Understanding the Theory of Liquidity Preference: A Comprehensive Guide

The theory of liquidity preference, a cornerstone of Keynesian economics, provides a framework for understanding how interest rates are determined in an economy. Developed by John Maynard Keynes, this theory posits that the interest rate adjusts to balance the supply and demand for money. In essence, it explains why people prefer to hold their wealth in liquid form – money – rather than in less liquid assets like bonds. This preference influences the prevailing interest rates and, consequently, affects investment and overall economic activity.

This comprehensive guide delves into the intricacies of the theory of liquidity preference, exploring its underlying assumptions, key components, and implications for monetary policy and economic stability. We will examine the motives behind holding money, the factors that shift the money supply and demand curves, and the role of central banks in managing liquidity to achieve macroeconomic goals.

Key Components of the Theory of Liquidity Preference

The theory of liquidity preference rests on several fundamental concepts. Understanding these components is crucial for grasping the overall framework.

The Demand for Money

At the heart of the theory lies the concept of money demand. Keynes identified three primary motives for holding money:

- Transactions Motive: This stems from the need to conduct everyday transactions. Individuals and businesses hold money to facilitate purchases of goods and services. The level of income is a significant determinant of the transactions demand for money; higher income generally leads to a greater need for transactions.

- Precautionary Motive: This reflects the desire to hold money as a buffer against unforeseen expenses or opportunities. Uncertainty about future income or expenses drives the precautionary demand for money.

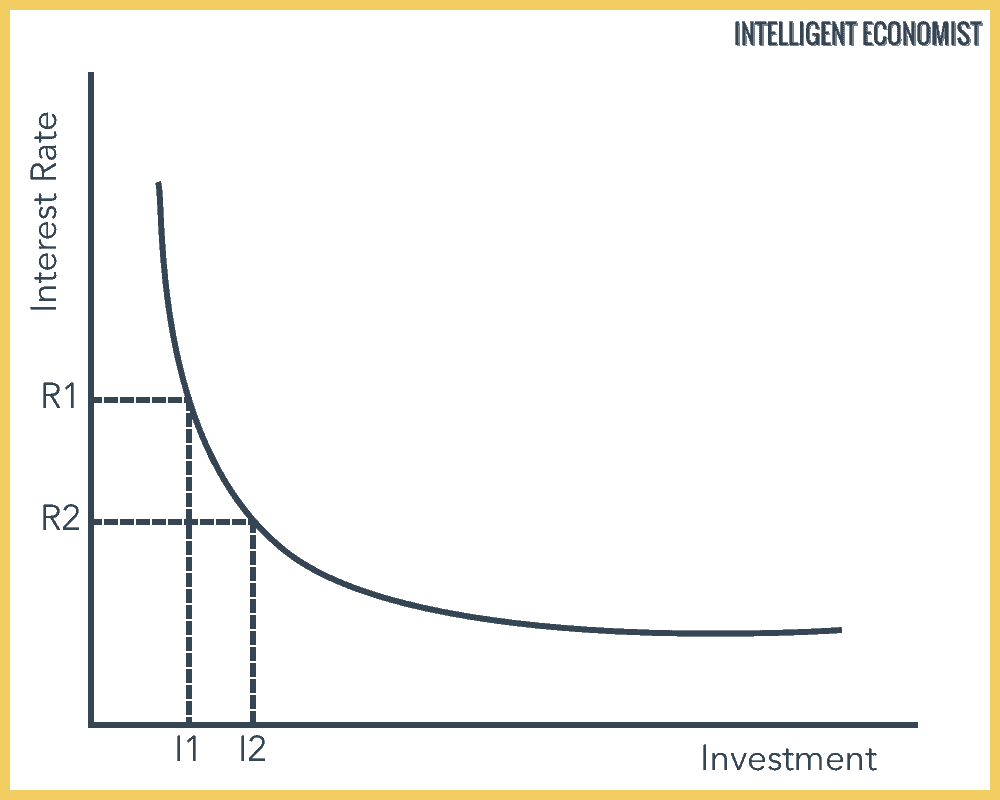

- Speculative Motive: This is the most distinctive element of Keynes’s theory. It arises from the belief that interest rates and bond prices are inversely related. If individuals expect interest rates to rise (and bond prices to fall), they will prefer to hold money now and buy bonds later when they are cheaper. Conversely, if they expect interest rates to fall (and bond prices to rise), they will prefer to buy bonds now. This speculative demand for money is inversely related to the current interest rate.

The total demand for money is the sum of these three motives. The theory of liquidity preference emphasizes the role of the interest rate in influencing the speculative demand and, consequently, the overall demand for money.

The Supply of Money

The supply of money is determined primarily by the central bank. The central bank controls the money supply through various tools, such as:

- Open Market Operations: Buying or selling government bonds to increase or decrease the money supply.

- Reserve Requirements: Setting the fraction of deposits that banks must hold in reserve.

- The Discount Rate: The interest rate at which commercial banks can borrow money directly from the central bank.

For simplicity, the theory of liquidity preference often assumes that the money supply is fixed by the central bank. This means that the money supply curve is vertical – it does not depend on the interest rate. However, in reality, central banks may adjust the money supply in response to economic conditions.

Equilibrium in the Money Market

The interest rate is determined by the intersection of the money demand and money supply curves. At the equilibrium interest rate, the quantity of money demanded equals the quantity of money supplied. If the interest rate is above the equilibrium level, there will be an excess supply of money, leading individuals and businesses to purchase bonds, driving down interest rates. Conversely, if the interest rate is below the equilibrium level, there will be an excess demand for money, leading individuals and businesses to sell bonds, driving up interest rates. [See also: How Interest Rates Affect the Economy]

Factors Shifting the Money Demand and Supply Curves

The equilibrium interest rate can change due to shifts in either the money demand or money supply curves. Several factors can cause these shifts:

Factors Shifting the Money Demand Curve

- Changes in Income: An increase in income will generally lead to an increase in the demand for money, shifting the money demand curve to the right. This is primarily due to the increased transactions demand for money.

- Changes in Price Level: A rise in the price level will also increase the demand for money, as more money is needed to purchase the same amount of goods and services. This shifts the money demand curve to the right.

- Changes in Expectations: Expectations about future interest rates and inflation can significantly affect the speculative demand for money. For example, if individuals expect interest rates to rise sharply, they will increase their demand for money, shifting the money demand curve to the right.

- Technological Advancements: Innovations in payment systems, such as the widespread adoption of credit cards or mobile payment apps, can reduce the demand for money, shifting the money demand curve to the left.

Factors Shifting the Money Supply Curve

- Central Bank Policy: The central bank’s actions are the primary driver of shifts in the money supply curve. Open market operations, changes in reserve requirements, and adjustments to the discount rate can all be used to increase or decrease the money supply.

- Changes in Bank Lending: The amount of lending activity by commercial banks can also affect the money supply. If banks become more willing to lend, the money supply will increase, shifting the money supply curve to the right. Conversely, if banks become more cautious about lending, the money supply will decrease, shifting the money supply curve to the left.

Implications for Monetary Policy

The theory of liquidity preference provides a theoretical basis for understanding how monetary policy affects interest rates and, consequently, the economy. By controlling the money supply, the central bank can influence interest rates and stimulate or restrain economic activity. [See also: The Role of Central Banks in Economic Stability]

Lowering Interest Rates

To stimulate the economy, the central bank can increase the money supply, which, according to the theory of liquidity preference, will lower interest rates. Lower interest rates encourage investment spending by businesses and consumption spending by households, leading to increased aggregate demand and economic growth.

Raising Interest Rates

To cool down an overheating economy or combat inflation, the central bank can decrease the money supply, which will raise interest rates. Higher interest rates discourage investment and consumption spending, leading to decreased aggregate demand and slower economic growth. The effectiveness of this depends on the elasticity of money demand, which is a key point in the theory of liquidity preference.

Criticisms and Limitations of the Theory of Liquidity Preference

While the theory of liquidity preference is a valuable framework for understanding interest rate determination, it is not without its criticisms and limitations:

- Simplifying Assumptions: The theory makes several simplifying assumptions, such as treating the money supply as fixed and focusing primarily on the short-run effects of monetary policy. In reality, the money supply can be endogenous, and monetary policy can have long-run effects.

- Ignoring Other Factors: The theory focuses primarily on the money market and ignores other factors that can influence interest rates, such as fiscal policy, international capital flows, and expectations about future economic conditions.

- The Liquidity Trap: The theory suggests that there may be situations where monetary policy becomes ineffective. This is known as the liquidity trap, where interest rates are already very low, and further increases in the money supply have little or no effect on interest rates or economic activity. This is because at very low interest rates, individuals and businesses may prefer to hold onto cash rather than invest, even if interest rates fall further.

Real-World Examples and Applications

Despite its limitations, the theory of liquidity preference remains a relevant tool for analyzing economic events and policy decisions. For example, during the 2008 financial crisis, central banks around the world aggressively lowered interest rates and increased the money supply in an attempt to stimulate economic activity. This was a direct application of the principles of the theory of liquidity preference. [See also: Lessons from the 2008 Financial Crisis]

Another example is the use of quantitative easing (QE) by central banks in recent years. QE involves the purchase of long-term government bonds and other assets to increase the money supply and lower long-term interest rates. This is intended to stimulate investment and consumption spending and boost economic growth. The theory of liquidity preference helps explain why QE can be effective in lowering long-term interest rates, even when short-term interest rates are already near zero.

Conclusion

The theory of liquidity preference provides a valuable framework for understanding how interest rates are determined and how monetary policy can affect the economy. While it has its limitations, it remains a relevant and influential theory in macroeconomics. By understanding the motives behind holding money, the factors that shift the money supply and demand curves, and the implications for monetary policy, we can gain a deeper understanding of the forces that drive economic activity. The theory of liquidity preference continues to be a cornerstone of modern macroeconomic thought, providing insights into the complex relationship between money, interest rates, and economic performance. Understanding this theory is crucial for anyone seeking to grasp the intricacies of monetary policy and its impact on the broader economy.