Unlocking Exponential Growth: A Deep Dive into Compound Trading

In the dynamic world of financial markets, traders constantly seek strategies to amplify their returns. While various approaches exist, compound trading stands out as a powerful method for achieving exponential growth over time. Unlike simple trading, which focuses on short-term gains, compound trading leverages the principle of reinvesting profits to generate even larger returns in the future. This article explores the intricacies of compound trading, its benefits, risks, and practical applications for traders of all levels.

Understanding the Fundamentals of Compound Trading

At its core, compound trading is the strategic reinvestment of profits earned from trades. Instead of withdrawing profits, traders use them to increase their trading capital. This larger capital base then allows them to take on larger positions, potentially generating even greater profits. This cycle repeats, leading to exponential growth over time. The key to successful compound trading lies in consistency, discipline, and a well-defined trading strategy.

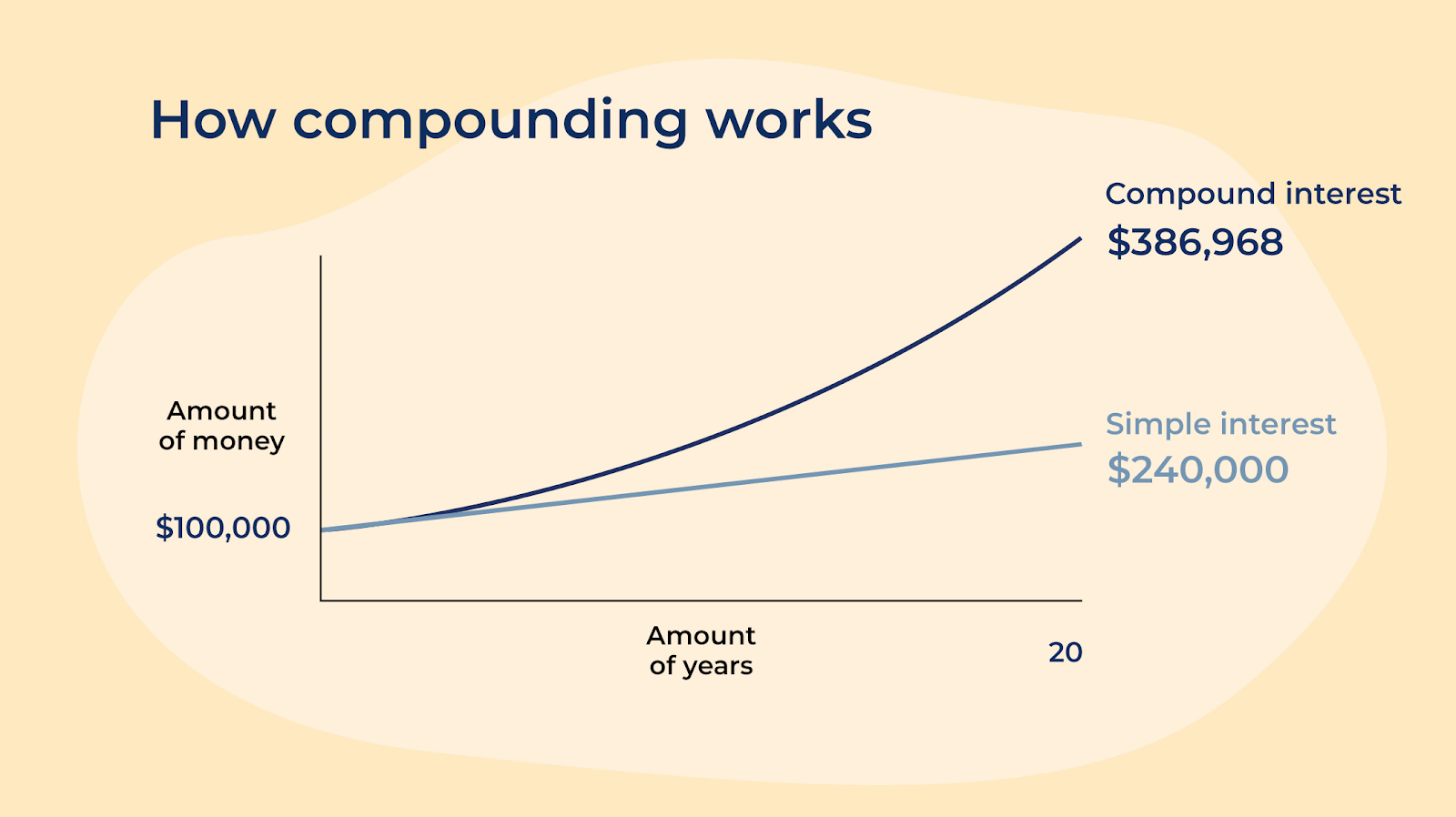

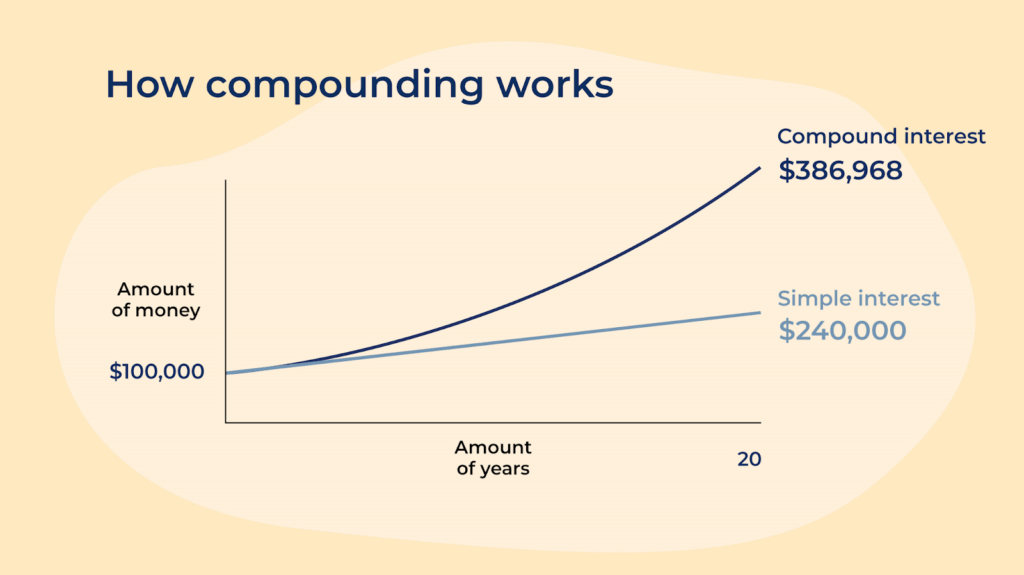

The concept is similar to compound interest in savings accounts. Just as interest earned on a deposit is added to the principal, generating more interest in the next period, profits from trading are added to the trading capital, leading to larger profits in subsequent trades. The power of compounding becomes increasingly evident over longer time horizons, making it a particularly attractive strategy for long-term wealth building.

The Benefits of Compound Trading

- Exponential Growth: The most significant benefit of compound trading is its potential for exponential growth. By consistently reinvesting profits, traders can significantly increase their capital base over time.

- Reduced Risk (Potentially): While it may seem counterintuitive, compound trading can, in some cases, reduce risk. As the capital base grows, traders may be able to allocate a smaller percentage of their portfolio to each trade, thereby limiting potential losses. However, this depends heavily on risk management strategies.

- Long-Term Wealth Building: Compound trading is ideally suited for long-term wealth building. Its compounding effect allows traders to accumulate substantial wealth over time, making it a valuable strategy for retirement planning or other long-term financial goals.

- Increased Trading Opportunities: A larger capital base opens up more trading opportunities. Traders can diversify their portfolios, explore different asset classes, and take advantage of market inefficiencies.

The Risks Associated with Compound Trading

While compound trading offers numerous benefits, it’s essential to acknowledge the inherent risks involved. These risks must be carefully considered and managed to avoid significant losses.

- Market Volatility: Market volatility can significantly impact compound trading. Unexpected market downturns can lead to substantial losses, eroding the capital base and hindering the compounding effect.

- Poor Trading Decisions: Inconsistent or poorly executed trading strategies can negate the benefits of compound trading. Losses can quickly accumulate, especially if risk management is inadequate.

- Emotional Trading: Emotional trading, driven by fear or greed, can lead to impulsive decisions and poor trade executions. This can be particularly detrimental to compound trading, as even small losses can compound over time.

- Over-Leveraging: Using excessive leverage can amplify both profits and losses. While leverage can accelerate the compounding effect, it also significantly increases the risk of substantial losses.

Strategies for Successful Compound Trading

To effectively implement compound trading, traders need to adopt a disciplined approach and implement sound risk management strategies.

Developing a Robust Trading Plan

A well-defined trading plan is crucial for successful compound trading. This plan should outline specific trading goals, risk tolerance levels, trading strategies, and money management rules. The plan should be regularly reviewed and adjusted as needed.

Implementing Strict Risk Management

Risk management is paramount in compound trading. Traders should implement stop-loss orders to limit potential losses on each trade. They should also avoid risking more than a small percentage of their capital on any single trade (e.g., 1-2%).

Choosing the Right Assets

The choice of assets to trade is critical. Traders should focus on assets they understand well and that align with their risk tolerance. Diversifying across different asset classes can also help to mitigate risk.

Maintaining Consistency and Discipline

Consistency and discipline are essential for successful compound trading. Traders should adhere to their trading plan, avoid emotional trading, and consistently reinvest profits. Patience is also key, as the compounding effect takes time to materialize.

Reinvesting Profits Strategically

Reinvesting profits should be done strategically. Traders should consider factors such as market conditions, risk tolerance, and trading opportunities when deciding how much to reinvest. It’s also important to avoid over-investing, as this can increase risk.

Compound Trading in Different Markets

The principles of compound trading can be applied to various financial markets, including:

- Forex: The foreign exchange market offers numerous opportunities for compound trading, given its high liquidity and volatility. However, it also carries significant risks due to leverage.

- Stocks: Investing in stocks with growth potential and reinvesting dividends can lead to significant compounding returns over the long term. [See also: Dividend Reinvestment Strategies]

- Cryptocurrencies: The cryptocurrency market is known for its high volatility and potential for rapid gains. Compound trading in cryptocurrencies can be highly rewarding but also carries substantial risks.

- Options: Options trading can be used to generate income, which can then be reinvested. However, options trading is complex and requires a thorough understanding of the underlying assets and risk management principles.

Examples of Compound Trading in Action

Let’s consider a hypothetical example to illustrate the power of compound trading. Suppose a trader starts with a capital of $10,000 and consistently generates an average monthly return of 5%. By reinvesting these profits each month, the trader’s capital would grow exponentially over time.

After one year, the trader’s capital would have grown to approximately $17,958.56. After five years, it would be an impressive $142,049.18. This demonstrates the significant impact of compounding over the long term. It’s important to remember that these are hypothetical returns and actual results may vary.

Tools and Resources for Compound Trading

Several tools and resources can assist traders in implementing compound trading strategies:

- Trading Platforms: Many trading platforms offer features such as automated trading, risk management tools, and portfolio tracking.

- Financial Calculators: Compound interest calculators can help traders estimate the potential growth of their capital over time.

- Educational Resources: Numerous books, articles, and online courses provide valuable insights into compound trading strategies and risk management techniques.

- Financial Advisors: Consulting with a financial advisor can provide personalized guidance and support in developing a compound trading strategy that aligns with individual financial goals.

The Future of Compound Trading

As financial markets continue to evolve, compound trading is likely to remain a relevant and valuable strategy for long-term wealth building. The increasing availability of sophisticated trading tools and educational resources is making compound trading more accessible to traders of all levels.

However, it’s crucial for traders to stay informed about market trends, adapt their strategies as needed, and prioritize risk management to navigate the challenges and opportunities that lie ahead. Compound trading, when implemented with discipline and a well-defined plan, can be a powerful tool for achieving financial success.

Conclusion

Compound trading offers a compelling path to exponential growth in the financial markets. By consistently reinvesting profits and implementing sound risk management strategies, traders can significantly increase their capital base over time. While it’s not without its risks, the potential rewards of compound trading make it a valuable strategy for long-term wealth building. Remember to always conduct thorough research, seek professional advice if needed, and prioritize responsible trading practices.