Unlocking Forex: A Comprehensive Guide to Micro Lots

In the dynamic world of forex trading, understanding the nuances of different lot sizes is crucial for both novice and seasoned traders. Among these, the micro lot stands out as a particularly accessible and risk-managed option. This article delves deep into the concept of micro lots, exploring their significance, advantages, how they work, and why they are an essential tool in a trader’s arsenal. Whether you’re just starting your forex journey or looking to refine your strategy, understanding micro lots is a key step towards informed and successful trading.

What Exactly is a Micro Lot?

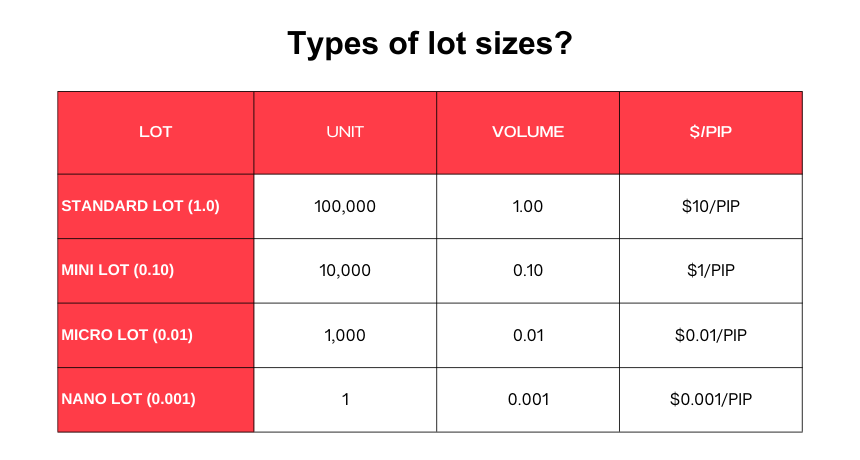

In the context of forex trading, a lot refers to a standardized unit of currency. A standard lot is 100,000 units of the base currency, a mini lot is 10,000 units, and a micro lot represents 1,000 units of the base currency. The base currency is the first currency in a currency pair (e.g., in EUR/USD, EUR is the base currency). Therefore, trading a micro lot of EUR/USD means you are controlling 1,000 Euros.

The introduction of micro lots has democratized forex trading, making it accessible to individuals with smaller capital amounts. Before micro lots, the capital required to trade even a single standard lot was substantial, effectively excluding many potential traders. Now, with the possibility of trading micro lots, traders can participate in the forex market with significantly lower risk and investment.

The Advantages of Trading Micro Lots

Reduced Risk Exposure: Perhaps the most significant advantage of trading micro lots is the reduced risk exposure. With smaller position sizes, the potential for significant losses is minimized. This makes micro lots ideal for beginners who are still learning the ropes and for experienced traders who want to test new strategies without risking a large portion of their capital. The low risk allows traders to get comfortable with the market’s volatility. Trading micro lots allows you to trade more frequently with smaller amounts of money at risk.

Accessibility for Beginners: As mentioned earlier, micro lots have lowered the barrier to entry for forex trading. Individuals with limited capital can now participate in the market and gain valuable experience without needing to invest large sums of money. This accessibility is crucial for fostering a new generation of forex traders.

Strategy Testing and Development: Micro lots are an excellent tool for testing and refining trading strategies. Traders can experiment with different approaches and indicators without risking substantial capital. This allows for a more controlled and methodical approach to strategy development, leading to more robust and profitable trading systems. They allow you to try out new ideas without risking large sums of money.

Psychological Benefits: The smaller financial commitment associated with micro lots can also have psychological benefits. Traders are less likely to be influenced by fear or greed when the stakes are lower, leading to more rational and disciplined decision-making. This can be particularly helpful for novice traders who are still developing their emotional control.

Precise Position Sizing: Micro lots allow for more precise position sizing. Traders can fine-tune their positions to match their risk tolerance and account size, ensuring that they are not overexposed to any single trade. This level of control is essential for effective risk management.

How to Trade Micro Lots

Trading micro lots is a straightforward process, similar to trading any other lot size. Here’s a step-by-step guide:

- Choose a Broker: Select a reputable forex broker that offers micro lot trading. Ensure that the broker is regulated and has a user-friendly trading platform.

- Open an Account: Open a trading account with the chosen broker. You may need to provide identification and proof of address.

- Fund Your Account: Deposit funds into your trading account. Most brokers offer a variety of funding methods, such as bank transfers, credit cards, and e-wallets.

- Select a Currency Pair: Choose the currency pair you want to trade. For example, EUR/USD, GBP/USD, or USD/JPY.

- Determine Your Lot Size: Specify the lot size you want to trade. In this case, you would select a micro lot (0.01 lot, equivalent to 1,000 units of the base currency).

- Set Your Order: Place your order, specifying whether you want to buy (go long) or sell (go short) the currency pair.

- Manage Your Trade: Monitor your trade and manage your risk by setting stop-loss and take-profit orders.

Risk Management with Micro Lots

While micro lots inherently reduce risk, effective risk management is still crucial. Here are some tips for managing risk when trading micro lots:

- Use Stop-Loss Orders: Always use stop-loss orders to limit your potential losses. A stop-loss order automatically closes your trade when the price reaches a predetermined level.

- Calculate Your Risk-Reward Ratio: Determine your risk-reward ratio for each trade. A favorable risk-reward ratio (e.g., 1:2 or 1:3) ensures that your potential profits outweigh your potential losses.

- Avoid Overleveraging: While leverage can amplify your profits, it can also amplify your losses. Avoid using excessive leverage, especially when trading micro lots.

- Diversify Your Trades: Don’t put all your eggs in one basket. Diversify your trades by trading multiple currency pairs.

- Stay Informed: Keep up-to-date with the latest market news and economic events. This will help you make more informed trading decisions.

Examples of Micro Lot Trading

Let’s consider a few examples to illustrate how micro lot trading works:

Example 1: EUR/USD

You want to trade EUR/USD and believe that the Euro will strengthen against the US Dollar. You decide to buy (go long) one micro lot of EUR/USD at a price of 1.1000. This means you are controlling 1,000 Euros. If the price rises to 1.1050, you would make a profit of $5 (0.0050 x 1,000). Conversely, if the price falls to 1.0950, you would incur a loss of $5.

Example 2: USD/JPY

You want to trade USD/JPY and believe that the US Dollar will weaken against the Japanese Yen. You decide to sell (go short) one micro lot of USD/JPY at a price of 140.00. This means you are controlling 1,000 US Dollars. If the price falls to 139.50, you would make a profit of 500 Yen (0.50 x 1,000). Conversely, if the price rises to 140.50, you would incur a loss of 500 Yen.

Micro Lots vs. Other Lot Sizes

Understanding how micro lots compare to other lot sizes is crucial for making informed trading decisions. Here’s a brief comparison:

- Standard Lot: 100,000 units of the base currency. Highest risk and reward.

- Mini Lot: 10,000 units of the base currency. Medium risk and reward.

- Micro Lot: 1,000 units of the base currency. Lowest risk and reward.

- Nano Lot: 100 units of the base currency. Even lower risk than micro lot, but not offered by all brokers.

The choice of lot size depends on your risk tolerance, account size, and trading strategy. While standard lots offer the potential for significant profits, they also carry the highest risk. Micro lots, on the other hand, offer a more conservative approach, allowing traders to participate in the market with minimal risk.

The Future of Micro Lot Trading

As the forex market continues to evolve, micro lot trading is likely to become even more popular. The increasing accessibility of online trading platforms and the growing demand for risk-managed investment options are driving the adoption of micro lots. Furthermore, as more and more individuals enter the forex market, the demand for smaller lot sizes will continue to grow.

The use of micro lots will likely become even more sophisticated, with brokers offering increasingly granular position sizing options. This will allow traders to fine-tune their positions to an even greater degree, further enhancing risk management capabilities. [See also: Forex Risk Management Strategies] [See also: Choosing the Right Forex Broker]

Conclusion

Micro lots have revolutionized forex trading by making it accessible to a wider audience and providing a risk-managed approach to trading. Whether you’re a beginner looking to learn the ropes or an experienced trader seeking to refine your strategies, micro lots offer a valuable tool for navigating the complexities of the forex market. By understanding the advantages of micro lots and implementing effective risk management techniques, you can increase your chances of success in the world of forex trading. Remember to always trade responsibly and to seek advice from a qualified financial advisor before making any investment decisions.