Unlock Financial Potential: Mastering the Leverage Profit Calculator

In the dynamic world of finance, understanding leverage is crucial for making informed investment decisions. A key tool in this process is the leverage profit calculator. This sophisticated instrument allows investors and traders to estimate potential profits and losses associated with leveraged investments. This article delves into the intricacies of leverage profit calculators, exploring their functionalities, benefits, and limitations. Whether you’re a seasoned investor or just starting, mastering the use of a leverage profit calculator can significantly enhance your financial strategy.

Understanding Leverage and Its Impact

Leverage, in its simplest form, is the use of borrowed capital to increase the potential return of an investment. It amplifies both profits and losses, making it a double-edged sword. A leverage profit calculator helps quantify this amplification by providing a clear picture of the potential outcomes based on different leverage ratios and market scenarios. Understanding the underlying mechanics of leverage is paramount before employing a leverage profit calculator effectively.

How Leverage Works

Imagine you have $1,000 to invest. Without leverage, your profit is directly tied to the percentage increase in the asset’s value. However, with leverage, you can control a larger position with the same initial capital. For instance, a leverage of 10:1 allows you to control $10,000 worth of assets with your $1,000. While this can magnify profits, it also significantly increases the potential for losses. This is where a leverage profit calculator becomes invaluable.

The Risks of Leverage

The primary risk associated with leverage is the potential for amplified losses. If the market moves against your position, the losses can quickly exceed your initial investment. This is why risk management is crucial when using leverage. A leverage profit calculator aids in this by illustrating the potential downside, allowing investors to set appropriate stop-loss orders and manage their risk exposure. [See also: Risk Management Strategies for Leveraged Trading]

The Leverage Profit Calculator: A Deep Dive

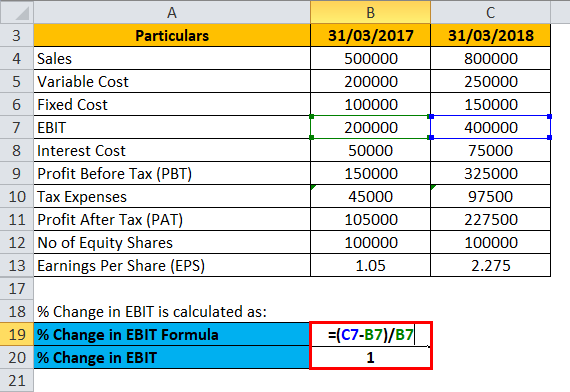

A leverage profit calculator is a tool designed to estimate the potential profit or loss of a leveraged investment. It typically requires several inputs, including the initial investment, leverage ratio, entry price, exit price, and any associated fees or commissions. By inputting these variables, the calculator provides a projection of the potential outcome of the trade.

Key Components of a Leverage Profit Calculator

- Initial Investment: The amount of capital you are willing to risk on the trade.

- Leverage Ratio: The ratio of borrowed capital to your own capital (e.g., 1:1, 10:1, 50:1).

- Entry Price: The price at which you enter the trade.

- Exit Price: The price at which you plan to exit the trade.

- Fees and Commissions: Any costs associated with the trade, such as broker fees or commissions.

How to Use a Leverage Profit Calculator

Using a leverage profit calculator is straightforward. You simply input the required information, and the calculator will generate an estimate of the potential profit or loss. It’s important to use accurate data and consider all relevant fees to get the most realistic projection. Different leverage profit calculators might have slightly different interfaces, but the core functionality remains the same.

Benefits of Using a Leverage Profit Calculator

Employing a leverage profit calculator offers several advantages for investors and traders. These benefits range from improved risk management to enhanced decision-making capabilities.

Improved Risk Management

One of the primary benefits of using a leverage profit calculator is its ability to help manage risk. By providing a clear picture of the potential losses associated with a leveraged trade, investors can set appropriate stop-loss orders and limit their exposure. This is particularly important for those new to leveraged trading. [See also: The Importance of Stop-Loss Orders in Forex Trading]

Enhanced Decision-Making

A leverage profit calculator allows for more informed decision-making. By comparing potential outcomes under different scenarios, investors can choose the most favorable trades and adjust their strategies accordingly. This can lead to more profitable trading outcomes over time. Using a leverage profit calculator can help test different strategies without risking real capital.

Scenario Analysis

Leverage profit calculators enable investors to perform scenario analysis. By adjusting the input variables, such as the exit price or leverage ratio, investors can see how different market conditions would impact their potential profit or loss. This allows for a more comprehensive understanding of the risks and rewards associated with a particular trade. This is crucial for developing a robust trading plan.

Limitations of Leverage Profit Calculators

While leverage profit calculators are valuable tools, they are not without limitations. It’s important to understand these limitations to avoid over-reliance on the calculator’s projections.

Market Volatility

Leverage profit calculators assume a certain level of market stability. However, in reality, markets can be highly volatile, and prices can fluctuate rapidly. This can lead to actual profits or losses that deviate significantly from the calculator’s projections. It is important to account for market volatility when using a leverage profit calculator.

Slippage and Gaps

Slippage occurs when the actual execution price of a trade differs from the intended price. Gaps are sudden jumps in price that can occur during periods of high volatility or market news events. These factors can impact the accuracy of a leverage profit calculator‘s projections. Many leverage profit calculators do not account for slippage or gaps.

Fees and Commissions

While most leverage profit calculators allow for the input of fees and commissions, it’s important to ensure that these figures are accurate. Hidden fees or unexpected commissions can significantly impact the profitability of a trade. Always double-check the fee structure with your broker before entering a leveraged trade. Accurate fee calculations are essential when using a leverage profit calculator.

Examples of Leverage Profit Calculator Use Cases

To illustrate the practical application of a leverage profit calculator, consider the following examples:

Forex Trading

In forex trading, leverage is commonly used to control larger positions. A trader might use a leverage profit calculator to determine the potential profit or loss of a currency pair trade based on different leverage ratios and market scenarios. This helps them manage their risk and make informed trading decisions. Using a leverage profit calculator is essential for forex traders using high leverage.

Stock Trading

While leverage is less common in stock trading, it can still be used to amplify returns. A trader might use a leverage profit calculator to assess the potential profit or loss of a stock trade based on different leverage ratios and price targets. This can help them determine whether the potential reward justifies the risk. [See also: Margin Trading in the Stock Market: A Comprehensive Guide]

Cryptocurrency Trading

Cryptocurrency trading is known for its high volatility, and leverage can be used to amplify both profits and losses. A trader might use a leverage profit calculator to evaluate the potential outcomes of a cryptocurrency trade based on different leverage ratios and price fluctuations. Due to the volatile nature of cryptocurrencies, it is crucial to use a leverage profit calculator with caution and to implement strict risk management strategies.

Choosing the Right Leverage Profit Calculator

With numerous leverage profit calculators available online, selecting the right one can be challenging. Here are some factors to consider when choosing a leverage profit calculator:

Accuracy and Reliability

The most important factor is the accuracy and reliability of the calculator. Look for calculators that use accurate formulas and provide clear, concise results. Test the calculator with known data to ensure that it produces accurate projections. A reliable leverage profit calculator is essential for making informed decisions.

User Interface

The calculator should have a user-friendly interface that is easy to navigate. The input fields should be clearly labeled, and the results should be presented in a clear and understandable format. A user-friendly leverage profit calculator saves time and reduces the risk of errors.

Features and Functionality

Consider the features and functionality offered by the calculator. Does it allow for the input of fees and commissions? Does it offer scenario analysis capabilities? Does it provide additional tools, such as risk management calculators? Choose a leverage profit calculator that meets your specific needs and requirements.

Best Practices for Using Leverage Profit Calculators

To maximize the benefits of a leverage profit calculator, follow these best practices:

Use Accurate Data

The accuracy of the calculator’s projections depends on the accuracy of the input data. Use accurate entry and exit prices, leverage ratios, and fees. Double-check your data before inputting it into the calculator. Garbage in, garbage out applies to leverage profit calculators.

Consider Market Volatility

Account for market volatility when interpreting the calculator’s results. The calculator provides a snapshot of potential outcomes under specific conditions, but market conditions can change rapidly. Be prepared for unexpected price fluctuations. Volatility should always be considered when using a leverage profit calculator.

Implement Risk Management Strategies

Use the calculator’s projections to implement effective risk management strategies. Set appropriate stop-loss orders and limit your exposure to leveraged trades. Never risk more than you can afford to lose. Risk management is paramount when using a leverage profit calculator and trading with leverage.

Conclusion

A leverage profit calculator is a valuable tool for investors and traders looking to understand the potential risks and rewards of leveraged investments. By providing a clear picture of potential profits and losses, it enables more informed decision-making and improved risk management. However, it’s important to understand the limitations of these calculators and to use them in conjunction with other risk management strategies. Mastering the use of a leverage profit calculator can significantly enhance your financial strategy and help you unlock your financial potential.