Unlocking Investment Performance: A Comprehensive Guide to the Information Ratio

In the dynamic world of finance, investors are constantly seeking metrics to evaluate the efficiency and effectiveness of their investment strategies. Among these tools, the information ratio stands out as a crucial indicator of risk-adjusted return. This article delves into the information ratio, exploring its definition, calculation, interpretation, and practical applications in portfolio management. By understanding this key performance indicator, investors can gain valuable insights into the skills of a portfolio manager and make more informed decisions.

What is the Information Ratio?

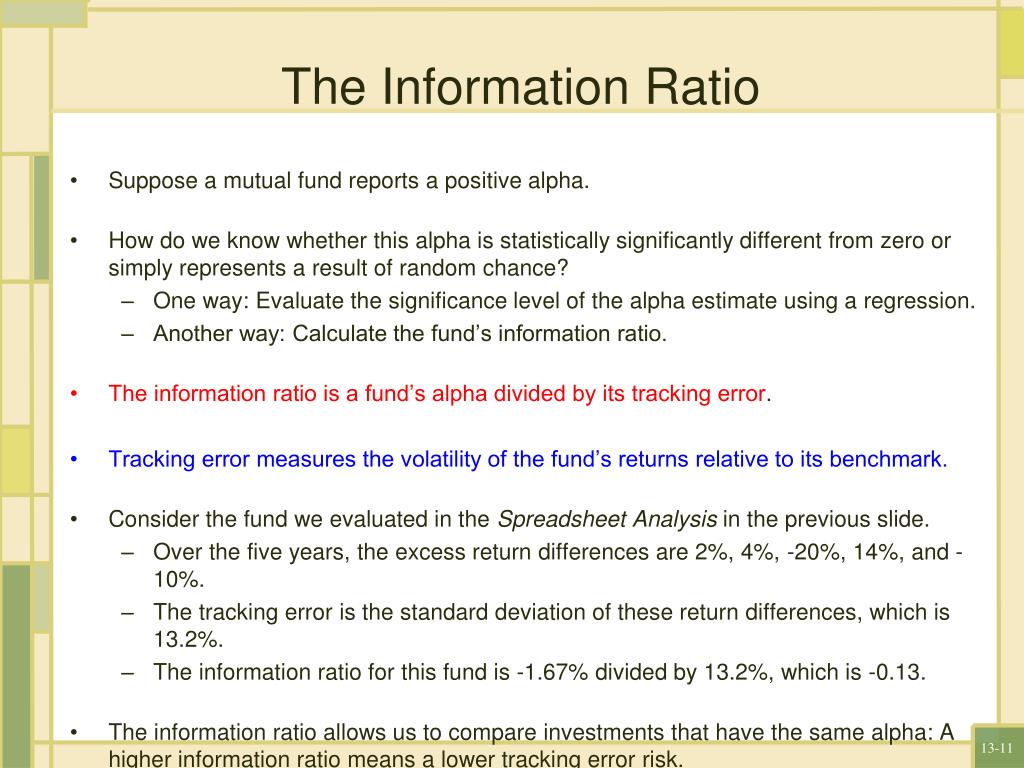

The information ratio (IR) is a measure of portfolio returns beyond the returns of a benchmark, usually an index, compared to the volatility of those excess returns. In simpler terms, it quantifies how much “bang for your buck” an investor gets for taking on active risk. A higher information ratio suggests that a portfolio manager is generating significant excess returns relative to the risk they are taking. It’s a valuable tool for assessing the consistency and skill of active management.

Understanding the Components

To fully grasp the information ratio, it’s essential to understand its two primary components:

- Active Return (Excess Return): This is the difference between the portfolio’s return and the benchmark’s return. It represents the value added by the portfolio manager’s active investment decisions. For example, if a portfolio returns 12% while its benchmark returns 10%, the active return is 2%.

- Tracking Error: This measures the volatility of the active returns. It quantifies how consistently the portfolio outperforms or underperforms the benchmark. A lower tracking error indicates that the portfolio’s returns are more closely aligned with the benchmark, while a higher tracking error suggests greater deviations.

Calculating the Information Ratio

The formula for calculating the information ratio is straightforward:

Information Ratio = Active Return / Tracking Error

Let’s illustrate this with an example. Suppose a portfolio has an active return of 5% and a tracking error of 8%. The information ratio would be 5% / 8% = 0.625. This indicates that for every unit of risk taken (as measured by tracking error), the portfolio generated 0.625 units of excess return.

Interpreting the Information Ratio

The interpretation of the information ratio is crucial for making informed investment decisions. Here’s a general guideline:

- High Information Ratio (Above 0.5): Generally indicates skilled active management. The portfolio manager is consistently generating excess returns relative to the risk taken.

- Moderate Information Ratio (Between 0.3 and 0.5): Suggests moderate skill in active management. The portfolio manager is generating some excess returns, but the consistency may vary.

- Low Information Ratio (Below 0.3): Indicates limited skill in active management. The portfolio manager is not consistently generating significant excess returns relative to the risk taken. An information ratio near zero suggests the manager is essentially mirroring the benchmark.

- Negative Information Ratio: Implies that the portfolio is underperforming the benchmark. This could be due to poor investment decisions or excessive risk-taking.

It’s important to note that these are general guidelines, and the interpretation of the information ratio should be considered in the context of the investment strategy, market conditions, and the investor’s risk tolerance.

The Significance of the Information Ratio in Investment Management

The information ratio plays a vital role in various aspects of investment management:

Portfolio Manager Evaluation

The information ratio is a key metric for evaluating the performance of portfolio managers. It provides a standardized measure of their ability to generate excess returns relative to the risk they take. Investors can use the information ratio to compare the performance of different portfolio managers and identify those who consistently deliver superior risk-adjusted returns. [See also: How to Evaluate a Portfolio Manager]

Portfolio Construction

The information ratio can also be used in portfolio construction to optimize the allocation of assets. By considering the expected active returns and tracking errors of different investment strategies, investors can construct portfolios that maximize the information ratio, thereby enhancing risk-adjusted returns. This involves a careful balancing act between seeking higher returns and managing the associated risks.

Risk Management

Tracking error, a component of the information ratio, is a crucial element of risk management. By monitoring the tracking error of a portfolio, investors can assess the level of active risk being taken. This allows them to make informed decisions about whether to adjust the portfolio’s asset allocation or investment strategy to align with their risk tolerance. [See also: Understanding Risk Tolerance in Investing]

Limitations of the Information Ratio

While the information ratio is a valuable tool, it’s essential to be aware of its limitations:

- Benchmark Dependency: The information ratio is highly dependent on the choice of benchmark. A different benchmark can significantly alter the calculated information ratio. Therefore, it’s crucial to select a benchmark that accurately reflects the investment strategy and risk profile of the portfolio.

- Backward-Looking: The information ratio is a backward-looking measure based on historical data. It doesn’t guarantee future performance. Market conditions and investment strategies can change over time, impacting the future information ratio.

- Sensitivity to Tracking Error: The information ratio can be highly sensitive to small changes in tracking error. A small increase in tracking error can significantly reduce the information ratio, even if the active return remains the same.

- Not a Standalone Metric: The information ratio should not be used in isolation. It should be considered in conjunction with other performance metrics, such as Sharpe ratio, Sortino ratio, and alpha, to gain a comprehensive understanding of a portfolio’s performance.

Practical Applications of the Information Ratio

The information ratio finds practical application across various investment scenarios:

Hedge Fund Analysis

Hedge funds often employ complex investment strategies aimed at generating absolute returns. The information ratio is a valuable tool for evaluating the performance of hedge fund managers, providing insights into their ability to generate excess returns while managing risk. A high information ratio suggests that the hedge fund manager is skilled at identifying and exploiting market inefficiencies.

Mutual Fund Selection

Investors can use the information ratio to compare the performance of different mutual funds within the same category. By selecting mutual funds with higher information ratios, investors can potentially enhance their risk-adjusted returns. However, it’s important to consider other factors, such as the fund’s expense ratio, investment strategy, and management team, before making a decision. [See also: Choosing the Right Mutual Fund]

Asset Allocation

The information ratio can be used to optimize asset allocation decisions. By considering the expected active returns and tracking errors of different asset classes, investors can construct portfolios that maximize the information ratio. This involves allocating a larger portion of the portfolio to asset classes with higher expected active returns and lower tracking errors.

The Information Ratio vs. The Sharpe Ratio

It is helpful to compare the information ratio to another common metric, the Sharpe ratio. While both are risk-adjusted performance measures, they differ in their benchmarks. The Sharpe ratio measures excess return over the risk-free rate, while the information ratio measures excess return over a specific benchmark. The Sharpe ratio is useful for evaluating the overall performance of a portfolio, while the information ratio is more useful for evaluating the skill of a portfolio manager relative to a specific benchmark.

Improving Your Information Ratio

For portfolio managers, striving to improve the information ratio is paramount. This can be achieved through several strategies:

- Refining Investment Strategies: Continuously analyze and refine investment strategies to identify opportunities for generating higher active returns.

- Enhancing Risk Management: Implement robust risk management practices to minimize tracking error and protect against potential losses.

- Improving Portfolio Construction: Optimize portfolio construction techniques to maximize the information ratio, taking into account the expected active returns and tracking errors of different investment strategies.

- Reducing Transaction Costs: Minimize transaction costs, such as brokerage fees and commissions, as these can erode active returns and negatively impact the information ratio.

Conclusion

The information ratio is a powerful tool for evaluating investment performance, providing valuable insights into the skill of portfolio managers and the effectiveness of investment strategies. By understanding its components, calculation, interpretation, and limitations, investors can make more informed decisions and potentially enhance their risk-adjusted returns. While it is not a perfect metric, the information ratio, when used in conjunction with other performance measures, offers a comprehensive view of investment performance. Remember to always consider the context of the investment strategy and market conditions when interpreting the information ratio. Ultimately, understanding and applying the information ratio can lead to smarter, more profitable investment decisions, improving your overall investment performance.