Unlocking Profits with the ABC Trading Pattern: A Comprehensive Guide

The ABC trading pattern is a popular and relatively simple technical analysis tool used by traders to identify potential buying or selling opportunities in the market. It’s based on the observation that price movements often occur in three waves, forming a distinct pattern that can be recognized and traded. This article provides a comprehensive guide to understanding, identifying, and trading the ABC trading pattern, offering insights for both novice and experienced traders.

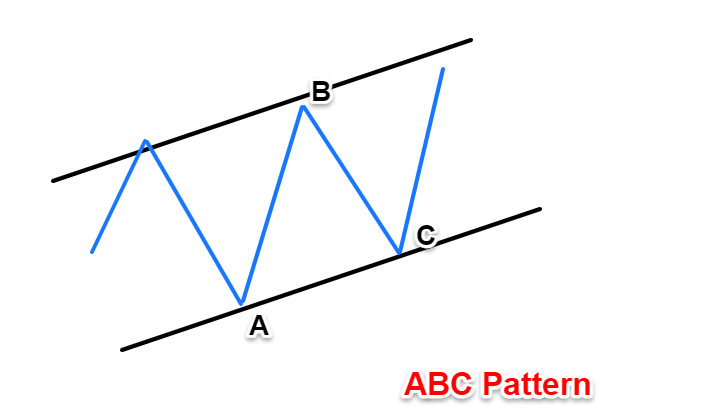

Understanding the ABC Trading Pattern

At its core, the ABC trading pattern is a three-legged price formation. It consists of an initial price move (leg A-B), a corrective move (leg B-C), and a continuation move (leg C-D). The pattern suggests that after the initial move, the price will retrace a portion of that move before resuming its original direction. Identifying these legs correctly is crucial for successful ABC trading.

The Key Components

- Leg A-B: This is the initial impulse move, which can be either upward or downward. It represents the prevailing trend or momentum in the market.

- Leg B-C: This is the corrective wave, which retraces a portion of the A-B leg. This retracement is often a Fibonacci retracement level, such as 38.2%, 50%, or 61.8%. The B-C leg provides an opportunity to enter the market in the direction of the original trend.

- Leg C-D: This is the continuation move, which extends beyond point B in the direction of the A-B leg. The C-D leg is where traders aim to profit as the price resumes its original trajectory.

Identifying the ABC Trading Pattern

Recognizing the ABC trading pattern requires careful observation and analysis of price charts. Traders often use technical indicators and Fibonacci retracement tools to help identify the pattern. Here’s a step-by-step guide to identifying the pattern:

- Identify the Initial Impulse Move (A-B): Look for a strong price move in either direction. This move should be significant enough to establish a clear trend.

- Identify the Corrective Wave (B-C): After the initial move, look for a retracement that violates the high or low of point A. Use Fibonacci retracement levels to identify potential support or resistance areas where the retracement might end. Common retracement levels include 38.2%, 50%, and 61.8%.

- Confirm the Continuation Move (C-D): Once the price reaches a potential retracement level, look for signs of reversal and continuation of the original trend. This could include candlestick patterns, momentum indicators, or trendline breaks.

Trading the ABC Trading Pattern

Once you’ve identified an ABC trading pattern, the next step is to develop a trading strategy. Here are some common approaches to trading this pattern:

Entry Points

The most common entry point is at point C, after the retracement has completed and the price is showing signs of resuming the original trend. Traders often use candlestick patterns or momentum indicators to confirm the reversal before entering the trade. Aggressive traders might enter before confirmation at a specific retracement level, but this carries higher risk.

Stop-Loss Placement

Proper stop-loss placement is crucial for managing risk. A common approach is to place the stop-loss order below point C for a long trade or above point C for a short trade. The distance between the entry point and the stop-loss order should be determined based on your risk tolerance and the volatility of the market.

Profit Targets

Profit targets can be determined using various methods, such as Fibonacci extensions or previous support and resistance levels. A common target is the 127.2% or 161.8% Fibonacci extension of the A-B leg. Another approach is to target a level equal to the length of the A-B leg projected from point C. [See also: Fibonacci Trading Strategies]

Example of an ABC Trading Pattern

Let’s consider an example of an ABC trading pattern in an uptrend. Suppose a stock price rises from $50 (A) to $60 (B). Then, it retraces to $55 (C), which is a 50% Fibonacci retracement of the A-B leg. A trader might enter a long position at $55, placing a stop-loss order below $55 (e.g., at $54.50) and setting a profit target at $65 (equal to the length of A-B projected from C). If the price continues to rise to $65, the trader would realize a profit. The ABC trading strategy in this scenario proves effective.

Variations of the ABC Trading Pattern

While the basic ABC trading pattern is straightforward, there are variations that traders should be aware of:

- Expanded ABC Pattern: In this variation, the C-D leg extends significantly beyond point B. This can be a sign of strong momentum in the direction of the trend.

- Contracting ABC Pattern: In this variation, the C-D leg fails to reach point B. This can indicate weakening momentum and a potential trend reversal.

- ABC Correction: This refers to the pattern used in corrective waves, where the ABC pattern appears as a corrective wave against the main trend.

Tools and Indicators for Trading the ABC Pattern

Several tools and indicators can assist in identifying and trading the ABC trading pattern:

- Fibonacci Retracement Tool: This tool helps identify potential retracement levels and is essential for identifying point C.

- Candlestick Patterns: These patterns can provide confirmation of reversals at point C.

- Momentum Indicators (e.g., RSI, MACD): These indicators can help confirm the continuation of the trend after the retracement.

- Trendlines: These can help identify the direction of the trend and potential support and resistance levels.

Advantages and Disadvantages of the ABC Trading Pattern

Like any trading strategy, the ABC trading pattern has its advantages and disadvantages:

Advantages

- Relatively Simple: The pattern is easy to understand and identify.

- Clear Entry and Exit Points: The pattern provides clear guidelines for entry, stop-loss placement, and profit targets.

- Applicable in Various Markets: The pattern can be used in stocks, forex, commodities, and other markets.

Disadvantages

- Subjectivity: Identifying the pattern can be subjective, and different traders might interpret it differently.

- False Signals: The pattern can generate false signals, especially in volatile markets.

- Requires Confirmation: It’s essential to use other technical indicators and tools to confirm the pattern before entering a trade.

Risk Management in ABC Trading

Effective risk management is crucial when trading the ABC trading pattern. Always use stop-loss orders to limit potential losses, and never risk more than you can afford to lose. Consider using position sizing techniques to adjust your trade size based on your risk tolerance and the volatility of the market. [See also: Risk Management Strategies in Trading]

Psychology of Trading the ABC Pattern

Trading psychology plays a significant role in the success of any trading strategy, including the ABC trading pattern. It’s important to remain disciplined and stick to your trading plan, even when faced with losses or uncertainty. Avoid emotional decision-making and always base your trades on sound analysis and risk management principles.

Conclusion

The ABC trading pattern is a valuable tool for traders looking to identify potential buying or selling opportunities in the market. By understanding the pattern’s components, identifying it correctly, and developing a sound trading strategy, traders can increase their chances of success. However, it’s essential to remember that the pattern is not foolproof and should be used in conjunction with other technical indicators and risk management techniques. With practice and discipline, the ABC trading pattern can be a powerful addition to any trader’s toolkit. Always remember that the efficacy of the ABC trading pattern depends on market conditions and the trader’s experience. Proper analysis and risk mitigation are key to successful ABC trading.