Unveiling Trading Liquidity Sweeps: A Deep Dive into Market Dynamics

In the fast-paced world of financial markets, understanding the nuances of trading strategies is crucial for both seasoned investors and newcomers alike. One such strategy, often shrouded in mystery, is the concept of trading liquidity sweeps. This article aims to demystify trading liquidity sweeps, providing a comprehensive overview of their mechanics, implications, and how they impact market participants.

What are Trading Liquidity Sweeps?

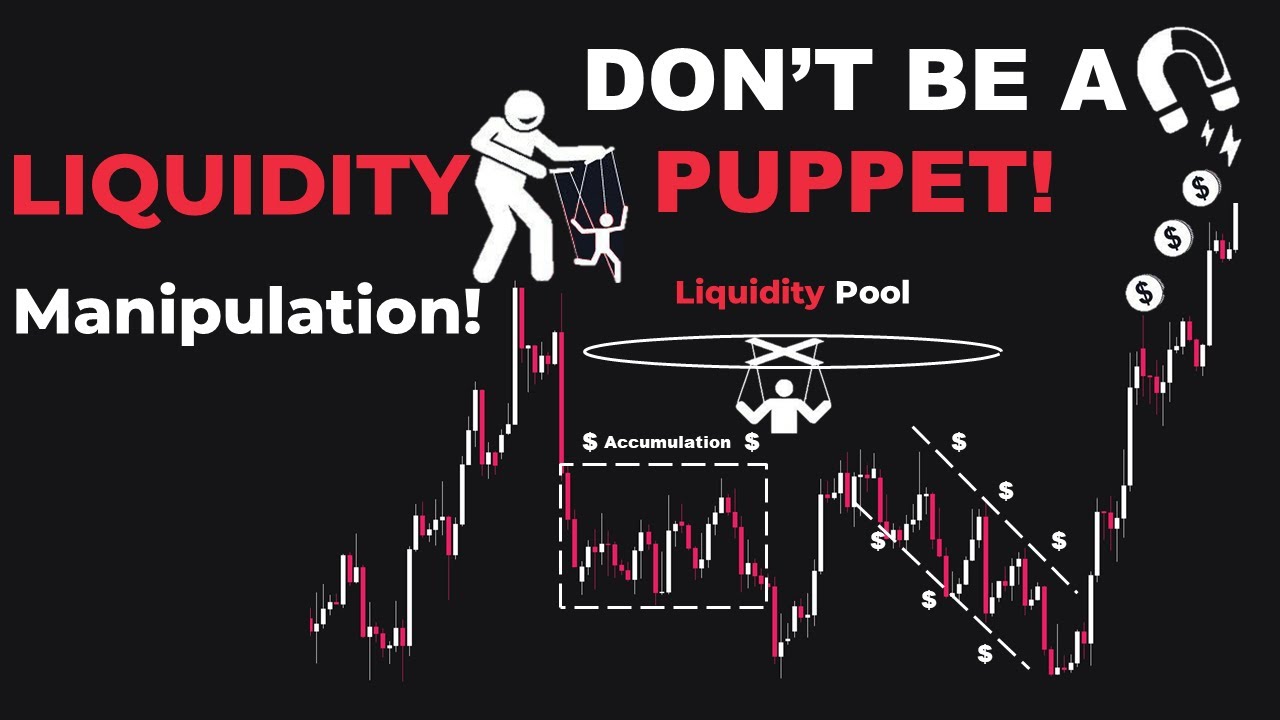

A trading liquidity sweep, also known as a liquidity grab or market sweep, refers to a rapid movement in price designed to trigger stop-loss orders or to induce panic selling or buying. These sweeps are often initiated by large institutional traders or market makers who possess significant capital and market influence. The goal is typically to accumulate a position at a more favorable price or to profit from the resulting volatility.

Essentially, a liquidity sweep hunts for resting stop-loss orders and other pending orders clustered around specific price levels. By pushing the price to these levels, the initiator can trigger these orders, creating a cascade effect that amplifies the initial price movement. This allows them to fill their orders at a desired price, often taking advantage of the forced selling or buying pressure.

The Mechanics of a Liquidity Sweep

To understand how a liquidity sweep works, it’s essential to consider the order book. The order book displays all the buy and sell orders at various price levels. Liquidity refers to the depth of these orders – the more orders available at a particular price, the higher the liquidity. However, liquidity isn’t evenly distributed; it tends to cluster around key support and resistance levels, as well as psychologically significant price points.

Large traders can exploit these liquidity pockets by placing aggressive orders that quickly consume the available liquidity. For example, if a large number of stop-loss orders are placed just below a key support level, a large sell order can push the price below that level, triggering these stop-loss orders. This creates further selling pressure, driving the price down even more rapidly. The initiator can then buy back the asset at a lower price, profiting from the sweep.

Identifying Potential Liquidity Sweeps

While predicting liquidity sweeps with certainty is impossible, traders can use various technical analysis tools and indicators to identify potential setups. Some common indicators include:

- Volume spikes: A sudden increase in trading volume can indicate the presence of large orders and potential liquidity sweeps.

- Price action patterns: Certain candlestick patterns, such as engulfing patterns or false breakouts, can signal a potential liquidity sweep.

- Order book analysis: Monitoring the order book can reveal clusters of orders around specific price levels, indicating areas where liquidity sweeps are likely to occur.

- Market sentiment: Extreme bullish or bearish sentiment can create conditions ripe for liquidity sweeps, as traders become overly confident in their positions.

Impact on Market Participants

Trading liquidity sweeps can have a significant impact on various market participants:

- Retail traders: Retail traders are often the most vulnerable to liquidity sweeps, as they typically have smaller accounts and less experience managing risk. Stop-loss orders, intended to limit losses, can be triggered during a liquidity sweep, resulting in unexpected losses.

- Institutional traders: While institutional traders can initiate liquidity sweeps, they can also be victims. Large institutions may have difficulty filling large orders without impacting the market price, making them susceptible to liquidity sweeps executed by even larger players.

- Market makers: Market makers provide liquidity to the market by quoting bid and ask prices. They can profit from liquidity sweeps by providing liquidity to the initiator and profiting from the spread. However, they can also be caught off guard if a liquidity sweep moves the price against their positions.

Strategies to Mitigate Risk from Liquidity Sweeps

While it’s impossible to completely eliminate the risk of being caught in a liquidity sweep, traders can implement strategies to mitigate their exposure:

- Wider stop-loss orders: Placing stop-loss orders further away from key support and resistance levels can reduce the likelihood of being triggered by a liquidity sweep. However, this also increases the potential loss if the trade moves against you.

- Limit orders: Using limit orders instead of market orders can help control the price at which you enter or exit a position. This can prevent you from being filled at an unfavorable price during a liquidity sweep.

- Position sizing: Reducing the size of your positions can limit the potential losses from a liquidity sweep.

- Diversification: Diversifying your portfolio across different assets and markets can reduce your overall risk exposure.

- Staying informed: Keeping up-to-date with market news and analysis can help you anticipate potential liquidity sweeps and adjust your trading strategy accordingly.

Examples of Trading Liquidity Sweeps

Real-world examples of trading liquidity sweeps are often difficult to definitively identify, as the intentions of large traders are rarely transparent. However, certain market events exhibit characteristics consistent with liquidity sweeps. These events often involve sudden, sharp price movements followed by a quick reversal. Consider instances where the price of a cryptocurrency rapidly declines, triggering numerous stop-loss orders, only to rebound sharply shortly after. This rapid decline and subsequent recovery can be indicative of a liquidity sweep designed to accumulate positions at lower prices.

Another example might involve a stock price hovering near a key resistance level. A large buy order suddenly pushes the price above the resistance, triggering breakout traders to enter long positions. However, the price quickly reverses, trapping these breakout traders and triggering their stop-loss orders. This scenario could be a liquidity sweep aimed at exploiting the clustered stop-loss orders above the resistance level.

The Ethical Considerations

The practice of initiating trading liquidity sweeps raises ethical questions. While not necessarily illegal, some argue that liquidity sweeps are manipulative and unfair to smaller traders. The ability of large institutions to influence market prices through liquidity sweeps can create an uneven playing field, where smaller traders are at a disadvantage. The ethics of liquidity sweeps often depend on the intent and execution. If the goal is solely to manipulate the market and profit at the expense of others, it can be considered unethical. However, if the liquidity sweep is a byproduct of legitimate trading activity, it may be viewed as a normal part of market dynamics.

The Future of Trading Liquidity Sweeps

As financial markets become more sophisticated and regulated, the landscape of trading liquidity sweeps is likely to evolve. Increased regulatory scrutiny and advancements in surveillance technology may make it more difficult to execute manipulative liquidity sweeps. However, the fundamental dynamics that drive liquidity sweeps – the presence of clustered orders and the ability of large traders to influence prices – are likely to persist. As such, understanding trading liquidity sweeps will remain a crucial skill for traders navigating the complexities of modern financial markets. [See also: High-Frequency Trading Strategies] [See also: Understanding Market Manipulation] [See also: Risk Management in Trading]

In conclusion, trading liquidity sweeps are a complex and controversial aspect of financial markets. While they can present opportunities for profit, they also pose significant risks. By understanding the mechanics of liquidity sweeps and implementing appropriate risk management strategies, traders can better navigate the challenges and opportunities presented by this market phenomenon. The key is to remain vigilant, adapt to changing market conditions, and prioritize risk management above all else.

Navigating the intricacies of the market requires continuous learning and adaptation. Grasping the concept of liquidity sweeps is just one piece of the puzzle. Further research into related topics, such as algorithmic trading and order book dynamics, can provide a more holistic understanding of market behavior. Remember, knowledge is power in the world of trading, and a well-informed trader is a more resilient and successful trader.