Unmasking Fake Stocks Screens: How to Spot and Avoid Investment Scams

In today’s digital age, the allure of quick riches through stock market investments is stronger than ever. However, this accessibility has also paved the way for sophisticated scams, often disguised as legitimate investment opportunities presented through meticulously crafted, but ultimately, fake stocks screens. These deceptive tools can mislead even seasoned investors, making it crucial to understand how to identify and avoid them. This article will delve into the world of fake stocks screens, providing you with the knowledge and strategies to protect your investments and navigate the market safely.

The Rise of Fake Stocks Screens

The proliferation of online trading platforms and readily available investment information has democratized the stock market. But this democratization has a dark side: the rise of fake stocks screens. Scammers exploit the desire for easy profits by creating websites or applications that mimic genuine stock screening tools. These fake stocks screens often promise unrealistic returns and highlight obscure or even non-existent companies, enticing unsuspecting investors to part with their money.

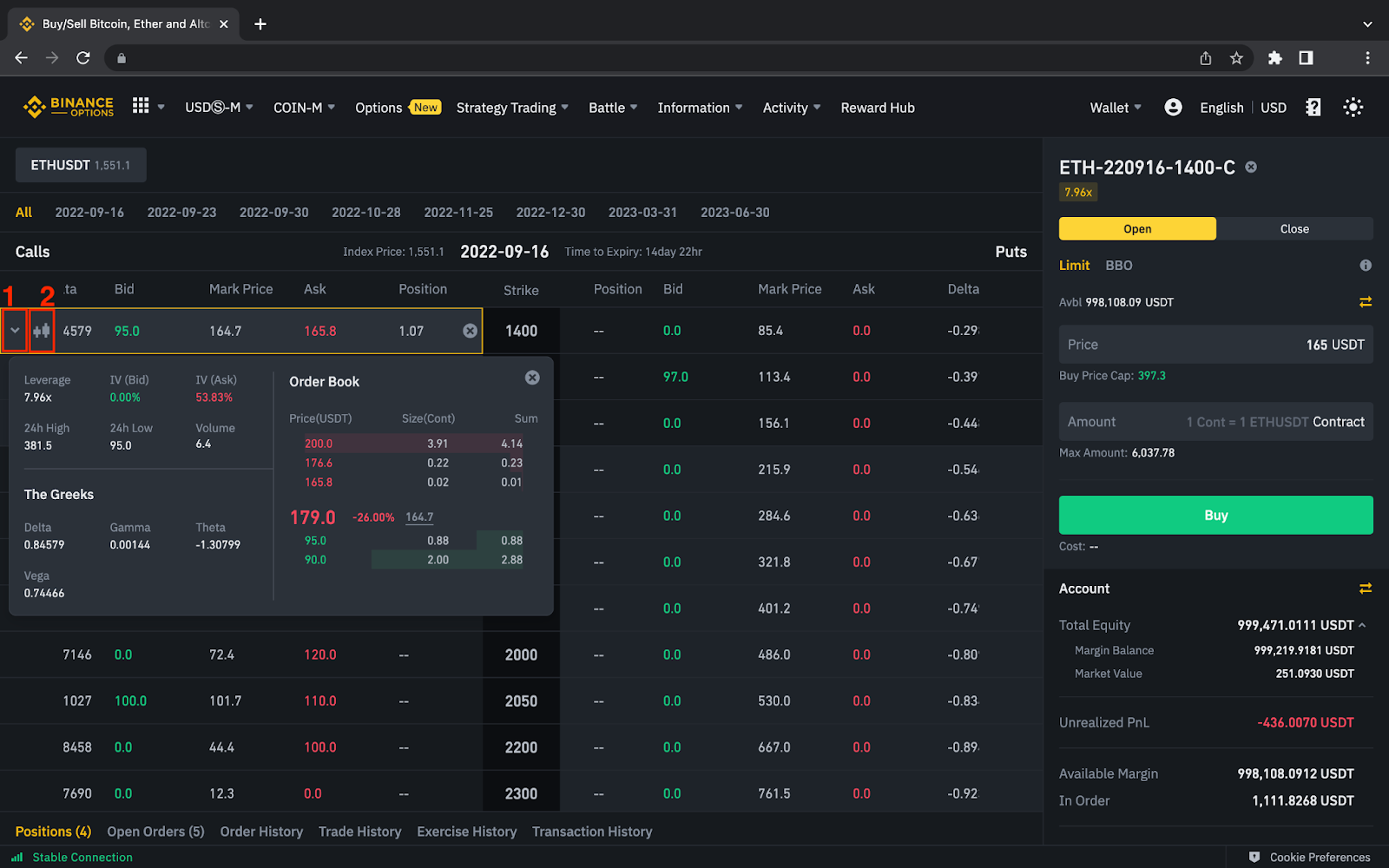

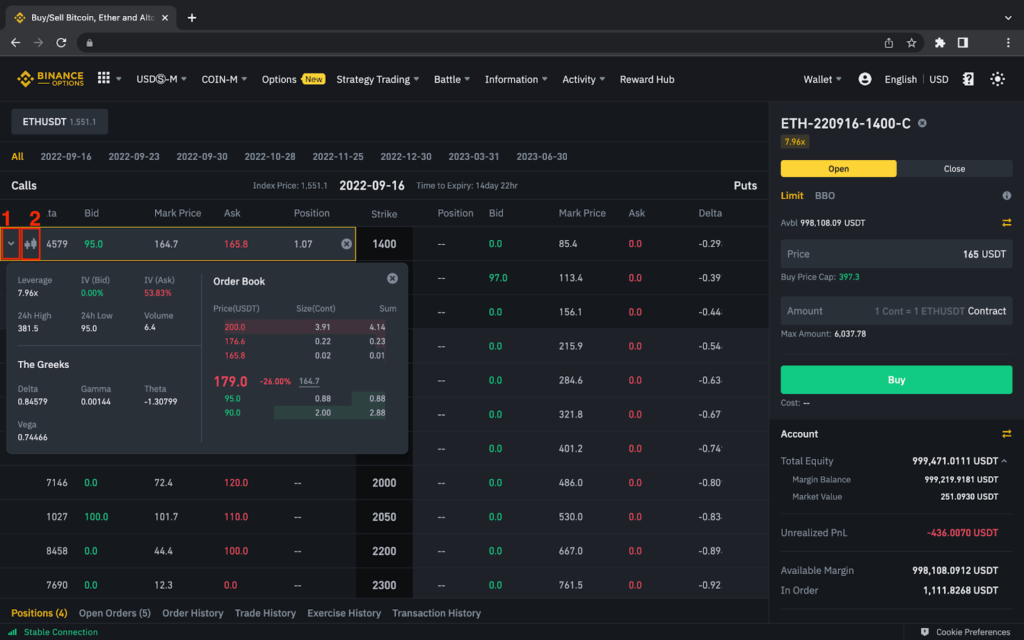

These fake stocks screens are designed to appear legitimate. They often feature professional-looking interfaces, real-time (or seemingly real-time) data, and persuasive marketing language. The goal is to create a sense of urgency and credibility, pushing investors to make quick decisions without proper due diligence.

How Fake Stocks Screens Work

The mechanics behind fake stocks screens are often complex, but the underlying principle is simple: manipulation. These screens might manipulate data to show inflated stock prices or trading volumes. They might also highlight companies that are connected to the scammers themselves, allowing them to artificially inflate the price of these stocks and then sell them off for a profit, leaving other investors with significant losses.

Often, fake stocks screens promote “pump and dump” schemes. Scammers will acquire a large position in a thinly traded stock, then use the fake stocks screen to generate interest and drive up the price. Once the price reaches a certain level, they sell their shares, leaving the remaining investors holding worthless stock. This is a classic example of market manipulation, and fake stocks screens are frequently used to facilitate these types of scams.

Red Flags: Identifying a Fake Stocks Screen

Recognizing the warning signs of a fake stocks screen is the first step in protecting your investments. Here are some key red flags to watch out for:

- Unrealistic Returns: If a stocks screen promises consistently high returns with little to no risk, it’s likely a scam. The stock market is inherently volatile, and no legitimate investment guarantees substantial profits.

- Obscure or Unknown Companies: Be wary of fake stocks screens that promote companies you’ve never heard of, especially if they lack a significant online presence or verifiable business operations.

- High-Pressure Sales Tactics: Scammers often use high-pressure tactics to push investors into making quick decisions. They might claim that the opportunity is limited or that the price will increase soon.

- Lack of Transparency: Legitimate stock screening tools are transparent about their data sources and methodologies. Fake stocks screens often lack this transparency, making it difficult to verify the information they provide.

- Poorly Designed Website or Application: While some fake stocks screens are sophisticated, many are poorly designed and riddled with errors. Look for inconsistencies in the design, grammar, and spelling.

- Requests for Personal Information: Be extremely cautious if a stocks screen asks for sensitive personal information, such as your Social Security number or bank account details. Legitimate investment platforms typically don’t require this information upfront.

- Missing Regulatory Information: Check if the platform provides information about its regulatory oversight. Reputable platforms are usually registered with relevant financial authorities. The absence of such information is a significant red flag.

Protecting Yourself from Fake Stocks Screens

Protecting yourself from fake stocks screens requires a combination of caution, research, and common sense. Here are some steps you can take to minimize your risk:

- Do Your Research: Before investing in any stock, conduct thorough research on the company, its financials, and its management team. Use reputable sources of information, such as the Securities and Exchange Commission (SEC) website and well-known financial news outlets.

- Verify the Source: Always verify the legitimacy of any stock screening tool or investment platform before using it. Check its registration with regulatory bodies, read reviews from other users, and look for any red flags.

- Be Skeptical of Unsolicited Offers: Be wary of unsolicited investment offers, especially those received through email or social media. Scammers often use these channels to target unsuspecting investors.

- Consult with a Financial Advisor: If you’re unsure about an investment opportunity, consult with a qualified financial advisor. A financial advisor can provide unbiased advice and help you make informed decisions.

- Use Reputable Stock Screeners: Stick to well-known and reputable stock screening tools from established financial institutions or reputable financial data providers. These platforms typically have robust security measures and are subject to regulatory oversight.

- Report Suspicious Activity: If you suspect that you’ve encountered a fake stocks screen or investment scam, report it to the SEC or other relevant regulatory authorities.

Real-World Examples of Fake Stocks Screen Scams

Numerous cases have highlighted the dangers of fake stocks screens. One common scenario involves scammers creating websites that mimic the look and feel of legitimate brokerage platforms. These websites lure investors with promises of high returns and low fees, but in reality, they are designed to steal personal information and investment funds. [See also: Avoiding Phishing Scams in Finance]

Another example involves the promotion of penny stocks through fake stocks screens. Scammers will use these screens to generate artificial interest in penny stocks, driving up the price and then selling their shares for a profit. Investors who buy the stock at the inflated price are left with significant losses when the price crashes.

The Role of Regulation and Enforcement

Regulatory bodies like the SEC play a crucial role in combating fake stocks screens and investment scams. The SEC has the authority to investigate and prosecute individuals and companies that engage in fraudulent activities. They also provide educational resources to help investors protect themselves from scams. [See also: SEC Investor Alerts and Bulletins]

However, regulation alone is not enough. Investors must also be vigilant and proactive in protecting their own interests. By understanding the risks associated with fake stocks screens and taking the necessary precautions, investors can significantly reduce their chances of becoming victims of fraud.

The Future of Fake Stocks Screens

As technology evolves, so too will the sophistication of fake stocks screens. Scammers are constantly developing new techniques to deceive investors, making it essential to stay informed and adapt your strategies accordingly. Artificial intelligence (AI) could be used to generate even more convincing fake stocks screens and personalized scam attempts.

The key to combating these evolving threats is education and awareness. By educating investors about the risks of fake stocks screens and providing them with the tools to identify and avoid them, we can create a safer and more transparent investment environment. [See also: Investing in a Digital Age]

Conclusion

Fake stocks screens pose a significant threat to investors in today’s digital age. By understanding how these scams work, recognizing the red flags, and taking the necessary precautions, you can protect your investments and navigate the stock market with confidence. Remember to always do your research, verify the source, and consult with a financial advisor if you’re unsure about an investment opportunity. Staying informed and vigilant is the best defense against fake stocks screens and other investment scams. The presence of fake stocks screens highlights the need for constant vigilance and education in the financial world. Don’t let the allure of quick profits cloud your judgment; always prioritize due diligence and sound investment principles. Identifying fake stocks screens is a critical skill for any investor looking to protect their capital. Remember, if something seems too good to be true, it probably is. The prevalence of fake stocks screens underscores the importance of financial literacy and responsible investing. Arm yourself with knowledge, and you’ll be better equipped to navigate the complexities of the stock market and avoid becoming a victim of fraud.