Unlock Your Financial Potential: Mastering Leverage with a Leverage Calculator

In the world of finance, understanding and effectively using leverage can be a game-changer. Whether you’re an experienced investor or just starting out, a leverage calculator is an indispensable tool for assessing risk and maximizing potential returns. This article delves into what leverage is, how a leverage calculator works, and how you can use it to make informed financial decisions. We’ll explore real-world examples and practical tips to help you harness the power of leverage responsibly.

What is Leverage?

Leverage, in its simplest form, is the use of borrowed capital to increase the potential return of an investment. It allows you to control a larger asset with a smaller amount of your own money. Think of it as using a small fulcrum to move a much heavier object. While leverage can amplify profits, it also magnifies losses, making risk management crucial.

Common forms of leverage include:

- Margin Trading: Borrowing money from a broker to buy stocks or other assets.

- Real Estate Mortgages: Using a loan to finance the purchase of a property.

- Options Trading: Using options contracts to control a larger number of shares with a smaller investment.

- Forex Trading: Trading currencies with high leverage ratios.

Each of these methods involves using borrowed funds to enhance your purchasing power, but they also come with varying degrees of risk. The key to successful leveraging lies in understanding these risks and using tools like a leverage calculator to quantify potential outcomes.

The Power of a Leverage Calculator

A leverage calculator is a simple yet powerful tool that helps you determine the potential impact of leverage on your investments. By inputting key variables such as the amount of capital you’re investing, the leverage ratio, and the potential return on the asset, the calculator can provide insights into your potential profits or losses. This allows you to assess whether the potential reward justifies the risk.

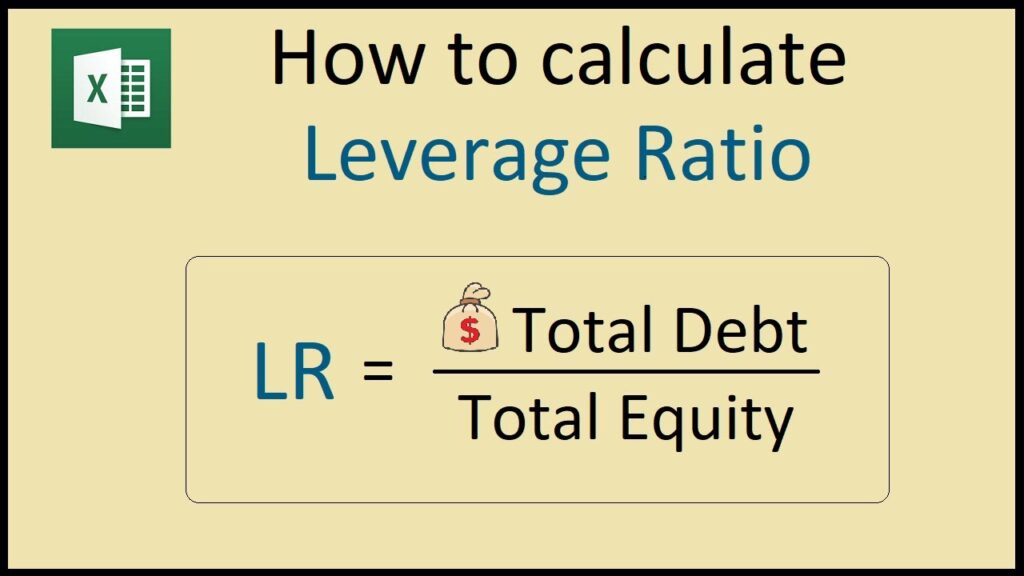

How a Leverage Calculator Works

Most leverage calculators require the following inputs:

- Investment Amount: The amount of your own capital you’re investing.

- Leverage Ratio: The ratio of borrowed funds to your own capital (e.g., 2:1, 5:1, 10:1).

- Asset Value: The total value of the asset you’re controlling with leverage.

- Potential Return: The expected percentage increase or decrease in the asset’s value.

Based on these inputs, the leverage calculator will output:

- Total Investment Value: The total value of the asset you control, including borrowed funds.

- Potential Profit/Loss: The estimated profit or loss based on the potential return.

- Return on Investment (ROI): The percentage return on your initial investment, taking leverage into account.

By manipulating these variables, you can quickly see how different levels of leverage can impact your returns and risks. This is invaluable for making informed decisions and managing your portfolio effectively. Understanding the impact of leverage is crucial, and a leverage calculator is an essential tool for this purpose.

Real-World Examples of Using a Leverage Calculator

Let’s look at a few scenarios to illustrate how a leverage calculator can be used in different investment contexts:

Example 1: Stock Trading with Margin

Suppose you want to buy $10,000 worth of stock, but you only have $5,000 available. Your broker offers a 2:1 margin, allowing you to borrow the remaining $5,000. Using a leverage calculator, you can analyze the potential outcomes.

Inputs:

- Investment Amount: $5,000

- Leverage Ratio: 2:1

- Asset Value: $10,000

Scenario A: The stock price increases by 10%.

- Potential Return: 10%

- Profit: $1,000

- ROI: 20% (Profit of $1,000 on a $5,000 investment)

Scenario B: The stock price decreases by 10%.

- Potential Return: -10%

- Loss: $1,000

- ROI: -20% (Loss of $1,000 on a $5,000 investment)

As you can see, leverage amplifies both gains and losses. A 10% price change resulted in a 20% ROI, either positive or negative. This highlights the importance of careful risk management when using leverage. A leverage calculator quickly demonstrates this impact.

Example 2: Real Estate Investment

Consider buying a rental property worth $200,000. You put down a 20% down payment ($40,000) and take out a mortgage for the remaining $160,000. You can use a leverage calculator to assess the potential returns based on rental income and property appreciation.

Inputs:

- Investment Amount: $40,000

- Leverage Ratio: 5:1 (approximate, based on loan to value)

- Asset Value: $200,000

Scenario A: The property appreciates by 5% annually, and you receive $10,000 in rental income after expenses.

- Potential Return (Appreciation): 5% of $200,000 = $10,000

- Total Return: $10,000 (appreciation) + $10,000 (rental income) = $20,000

- ROI: 50% (Return of $20,000 on a $40,000 investment)

Scenario B: The property depreciates by 5% annually, and you receive $10,000 in rental income after expenses.

- Potential Return (Depreciation): -5% of $200,000 = -$10,000

- Total Return: -$10,000 (depreciation) + $10,000 (rental income) = $0

- ROI: 0% (Return of $0 on a $40,000 investment)

In this case, leverage allows you to control a valuable asset with a relatively small initial investment. The leverage calculator helps you understand how changes in property value and rental income can impact your overall return. Remember to factor in mortgage payments and other expenses for a more accurate assessment.

Benefits of Using a Leverage Calculator

Using a leverage calculator offers several key benefits:

- Risk Assessment: Helps you quantify potential losses and understand the downside of leverage.

- Informed Decision-Making: Provides data-driven insights to make better investment choices.

- Portfolio Optimization: Allows you to adjust your leverage levels based on your risk tolerance and investment goals.

- Scenario Planning: Enables you to simulate different market conditions and assess their impact on your portfolio.

- Educational Tool: Helps you learn about the mechanics of leverage and its effects on your investments.

Risks of Leverage and How to Mitigate Them

While leverage can be a powerful tool, it’s essential to be aware of the risks involved:

- Magnified Losses: As we’ve seen, leverage amplifies both gains and losses. A small adverse price movement can result in significant losses.

- Margin Calls: If the value of your leveraged asset falls below a certain level, your broker may issue a margin call, requiring you to deposit additional funds to cover the losses.

- Interest Costs: Borrowed funds come with interest costs, which can eat into your profits.

- Increased Volatility: Leveraged positions tend to be more volatile, making them more susceptible to market fluctuations.

To mitigate these risks, consider the following:

- Use Stop-Loss Orders: Set stop-loss orders to automatically sell your asset if it reaches a certain price, limiting your potential losses.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Diversify your investments to reduce the impact of any single asset’s performance.

- Start Small: Begin with smaller leverage ratios and gradually increase them as you gain experience and confidence.

- Monitor Your Positions: Regularly check your leveraged positions and adjust them as needed based on market conditions.

- Understand the Terms: Carefully read and understand the terms and conditions of your margin agreement or loan.

Choosing the Right Leverage Calculator

Many online leverage calculators are available, each with its own features and capabilities. When choosing a leverage calculator, consider the following:

- Accuracy: Ensure the calculator uses accurate formulas and data.

- User-Friendliness: Look for a calculator that is easy to use and understand.

- Customization: Choose a calculator that allows you to input all relevant variables, such as interest rates and transaction costs.

- Additional Features: Some calculators offer additional features, such as charting and scenario analysis.

- Reputation: Opt for a calculator from a reputable source.

By carefully selecting a leverage calculator and using it responsibly, you can gain valuable insights into the potential risks and rewards of leverage.

Conclusion

Leverage can be a powerful tool for amplifying investment returns, but it also comes with significant risks. A leverage calculator is an essential tool for understanding these risks and making informed financial decisions. By using a leverage calculator, you can assess the potential impact of leverage on your investments, optimize your portfolio, and manage your risk effectively. Remember to use leverage responsibly, and always prioritize risk management.

In today’s fast-paced financial world, staying informed and making data-driven decisions is more important than ever. A leverage calculator empowers you to do just that, helping you unlock your financial potential while mitigating potential losses. So, whether you’re trading stocks, investing in real estate, or exploring other leveraged opportunities, make sure to have a leverage calculator in your toolkit.

[See also: Understanding Margin Trading]

[See also: Risk Management Strategies for Investors]

[See also: How to Calculate Return on Investment (ROI)]