Unveiling the Mystery: Understanding Bearer Bonds Value in Today’s Financial Landscape

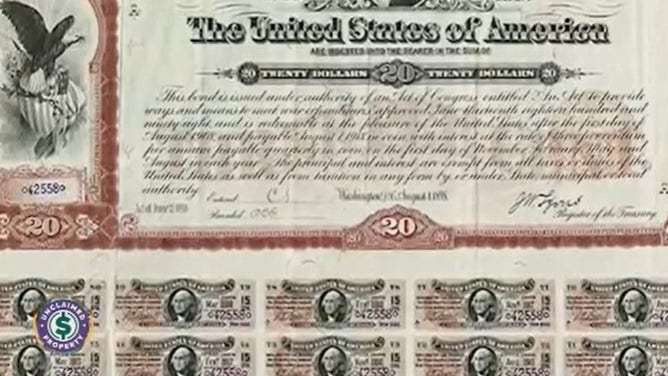

Bearer bonds, once a staple of international finance, represent a fascinating, albeit somewhat controversial, chapter in the history of financial instruments. Unlike registered bonds, where ownership is recorded, bearer bonds value lies in the possession of the physical certificate. Whoever holds the bond is presumed to be the owner, making them highly liquid and anonymous. This anonymity, while attractive to some, has also made them susceptible to illicit activities. Understanding bearer bonds value requires delving into their historical context, legal implications, and current relevance in the modern financial world.

A Historical Perspective on Bearer Bonds

The origins of bearer bonds can be traced back to the 19th century when they were widely used for government and corporate financing. Their appeal stemmed from their ease of transfer and lack of registration requirements. This made them particularly useful for international transactions and investors seeking privacy. Governments issued bearer bonds to raise capital for infrastructure projects, wars, and other public expenditures. Corporations utilized them to fund expansion and other business ventures. The ease of transfer and anonymity were key features that drove their popularity.

However, the very features that made bearer bonds attractive also led to their misuse. The lack of a paper trail made them a favorite tool for tax evasion, money laundering, and other illegal activities. This prompted governments worldwide to implement regulations aimed at curbing their use and promoting transparency in financial markets. [See also: History of Bond Markets]

The Legal and Regulatory Landscape of Bearer Bonds

In response to concerns about illicit activities, many countries have either banned or severely restricted the issuance and trading of bearer bonds. The United States, for example, effectively banned the issuance of bearer bonds in 1982 through the Tax Equity and Fiscal Responsibility Act (TEFRA). This legislation aimed to reduce tax evasion by requiring registration of most debt instruments. Other countries followed suit, enacting similar regulations to combat financial crime.

Despite these restrictions, some bearer bonds issued before the ban still exist and may be traded on secondary markets. However, these transactions are subject to strict scrutiny and reporting requirements. Financial institutions are required to conduct due diligence on customers trading in bearer bonds to ensure compliance with anti-money laundering (AML) regulations. The bearer bonds value is affected by these regulations, often trading at a discount compared to registered bonds due to the increased risk and compliance costs associated with them.

Factors Influencing Bearer Bonds Value

Several factors influence the bearer bonds value in the current market:

- Interest Rates: Like all bonds, bearer bonds are sensitive to changes in interest rates. When interest rates rise, the value of existing bonds, including bearer bonds, tends to fall, and vice versa.

- Creditworthiness of the Issuer: The financial stability and credit rating of the entity that issued the bond play a significant role in determining its value. Bonds issued by governments or corporations with high credit ratings are generally considered less risky and therefore more valuable.

- Time to Maturity: The amount of time remaining until the bond matures and the principal is repaid also affects its value. Longer-term bonds are typically more sensitive to interest rate changes than shorter-term bonds.

- Liquidity: Due to regulatory restrictions and concerns about illicit activities, bearer bonds are generally less liquid than registered bonds. This lack of liquidity can depress their value.

- Regulatory Environment: The legal and regulatory environment surrounding bearer bonds can significantly impact their value. Stricter regulations and increased compliance costs can reduce demand and lower prices.

The Role of Anonymity and Its Impact on Value

The anonymity associated with bearer bonds is a double-edged sword. While it can be attractive to investors seeking privacy, it also makes them vulnerable to misuse. This inherent risk affects the bearer bonds value. The potential for illegal activities necessitates increased scrutiny from regulators and financial institutions, leading to higher transaction costs and reduced liquidity. [See also: The Dark Side of Anonymity in Finance]

Furthermore, the lack of transparency makes it difficult to track ownership and prevent tax evasion. Governments around the world are increasingly focused on combating financial crime and promoting transparency. This trend is likely to further restrict the use of bearer bonds and negatively impact their value.

Bearer Bonds in the Modern Financial World

In today’s financial world, bearer bonds are largely a relic of the past. The vast majority of bonds are now issued in registered form, providing greater transparency and reducing the risk of illicit activities. However, some bearer bonds issued before the bans still exist and may be traded on secondary markets.

These remaining bearer bonds are typically held by institutional investors, high-net-worth individuals, or collectors. The value of these bonds is often influenced by their historical significance and rarity, in addition to the factors mentioned above. It’s crucial to conduct thorough due diligence and seek professional advice before investing in bearer bonds due to the complex regulatory environment and inherent risks.

The Future of Bearer Bonds

The future of bearer bonds appears bleak. As governments continue to crack down on financial crime and promote transparency, the use of bearer bonds is likely to further decline. The increased regulatory burden and compliance costs associated with them make them less attractive to investors and issuers alike.

While some bearer bonds may continue to exist in niche markets, their overall importance in the global financial system is expected to diminish. The focus on transparency and accountability will likely drive the continued shift towards registered securities and other more transparent financial instruments. The bearer bonds value will likely reflect this decline in relevance over time.

Examples of Bearer Bonds in History

Historically, many nations and corporations issued bearer bonds. For example, numerous European countries used them extensively to finance wars and infrastructure projects in the 19th and early 20th centuries. Railroad companies in the United States also relied on bearer bonds to fund their expansion across the country.

These historical examples highlight the role that bearer bonds played in facilitating economic development and government finance. However, they also underscore the potential for misuse and the need for strong regulatory oversight. The bearer bonds value in these instances was tied directly to the success and stability of the issuing entity.

Conclusion: Evaluating Bearer Bonds Value Today

Understanding bearer bonds value requires a nuanced perspective that considers their historical context, legal implications, and current relevance. While they once played a significant role in international finance, their use has been severely restricted due to concerns about illicit activities. The remaining bearer bonds in circulation are subject to strict scrutiny and often trade at a discount compared to registered bonds.

As governments continue to prioritize transparency and combat financial crime, the future of bearer bonds appears limited. Investors considering investing in bearer bonds should conduct thorough due diligence and seek professional advice to navigate the complex regulatory landscape and assess the inherent risks. Ultimately, the bearer bonds value is a reflection of their diminishing role in the modern financial system and the increasing emphasis on transparency and accountability.