Unlocking Exponential Growth: A Comprehensive Guide to Compound Trading

In the dynamic world of financial markets, the pursuit of consistent and substantial returns is a universal aspiration. Among the various strategies employed by traders and investors, compound trading stands out as a powerful method for accelerating wealth accumulation. This article delves into the intricacies of compound trading, exploring its principles, benefits, risks, and practical applications. We will examine how this approach can transform modest initial investments into significant portfolios over time, while also highlighting the importance of risk management and strategic decision-making.

Understanding the Fundamentals of Compound Trading

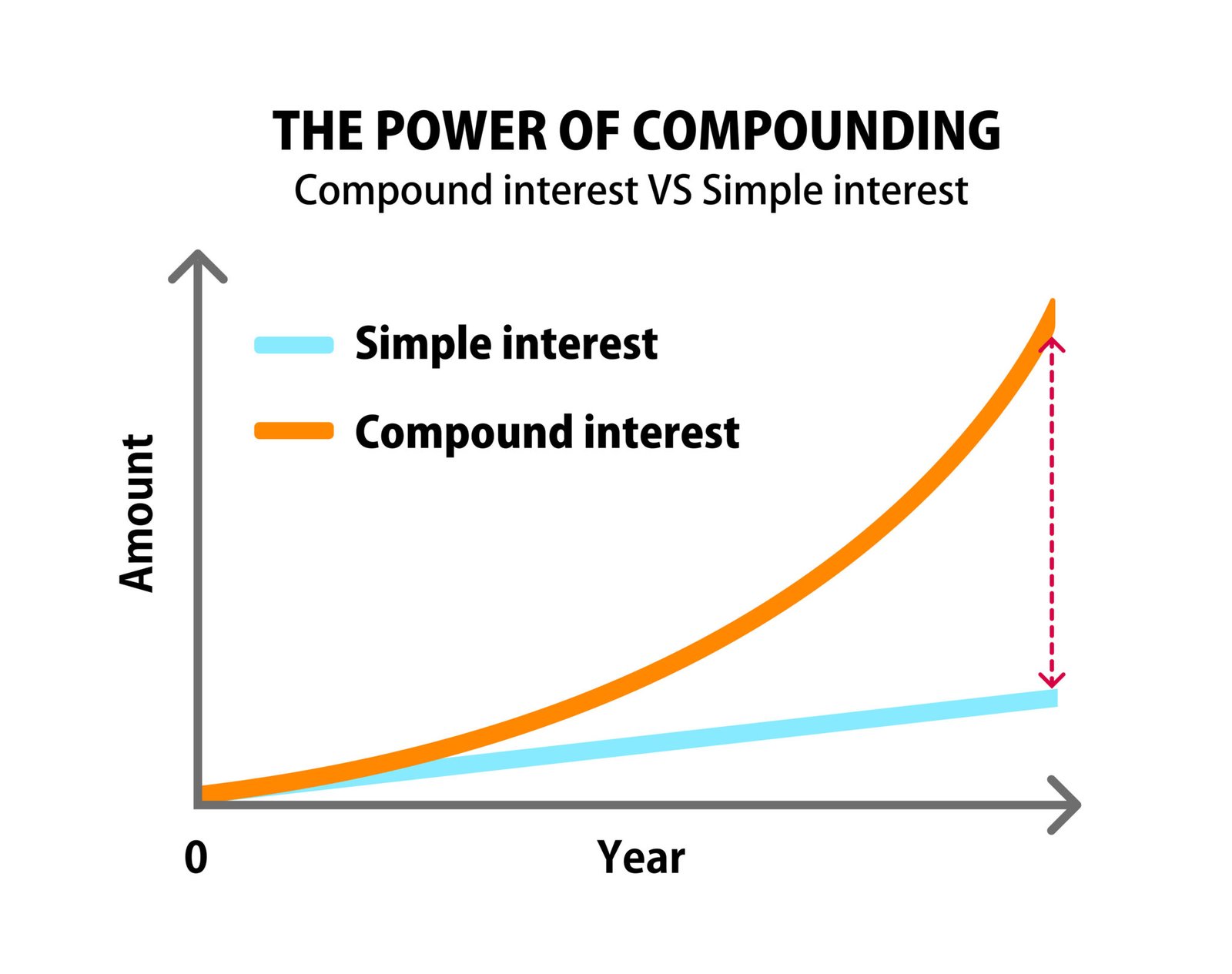

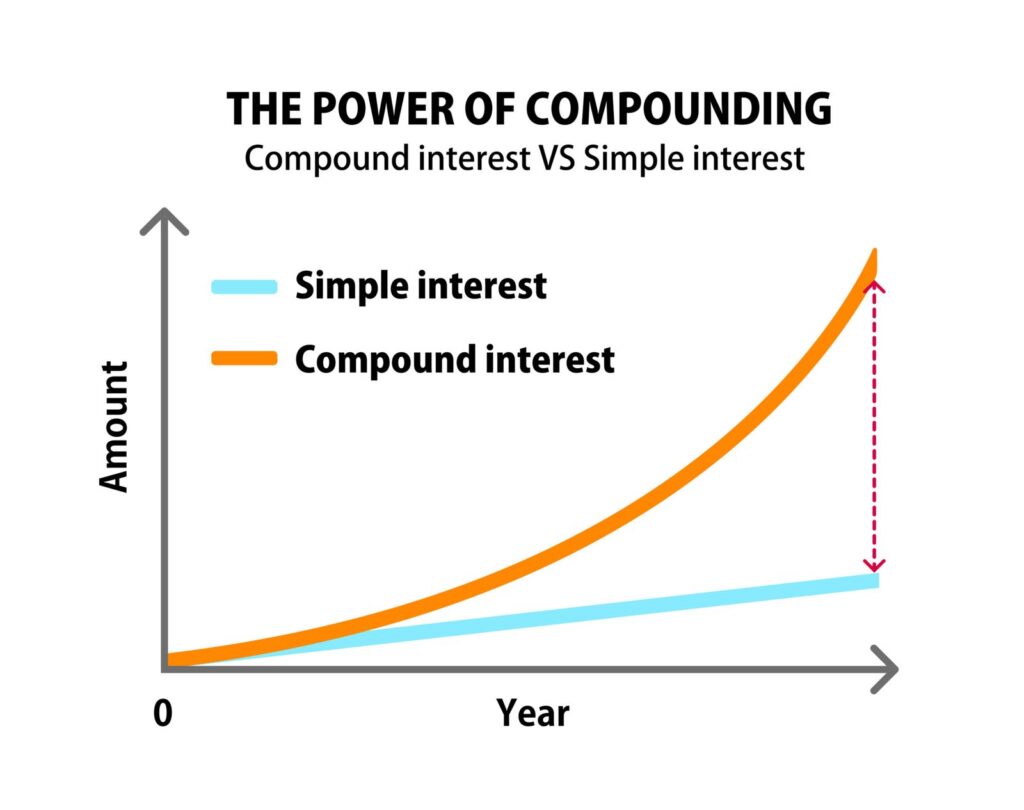

At its core, compound trading leverages the concept of compounding, a fundamental principle in finance where earnings from an investment generate further earnings. In the context of trading, this means reinvesting profits from successful trades to increase the size of subsequent trades. This iterative process, when executed effectively, can lead to exponential growth in the trading account.

The Power of Reinvestment

The magic of compound trading lies in the reinvestment of profits. Instead of withdrawing earnings after each successful trade, traders allocate those profits to increase their trading capital. This larger capital base then allows for larger position sizes in future trades, potentially leading to greater profit margins. Over time, this cycle of reinvestment and increased profitability can create a snowball effect, significantly accelerating the growth of the trading account. [See also: Understanding Leverage in Trading]

Key Principles of Compound Trading

- Consistent Profitability: The foundation of compound trading is the ability to generate consistent profits. Without a steady stream of earnings, there is no capital to reinvest, and the compounding effect cannot take place.

- Disciplined Risk Management: While compound trading can amplify returns, it also magnifies losses if risk is not managed effectively. Implementing robust risk management strategies, such as setting stop-loss orders and limiting position sizes, is crucial for protecting the trading account.

- Strategic Capital Allocation: Determining how much of the profits to reinvest is a critical decision. A conservative approach may involve reinvesting a smaller percentage of profits, while an aggressive strategy may involve reinvesting a larger portion. The optimal allocation strategy depends on the trader’s risk tolerance, trading style, and market conditions.

Benefits of Compound Trading

Compound trading offers several compelling advantages for traders who are willing to invest the time and effort to master its principles.

Accelerated Wealth Accumulation

The most significant benefit of compound trading is its potential to accelerate wealth accumulation. By reinvesting profits, traders can exponentially increase their trading capital over time, leading to substantial portfolio growth. This is especially beneficial for traders with limited initial capital, as it allows them to grow their accounts more rapidly than traditional investment strategies.

Enhanced Learning and Skill Development

Compound trading encourages continuous learning and skill development. As traders strive to generate consistent profits, they are motivated to refine their trading strategies, improve their market analysis skills, and enhance their risk management techniques. This ongoing learning process can lead to a deeper understanding of the financial markets and improve overall trading performance. [See also: Mastering Technical Analysis for Trading]

Increased Financial Flexibility

As the trading account grows through compound trading, traders gain increased financial flexibility. They can use the accumulated capital to diversify their investments, pursue other financial goals, or even transition to full-time trading. This financial freedom can provide a greater sense of security and control over their financial future.

Risks and Challenges of Compound Trading

While compound trading offers significant benefits, it is essential to acknowledge the risks and challenges associated with this approach.

Magnified Losses

The same principle that allows compound trading to amplify returns can also magnify losses. If a trader experiences a series of losing trades, the losses can quickly erode the trading capital, potentially leading to significant setbacks. This underscores the importance of diligent risk management and the need to avoid over-leveraging the account.

Emotional Discipline

Compound trading requires a high degree of emotional discipline. Traders must be able to resist the temptation to withdraw profits for personal use and instead focus on reinvesting those earnings to fuel further growth. They must also be able to manage the emotional stress of both winning and losing trades, avoiding impulsive decisions that can jeopardize their trading strategy. [See also: The Psychology of Trading]

Market Volatility

Market volatility can pose a significant challenge to compound trading. Unexpected market events can lead to sudden price swings, potentially triggering stop-loss orders and causing significant losses. Traders must be prepared to adapt their strategies to changing market conditions and remain vigilant in monitoring their positions.

Strategies for Effective Compound Trading

To successfully implement compound trading, traders should adopt a strategic approach that encompasses careful planning, disciplined execution, and continuous monitoring.

Develop a Comprehensive Trading Plan

A well-defined trading plan is essential for compound trading. The plan should outline the trader’s goals, risk tolerance, trading style, and specific strategies for identifying and executing trades. It should also include detailed risk management protocols, such as stop-loss levels and position sizing rules.

Implement Robust Risk Management

Risk management is paramount in compound trading. Traders should use stop-loss orders to limit potential losses on each trade and avoid over-leveraging their accounts. They should also diversify their trading portfolio to reduce the impact of any single trade on their overall performance.

Monitor and Adapt

The financial markets are constantly evolving, and traders must be prepared to adapt their strategies to changing conditions. Regular monitoring of market trends, economic indicators, and geopolitical events is crucial for identifying potential opportunities and risks. Traders should also review their trading performance regularly, identifying areas for improvement and adjusting their strategies accordingly.

Start Small and Scale Up

When starting with compound trading, it is prudent to begin with a small amount of capital and gradually increase the position sizes as the account grows. This allows traders to gain experience and refine their strategies without risking significant losses. As their confidence and profitability increase, they can scale up their trading activities to accelerate the compounding effect.

Examples of Compound Trading in Action

To illustrate the power of compound trading, consider the following examples:

Example Scenario One

A trader starts with an initial capital of $1,000 and consistently generates a 5% profit per month. By reinvesting all profits, the trading account would grow to approximately $1,796 after one year. This represents a return of nearly 80% on the initial investment, significantly higher than traditional investment options.

Example Scenario Two

Another trader starts with an initial capital of $5,000 and aims for a 2% profit per week. By reinvesting all profits, the trading account would grow to approximately $13,725 after one year. This demonstrates the potential for substantial growth even with relatively modest weekly returns.

Conclusion

Compound trading is a powerful strategy for accelerating wealth accumulation in the financial markets. By reinvesting profits and managing risk effectively, traders can unlock exponential growth in their trading accounts. However, it is essential to approach compound trading with a clear understanding of its principles, benefits, and risks. By developing a comprehensive trading plan, implementing robust risk management protocols, and continuously monitoring and adapting to market conditions, traders can increase their chances of success and achieve their financial goals through the power of compounding. The key to successful compound trading lies in consistency, discipline, and a commitment to continuous learning and improvement. As you embark on your journey into the world of compound trading, remember that patience and perseverance are essential virtues. The rewards of compound trading may not be immediately apparent, but over time, the cumulative effect of reinvesting profits can lead to significant and sustainable wealth accumulation. This strategy, when executed with diligence and foresight, can transform your trading endeavors and pave the way for long-term financial success.