Unlock Financial Power: Mastering the Leverage Profit Calculator

In the dynamic world of finance, understanding and utilizing leverage is crucial for maximizing potential returns. A leverage profit calculator serves as an indispensable tool for investors and traders alike, enabling them to assess the potential gains and risks associated with leveraged investments. This article delves into the intricacies of leverage profit calculators, exploring their functionality, benefits, and how to use them effectively to make informed financial decisions.

Understanding Leverage and Its Impact

Leverage, in its simplest form, is the use of borrowed capital to increase the potential return of an investment. It allows individuals or businesses to control a larger asset base with a smaller amount of their own capital. While leverage can amplify profits, it also magnifies losses, making risk management a critical component of any leveraged strategy.

The Double-Edged Sword of Leverage

The allure of leverage lies in its ability to generate substantial returns with minimal capital outlay. For example, if an investor uses leverage to purchase a property and the property value increases, the return on their initial investment is significantly higher than if they had purchased the property outright. However, if the property value decreases, the investor is responsible for the full loss, which can quickly erode their capital.

What is a Leverage Profit Calculator?

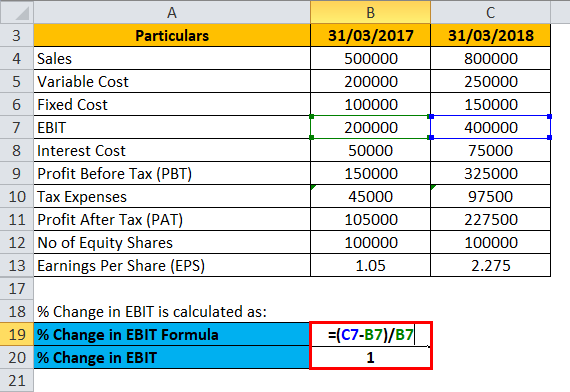

A leverage profit calculator is a tool designed to estimate the potential profit or loss from a leveraged investment. It takes into account factors such as the initial investment, the leverage ratio, the asset’s price movement, and any associated fees or interest charges. By inputting these variables, users can gain a clearer understanding of the potential outcomes of their leveraged positions.

Key Components of a Leverage Profit Calculator

- Initial Investment: The amount of capital the investor puts up.

- Leverage Ratio: The ratio of borrowed capital to the investor’s own capital (e.g., 1:10 leverage means for every $1 of the investor’s capital, $10 is borrowed).

- Asset Price: The current price of the asset being leveraged.

- Price Change: The anticipated or actual change in the asset’s price.

- Fees and Interest: Any costs associated with the leveraged position, such as brokerage fees or interest on borrowed capital.

Benefits of Using a Leverage Profit Calculator

Employing a leverage profit calculator offers several advantages for investors and traders:

- Risk Assessment: It allows users to quantify the potential downside risks associated with a leveraged investment, enabling them to make more informed decisions.

- Profit Potential: It helps users estimate the potential profit from a leveraged investment, allowing them to assess whether the potential reward justifies the risk.

- Strategy Optimization: By experimenting with different leverage ratios and price movements, users can optimize their trading strategies to maximize potential returns while minimizing risk.

- Financial Planning: It aids in financial planning by providing a clear picture of the potential impact of leveraged investments on an individual’s or business’s overall financial situation.

How to Use a Leverage Profit Calculator Effectively

To maximize the benefits of a leverage profit calculator, follow these steps:

- Gather Accurate Data: Ensure that all input data, such as the initial investment, leverage ratio, asset price, and fees, is accurate and up-to-date.

- Experiment with Different Scenarios: Use the calculator to simulate different price movements and leverage ratios to understand the potential impact on profit and loss.

- Consider Fees and Interest: Always factor in any fees or interest charges associated with the leveraged position, as these can significantly impact the overall profitability.

- Understand the Limitations: Recognize that a leverage profit calculator provides an estimate based on the input data. Actual results may vary due to market volatility and other unforeseen factors.

Examples of Leverage Profit Calculator Applications

The leverage profit calculator can be applied in various financial scenarios:

Real Estate Investments

Real estate investors often use leverage in the form of mortgages to purchase properties. A leverage profit calculator can help them estimate the potential return on their investment, taking into account factors such as the property value, mortgage interest rates, and rental income. This allows investors to evaluate the profitability of their real estate ventures and make informed decisions about property acquisitions.

Forex Trading

Forex traders frequently employ leverage to amplify their trading positions. A leverage profit calculator can assist them in determining the potential profit or loss from a forex trade, considering factors such as the currency pair, leverage ratio, and pip movement. This enables traders to manage their risk exposure and optimize their trading strategies in the volatile forex market.

Stock Trading

While less common than in forex or real estate, leverage can also be used in stock trading through margin accounts. A leverage profit calculator can help stock traders assess the potential gains and losses from leveraged stock positions, taking into account factors such as the stock price, margin interest rates, and dividend income. This allows traders to make informed decisions about their stock investments and manage their margin exposure.

The Importance of Risk Management with Leverage

While the leverage profit calculator helps in estimating potential gains, it’s crucial to remember that leverage amplifies both profits and losses. Effective risk management is paramount when using leverage. Here are some key risk management strategies:

- Stop-Loss Orders: Implementing stop-loss orders can automatically close a position when it reaches a predetermined loss level, limiting potential downside.

- Position Sizing: Carefully determine the size of each leveraged position to avoid overexposure to any single asset or market.

- Diversification: Diversifying investments across different asset classes and markets can help reduce overall portfolio risk.

- Continuous Monitoring: Regularly monitor leveraged positions and adjust strategies as needed based on market conditions and risk tolerance.

Choosing the Right Leverage Profit Calculator

Several leverage profit calculators are available online, each with its own features and functionalities. When selecting a calculator, consider the following:

- Ease of Use: Choose a calculator that is user-friendly and easy to navigate.

- Customization: Look for a calculator that allows you to input all relevant variables, such as fees, interest rates, and taxes.

- Accuracy: Ensure that the calculator provides accurate and reliable results.

- Additional Features: Some calculators offer additional features, such as charting tools or risk management indicators.

The Future of Leverage and Profit Calculation

As financial markets continue to evolve, the role of leverage profit calculators will become increasingly important. Advancements in technology and data analytics are likely to lead to more sophisticated calculators that can provide even more accurate and insightful estimates of potential profit and loss. Furthermore, the integration of artificial intelligence and machine learning could enable calculators to adapt to changing market conditions and provide personalized recommendations for risk management and strategy optimization.

Conclusion

A leverage profit calculator is an essential tool for anyone considering leveraged investments. By understanding its functionality, benefits, and limitations, investors and traders can make more informed decisions, manage their risk exposure, and optimize their trading strategies. Remember that while leverage can amplify profits, it also magnifies losses, so effective risk management is crucial. By combining the power of a leverage profit calculator with sound risk management practices, you can unlock the financial power of leverage and achieve your investment goals. Understanding how a leverage profit calculator functions is crucial for making calculated financial choices. Always remember to factor in potential losses alongside projected profits. The responsible usage of a leverage profit calculator can lead to more informed and potentially successful investment outcomes. A reliable leverage profit calculator is invaluable for navigating the complexities of leveraged investments. Utilizing a leverage profit calculator effectively requires a thorough understanding of its inputs and outputs. For strategic financial planning, a leverage profit calculator is an indispensable asset. Consider using a leverage profit calculator to assess various investment scenarios before committing capital. With a leverage profit calculator, you can better understand the risk-reward dynamics of leveraged investments. A well-designed leverage profit calculator simplifies the complex calculations involved in leveraged trading. A leverage profit calculator helps you visualize the impact of different leverage ratios on your potential earnings. Using a leverage profit calculator can lead to more confident and well-informed investment decisions. Always double-check the results provided by a leverage profit calculator to ensure accuracy and relevance. Understanding how a leverage profit calculator works will empower you to make wiser financial choices. A leverage profit calculator is a powerful tool when used responsibly and in conjunction with sound financial principles. Using a leverage profit calculator is a proactive step toward managing risk and maximizing potential returns in leveraged investments. Remember to update the inputs of your leverage profit calculator regularly to reflect changing market conditions and personal financial goals. Before making any investment decisions, consult with a financial advisor and utilize a leverage profit calculator to understand the potential impacts of leverage.

[See also: Understanding Margin Trading and Its Risks]

[See also: Forex Leverage: Maximizing Profits and Managing Risk]

[See also: Real Estate Investment Analysis: A Comprehensive Guide]