Unlocking Forex Profit: Strategies and Insights for Consistent Gains

The allure of the foreign exchange market, or Forex, lies in its potential for significant forex profit. With trillions of dollars changing hands daily, Forex presents opportunities for traders of all levels to capitalize on currency fluctuations. However, navigating this complex landscape requires a strategic approach, a deep understanding of market dynamics, and a commitment to continuous learning. This article delves into the core principles of achieving consistent forex profit, exploring proven strategies, risk management techniques, and essential insights for sustainable success.

Understanding the Forex Market

Before diving into strategies, it’s crucial to grasp the fundamentals of the Forex market. Unlike traditional stock exchanges, Forex operates 24 hours a day, five days a week, across various global financial centers. Currencies are traded in pairs, such as EUR/USD (Euro/US Dollar) or GBP/JPY (British Pound/Japanese Yen). The value of one currency relative to another determines the exchange rate.

- Base Currency: The first currency in the pair (e.g., EUR in EUR/USD).

- Quote Currency: The second currency in the pair (e.g., USD in EUR/USD).

- Pip (Point in Percentage): The smallest price increment in Forex, typically 0.0001 for most currency pairs.

- Leverage: A tool that allows traders to control larger positions with a smaller amount of capital. While leverage can amplify forex profit, it also magnifies potential losses.

Essential Strategies for Forex Profit

Achieving consistent forex profit requires a well-defined trading strategy. Here are some popular approaches:

Trend Following

Trend following involves identifying the prevailing trend in a currency pair and trading in the direction of that trend. This strategy is based on the assumption that trends tend to persist for a certain period.

How it works:

- Identify the trend: Use technical indicators like moving averages, trendlines, and MACD (Moving Average Convergence Divergence) to determine the direction of the trend.

- Enter the trade: Open a long position (buy) if the trend is upward and a short position (sell) if the trend is downward.

- Set stop-loss and take-profit levels: Protect your capital and lock in profits by setting appropriate stop-loss and take-profit orders.

Range Trading

Range trading is suitable for markets that are consolidating or trading within a defined range. Traders aim to profit from the price fluctuations between the support and resistance levels.

How it works:

- Identify the range: Determine the support and resistance levels within which the currency pair is trading.

- Buy at support: Open a long position when the price reaches the support level.

- Sell at resistance: Open a short position when the price reaches the resistance level.

- Manage risk: Place stop-loss orders just below the support level (for long positions) and just above the resistance level (for short positions).

Breakout Trading

Breakout trading involves identifying key levels of support or resistance and trading in the direction of the breakout. This strategy is based on the idea that once a price breaks through a significant level, it is likely to continue moving in that direction.

How it works:

- Identify key levels: Look for strong support or resistance levels that have been tested multiple times.

- Wait for the breakout: Monitor the price action and wait for a clear breakout above resistance or below support.

- Confirm the breakout: Use volume indicators and price patterns to confirm the validity of the breakout.

- Enter the trade: Open a long position after a breakout above resistance and a short position after a breakout below support.

Scalping

Scalping is a short-term trading strategy that involves making small forex profit from minor price fluctuations. Scalpers typically hold positions for only a few seconds or minutes, aiming to accumulate small profits over a large number of trades.

How it works:

- Use short timeframes: Scalpers typically use 1-minute or 5-minute charts.

- Focus on volatility: Look for currency pairs that are experiencing high volatility.

- Enter and exit quickly: Scalpers aim to capture small profits and avoid holding positions for extended periods.

- Manage risk tightly: Use tight stop-loss orders to limit potential losses.

Risk Management: Protecting Your Capital

Effective risk management is paramount to achieving consistent forex profit. Without proper risk management, even the most profitable strategies can be wiped out by a single losing trade. Here are some essential risk management techniques:

- Stop-Loss Orders: A stop-loss order automatically closes a trade when the price reaches a predetermined level, limiting potential losses.

- Take-Profit Orders: A take-profit order automatically closes a trade when the price reaches a predetermined level, locking in profits.

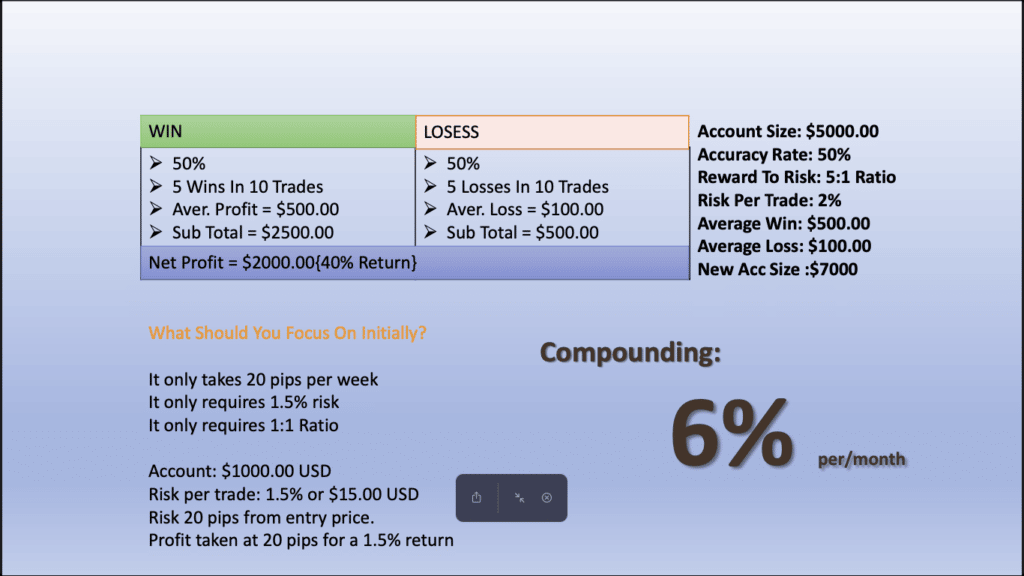

- Position Sizing: Determine the appropriate size of each trade based on your account balance and risk tolerance. A common rule of thumb is to risk no more than 1-2% of your capital on any single trade.

- Leverage Management: Use leverage cautiously. While it can amplify profits, it also magnifies losses. Start with low leverage and gradually increase it as you gain experience.

- Diversification: Avoid putting all your eggs in one basket. Diversify your trading portfolio by trading multiple currency pairs.

The Psychology of Forex Trading

Successful Forex trading requires not only technical skills but also a strong understanding of trading psychology. Emotions like fear and greed can cloud judgment and lead to impulsive decisions. Here are some tips for managing your emotions while trading:

- Develop a trading plan: A well-defined trading plan provides a framework for making rational decisions and avoiding emotional trading.

- Stick to your plan: Follow your trading plan consistently, even when faced with market volatility.

- Manage your emotions: Be aware of your emotional state and take steps to avoid trading when you are feeling stressed, angry, or overly confident.

- Learn from your mistakes: Analyze your losing trades to identify areas for improvement.

- Be patient: Forex trading is a marathon, not a sprint. It takes time and effort to develop the skills and discipline required to achieve consistent forex profit.

Staying Informed: Market Analysis and News

Staying informed about global economic events and market trends is crucial for making informed trading decisions. Here are some resources for staying up-to-date:

- Economic Calendars: Track important economic releases, such as GDP figures, inflation data, and employment reports.

- Financial News Websites: Follow reputable financial news websites for market analysis and commentary.

- Technical Analysis Tools: Use technical indicators and charting patterns to identify potential trading opportunities.

- Fundamental Analysis: Understand the underlying economic factors that drive currency values.

Continuous Learning and Adaptation

The Forex market is constantly evolving, so it’s essential to commit to continuous learning and adaptation. Attend webinars, read books, and follow experienced traders to stay abreast of the latest strategies and techniques. Be willing to adjust your trading plan as market conditions change.

The Role of Technology in Forex Profit

Modern technology plays a significant role in maximizing forex profit. Automated trading systems, or Expert Advisors (EAs), can execute trades based on pre-defined rules, freeing up traders to focus on other aspects of their strategy. However, it’s important to carefully vet and backtest any EA before deploying it on a live account. [See also: Choosing the Right Forex Broker]

Common Pitfalls to Avoid

Many novice traders fall prey to common pitfalls that hinder their ability to achieve consistent forex profit. These include over-leveraging, lack of a trading plan, emotional trading, and failure to manage risk. Avoiding these mistakes is crucial for long-term success.

Conclusion: A Path to Consistent Forex Profit

Achieving consistent forex profit is a challenging but attainable goal. By understanding the market, developing a sound trading strategy, managing risk effectively, and continuously learning and adapting, traders can increase their chances of success. Remember that there are no guarantees in Forex trading, and losses are inevitable. However, with discipline, patience, and a commitment to improvement, it is possible to unlock the potential for sustainable forex profit.

The journey to consistent forex profit requires dedication and perseverance. It’s a continuous process of learning, adapting, and refining your strategies. By embracing a disciplined approach and focusing on long-term growth, you can increase your chances of achieving your financial goals in the dynamic world of Forex trading. Remember that consistent forex profit is a result of diligent research, careful planning, and unwavering discipline. Good luck!