Unlock Your Trading Potential: Mastering Forex Leverage with a Calculator

In the dynamic world of Forex trading, understanding and effectively using leverage is crucial for both seasoned traders and newcomers alike. Leverage, essentially borrowed capital, allows traders to control larger positions than their initial investment would typically permit. A forex leverage calculator is an indispensable tool in this arena, helping traders to quantify the potential risks and rewards associated with different leverage ratios. This article delves into the intricacies of forex leverage, highlighting the importance of using a forex leverage calculator to make informed trading decisions.

What is Forex Leverage?

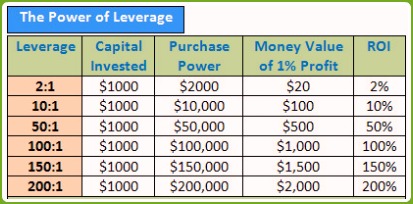

Forex leverage is a mechanism that enables traders to amplify their trading power. It allows you to control a significant amount of money in the market with a relatively small amount of capital. For instance, a leverage of 1:100 means that for every $1 you have in your account, you can control $100 worth of currency. While this can significantly increase potential profits, it also magnifies potential losses.

The availability of high leverage is one of the key attractions of the Forex market. However, it’s vital to approach it with caution and a thorough understanding of its implications. Without proper risk management, high leverage can quickly lead to substantial losses, potentially wiping out your trading account.

The Importance of a Forex Leverage Calculator

A forex leverage calculator is a tool designed to help traders determine the amount of capital they need to open a specific position, considering their desired leverage ratio. It provides a clear picture of the potential profit and loss scenarios, allowing traders to make more informed decisions. Here’s why a forex leverage calculator is essential:

- Risk Management: By calculating the required margin and potential losses, traders can effectively manage their risk exposure.

- Position Sizing: A forex leverage calculator helps determine the appropriate position size based on your account balance and risk tolerance.

- Informed Decisions: It provides a clear understanding of the potential impact of leverage on your trades, enabling you to make more informed decisions.

- Avoid Over-Leveraging: The calculator helps prevent over-leveraging, which is a common mistake among novice traders.

How to Use a Forex Leverage Calculator

Using a forex leverage calculator is typically straightforward. Most calculators require you to input the following information:

- Account Balance: The total amount of money in your trading account.

- Leverage Ratio: The leverage offered by your broker (e.g., 1:50, 1:100, 1:200).

- Position Size: The size of the trade you want to place (usually expressed in lots).

- Currency Pair: The specific currency pair you are trading (e.g., EUR/USD, GBP/JPY).

Once you input these values, the calculator will typically display the following:

- Required Margin: The amount of money you need to have in your account to open the position.

- Pip Value: The value of each pip (point in percentage) movement in the currency pair.

- Potential Profit/Loss: An estimate of the potential profit or loss based on a specific price movement.

Understanding the Risks of High Leverage

While leverage can amplify profits, it’s crucial to understand the inherent risks. High leverage means that even small price movements can have a significant impact on your account balance. If the market moves against your position, you could quickly lose a substantial portion of your capital.

Consider this scenario: You have an account balance of $1,000 and use a leverage of 1:200 to open a position worth $200,000. If the market moves against you by just 0.5%, you could lose $1,000, wiping out your entire account. This highlights the importance of using a forex leverage calculator and implementing robust risk management strategies.

Risk Management Strategies for Leveraged Trading

To mitigate the risks associated with leverage, consider the following risk management strategies:

- Set Stop-Loss Orders: A stop-loss order automatically closes your position when the price reaches a predetermined level, limiting your potential losses.

- Use Appropriate Position Sizing: Avoid risking more than a small percentage of your account balance on any single trade. A common rule of thumb is to risk no more than 1-2% of your capital per trade.

- Understand Margin Calls: Be aware of your broker’s margin call policy. A margin call occurs when your account balance falls below a certain level, requiring you to deposit additional funds to maintain your open positions.

- Stay Informed: Keep up-to-date with market news and economic events that could impact your trades.

Choosing the Right Leverage Ratio

The optimal leverage ratio depends on your individual risk tolerance, trading style, and experience level. Novice traders should typically start with lower leverage ratios (e.g., 1:20 or 1:50) to minimize their risk exposure. As you gain experience and develop a better understanding of the market, you can gradually increase your leverage if appropriate.

It’s important to remember that there is no one-size-fits-all answer when it comes to leverage. The best leverage ratio is the one that allows you to trade comfortably within your risk tolerance while still providing the opportunity to generate profits.

The Role of Brokers in Providing Leverage

Forex brokers play a crucial role in providing leverage to traders. They essentially lend you the capital needed to control larger positions. However, it’s important to choose a reputable and regulated broker that offers competitive leverage ratios and transparent trading conditions.

When selecting a broker, consider the following factors:

- Regulation: Ensure the broker is regulated by a reputable financial authority.

- Leverage Options: Check the available leverage ratios and choose one that aligns with your trading strategy.

- Trading Platform: Evaluate the broker’s trading platform and ensure it offers the tools and features you need.

- Customer Support: Look for a broker with responsive and helpful customer support.

Beyond the Calculator: Mastering Forex Trading

While a forex leverage calculator is a valuable tool, it’s just one piece of the puzzle when it comes to successful Forex trading. To truly master the market, you need to develop a comprehensive trading strategy that includes:

- Technical Analysis: Analyzing price charts and patterns to identify potential trading opportunities.

- Fundamental Analysis: Evaluating economic indicators and news events to understand the underlying factors driving currency movements.

- Risk Management: Implementing strategies to protect your capital and minimize potential losses.

- Trading Psychology: Developing the discipline and emotional control needed to make rational trading decisions.

Conclusion: Leverage Forex Calculator as a Cornerstone of Responsible Trading

In conclusion, forex leverage is a powerful tool that can amplify both profits and losses. A forex leverage calculator is an essential instrument for understanding and managing the risks associated with leverage. By using a calculator, traders can make informed decisions about position sizing, risk management, and overall trading strategy. Remember that responsible trading involves not only understanding the potential rewards of leverage but also being fully aware of the inherent risks and implementing strategies to mitigate them. Mastering the use of a forex leverage calculator is a critical step toward achieving long-term success in the Forex market. Using the forex leverage calculator empowers you to trade with confidence and strategic precision. Always remember that responsible use of a forex leverage calculator is paramount to protecting your capital and maximizing your potential for profitability in the dynamic world of Forex trading. The key to success lies in understanding how to effectively use leverage and a forex leverage calculator in conjunction with sound risk management practices. [See also: Forex Trading Strategies for Beginners] [See also: Understanding Forex Margin and Margin Calls]