Unmasking the Illusion: The Dangers of Fake Trading Screens

In the fast-paced world of finance, where fortunes can be made or lost in the blink of an eye, the allure of quick profits often leads individuals to seek shortcuts and easy gains. This desire, unfortunately, creates fertile ground for fraudulent schemes, and one particularly insidious method involves the use of fake trading screens. These deceptive tools present a fabricated reality of market activity, enticing unsuspecting victims to invest in nonexistent or manipulated assets. Understanding how these scams operate and the potential consequences is crucial for protecting yourself and others from financial ruin.

This article aims to delve into the world of fake trading screens, exposing their mechanics, highlighting the red flags to watch out for, and providing practical advice on how to avoid becoming a victim. We will examine real-world examples of these scams, explore the legal ramifications for perpetrators, and discuss the role of regulatory bodies in combating this growing threat. By shedding light on this deceptive practice, we hope to empower individuals with the knowledge and tools necessary to navigate the financial landscape with confidence and vigilance.

What are Fake Trading Screens?

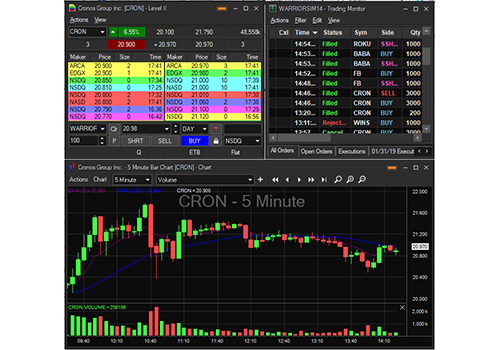

Fake trading screens are sophisticated software programs or websites designed to mimic the appearance and functionality of legitimate trading platforms. They display fabricated data, including price movements, trading volumes, and account balances, creating the illusion of real-time market activity. These screens are typically used by scammers to deceive individuals into believing they are making profitable investments, when in reality, their money is being siphoned off by the perpetrators.

Unlike legitimate trading platforms, which connect users to actual financial markets, fake trading screens operate in a closed environment controlled entirely by the scammers. This allows them to manipulate the data displayed on the screen, making it appear as though investments are generating substantial returns. In reality, the victim’s funds are never actually invested in any asset. The scammers simply pocket the money and may even provide fabricated statements showing fictitious profits to encourage further investment.

Common Features of Fake Trading Screens

- Unrealistic Returns: Promising guaranteed or excessively high returns with little to no risk is a common tactic used by scammers. Legitimate investments always carry some degree of risk, and no one can guarantee specific returns.

- Complex Jargon: Using technical terms and financial jargon to confuse and intimidate potential victims. This can make it difficult for individuals to understand the true nature of the investment and the risks involved.

- Pressure Tactics: Employing high-pressure sales tactics to rush individuals into making quick decisions. Scammers often create a sense of urgency by claiming that the opportunity is limited or that the price is about to increase.

- Unregulated Platforms: Operating on unregulated platforms or websites that lack proper licensing and oversight. This makes it difficult to hold the scammers accountable for their actions.

- Lack of Transparency: Providing limited information about the investment strategy, the underlying assets, or the individuals behind the platform. Legitimate investment firms are always transparent about their operations and provide detailed information to their clients.

How Fake Trading Screen Scams Work

The mechanics of fake trading screen scams typically follow a well-defined pattern. First, scammers lure victims through various channels, such as social media advertisements, unsolicited emails, or phone calls. These initial contacts often promise lucrative investment opportunities with minimal risk.

Once a victim expresses interest, the scammers will often provide access to a fake trading screen, which appears to show impressive gains on their initial investment. This fabricated success is designed to build trust and encourage the victim to invest larger sums of money. The scammers may even allow the victim to withdraw a small portion of their purported profits to further solidify their confidence.

However, when the victim attempts to withdraw a significant amount of money, the scammers will typically invent excuses to delay or deny the withdrawal. They may claim that there are technical issues, regulatory requirements, or taxes that need to be paid before the funds can be released. These excuses are simply tactics to stall the victim and extract even more money from them. Ultimately, the victim will realize that their money is gone and that they have been scammed.

Real-World Examples

Numerous cases of fake trading screen scams have been reported around the world. In one instance, a group of scammers created a sophisticated fake trading platform that mimicked the appearance of a well-known brokerage firm. They used this platform to defraud hundreds of investors out of millions of dollars. The scammers were eventually caught and prosecuted, but many of the victims lost their life savings.

Another common scam involves the use of fake cryptocurrency trading screens. Scammers create websites that appear to offer access to cryptocurrency markets, but in reality, they are simply stealing the victim’s cryptocurrency. These scams are particularly prevalent due to the anonymity and lack of regulation in the cryptocurrency space.

Red Flags to Watch Out For

Protecting yourself from fake trading screen scams requires vigilance and a healthy dose of skepticism. Here are some red flags to watch out for:

- Unsolicited Offers: Be wary of unsolicited investment offers, especially those that come from unknown sources.

- Guaranteed Returns: No legitimate investment can guarantee a specific return.

- High-Pressure Sales Tactics: Don’t be pressured into making quick decisions.

- Unregulated Platforms: Only invest through regulated platforms that are licensed and overseen by reputable financial authorities.

- Lack of Transparency: Be wary of platforms that lack transparency or provide limited information about their operations.

- Difficulty Withdrawing Funds: If you encounter difficulty withdrawing your funds, it’s a major red flag.

- Promises of Easy Money: If it sounds too good to be true, it probably is.

How to Avoid Fake Trading Screen Scams

Here are some practical tips to help you avoid becoming a victim of fake trading screen scams:

- Do Your Research: Before investing any money, thoroughly research the platform and the individuals behind it. Check for reviews, complaints, and regulatory information.

- Verify Credentials: Verify that the platform is licensed and regulated by a reputable financial authority.

- Use Reputable Platforms: Only invest through well-established and reputable trading platforms.

- Be Skeptical: Be skeptical of unsolicited offers and promises of guaranteed returns.

- Start Small: If you decide to invest, start with a small amount of money and gradually increase your investment as you gain confidence.

- Monitor Your Account: Regularly monitor your account activity and report any suspicious transactions.

- Seek Professional Advice: Consult with a qualified financial advisor before making any investment decisions.

- Trust Your Gut: If something doesn’t feel right, trust your instincts and walk away.

The Legal Ramifications for Perpetrators

Operating fake trading screens is a serious crime that carries significant legal ramifications. Perpetrators can face charges of fraud, money laundering, and conspiracy, which can result in lengthy prison sentences and substantial fines. Regulatory bodies, such as the Securities and Exchange Commission (SEC) in the United States, actively investigate and prosecute these types of scams.

In addition to criminal charges, perpetrators may also face civil lawsuits from victims seeking to recover their losses. These lawsuits can result in significant financial penalties and reputational damage. [See also: SEC Enforcement Actions] The legal consequences for operating fake trading screens are severe, and individuals who engage in this type of activity should be aware of the risks involved.

The Role of Regulatory Bodies

Regulatory bodies play a crucial role in combating fake trading screen scams. These agencies are responsible for overseeing the financial markets, enforcing regulations, and protecting investors. They conduct investigations, bring enforcement actions against perpetrators, and provide educational resources to help investors avoid scams.

Regulatory bodies also work to improve the regulatory framework and close loopholes that scammers exploit. They collaborate with international agencies to combat cross-border fraud and share information about emerging threats. [See also: International Financial Regulations] The efforts of regulatory bodies are essential for maintaining the integrity of the financial markets and protecting investors from fake trading screen scams.

Conclusion

Fake trading screens pose a significant threat to unsuspecting investors. By understanding how these scams operate, recognizing the red flags, and taking proactive steps to protect yourself, you can significantly reduce your risk of becoming a victim. Remember to always do your research, verify credentials, be skeptical of unsolicited offers, and seek professional advice before making any investment decisions. Vigilance and awareness are your best defenses against the deceptive tactics of fake trading screen scammers. Staying informed and spreading awareness about these scams can help protect yourself and your community from financial exploitation. The promise of easy money is often a mirage, and a healthy dose of skepticism can save you from significant financial harm. Protecting yourself from fake trading screens is a crucial step in securing your financial future.