Unlock Your Trading Potential: How to Leverage a Forex Calculator for Smarter Decisions

In the fast-paced world of Forex trading, making informed decisions is paramount to success. One tool that stands out for its ability to enhance trading strategies and minimize risks is the Forex calculator. But how can you effectively leverage a Forex calculator to optimize your trading outcomes? This article delves into the practical applications of Forex calculators, providing you with the knowledge to make smarter, more strategic trading choices.

Understanding Forex Calculators

A Forex calculator is a versatile online tool designed to assist traders in various aspects of currency trading. It offers a range of functionalities, including:

- Pip Value Calculation: Determining the monetary value of a pip (percentage in point) for a specific currency pair.

- Margin Calculation: Estimating the amount of capital required to open and maintain a trade with leverage.

- Profit/Loss Calculation: Projecting potential profits or losses based on entry and exit prices.

- Currency Conversion: Converting currencies at real-time exchange rates.

- Fibonacci Calculation: Identifying potential support and resistance levels using Fibonacci retracements.

Each of these functions provides valuable insights that can significantly impact your trading strategy. By understanding how to use these tools, traders can gain a competitive edge and make data-driven decisions. [See also: Understanding Forex Leverage: A Beginner’s Guide]

Why Leverage a Forex Calculator?

Leveraging a Forex calculator is crucial for several reasons:

- Risk Management: Forex calculators help traders assess potential risks before entering a trade. By calculating pip values and margin requirements, traders can determine the appropriate position size and leverage level.

- Profit Optimization: By projecting potential profits and losses, traders can identify the most favorable trading opportunities and adjust their strategies accordingly.

- Informed Decision-Making: Forex calculators provide data-driven insights that can help traders make more informed decisions. This is especially important in the volatile Forex market, where emotions can often cloud judgment.

- Time Efficiency: Manually calculating these values can be time-consuming and prone to errors. Forex calculators automate these calculations, saving traders valuable time and effort.

Ultimately, leveraging a Forex calculator empowers traders to approach the market with greater confidence and precision.

Key Features and Functions of a Forex Calculator

Let’s explore some of the core features of a Forex calculator in more detail:

Pip Value Calculator

The pip value calculator determines the monetary value of a pip for a specific currency pair. This is essential for calculating potential profits or losses. The formula for calculating pip value varies depending on whether the currency pair is quoted directly or indirectly.

For example, if you’re trading EUR/USD and the pip value is $10, a 10-pip movement in your favor would result in a $100 profit. Conversely, a 10-pip movement against you would result in a $100 loss. Understanding pip value allows you to accurately assess the risk and reward potential of each trade.

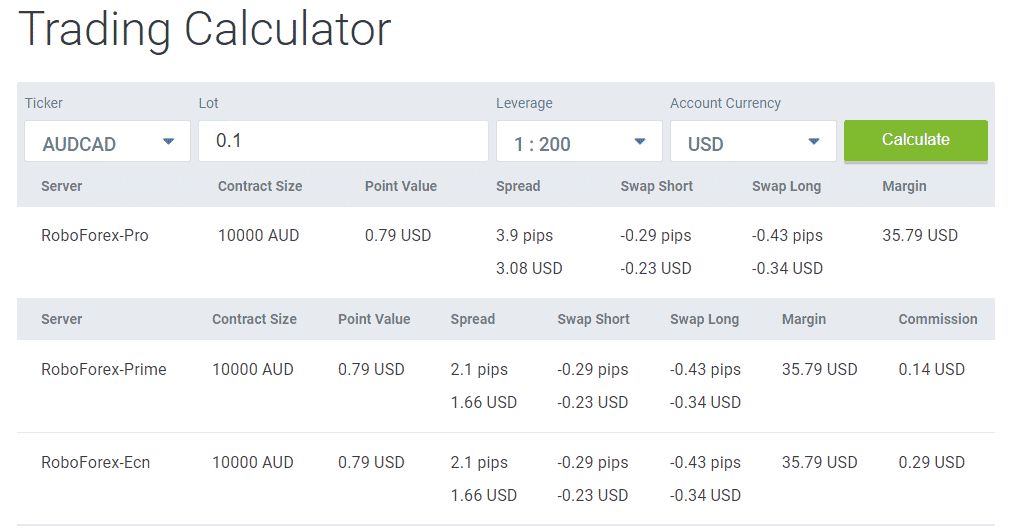

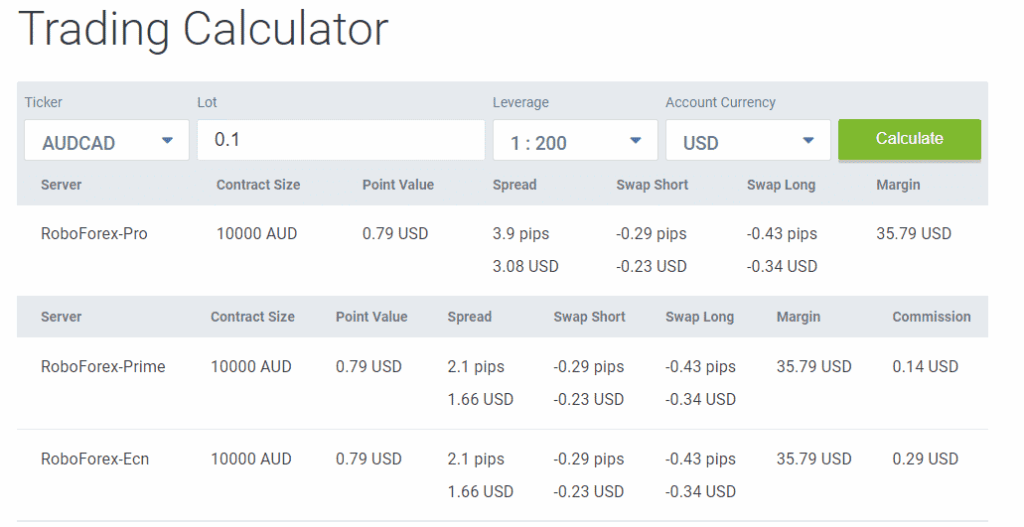

Margin Calculator

The margin calculator estimates the amount of capital required to open and maintain a trade with leverage. Margin is the deposit required to open a leveraged position. The margin requirement is typically expressed as a percentage of the total trade value.

For instance, if your broker offers a leverage of 100:1, the margin requirement would be 1%. This means that for every $10,000 worth of currency you trade, you would need to deposit $100 into your account as margin. The margin calculator helps you determine the appropriate position size based on your available capital and risk tolerance.

Profit/Loss Calculator

The profit/loss calculator projects potential profits or losses based on entry and exit prices. This tool allows you to simulate different trading scenarios and assess the potential outcomes before entering a trade.

To use the profit/loss calculator, you need to input the currency pair, position size, entry price, and exit price. The calculator will then provide you with an estimate of your potential profit or loss, taking into account any commissions or fees.

Currency Converter

The currency converter converts currencies at real-time exchange rates. This is useful for traders who trade multiple currency pairs or who need to convert profits or losses back to their base currency.

The currency converter uses real-time exchange rate data to provide accurate and up-to-date conversions. This ensures that you have the most current information when making trading decisions.

Fibonacci Calculator

The Fibonacci calculator identifies potential support and resistance levels using Fibonacci retracements. Fibonacci retracements are a popular technical analysis tool that can help traders identify potential entry and exit points.

To use the Fibonacci calculator, you need to input the high and low prices of a recent price movement. The calculator will then generate a series of Fibonacci retracement levels, which can be used to identify potential support and resistance levels. [See also: Mastering Fibonacci Retracements: A Trader’s Guide]

How to Effectively Leverage a Forex Calculator

To effectively leverage a Forex calculator, consider these strategies:

- Risk Assessment: Use the pip value and margin calculators to assess the risk associated with each trade. Determine the appropriate position size and leverage level based on your risk tolerance.

- Profit Target Setting: Use the profit/loss calculator to set realistic profit targets. Identify potential exit points based on technical analysis and market conditions.

- Scenario Planning: Use the profit/loss calculator to simulate different trading scenarios. Assess the potential outcomes under various market conditions.

- Currency Conversion: Use the currency converter to convert profits or losses back to your base currency. This will help you track your overall performance.

- Technical Analysis: Use the Fibonacci calculator to identify potential support and resistance levels. This can help you identify potential entry and exit points.

By integrating these strategies into your trading routine, you can significantly enhance your decision-making process and improve your overall trading performance. Remember, a Forex calculator is a tool, and like any tool, its effectiveness depends on how skillfully it is used.

Choosing the Right Forex Calculator

With numerous Forex calculators available online, selecting the right one can be overwhelming. Consider these factors when making your choice:

- Accuracy: Ensure the calculator uses real-time exchange rate data and accurate formulas.

- User-Friendliness: Choose a calculator with a clear and intuitive interface.

- Features: Select a calculator that offers the features you need, such as pip value calculation, margin calculation, and profit/loss projection.

- Reputation: Opt for calculators from reputable sources, such as established Forex brokers or financial websites.

Investing time in selecting the right Forex calculator will pay dividends in the long run by providing you with reliable and accurate information.

Common Mistakes to Avoid When Using a Forex Calculator

While Forex calculators are valuable tools, it’s essential to avoid common mistakes that can lead to inaccurate results:

- Using outdated exchange rates: Ensure the calculator uses real-time exchange rate data.

- Inputting incorrect values: Double-check all input values, such as position size, entry price, and exit price.

- Ignoring commissions and fees: Factor in any commissions or fees charged by your broker when calculating potential profits or losses.

- Over-reliance on the calculator: Remember that the calculator is just a tool. Use it in conjunction with other forms of analysis, such as technical and fundamental analysis.

By avoiding these common mistakes, you can ensure that you are leveraging the Forex calculator effectively and making informed trading decisions.

The Future of Forex Calculators

As technology continues to evolve, Forex calculators are becoming increasingly sophisticated. Future calculators may incorporate features such as:

- Artificial Intelligence (AI): AI-powered calculators could analyze market data and provide personalized trading recommendations.

- Machine Learning (ML): ML algorithms could learn from past trades and improve the accuracy of profit/loss projections.

- Integration with trading platforms: Seamless integration with trading platforms could allow traders to access calculator functions directly from their trading interface.

These advancements promise to make Forex calculators even more valuable tools for traders of all levels. The continued evolution of Forex calculators reflects the ongoing quest for efficiency and precision in the Forex market.

Conclusion

Leveraging a Forex calculator is essential for any trader looking to make informed decisions and optimize their trading outcomes. By understanding the various functions of a Forex calculator and integrating them into your trading routine, you can significantly enhance your risk management, profit optimization, and overall trading performance. Remember to choose the right calculator, avoid common mistakes, and stay informed about the latest advancements in Forex calculator technology. With the right tools and knowledge, you can unlock your trading potential and achieve your financial goals in the Forex market. The power to make smarter trading decisions is at your fingertips – learn to effectively leverage a Forex calculator and watch your trading strategy flourish.