Unveiling the Mystery: Understanding Bearer Bonds Value in Today’s Financial Landscape

Bearer bonds, once a staple of international finance, hold a certain mystique. Their very nature – ownership transferred simply by possession – contributed to their popularity and, eventually, their decline. Today, understanding bearer bonds value requires a look back at their history, an analysis of their remaining uses, and an awareness of the regulatory landscape that now surrounds them. This article aims to provide a comprehensive overview of these intriguing financial instruments, shedding light on their past, present, and the factors that influence their value.

A Historical Perspective on Bearer Bonds

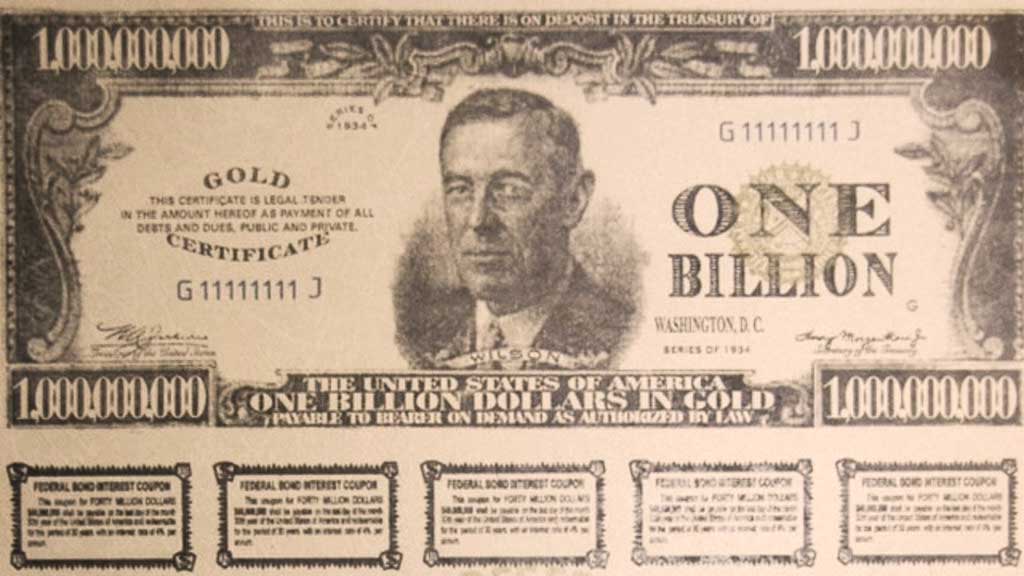

Bearer bonds represent a bygone era of financial privacy. Unlike registered bonds, which record ownership in a central registry, bearer bonds are unregistered. Whoever physically possesses the bond is considered the owner. This characteristic made them highly attractive for investors seeking anonymity, particularly in regions with unstable political climates or strict capital controls.

Historically, bearer bonds played a significant role in international capital flows. Governments and corporations alike issued them to raise funds, often attracting investors from around the globe. The ease of transfer and the lack of reporting requirements made them a convenient tool for cross-border transactions. However, these same features also made them susceptible to misuse.

The Rise and Fall of Popularity

The golden age of bearer bonds extended through much of the 20th century. They were widely used in Europe and Latin America, facilitating both legitimate investment and less savory activities. As global financial regulations tightened, however, the use of bearer bonds came under increasing scrutiny. Concerns about money laundering, tax evasion, and terrorist financing led to a gradual decline in their prevalence.

The Regulatory Crackdown on Bearer Bonds

The anonymity afforded by bearer bonds proved to be a double-edged sword. While attractive to legitimate investors seeking privacy, it also provided a haven for illicit activities. In response, international organizations and national governments began to implement stricter regulations aimed at curbing their use. The Financial Action Task Force (FATF), for example, has been instrumental in promoting measures to combat money laundering and terrorist financing, including restrictions on bearer bonds.

Many countries have either outlawed the issuance of new bearer bonds or imposed stringent reporting requirements on their transfer. The United States, for instance, effectively eliminated bearer bonds in the 1980s through tax law changes. European countries have also taken steps to restrict their use, with some banning them altogether. These regulatory changes have significantly impacted the bearer bonds value and their overall market presence.

Impact of Regulation on Value

The increased regulatory scrutiny has undoubtedly affected the bearer bonds value. With fewer opportunities for anonymous transactions and greater risks of detection, the demand for these instruments has diminished. As a result, the prices of outstanding bearer bonds may reflect a discount compared to registered bonds with similar characteristics. The exact discount will depend on factors such as the bond’s maturity, credit rating, and the specific regulations in the jurisdiction where it is held.

Factors Influencing Bearer Bonds Value Today

While the market for bearer bonds has shrunk considerably, they still exist. Determining their value requires careful consideration of several factors:

- Creditworthiness of the Issuer: As with any bond, the financial health of the issuer is a primary determinant of value. A bond issued by a financially stable entity will generally be worth more than one issued by a struggling company or government.

- Interest Rate Environment: Changes in interest rates can impact the value of all bonds, including bearer bonds. When interest rates rise, the value of existing bonds typically falls, and vice versa.

- Maturity Date: The length of time until the bond matures also affects its value. Longer-term bonds are generally more sensitive to interest rate changes than shorter-term bonds.

- Regulatory Environment: The specific regulations in the jurisdiction where the bond is held can have a significant impact on its value. Stricter regulations may reduce demand and lower prices.

- Liquidity: The ease with which a bearer bond can be bought or sold also affects its value. Due to their limited market and regulatory complexities, bearer bonds may be less liquid than registered bonds.

The Role of Anonymity: A Double-Edged Sword

The anonymity associated with bearer bonds remains a key factor influencing their value. On one hand, it can be attractive to investors seeking privacy or those operating in jurisdictions with unstable political climates. On the other hand, it also makes them vulnerable to misuse by those seeking to evade taxes or launder money. This inherent tension contributes to the complexity of valuing bearer bonds.

For legitimate investors, the perceived risk associated with holding bearer bonds may outweigh the benefits of anonymity. The potential for increased scrutiny from regulators and the difficulty in proving ownership in case of loss or theft can make them less attractive than registered bonds. [See also: Understanding Registered Bonds]

Potential Uses of Bearer Bonds Today

Despite the regulatory challenges, bearer bonds may still have legitimate uses in certain niche markets. For example, they could be used in jurisdictions where registered bonds are not readily available or where investors place a high value on privacy. However, these uses are becoming increasingly rare as global financial regulations continue to tighten.

Challenges in Valuing Bearer Bonds

Valuing bearer bonds presents unique challenges compared to valuing registered bonds. The lack of a central registry makes it difficult to track ownership and trading activity. This lack of transparency can make it harder to assess the true market value of a particular bond.

Furthermore, the regulatory risks associated with bearer bonds can be difficult to quantify. The potential for future regulatory changes or increased enforcement actions can create uncertainty and impact investor sentiment. [See also: Impact of Financial Regulations on Bond Values]

Seeking Professional Advice

Given the complexities involved, it is crucial to seek professional advice before investing in bearer bonds. A qualified financial advisor can help you assess the risks and rewards, understand the regulatory implications, and determine whether they are a suitable investment for your particular circumstances. Due diligence is paramount when considering these types of investments.

The Future of Bearer Bonds

The future of bearer bonds appears bleak. As global financial regulations continue to tighten and the demand for transparency increases, their use is likely to decline further. While they may continue to exist in niche markets for some time, their role in the global financial system is expected to diminish significantly. Understanding the historical context and regulatory landscape is key to interpreting the bearer bonds value.

The focus on combating financial crime and promoting tax compliance is likely to further restrict the use of bearer bonds in the years to come. Investors seeking privacy will need to explore alternative options that comply with applicable laws and regulations. [See also: Alternative Investment Strategies for Privacy]

Conclusion: Navigating the Complexities of Bearer Bonds Value

Bearer bonds represent a fascinating chapter in financial history. While their anonymity once made them a popular choice for investors, the regulatory crackdown has significantly impacted their value and prevalence. Today, understanding bearer bonds value requires a nuanced understanding of their historical context, the regulatory landscape, and the factors that influence their market price. Due to regulatory risks and declining use, it is critical to approach these investments with caution and seek professional financial advice. The era of bearer bonds as a mainstream financial instrument is likely over, replaced by more transparent and regulated alternatives. The inherent bearer bonds value proposition of anonymity is increasingly outweighed by the risks they pose in a world demanding financial transparency. Determining a fair bearer bonds value requires expertise and a thorough understanding of the current market conditions. The potential benefits of bearer bonds must be carefully weighed against the risks and regulatory complexities. The bearer bonds value also depends on the specific terms of the bond and the creditworthiness of the issuer. Investors should always conduct thorough research before investing in bearer bonds. Remember that the bearer bonds value is not just about the face value of the bond, but also about the risks and potential rewards associated with it.