Unlocking Profitability: Understanding PL in Trading and Its Significance

In the dynamic world of financial markets, understanding the nuances of trading is crucial for success. Among the essential concepts that every trader needs to grasp is **PL in trading**, which stands for Profit and Loss. This metric represents the difference between the buying and selling prices of assets, reflecting the financial outcome of a trading activity. A positive PL indicates a profit, while a negative PL signifies a loss. Mastering the understanding of **PL in trading** is not just about calculating numbers; it’s about gaining insights into the effectiveness of your trading strategies and making informed decisions.

The Fundamentals of PL in Trading

At its core, **PL in trading** is a simple calculation: Selling Price – Buying Price = Profit/Loss. However, the intricacies lie in the factors that influence these prices, such as market volatility, trading fees, and the trader’s own strategies. To truly understand your **PL in trading**, you need to delve deeper into its components and how they interact.

Calculating Profit

Profit is generated when you sell an asset at a higher price than you bought it for. The difference represents your gross profit. However, it’s important to factor in any associated costs, such as brokerage fees or commissions, to arrive at your net profit. For example, if you bought 100 shares of a stock at $10 per share and sold them at $12 per share, your gross profit would be $200. If your brokerage charged a $10 commission, your net profit would be $190.

Calculating Loss

A loss occurs when you sell an asset at a lower price than you bought it for. Similar to calculating profit, you need to consider any associated costs. For example, if you bought 100 shares of a stock at $10 per share and sold them at $8 per share, your gross loss would be $200. Factoring in a $10 commission, your net loss would be $210.

Why PL in Trading Matters

**PL in trading** is more than just a number; it’s a critical indicator of your trading performance. By tracking your **PL in trading**, you can:

- Evaluate the effectiveness of your trading strategies.

- Identify areas for improvement.

- Manage risk more effectively.

- Make informed decisions about future trades.

Without a clear understanding of your **PL in trading**, you’re essentially trading in the dark, relying on gut feelings rather than data-driven insights. This can lead to inconsistent results and ultimately, financial losses. Analyzing your **PL in trading** helps you to see the bigger picture and refine your approach to the market.

Factors Affecting PL in Trading

Several factors can influence your **PL in trading**, both directly and indirectly. Understanding these factors is crucial for managing risk and maximizing profitability.

Market Volatility

Market volatility refers to the degree of price fluctuations in a given market or asset. High volatility can lead to both significant profits and significant losses. Traders need to be prepared for rapid price swings and adjust their strategies accordingly. During periods of high volatility, stop-loss orders can be particularly important for limiting potential losses. Understanding how market volatility impacts **PL in trading** is vital for risk management.

Trading Fees and Commissions

Every trade incurs fees and commissions, which can eat into your profits. It’s important to factor these costs into your calculations to get an accurate picture of your net **PL in trading**. Some brokers offer lower fees than others, so it’s worth shopping around to find the best deal. Consider the frequency of your trades; high-frequency traders should prioritize brokers with low per-trade fees.

Trading Strategy

Your trading strategy plays a significant role in determining your **PL in trading**. Different strategies have different risk profiles and potential returns. For example, a day trading strategy might generate small profits or losses on a daily basis, while a long-term investment strategy might yield larger profits or losses over a longer period. [See also: Day Trading Strategies for Beginners] The effectiveness of your chosen strategy directly impacts your overall **PL in trading**.

Risk Management

Effective risk management is essential for protecting your capital and maximizing your **PL in trading**. This includes setting stop-loss orders, diversifying your portfolio, and avoiding over-leveraging. A well-defined risk management plan can help you to weather market downturns and preserve your capital for future opportunities. Neglecting risk management can lead to significant losses and negatively impact your long-term **PL in trading**.

Tools and Techniques for Tracking PL in Trading

Fortunately, there are numerous tools and techniques available to help you track your **PL in trading** effectively.

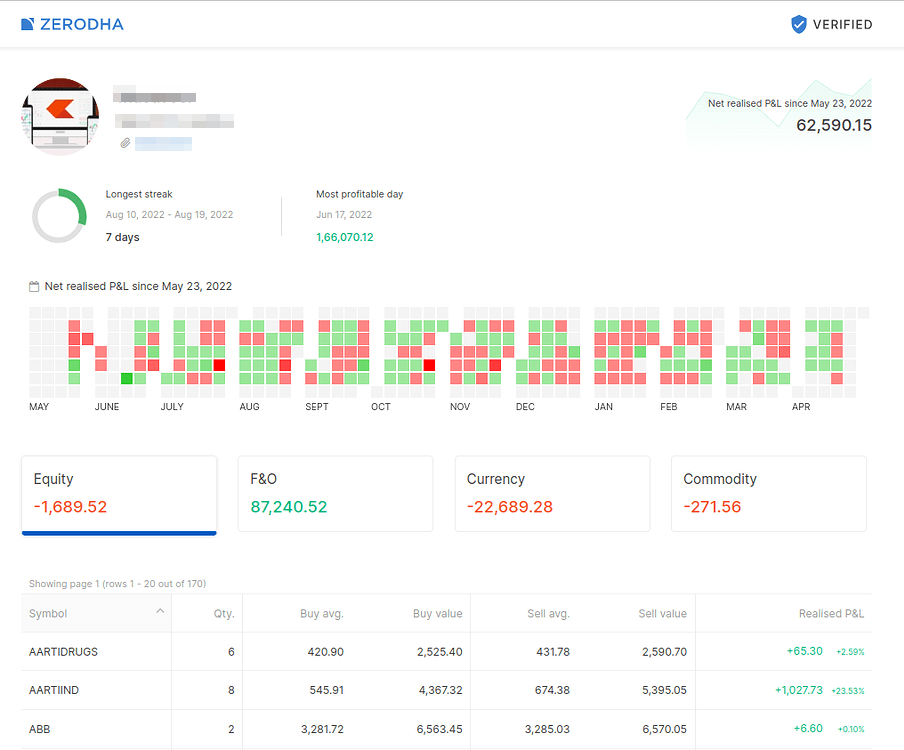

Trading Platforms

Most trading platforms offer built-in tools for tracking your **PL in trading**. These tools typically provide real-time data on your open positions, as well as historical data on your closed positions. You can use these tools to analyze your trading performance and identify areas for improvement. Familiarize yourself with the features of your trading platform to leverage its **PL in trading** tracking capabilities.

Spreadsheets

Spreadsheets like Microsoft Excel or Google Sheets can be used to manually track your **PL in trading**. This requires more effort but allows for greater customization. You can create your own formulas and charts to analyze your trading data in detail. [See also: Advanced Excel Techniques for Traders] Using spreadsheets provides a granular view of your **PL in trading** and allows for personalized analysis.

Trading Journals

A trading journal is a written record of your trades, including the reasons for entering and exiting each trade, as well as your emotions and observations. This can be a valuable tool for identifying patterns in your trading behavior and improving your decision-making. By reviewing your trading journal, you can gain insights into your **PL in trading** and identify areas where you can improve your strategy.

Advanced Strategies for Optimizing PL in Trading

Once you have a solid understanding of the fundamentals of **PL in trading**, you can start exploring more advanced strategies for optimizing your profitability.

Position Sizing

Position sizing refers to the amount of capital you allocate to each trade. A well-designed position sizing strategy can help you to manage risk and maximize your potential returns. For example, you might choose to allocate a smaller percentage of your capital to higher-risk trades and a larger percentage to lower-risk trades. Proper position sizing directly influences your overall **PL in trading** by balancing risk and reward.

Stop-Loss Orders

Stop-loss orders are orders to automatically sell an asset if it reaches a certain price. These orders can help you to limit your potential losses and protect your capital. It’s important to set stop-loss orders at appropriate levels, taking into account the volatility of the market and the risk profile of your trades. Strategic use of stop-loss orders is crucial for protecting your **PL in trading**.

Take-Profit Orders

Take-profit orders are orders to automatically sell an asset when it reaches a certain price. These orders can help you to lock in profits and avoid the temptation to hold onto winning trades for too long. Setting take-profit orders at realistic levels can help you to consistently improve your **PL in trading**.

The Psychology of PL in Trading

It’s essential to acknowledge the psychological aspect of trading and how it influences your **PL in trading**. Fear and greed can lead to impulsive decisions that negatively impact your trading performance. Developing emotional discipline and sticking to your trading plan is crucial for long-term success. Recognizing and managing your emotions are key to consistently improving your **PL in trading**.

Conclusion

Understanding **PL in trading** is fundamental to achieving success in the financial markets. By tracking your **PL in trading**, you can evaluate the effectiveness of your strategies, manage risk, and make informed decisions. Whether you’re a beginner or an experienced trader, mastering the concepts discussed in this article will undoubtedly contribute to your profitability and long-term trading success. Remember, consistent monitoring and analysis of your **PL in trading** are key to continuous improvement and financial growth.