Unlocking Financial Strategies: Mastering the Swap Calculator for Informed Decisions

In today’s complex financial landscape, making informed decisions is paramount. Whether you’re a seasoned investor, a corporate treasurer, or simply managing your personal finances, understanding the intricacies of financial instruments like swaps can significantly impact your bottom line. A crucial tool in navigating this world is the swap calculator. This article delves into the functionalities, applications, and benefits of using a swap calculator, empowering you to make strategic financial choices.

Understanding the Basics of Swaps

Before diving into the specifics of a swap calculator, it’s essential to grasp the underlying concept of swaps. A swap is a derivative contract through which two parties exchange financial instruments. These instruments can be almost anything, but most swaps involve cash flows based on a notional principal amount. The most common types of swaps include:

- Interest Rate Swaps: Exchange fixed interest rate payments for floating interest rate payments, or vice versa.

- Currency Swaps: Exchange principal and interest payments in one currency for principal and interest payments in another currency.

- Commodity Swaps: Exchange fixed payments for payments based on the price of a commodity.

- Equity Swaps: Exchange cash flows based on the return of an equity index or a basket of stocks for fixed or floating interest rate payments.

Swaps are used for a variety of purposes, including hedging risks, speculating on market movements, and managing assets and liabilities. They allow entities to modify their exposure to interest rates, currencies, commodities, or equities without altering their underlying assets.

The Role of a Swap Calculator

A swap calculator is a tool designed to simplify the complex calculations involved in valuing and analyzing swap contracts. It automates the process of determining the present value of future cash flows, taking into account factors such as interest rates, payment frequencies, and the term of the swap. By using a swap calculator, users can quickly and accurately assess the potential costs and benefits of entering into a swap agreement.

Key Features of a Swap Calculator

While specific features may vary depending on the calculator, most comprehensive swap calculators include the following functionalities:

- Interest Rate Swap Calculation: Determines the fair value of an interest rate swap based on the fixed and floating rates, notional principal, and payment frequency.

- Currency Swap Calculation: Calculates the exchange of principal and interest payments in different currencies, taking into account exchange rates and interest rate differentials.

- Sensitivity Analysis: Allows users to assess the impact of changes in interest rates or exchange rates on the value of the swap.

- Present Value Calculation: Determines the present value of future cash flows associated with the swap, using appropriate discount rates.

- Customization Options: Enables users to adjust various parameters, such as payment frequencies, compounding methods, and day count conventions.

Benefits of Using a Swap Calculator

Employing a swap calculator offers numerous advantages for financial professionals and individuals alike:

- Accuracy: Reduces the risk of errors associated with manual calculations, ensuring more precise valuations.

- Efficiency: Automates complex calculations, saving time and resources.

- Transparency: Provides clear and detailed insights into the factors driving the value of the swap.

- Decision-Making: Facilitates informed decision-making by allowing users to quickly assess the potential outcomes of different swap scenarios.

- Risk Management: Helps identify and quantify the risks associated with swap contracts, enabling better risk management strategies.

How to Use a Swap Calculator: A Step-by-Step Guide

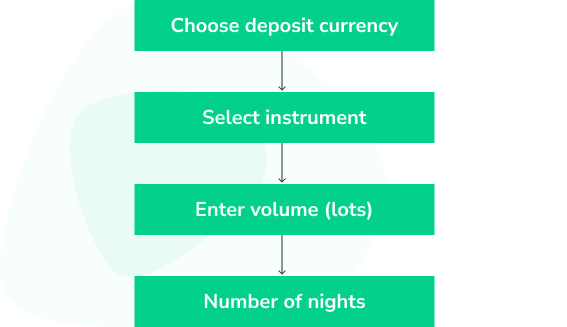

Using a swap calculator typically involves the following steps:

- Gather the Necessary Information: Collect all relevant data, including the notional principal, fixed and floating rates, payment frequencies, term of the swap, and any applicable exchange rates.

- Input the Data into the Calculator: Enter the information into the appropriate fields of the swap calculator.

- Select the Calculation Method: Choose the appropriate calculation method based on the type of swap and the desired output (e.g., present value, fair value).

- Review the Results: Carefully examine the results generated by the swap calculator, paying attention to key metrics such as the present value of cash flows and the sensitivity to changes in market conditions.

- Analyze the Implications: Use the results to assess the potential costs and benefits of the swap and make informed decisions based on your financial goals.

Real-World Applications of Swap Calculators

Swap calculators are used in a wide range of applications across various industries:

- Corporate Finance: Companies use swap calculators to manage their exposure to interest rate and currency risks, hedge their liabilities, and optimize their capital structure.

- Investment Management: Portfolio managers use swap calculators to enhance returns, manage risk, and gain exposure to different asset classes.

- Banking: Banks use swap calculators to price and manage their swap portfolios, hedge their interest rate risk, and offer customized swap solutions to their clients.

- Real Estate: Real estate developers and investors use swap calculators to manage their exposure to interest rate risk on mortgages and other debt obligations.

- Personal Finance: Individuals can use swap calculators to understand the implications of interest rate swaps on their mortgages or other loans.

Choosing the Right Swap Calculator

With numerous swap calculator options available, selecting the right one can be challenging. Consider the following factors when making your choice:

- Accuracy and Reliability: Ensure that the swap calculator uses accurate and reliable data sources and calculation methods.

- Ease of Use: Choose a swap calculator with a user-friendly interface and clear instructions.

- Features and Functionality: Select a swap calculator that offers the features and functionality you need for your specific applications.

- Customization Options: Look for a swap calculator that allows you to customize various parameters to suit your specific needs.

- Cost: Consider the cost of the swap calculator and whether it fits within your budget. Some swap calculators are free, while others require a subscription or one-time purchase.

The Future of Swap Calculators

As financial markets continue to evolve, swap calculators are becoming increasingly sophisticated. Future developments may include:

- Integration with Real-Time Data Feeds: Seamless integration with real-time market data will provide users with up-to-date information for more accurate valuations.

- Artificial Intelligence and Machine Learning: AI-powered swap calculators will be able to analyze vast amounts of data and identify hidden patterns and opportunities.

- Cloud-Based Solutions: Cloud-based swap calculators will offer greater accessibility and scalability, allowing users to access the tools from anywhere in the world.

- Enhanced Visualization: Improved visualization tools will help users better understand the results of their calculations and communicate their findings to others.

Conclusion

A swap calculator is an indispensable tool for anyone involved in financial markets. By automating complex calculations and providing valuable insights, it empowers users to make informed decisions, manage risk, and optimize their financial strategies. Whether you’re a corporate treasurer, an investment manager, or simply managing your personal finances, understanding and utilizing a swap calculator can significantly enhance your financial outcomes. The ability to quickly and accurately assess the potential costs and benefits of swap agreements is crucial in today’s dynamic financial environment. Embrace the power of the swap calculator and unlock new possibilities for financial success. The swap calculator is a key to understanding complex financial instruments. This tool’s precision and efficiency make it invaluable. Learning to use a swap calculator effectively is a worthwhile investment. Remember to always validate the inputs and outputs of any swap calculator with independent research and professional advice. A reliable swap calculator can significantly streamline your financial analysis. [See also: Understanding Interest Rate Derivatives] [See also: Hedging Strategies in Currency Markets] [See also: Risk Management with Financial Derivatives]