Unlocking Financial Potential: A Comprehensive Guide to Leverage Calculation

In the intricate world of finance, understanding and strategically applying leverage is paramount for both individuals and businesses aiming to amplify returns. Leverage, in its essence, is the use of borrowed capital to increase the potential return of an investment. However, this powerful tool is a double-edged sword; while it can significantly magnify gains, it can also exponentially increase losses. This article delves into the concept of leverage calculation, exploring its mechanics, benefits, risks, and practical applications, providing a comprehensive guide for anyone seeking to navigate the complexities of financial leverage.

What is Leverage?

Leverage, also known as gearing, refers to the use of debt to finance an investment or project. By borrowing funds, investors and companies can control a larger asset base than they could with their own capital alone. This can lead to higher returns if the investment performs well. Common examples of leverage include taking out a mortgage to buy a property, using margin in stock trading, or a company issuing bonds to fund expansion.

Understanding Leverage Calculation

Leverage calculation involves determining the extent to which a company or individual is using debt to finance its assets. Several metrics can be used to assess leverage, each providing a unique perspective on a company’s financial health. Let’s explore some key leverage calculation methods:

Debt-to-Equity Ratio

The debt-to-equity ratio (D/E) is a fundamental leverage calculation that compares a company’s total debt to its shareholders’ equity. It indicates the proportion of a company’s financing that comes from debt versus equity. The formula is straightforward:

Debt-to-Equity Ratio = Total Debt / Shareholders’ Equity

A high D/E ratio suggests that a company relies heavily on debt financing, which can increase financial risk. Conversely, a low D/E ratio indicates a more conservative approach with greater reliance on equity.

Debt-to-Assets Ratio

The debt-to-assets ratio assesses the proportion of a company’s assets that are financed by debt. It provides insight into the company’s solvency and its ability to meet its obligations. The formula is:

Debt-to-Assets Ratio = Total Debt / Total Assets

A higher ratio indicates that a larger portion of the company’s assets is funded by debt, increasing financial risk. This leverage calculation is useful in evaluating how much of a company’s assets would remain if it were to repay its debts.

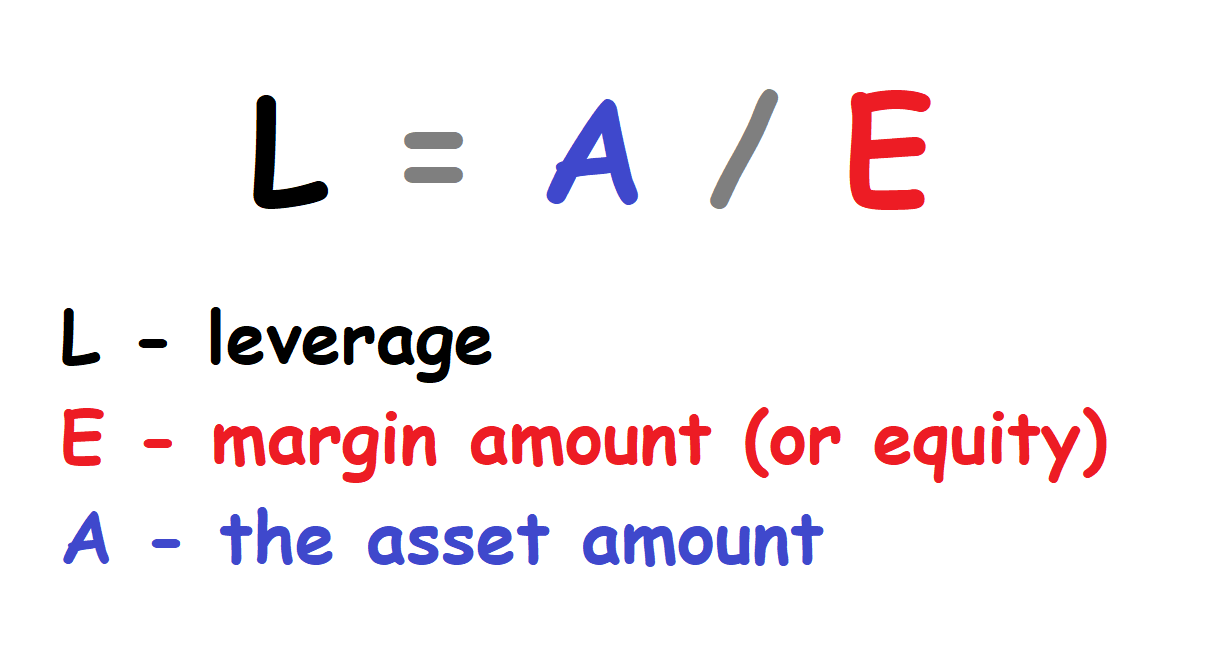

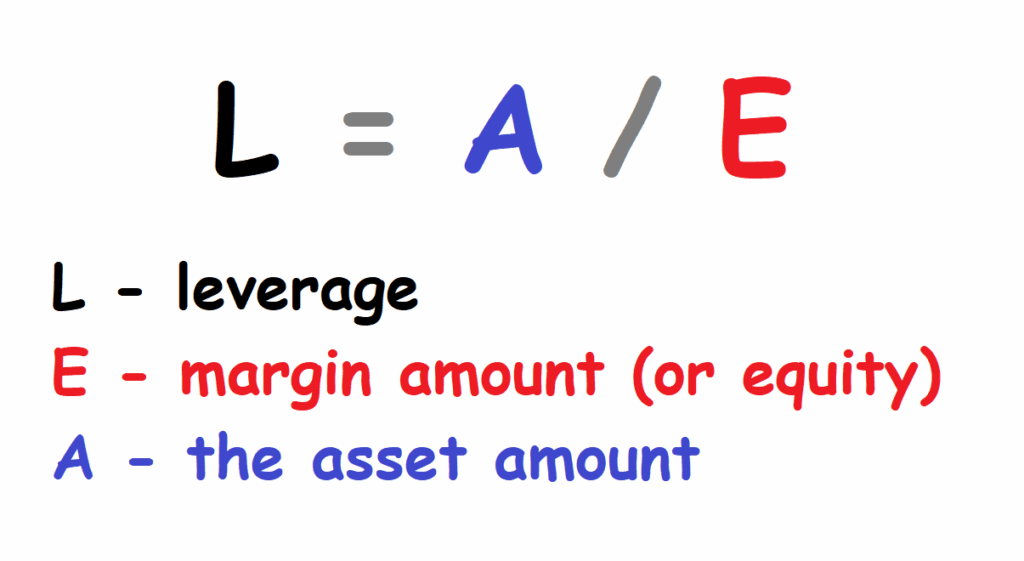

Equity Multiplier

The equity multiplier, also known as the financial leverage ratio, measures the amount of assets a company has relative to its equity. It is calculated as:

Equity Multiplier = Total Assets / Shareholders’ Equity

A higher equity multiplier suggests that the company is using more debt to finance its assets, thereby amplifying returns (and risks) to shareholders. This leverage calculation is directly tied to the debt-to-equity ratio, providing a similar view on financial structure.

Financial Leverage Formula

The term “Financial Leverage Formula” can refer to various calculations, but often encompasses the broader concept of using debt to amplify returns. One way to think about the formula is in terms of how leverage affects return on equity (ROE). ROE can be decomposed using the DuPont analysis, which includes the equity multiplier (a measure of leverage) along with profit margin and asset turnover.

DuPont Analysis: ROE = Profit Margin * Asset Turnover * Equity Multiplier

This demonstrates how leverage (represented by the Equity Multiplier) directly impacts ROE. A higher multiplier, achieved through increased debt, can boost ROE, but also increases financial risk.

Benefits of Using Leverage

While leverage comes with inherent risks, it also offers several potential benefits:

- Magnified Returns: The primary advantage of leverage is the potential to amplify returns on investment. By using borrowed funds, investors can control a larger asset base and generate higher profits if the investment performs well.

- Increased Investment Capacity: Leverage allows individuals and companies to invest in projects or assets that would otherwise be beyond their financial reach.

- Tax Advantages: In many jurisdictions, interest payments on debt are tax-deductible, reducing the overall cost of borrowing.

- Improved Return on Equity (ROE): As discussed, leverage can increase ROE, making a company more attractive to investors.

Risks Associated with Leverage

The risks of leverage are equally significant and must be carefully considered:

- Magnified Losses: Just as leverage can amplify gains, it can also magnify losses. If an investment performs poorly, the borrower is still obligated to repay the debt, potentially leading to significant financial distress.

- Increased Financial Risk: High levels of debt increase a company’s financial risk, making it more vulnerable to economic downturns and changes in interest rates.

- Bankruptcy Risk: If a company is unable to meet its debt obligations, it may face bankruptcy.

- Covenants and Restrictions: Lenders often impose covenants and restrictions on borrowers, limiting their operational flexibility.

Practical Applications of Leverage Calculation

Leverage calculation is essential in various financial contexts:

Corporate Finance

Companies use leverage calculation to determine the optimal capital structure, balancing the benefits of debt financing with the associated risks. They also use it to assess their ability to take on new debt and manage their existing obligations.

Investment Analysis

Investors use leverage calculation to evaluate the financial health of companies they are considering investing in. By analyzing metrics such as the debt-to-equity ratio and debt-to-assets ratio, investors can assess a company’s financial risk and its ability to generate returns.

Personal Finance

Individuals use leverage when taking out mortgages, using credit cards, or investing on margin. Understanding leverage calculation helps individuals make informed decisions about their borrowing and investment strategies, mitigating the risk of over-leveraging.

Examples of Leverage in Action

Let’s consider a few examples to illustrate how leverage works in practice:

Real Estate Investment

An investor purchases a property for $500,000, using a mortgage of $400,000 and their own capital of $100,000. The leverage is 4:1 (debt to equity). If the property value increases by 10% to $550,000, the investor’s equity increases by $50,000, representing a 50% return on their initial investment of $100,000. However, if the property value decreases by 10% to $450,000, the investor’s equity decreases by $50,000, resulting in a 50% loss.

Stock Trading on Margin

A trader uses margin to purchase $10,000 worth of stock, using $5,000 of their own capital and $5,000 borrowed from their broker. The leverage is 2:1. If the stock price increases by 20%, the trader earns a profit of $2,000, representing a 40% return on their initial investment. However, if the stock price decreases by 20%, the trader incurs a loss of $2,000, resulting in a 40% loss.

Strategies for Managing Leverage

Effective leverage management is crucial for mitigating risk and maximizing returns. Here are some strategies to consider:

- Diversification: Diversifying investments can reduce the overall risk associated with leverage.

- Risk Assessment: Conduct thorough risk assessments before using leverage, considering potential downside scenarios.

- Setting Limits: Establish clear limits on the amount of leverage used, based on individual risk tolerance and financial capacity.

- Monitoring: Continuously monitor investments and adjust leverage levels as needed, based on market conditions and performance.

- Hedging: Use hedging strategies to protect against potential losses from leveraged investments.

The Future of Leverage

As financial markets evolve, the use of leverage will continue to be a critical tool for investors and companies. Technological advancements, such as algorithmic trading and artificial intelligence, are enabling more sophisticated leverage strategies and risk management techniques. However, the fundamental principles of leverage calculation and risk assessment will remain essential for navigating the complexities of the financial landscape.

Conclusion

Leverage is a powerful financial tool that can amplify returns and increase investment capacity. However, it also carries significant risks, including magnified losses and increased financial vulnerability. Understanding leverage calculation and implementing effective risk management strategies are essential for maximizing the benefits of leverage while mitigating its potential downsides. By carefully assessing the risks and rewards, individuals and companies can strategically use leverage to achieve their financial goals.

In conclusion, mastering the art of leverage calculation is not merely about crunching numbers; it’s about understanding the delicate balance between risk and reward. Whether you’re an individual investor or a corporate finance professional, a solid grasp of leverage principles is indispensable for navigating the complexities of modern finance. Remember, leverage is a tool, and like any tool, its effectiveness depends on the skill and knowledge of the user. Use it wisely, and it can unlock significant financial potential.

[See also: Understanding Debt-to-Equity Ratio]

[See also: Risk Management Strategies for Investors]

[See also: How to Calculate Return on Equity]