand, interest rates fall.

For example, if the central bank increases the money supply, individuals will have more cash than they desire. This surplus of money will lead them to seek out other investment opportunities, such as bonds. Increased demand for bonds will drive up their prices and, consequently, lower interest rates. This process continues until the money market reaches equilibrium, where the quantity of money demanded equals the quantity supplied. The liquidity preference theory provides a framework for understanding how monetary policy affects interest rates and the broader economy.

Implications for Economic Policy

The liquidity preference theory has significant implications for economic policy. It suggests that monetary policy can be an effective tool for influencing interest rates and stimulating or cooling down economic activity. By adjusting the money supply, central banks can manipulate interest rates to achieve their desired macroeconomic goals.

For instance, during a recession, a central bank might increase the money supply to lower interest rates. Lower interest rates encourage borrowing and investment, which can help to boost economic growth. Conversely, during periods of high inflation, a central bank might decrease the money supply to raise interest rates. Higher interest rates can curb spending and investment, which can help to bring inflation under control. The effectiveness of monetary policy, however, can be influenced by factors such as the sensitivity of money demand to interest rates and the credibility of the central bank. The liquidity preference theory helps policymakers understand these dynamics and make informed decisions.

Criticisms and Limitations

While the liquidity preference theory is a valuable tool for understanding the relationship between money, interest rates, and economic activity, it is not without its criticisms and limitations. One common criticism is that the theory oversimplifies the complex factors that influence interest rates. Other factors, such as credit risk, inflation expectations, and global capital flows, can also play a significant role in determining interest rate levels.

Another limitation is that the theory assumes that individuals are primarily motivated by rational self-interest. In reality, psychological factors, such as herd behavior and emotional biases, can also influence investment decisions. These factors can lead to deviations from the predictions of the liquidity preference theory.

Furthermore, the theory may not accurately reflect the behavior of financial markets in all situations. For example, during periods of financial crisis, the demand for liquidity can surge dramatically, leading to a “flight to safety” and a breakdown in the normal relationship between money supply, money demand, and interest rates. Despite these limitations, the liquidity preference theory remains a useful framework for understanding the fundamental drivers of interest rates and the role of monetary policy in the economy. [See also: Understanding Monetary Policy]

Real-World Examples

To further illustrate the liquidity preference theory, consider a few real-world examples. During the 2008 financial crisis, the demand for liquidity surged as investors became increasingly risk-averse. This led to a sharp increase in interest rates, even as central banks around the world were injecting massive amounts of liquidity into the financial system. The increased demand for liquidity overwhelmed the increased supply, resulting in higher borrowing costs for businesses and consumers. [See also: The 2008 Financial Crisis Explained]

Another example can be seen in the response of central banks to the COVID-19 pandemic. As the pandemic triggered a sharp economic downturn, central banks lowered interest rates to near-zero levels and implemented large-scale asset purchase programs (quantitative easing) to increase the money supply. These actions were intended to stimulate borrowing and investment, and to prevent a collapse in economic activity. The effectiveness of these measures, however, was debated, as the demand for liquidity remained high due to ongoing uncertainty and risk aversion. The liquidity preference theory helps to explain why these interventions may not always be fully effective, particularly during times of crisis.

Conclusion

The liquidity preference theory provides a valuable framework for understanding the relationship between money, interest rates, and economic activity. While it has its limitations, it remains a cornerstone of Keynesian economics and a useful tool for policymakers. By understanding the motives that drive individuals’ demand for money, central banks can make more informed decisions about monetary policy and better manage the economy. The liquidity preference theory continues to be relevant in today’s complex and ever-changing financial landscape, offering insights into the forces that shape interest rates and influence economic outcomes. The speculative motive, in particular, highlights how expectations about future interest rates can drive current investment decisions. Understanding the liquidity preference theory is essential for anyone seeking to grasp the inner workings of modern monetary economics. This theory also connects directly to understanding how central banks influence inflation and economic growth. Ultimately, the liquidity preference theory helps us understand why we prefer to have cash on hand and how that preference affects the broader economy. It is a critical concept for anyone interested in economics or finance. The liquidity preference theory is a fundamental concept. Even with alternative theories, it remains relevant. The liquidity preference theory is a concept frequently discussed in advanced economics courses and remains a cornerstone of monetary policy analysis. The liquidity preference theory is very important. Examining the liquidity preference theory reveals insights into human financial behavior. The liquidity preference theory is the foundation for understanding monetary policy. The liquidity preference theory helps to explain investor behavior during economic downturns. The liquidity preference theory underscores the significance of maintaining adequate cash reserves, both for individuals and businesses. The liquidity preference theory is a useful concept to understand. Consider the liquidity preference theory when evaluating investment strategies.