Unlocking Forex Profit: Strategies and Insights for Consistent Gains

The allure of the foreign exchange (forex) market lies in its potential for significant forex profit. However, navigating this complex landscape requires a strategic approach, a deep understanding of market dynamics, and disciplined risk management. This article delves into the essential strategies and insights necessary for achieving consistent forex profit, providing a comprehensive guide for both novice and experienced traders.

Understanding the Forex Market

Before diving into specific strategies, it’s crucial to grasp the fundamentals of the forex market. The forex market is a decentralized global marketplace where currencies are traded. Unlike stock exchanges, there is no central physical location. Trading occurs electronically over-the-counter (OTC), 24 hours a day, five days a week. This continuous trading cycle allows for flexibility but also necessitates constant vigilance.

Currency pairs are the foundation of forex trading. Each pair represents the relative value of one currency against another. For instance, EUR/USD represents the Euro versus the US Dollar. Traders speculate on whether the base currency (EUR in this case) will appreciate or depreciate against the quote currency (USD).

Key Factors Influencing Forex Rates

Several factors can influence forex rates, including:

- Economic Indicators: GDP growth, inflation rates, unemployment figures, and interest rate decisions significantly impact currency values.

- Geopolitical Events: Political instability, trade wars, and unexpected global events can create volatility in the forex market.

- Central Bank Policies: Actions taken by central banks, such as quantitative easing or interest rate hikes, directly affect currency values.

- Market Sentiment: Overall market optimism or pessimism can drive currency movements, often based on speculation and news flow.

Strategies for Maximizing Forex Profit

Achieving consistent forex profit requires a well-defined trading strategy. Here are some popular and effective approaches:

Trend Following

Trend following involves identifying and capitalizing on existing market trends. Traders analyze price charts to determine the direction of the trend and then enter positions that align with that direction. This strategy relies on the assumption that trends tend to persist for a certain period. [See also: Identifying Forex Trends]

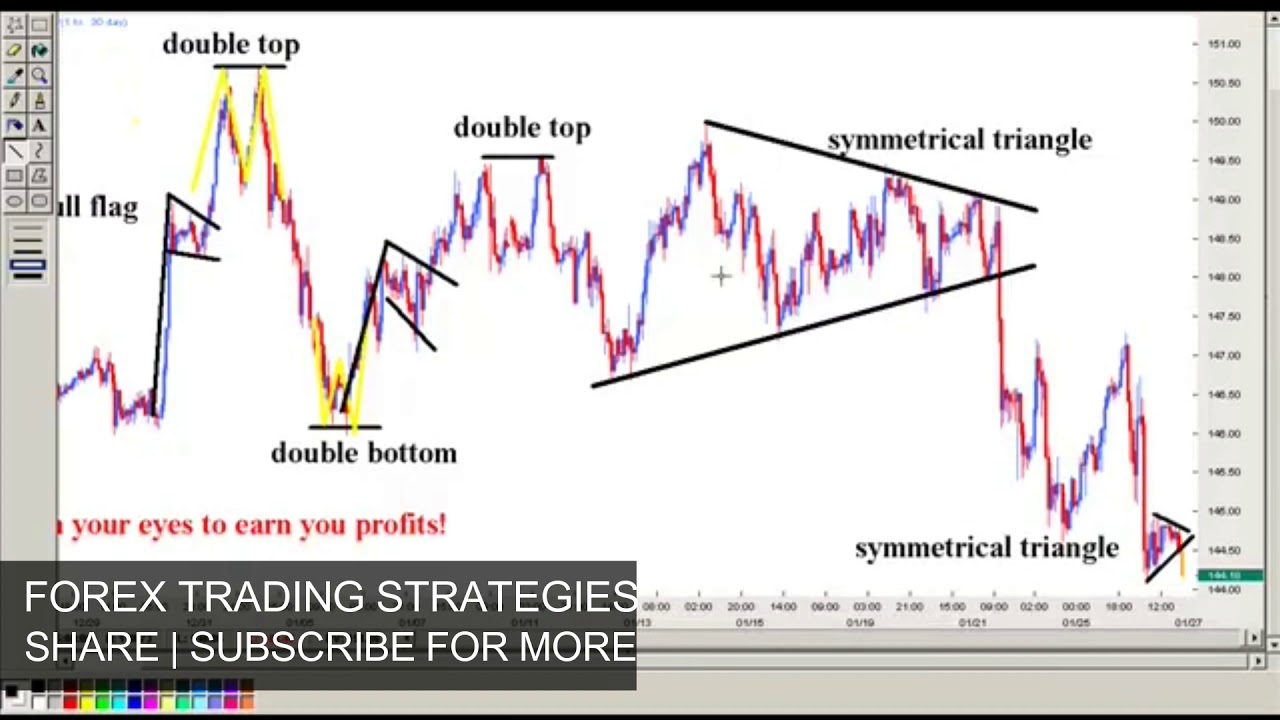

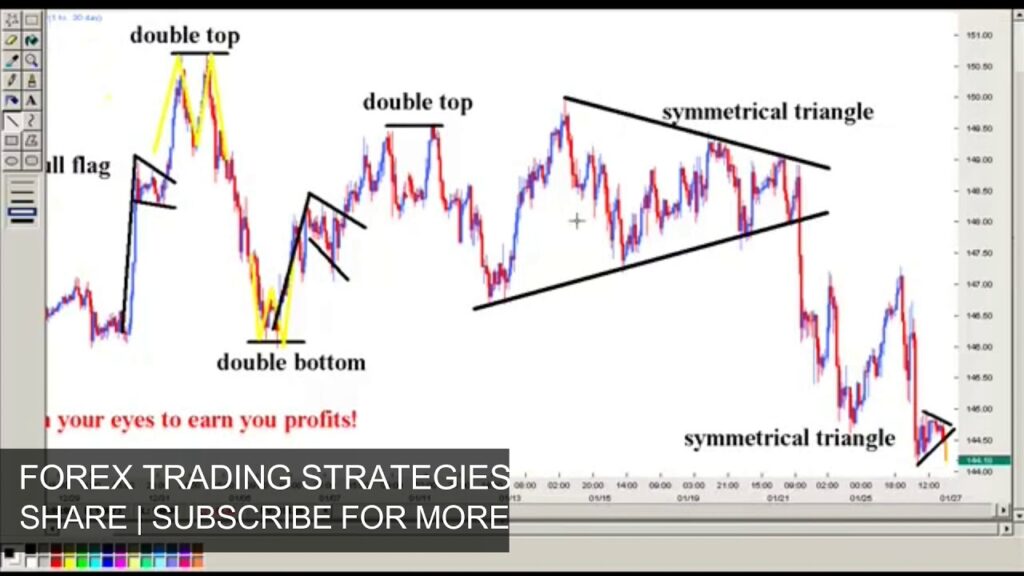

Breakout Trading

Breakout trading focuses on identifying price levels where significant price movement is likely to occur. Traders look for instances where the price breaks through a resistance level (above) or a support level (below). A breakout often signals the start of a new trend, providing opportunities for forex profit.

Range Trading

Range trading is suitable for markets that are not trending but are instead moving within a defined range. Traders identify the upper and lower boundaries of the range and then buy at the lower boundary and sell at the upper boundary. This strategy is effective when the market lacks a clear directional bias.

Scalping

Scalping is a high-frequency trading strategy that involves making numerous small trades throughout the day. Scalpers aim to profit from minor price fluctuations, often holding positions for only a few seconds or minutes. This strategy requires quick decision-making and tight risk management. While the individual forex profit from each trade may be small, the cumulative effect can be substantial.

Swing Trading

Swing trading involves holding positions for several days or weeks, aiming to capture larger price swings. Swing traders analyze price charts to identify potential turning points and then enter positions accordingly. This strategy requires more patience than scalping but can potentially yield higher forex profit.

Essential Risk Management Techniques

Risk management is paramount in forex trading. Without proper risk management, even the most profitable strategies can lead to significant losses. Here are some essential techniques:

Stop-Loss Orders

A stop-loss order is an instruction to automatically close a trade when the price reaches a predetermined level. This helps to limit potential losses. Setting appropriate stop-loss levels is crucial for protecting capital and preventing large drawdowns.

Take-Profit Orders

A take-profit order is an instruction to automatically close a trade when the price reaches a predetermined profit target. This helps to lock in forex profit and prevent the temptation to hold on to winning trades for too long. Setting realistic take-profit levels is essential for achieving consistent gains.

Position Sizing

Position sizing refers to the amount of capital allocated to each trade. It’s crucial to avoid risking too much capital on any single trade. A common rule of thumb is to risk no more than 1-2% of your trading capital per trade. Proper position sizing helps to protect your capital and prevent emotional decision-making.

Leverage Management

Leverage allows traders to control a larger position with a smaller amount of capital. While leverage can amplify forex profit, it can also amplify losses. It’s crucial to use leverage responsibly and understand the risks involved. Novice traders should start with low leverage ratios and gradually increase them as they gain experience.

The Importance of Forex Education and Analysis

Continuous education and market analysis are essential for achieving long-term forex profit. Traders should stay informed about economic news, geopolitical events, and central bank policies. They should also develop their analytical skills by studying price charts, technical indicators, and fundamental data.

Technical Analysis

Technical analysis involves studying price charts and using technical indicators to identify potential trading opportunities. Technical analysts believe that historical price patterns can provide insights into future price movements. Common technical indicators include moving averages, RSI, MACD, and Fibonacci retracements.

Fundamental Analysis

Fundamental analysis involves analyzing economic data, news events, and other factors that can influence currency values. Fundamental analysts believe that currency values are ultimately driven by underlying economic fundamentals. By understanding these fundamentals, traders can make informed decisions about which currencies to buy or sell.

Psychology of Forex Trading

The psychology of trading plays a significant role in achieving forex profit. Emotions such as fear and greed can lead to irrational decision-making. It’s crucial to develop a disciplined and objective approach to trading. Traders should avoid letting their emotions dictate their decisions and should instead rely on their trading strategy and risk management plan.

Overcoming Emotional Biases

Recognizing and overcoming emotional biases is essential for successful forex trading. Common biases include:

- Confirmation Bias: Seeking out information that confirms existing beliefs and ignoring information that contradicts them.

- Loss Aversion: Feeling the pain of a loss more strongly than the pleasure of an equivalent gain.

- Overconfidence: Overestimating one’s ability to predict market movements.

Choosing the Right Forex Broker

Selecting a reputable and reliable forex broker is crucial for ensuring a positive trading experience. Consider the following factors when choosing a broker:

- Regulation: Ensure that the broker is regulated by a reputable regulatory agency.

- Trading Platform: Choose a broker that offers a user-friendly and feature-rich trading platform.

- Spreads and Commissions: Compare the spreads and commissions offered by different brokers.

- Customer Support: Ensure that the broker offers responsive and helpful customer support.

- Account Options: Look for a broker that offers a variety of account options to suit your trading needs.

Staying Updated and Adapting to Market Changes

The forex market is constantly evolving, so it’s essential to stay updated on market trends and adapt your strategies accordingly. This involves continuously learning, analyzing market data, and refining your trading plan. Successful traders are those who can adapt to changing market conditions and maintain a flexible approach.

Conclusion: Consistent Forex Profit Requires Discipline and Strategy

Achieving consistent forex profit is not a get-rich-quick scheme. It requires a combination of knowledge, strategy, discipline, and risk management. By understanding the fundamentals of the forex market, developing a well-defined trading strategy, implementing robust risk management techniques, and continuously educating yourself, you can increase your chances of success in the forex market. Remember that patience and persistence are key to unlocking the potential for consistent forex profit.

Ultimately, the pursuit of forex profit is a journey of continuous learning and refinement. Embrace the challenges, learn from your mistakes, and stay committed to your trading plan. With dedication and a strategic approach, you can navigate the complexities of the forex market and achieve your financial goals.