Unlocking Forex Secrets: Mastering the Order Block Trading Strategy

In the dynamic world of Forex trading, identifying high-probability setups is crucial for consistent profitability. One such setup revolves around understanding and utilizing order blocks. This article delves into the intricacies of order block forex trading, providing a comprehensive guide for traders of all levels. We’ll explore what order blocks are, how to identify them, and how to incorporate them into your trading strategy for potentially improved results in the forex market. Understanding order blocks can give you an edge in predicting price movements and executing more informed trades.

What are Order Blocks in Forex?

An order block is essentially a specific price area where large institutional traders (like banks or hedge funds) have placed significant buy or sell orders. These orders often represent the last accumulation or distribution phase before a significant price move. The concept is rooted in the idea that large institutions can’t execute their entire order at once without significantly impacting the price. Therefore, they accumulate or distribute their positions over time, leaving behind a discernible footprint on the price chart.

Think of it like this: a large investor wants to buy a million shares of a company. If they placed a market order for all those shares at once, the price would immediately jump up, potentially costing them more money. Instead, they might break up the order into smaller chunks and execute them over time, creating a demand zone—an order block.

Identifying Order Blocks: A Step-by-Step Guide

Identifying order blocks requires careful observation of price action and understanding of market structure. Here’s a breakdown of the key steps:

Step 1: Define Market Structure

Before looking for order blocks, you need to identify the prevailing trend. Is the market trending upwards, downwards, or ranging? Understanding the overall trend context is crucial for interpreting the significance of potential order blocks. Look for higher highs and higher lows in an uptrend, and lower highs and lower lows in a downtrend. A ranging market requires a different approach, focusing on support and resistance levels.

Step 2: Locate Impulsive Moves

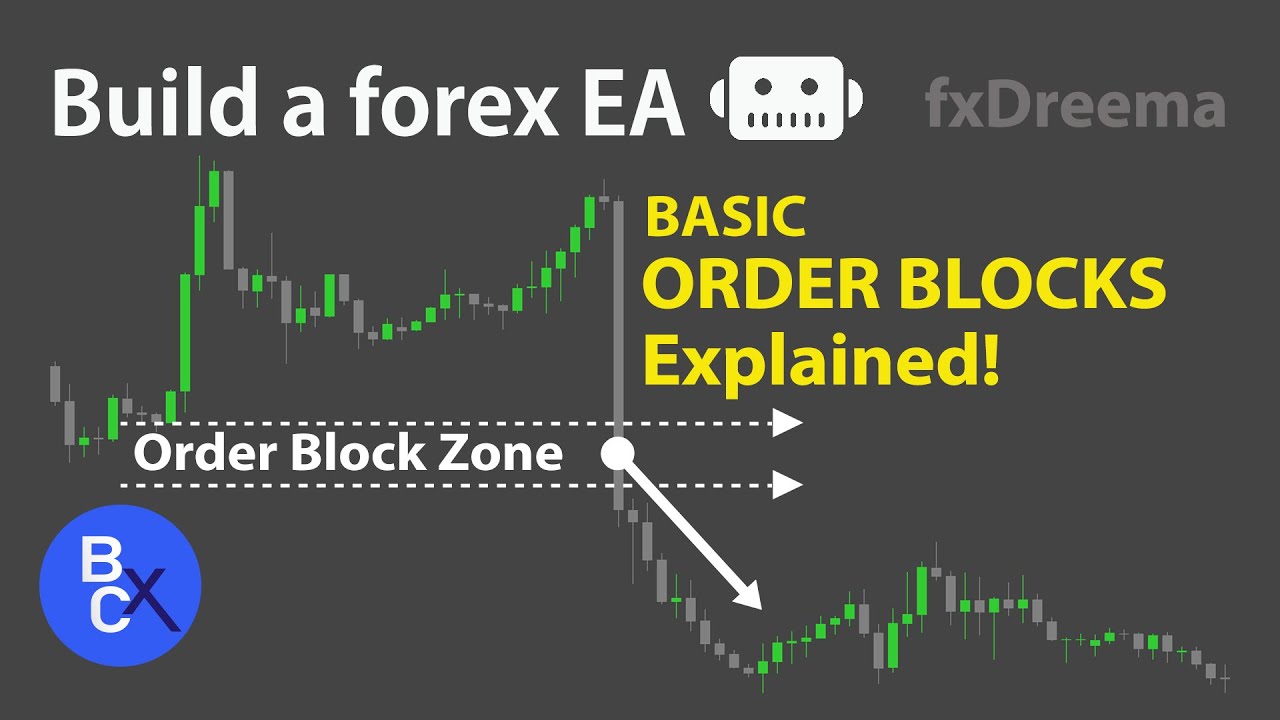

Order blocks are typically associated with strong, impulsive price movements. Look for significant candles that break through previous levels of support or resistance. These moves indicate that large orders have been executed, potentially leaving behind an order block.

Step 3: Identify the Last Candle Before the Impulsive Move

This is the core of identifying an order block. In an uptrend (bullish order block), the last down candle (or series of down candles) before the impulsive move upwards is the potential order block. Conversely, in a downtrend (bearish order block), the last up candle (or series of up candles) before the impulsive move downwards is the potential order block. Mark this area on your chart.

Step 4: Refine the Order Block

Sometimes, the initial order block identified might be too large. You can refine it by focusing on the body of the candle rather than the entire range. This will give you a more precise area to watch for price reactions. Consider using Fibonacci retracement levels to further refine potential entry points within the order block.

Step 5: Confirmation and Validation

Not every identified area will act as a valid order block. You need confirmation. Look for price to retrace back to the identified order block and show signs of rejection. This could be in the form of candlestick patterns (e.g., pin bars, engulfing patterns) or a bounce off the level. Volume analysis can also be helpful; increased volume upon the retest of the order block strengthens the validity of the setup.

Trading with Order Blocks: Strategies and Techniques

Once you’ve identified a potential order block, the next step is to incorporate it into your trading strategy. Here are some common techniques:

Entry Strategies

- Limit Orders: Place a limit order at the top (for bearish order blocks) or bottom (for bullish order blocks) of the identified zone. This allows you to enter the trade automatically when the price retraces to the order block.

- Confirmation Entries: Wait for price to retrace to the order block and show signs of rejection before entering the trade. This reduces the risk of entering a false breakout. Look for candlestick patterns or other technical indicators to confirm the validity of the order block.

Stop-Loss Placement

Proper stop-loss placement is crucial for managing risk. Here are some common strategies:

- Below/Above the Order Block: Place your stop-loss slightly below the low of the bullish order block or slightly above the high of the bearish order block. This protects your trade in case the price breaks through the order block.

- Based on Volatility: Use Average True Range (ATR) or other volatility indicators to determine an appropriate stop-loss distance. This accounts for the current market volatility and prevents premature stop-loss triggers.

Take-Profit Targets

Setting realistic take-profit targets is essential for maximizing profits. Here are some common approaches:

- Previous Highs/Lows: Target previous highs in an uptrend or previous lows in a downtrend. These levels often act as natural areas of support or resistance.

- Fibonacci Extensions: Use Fibonacci extensions to project potential price targets based on the initial impulsive move.

- Risk-Reward Ratio: Aim for a favorable risk-reward ratio (e.g., 1:2 or 1:3). This ensures that your potential profits outweigh your potential losses.

Advantages and Disadvantages of Order Block Trading

Like any trading strategy, order block forex trading has its pros and cons:

Advantages

- High Probability Setups: When identified correctly, order blocks can offer high-probability trading opportunities.

- Clear Entry and Exit Points: Order blocks provide clear levels for entry, stop-loss, and take-profit, making it easier to manage trades.

- Objective Approach: The identification of order blocks is based on price action and market structure, making it a relatively objective trading strategy.

Disadvantages

- Subjectivity in Identification: While the concept is objective, the actual identification of order blocks can be subjective and require experience.

- False Signals: Not every identified area will act as a valid order block, leading to potential false signals.

- Requires Patience: Waiting for price to retrace to the order block can require patience and discipline.

Common Mistakes to Avoid When Trading Order Blocks

To improve your success rate with order block trading, avoid these common mistakes:

- Ignoring the Overall Trend: Trading order blocks against the prevailing trend is a recipe for disaster. Always trade in the direction of the trend.

- Over-Leveraging: Using excessive leverage can amplify losses, especially if the order block fails to hold.

- Ignoring Risk Management: Failing to set stop-loss orders or manage risk properly can lead to significant losses.

- Chasing Price: Don’t chase the price if it moves away from the order block. Wait for a retracement or look for other opportunities.

- Over-Analyzing: While analysis is important, over-analyzing can lead to paralysis. Trust your initial analysis and execute your trade.

Advanced Order Block Concepts

Once you’ve mastered the basics, you can explore more advanced order block concepts:

Mitigation Blocks

These are order blocks that have already been tested and mitigated. They often act as continuation patterns, providing opportunities to enter trades in the direction of the trend.

Breaker Blocks

A breaker block is essentially a failed order block that becomes a support or resistance level. If price breaks through an order block, that order block can then act as a breaker block, signaling a potential trend reversal.

Order Block Confluence

Combining order block analysis with other technical indicators can increase the probability of success. Look for confluence with Fibonacci levels, trendlines, or other support and resistance areas.

Tools and Resources for Order Block Trading

Several tools and resources can assist you in identifying and trading order blocks:

- TradingView: A popular charting platform with various tools and indicators for technical analysis.

- MetaTrader 4/5: Widely used trading platforms that support custom indicators and automated trading strategies.

- Forex Forums and Communities: Online forums and communities where traders share ideas and discuss order block trading strategies.

- Books and Courses: Numerous books and online courses cover order block trading in detail.

The Psychology of Order Block Trading

Trading psychology plays a crucial role in successful order block trading. It’s important to remain disciplined, patient, and objective. Avoid emotional trading decisions and stick to your trading plan. Remember that losses are part of the game, and it’s important to learn from them and adjust your strategy accordingly. [See also: Risk Management in Forex Trading]

Conclusion: Mastering the Order Block Forex Strategy

Understanding and utilizing order blocks can significantly enhance your Forex trading strategy. By learning how to identify them, incorporating them into your trading plan, and managing risk effectively, you can potentially improve your trading results. Remember that practice and experience are key to mastering this technique. Continue to refine your skills, adapt to changing market conditions, and always prioritize risk management. The order block forex strategy, when used correctly, can be a powerful tool in your trading arsenal, helping you to navigate the complexities of the Forex market with greater confidence and precision. Don’t underestimate the power of these institutional footprints – they can provide valuable insights into potential price movements and help you make more informed trading decisions. Keep learning, keep practicing, and keep adapting, and you’ll be well on your way to mastering the art of order block forex trading.