Understanding What is Liquidity Preference Theory: A Comprehensive Guide

In the realm of economics, understanding the forces that drive interest rates and investment decisions is crucial. One such pivotal concept is the liquidity preference theory. Proposed by the renowned economist John Maynard Keynes, this theory elucidates how individuals and businesses prioritize having liquid assets, like cash, over less liquid investments. This preference, in turn, influences the prevailing interest rates in an economy. Understanding what is liquidity preference theory is essential for anyone seeking to grasp the dynamics of monetary policy and financial markets.

The Core Principles of Liquidity Preference Theory

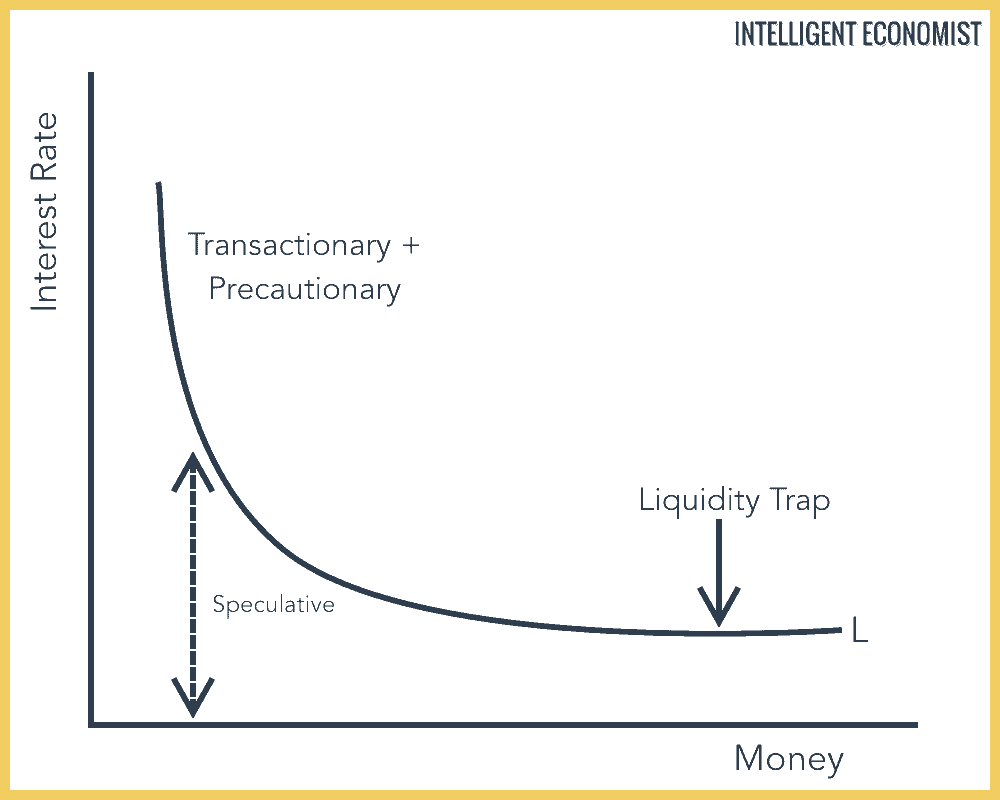

The liquidity preference theory posits that interest rates are determined by the supply and demand for money. Keynes argued that individuals and businesses hold money for three primary reasons:

- Transaction Motive: Holding money to facilitate everyday transactions. This is directly related to income; the higher the income, the more money individuals hold for transactions.

- Precautionary Motive: Holding money as a buffer against unforeseen expenses or emergencies. The level of uncertainty in the economy influences this motive.

- Speculative Motive: Holding money to take advantage of future investment opportunities. This is inversely related to interest rates; when interest rates are low, people prefer to hold money, anticipating that rates will rise.

These three motives collectively determine the demand for money. The supply of money, primarily controlled by central banks, interacts with this demand to establish the equilibrium interest rate. A shift in either the supply or demand for money will subsequently affect interest rates.

The Role of Interest Rates

Interest rates play a critical role in the liquidity preference theory. They represent the opportunity cost of holding money. When interest rates are high, the opportunity cost of holding cash is also high, as individuals forgo potential returns from investments. Conversely, when interest rates are low, the opportunity cost of holding cash is low, making it more appealing to hold onto liquid assets. This inverse relationship between interest rates and the demand for money is a cornerstone of the theory.

According to Keynes, the speculative motive is particularly sensitive to interest rate fluctuations. When interest rates are expected to rise, individuals will hold onto cash, anticipating that they can invest at higher rates in the future. This increased demand for money drives interest rates up, further validating their initial expectations. Conversely, if interest rates are expected to fall, individuals will invest their cash, decreasing the demand for money and pushing interest rates down.

Factors Influencing Liquidity Preference

Several factors can influence an individual’s or a business’s liquidity preference. These include:

- Income Levels: Higher income typically leads to a higher demand for money for transaction purposes.

- Price Levels: Inflation erodes the purchasing power of money, increasing the demand for it to maintain the same level of real transactions.

- Economic Uncertainty: During times of economic uncertainty, individuals and businesses tend to increase their liquidity preference as a precautionary measure.

- Expectations about Future Interest Rates: As discussed earlier, expectations about future interest rates significantly impact the speculative demand for money.

- Changes in Monetary Policy: Actions taken by central banks, such as adjusting the money supply or setting benchmark interest rates, directly influence the overall liquidity preference in the economy.

The Impact of Monetary Policy

Central banks utilize the principles of the liquidity preference theory to influence economic activity through monetary policy. By manipulating the money supply, central banks can impact interest rates and, consequently, investment and consumption decisions. For example, increasing the money supply typically lowers interest rates, encouraging borrowing and investment, which can stimulate economic growth. Conversely, decreasing the money supply raises interest rates, discouraging borrowing and investment, which can help control inflation.

However, the effectiveness of monetary policy can be influenced by various factors, including the sensitivity of investment to interest rate changes and the overall level of confidence in the economy. During periods of high uncertainty, even low interest rates may not be enough to stimulate investment if businesses are hesitant to take on new projects.

Criticisms and Limitations of Liquidity Preference Theory

While the liquidity preference theory provides valuable insights into the dynamics of interest rates and money demand, it is not without its criticisms and limitations. Some common criticisms include:

- Oversimplification: Critics argue that the theory oversimplifies the complexities of financial markets and ignores other factors that can influence interest rates, such as credit risk and global capital flows.

- Focus on Short-Term: The theory is primarily focused on short-term interest rate fluctuations and may not adequately explain long-term trends.

- Neglect of Supply-Side Factors: Some economists argue that the theory places too much emphasis on demand-side factors and neglects the role of supply-side factors, such as technological innovation and productivity growth, in determining interest rates.

- Rational Expectations: The theory assumes that individuals form expectations about future interest rates based on current information. However, some economists argue that individuals may have rational expectations, meaning they incorporate all available information, including government policies and economic forecasts, into their expectations.

Examples of Liquidity Preference in Action

Consider the following examples to illustrate the liquidity preference theory in action:

- Economic Recession: During an economic recession, businesses may become more cautious and increase their liquidity preference to weather potential financial difficulties. This increased demand for money can drive up interest rates, further dampening economic activity.

- Central Bank Intervention: If a central bank wants to stimulate economic growth, it may increase the money supply through open market operations. This increase in the money supply lowers interest rates, encouraging borrowing and investment, and ultimately boosting economic activity.

- Anticipation of Inflation: If individuals and businesses anticipate higher inflation in the future, they may increase their liquidity preference to protect their purchasing power. This increased demand for money can lead to higher interest rates.

Liquidity Preference vs. Loanable Funds Theory

It’s important to differentiate the liquidity preference theory from the loanable funds theory, another explanation of interest rate determination. The loanable funds theory suggests that interest rates are determined by the supply and demand for loanable funds, which include savings, investment, and government borrowing. While both theories aim to explain interest rate movements, they differ in their focus. Liquidity preference theory emphasizes the demand for money and the role of expectations, while the loanable funds theory focuses on the supply and demand for credit.

Real-World Applications and Implications

Understanding what is liquidity preference theory has significant real-world applications. It helps policymakers make informed decisions about monetary policy, allowing them to influence economic activity and control inflation. Investors can also use the theory to anticipate interest rate movements and make strategic investment decisions. For example, if an investor anticipates an increase in liquidity preference due to economic uncertainty, they might consider shifting their portfolio towards more liquid assets, such as cash or short-term bonds.

Furthermore, the liquidity preference theory can help businesses manage their cash flow and investment strategies. By understanding the factors that influence liquidity preference, businesses can make informed decisions about how much cash to hold and when to invest in longer-term assets. [See also: Understanding Interest Rate Risk]

Conclusion

The liquidity preference theory, developed by John Maynard Keynes, provides a valuable framework for understanding the determinants of interest rates and the role of money demand in the economy. By considering the transaction, precautionary, and speculative motives for holding money, this theory explains how individuals and businesses prioritize liquidity and how this preference impacts interest rates. While the theory has its limitations and criticisms, it remains a fundamental concept in macroeconomics and continues to inform monetary policy decisions around the world. Understanding what is liquidity preference theory is crucial for anyone seeking to navigate the complexities of financial markets and the broader economy. Its core principles are essential for comprehending how central banks manage monetary policy and how economic actors respond to changing conditions.

Ultimately, the liquidity preference theory underscores the importance of understanding the psychological and behavioral factors that influence economic decisions. By recognizing that individuals and businesses are not always perfectly rational and that their expectations and preferences can significantly impact market outcomes, we can gain a deeper appreciation for the complexities of the modern economy. Further research and analysis continue to refine and expand upon Keynes’s original insights, ensuring that the liquidity preference theory remains a relevant and valuable tool for economists and policymakers alike.