Unlock Your Financial Potential with a Leverage Calculator

In the dynamic world of finance, understanding and managing risk is paramount. One of the key tools for navigating this landscape is the leverage calculator. This seemingly simple tool can be a game-changer for investors, traders, and businesses alike, providing critical insights into the potential rewards and risks associated with using borrowed capital. Whether you’re a seasoned professional or just starting your financial journey, a leverage calculator can empower you to make more informed and strategic decisions. This article delves into the intricacies of leverage, explores the benefits of using a leverage calculator, and provides practical examples to illustrate its importance.

What is Leverage?

At its core, leverage refers to the use of borrowed capital to increase the potential return on an investment. It’s a strategy employed across various financial sectors, from stock trading and real estate investment to corporate finance. The basic premise is that by using borrowed funds, you can control a larger asset base than you could with your own capital alone. This amplifies both potential profits and potential losses.

For example, imagine you have $10,000 to invest. Without leverage, you can only purchase $10,000 worth of assets. However, if you use leverage at a ratio of 2:1, you can control $20,000 worth of assets, effectively doubling your potential gains (or losses).

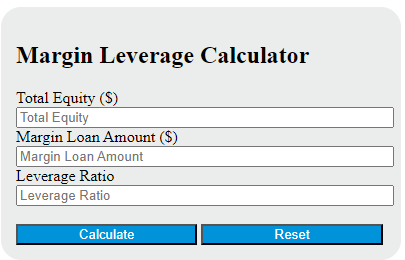

How a Leverage Calculator Works

A leverage calculator is a tool designed to quantify the impact of leverage on your investments. It typically requires you to input several key variables, such as:

- Initial Investment: The amount of your own capital you’re willing to commit.

- Leverage Ratio: The ratio of borrowed funds to your own capital (e.g., 2:1, 5:1, 10:1).

- Asset Value: The total value of the assets you’re controlling with the leveraged funds.

- Potential Profit/Loss: Your estimated profit or loss on the investment.

Based on these inputs, the leverage calculator will output various metrics, including:

- Total Capital Controlled: The total value of assets you’re managing with leverage.

- Potential Profit/Loss with Leverage: The amplified profit or loss based on the leverage ratio.

- Return on Investment (ROI): The percentage return on your initial investment, taking leverage into account.

Benefits of Using a Leverage Calculator

The benefits of using a leverage calculator are numerous and can significantly improve your financial decision-making. Here are some key advantages:

Risk Assessment

One of the primary benefits is the ability to accurately assess the potential risks associated with leverage. By inputting different scenarios into the calculator, you can see how varying levels of leverage can impact your potential losses. This allows you to make more informed decisions about how much leverage to use, if any.

Profit Potential Analysis

Conversely, a leverage calculator can also help you understand the potential profit you could generate by using leverage. By simulating different profit scenarios, you can determine whether the potential rewards justify the risks involved. This is particularly useful for traders and investors looking to maximize their returns.

Strategic Planning

A leverage calculator can be an invaluable tool for strategic financial planning. Whether you’re a business owner considering taking on debt to expand your operations or an individual investor looking to diversify your portfolio, the calculator can help you assess the potential impact of leverage on your overall financial strategy. [See also: Understanding Debt-to-Equity Ratio]

Informed Decision-Making

Ultimately, the biggest benefit of using a leverage calculator is that it empowers you to make more informed decisions. By providing you with a clear and concise picture of the potential risks and rewards associated with leverage, the calculator helps you avoid making rash or poorly considered financial choices.

Practical Examples of Leverage in Action

To illustrate the importance of a leverage calculator, let’s consider a few practical examples:

Real Estate Investment

Imagine you want to purchase a rental property worth $200,000. You have $50,000 for a down payment and plan to finance the remaining $150,000 with a mortgage. This represents a leverage ratio of 4:1 (total asset value divided by your initial investment). Using a leverage calculator, you can analyze the potential return on investment based on different rental income scenarios, property appreciation rates, and interest rates. You can also assess the risk of negative cash flow if rental income falls short of mortgage payments and expenses. This allows you to determine if the potential rewards of the investment justify the risks involved and whether the leverage ratio is appropriate for your risk tolerance.

Stock Trading

In the stock market, leverage is commonly used through margin accounts. Let’s say you have $10,000 in your account and your broker offers a leverage ratio of 2:1. This means you can control $20,000 worth of stocks. If the stocks you purchase increase in value by 10%, you’ll earn a profit of $2,000 (10% of $20,000), representing a 20% return on your initial investment of $10,000. However, if the stocks decrease in value by 10%, you’ll incur a loss of $2,000, wiping out 20% of your initial investment. A leverage calculator can help you visualize these potential gains and losses, taking into account factors such as margin interest rates and potential margin calls. [See also: Margin Trading Strategies]

Corporate Finance

Businesses often use leverage to finance expansion projects, acquisitions, or working capital needs. For example, a company might borrow $1 million to invest in new equipment that is expected to increase revenue by $300,000 per year. Using a leverage calculator, the company can analyze the impact of this debt on its profitability, cash flow, and debt-to-equity ratio. The calculator can also help the company determine the optimal amount of debt to take on, considering factors such as interest rates, repayment terms, and the company’s overall financial health. This ensures that the company is using leverage strategically to maximize its growth potential without taking on excessive risk.

Choosing the Right Leverage Calculator

With the plethora of online tools available, selecting the right leverage calculator is crucial. Look for calculators that offer:

- Customizable Inputs: The ability to input a wide range of variables to tailor the calculation to your specific situation.

- Clear Outputs: Easy-to-understand results that clearly illustrate the potential risks and rewards of leverage.

- Reputable Source: Choose calculators from trusted financial institutions or reputable websites.

- User-Friendly Interface: A calculator that is easy to navigate and use, even for those with limited financial knowledge.

The Risks of Over-Leveraging

While leverage can amplify profits, it’s crucial to be aware of the significant risks involved. Over-leveraging can lead to:

- Increased Losses: As mentioned earlier, leverage magnifies both gains and losses. If your investment performs poorly, your losses can be significantly higher than if you hadn’t used leverage.

- Margin Calls: In trading, a margin call occurs when the value of your assets falls below a certain level, requiring you to deposit additional funds to cover potential losses. Failure to meet a margin call can result in the forced liquidation of your assets at unfavorable prices.

- Financial Distress: For businesses, excessive debt can lead to financial distress, making it difficult to meet debt obligations and potentially leading to bankruptcy.

- Emotional Stress: Managing leveraged investments can be stressful, especially during periods of market volatility. The potential for large losses can lead to anxiety and poor decision-making.

Best Practices for Using Leverage

To mitigate the risks of leverage, consider these best practices:

- Understand Your Risk Tolerance: Before using leverage, carefully assess your risk tolerance and only use leverage if you’re comfortable with the potential for significant losses.

- Start Small: Begin with small amounts of leverage and gradually increase your exposure as you gain experience and confidence.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Diversify your investments to reduce the impact of any single investment on your overall portfolio.

- Use Stop-Loss Orders: In trading, use stop-loss orders to automatically limit your potential losses on leveraged positions.

- Monitor Your Investments Closely: Regularly monitor your leveraged investments and be prepared to adjust your positions if market conditions change.

- Seek Professional Advice: If you’re unsure about how to use leverage effectively, consult with a qualified financial advisor.

Conclusion

A leverage calculator is an indispensable tool for anyone looking to understand and manage the risks and rewards of using borrowed capital. By providing a clear and concise picture of the potential impact of leverage on your investments, it empowers you to make more informed and strategic decisions. However, it’s crucial to remember that leverage is a double-edged sword. While it can amplify profits, it can also magnify losses. By understanding the risks involved and following best practices, you can use leverage effectively to unlock your financial potential while minimizing the potential for financial distress. Understanding the nuances of leverage and utilizing a leverage calculator effectively can significantly enhance your financial strategy and improve your overall investment outcomes. Remember to always prioritize risk management and seek professional advice when needed.