What are Bearer Bonds? A Comprehensive Guide

In the world of finance, understanding different types of securities is crucial for both investors and those involved in financial markets. One such security, though less common today, is the bearer bond. So, what are bearer bonds? This article aims to provide a comprehensive overview of bearer bonds, covering their definition, history, characteristics, advantages, disadvantages, and current status in the global financial landscape.

Defining Bearer Bonds

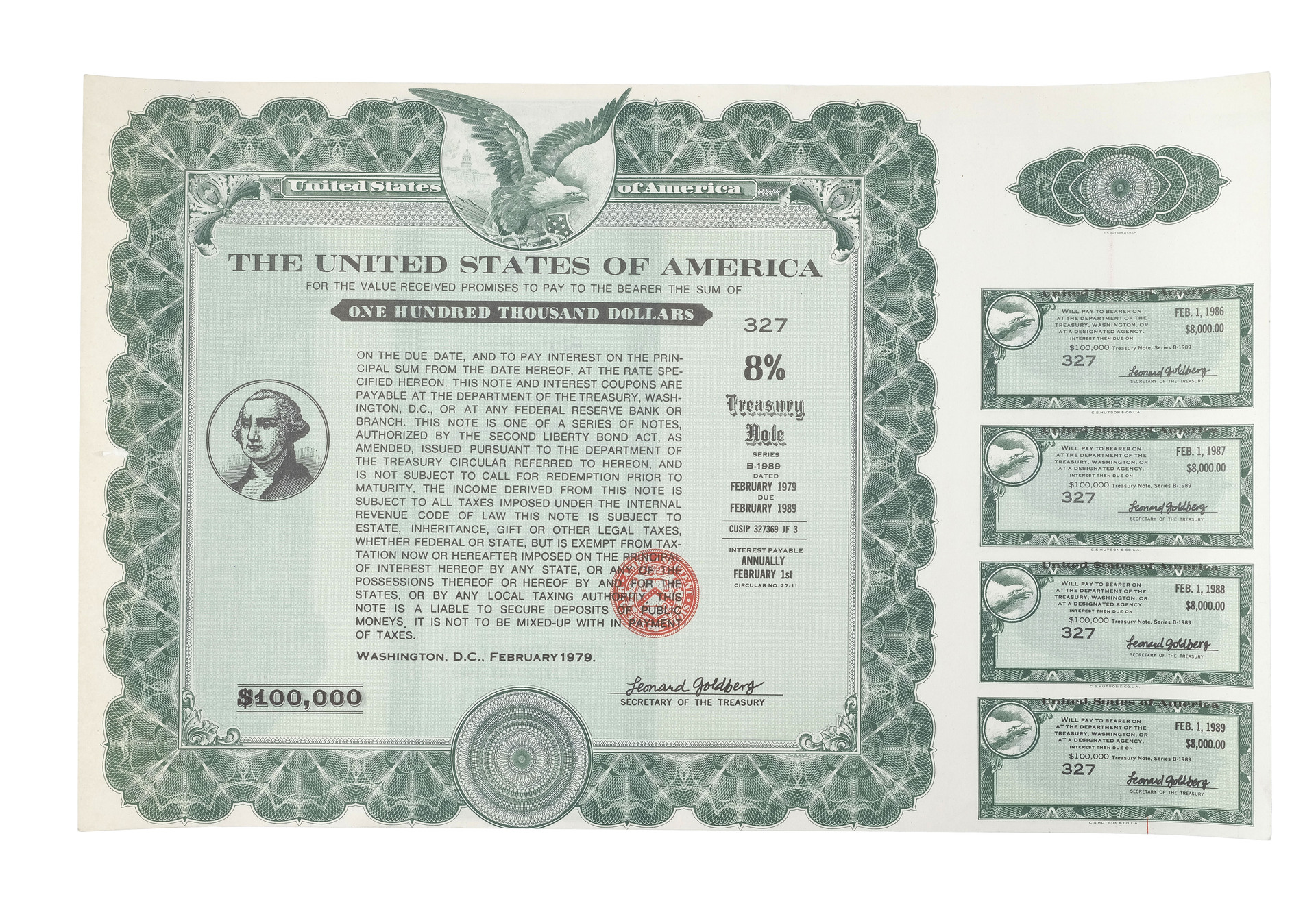

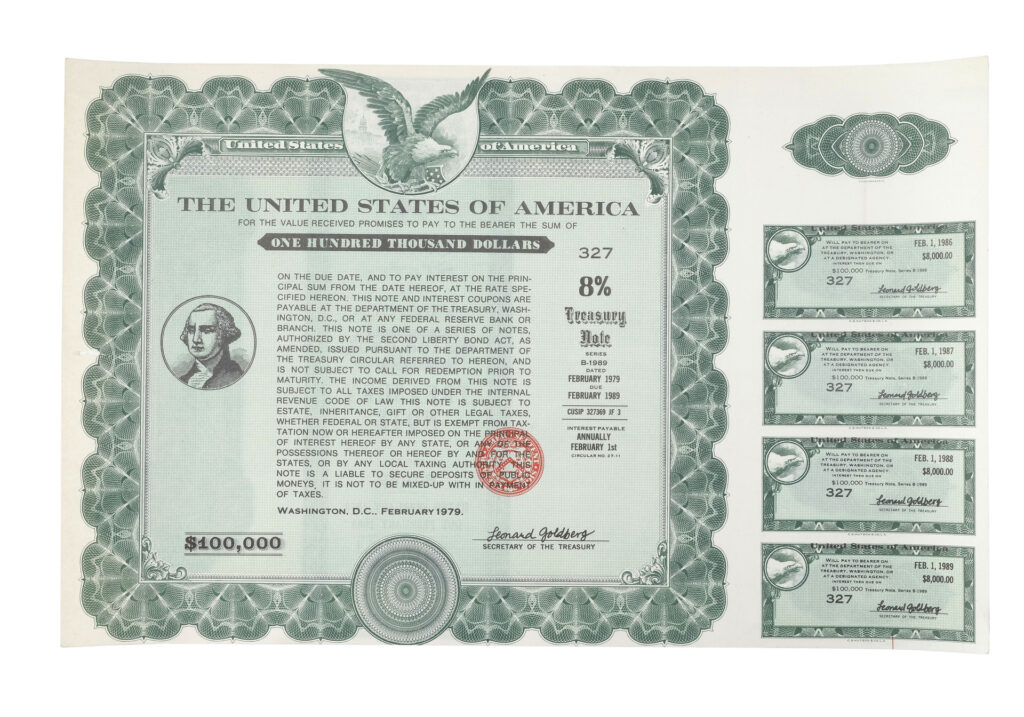

What are bearer bonds? Simply put, a bearer bond is a debt security that is owned by whoever holds the physical bond certificate. Unlike registered bonds, where the owner’s name is recorded with the issuer, bearer bonds do not have any owner information registered. The holder of the bond is presumed to be the owner, and they receive interest payments and the principal upon maturity simply by presenting the bond to the issuer or their agent.

A Brief History of Bearer Bonds

Bearer bonds have a long history, dating back to the 19th century. They were a popular instrument for raising capital, especially for governments and corporations, because they offered anonymity and ease of transfer. Before the advent of sophisticated electronic tracking systems, bearer bonds were a convenient way to move capital across borders and maintain privacy. Historically, what are bearer bonds represented was a physical embodiment of wealth that could be easily traded and transported.

Key Characteristics of Bearer Bonds

- Anonymity: The primary characteristic of a bearer bond is its anonymity. The issuer does not know who the bondholder is, making it attractive to those seeking privacy.

- Physical Certificate: Ownership is determined by possession of the physical bond certificate. This certificate must be presented to receive interest payments and principal repayment.

- Ease of Transfer: Bearer bonds can be easily transferred from one party to another simply by handing over the certificate. This ease of transfer made them popular in the past.

- Interest Payments via Coupons: Interest payments are typically made through detachable coupons attached to the bond. The bondholder clips the coupon and presents it to a bank or the issuer for payment.

- Maturity Date: Like other bonds, bearer bonds have a specific maturity date when the principal is repaid to the holder.

Advantages of Bearer Bonds

While bearer bonds are less prevalent today, they did offer certain advantages, particularly in the past:

- Privacy: The anonymity offered by bearer bonds was a major draw for investors who valued privacy. This was especially true in countries with unstable political or economic climates.

- Ease of Transfer: The ease with which bearer bonds could be transferred made them a convenient tool for cross-border transactions and estate planning.

- Tax Evasion: Unfortunately, the anonymity of bearer bonds also made them attractive for tax evasion and other illicit activities. This is one of the primary reasons for their decline in popularity.

Disadvantages of Bearer Bonds

The drawbacks of bearer bonds have led to their decline and increased scrutiny:

- Loss and Theft: Because ownership is determined by possession, the loss or theft of a bearer bond certificate can result in the loss of the investment. There is no way to prove ownership without the physical bond.

- Risk of Counterfeiting: Bearer bonds are susceptible to counterfeiting, which can result in significant losses for investors.

- Use in Illegal Activities: The anonymity of bearer bonds has made them a tool for money laundering, tax evasion, and other illegal activities.

- Regulatory Scrutiny: Due to their potential for misuse, bearer bonds are subject to increased regulatory scrutiny, making them less attractive to issuers and investors.

The Decline of Bearer Bonds

In recent decades, bearer bonds have faced increasing scrutiny and regulation due to their potential for misuse. Governments around the world have taken steps to discourage their use and promote greater transparency in financial transactions. Several factors contributed to the decline of bearer bonds:

- Increased Regulation: International organizations like the Financial Action Task Force (FATF) have pushed for stricter regulations on bearer bonds to combat money laundering and terrorist financing.

- Tax Information Exchange Agreements: Agreements like the Foreign Account Tax Compliance Act (FATCA) and the Common Reporting Standard (CRS) require financial institutions to report information about foreign accounts, making it more difficult to hide assets using bearer bonds.

- Technological Advancements: The development of electronic tracking systems and digital securities has made registered bonds more efficient and secure, reducing the need for bearer bonds.

Bearer Bonds Today

Today, bearer bonds are much less common than they were in the past. Many countries have either banned them outright or imposed strict regulations on their issuance and trading. While they may still exist in some jurisdictions, their use is limited. Most modern bond issuances are in registered form, where the owner’s information is recorded with the issuer or a central depository. Investors and financial institutions are generally wary of bearer bonds due to the regulatory risks and potential for illegal activities.

Registered Bonds vs. Bearer Bonds

To further understand what are bearer bonds, it’s helpful to compare them to registered bonds:

- Ownership: In registered bonds, the owner’s name is recorded with the issuer or a central registry. In bearer bonds, ownership is determined by possession of the physical certificate.

- Transferability: Registered bonds typically require a formal transfer process, while bearer bonds can be transferred simply by handing over the certificate.

- Security: Registered bonds offer greater security because the owner’s identity is known, and the bond can be reissued if lost or stolen. Bearer bonds offer no such protection.

- Regulation: Registered bonds are subject to less regulatory scrutiny than bearer bonds due to their greater transparency.

The Future of Anonymity in Finance

The decline of bearer bonds reflects a broader trend towards greater transparency in the financial system. While privacy remains a concern for some investors, governments and regulators are increasingly focused on combating financial crime and ensuring tax compliance. The future of anonymity in finance is likely to involve a careful balance between protecting individual privacy and preventing illicit activities.

Implications for Investors

For investors, understanding the history and characteristics of bearer bonds is important, even if they are not actively traded. It provides insight into the evolution of financial markets and the challenges of balancing privacy with regulatory oversight. Investors should be aware of the risks associated with bearer bonds and the potential for legal and financial consequences if they are used for illegal purposes.

Furthermore, the shift away from bearer bonds towards registered securities highlights the importance of due diligence and compliance in investment activities. Investors should ensure that they are complying with all applicable laws and regulations and that they are not inadvertently involved in money laundering or tax evasion.

Conclusion

So, what are bearer bonds? They are debt securities owned by whoever holds the physical certificate, offering anonymity but also posing risks related to loss, theft, and illegal activities. While they were once a popular tool for raising capital, bearer bonds have largely been replaced by registered bonds due to increased regulation and the need for greater transparency in the financial system. Understanding the history and characteristics of bearer bonds provides valuable insight into the evolution of financial markets and the ongoing efforts to combat financial crime. The legacy of bearer bonds serves as a reminder of the importance of transparency, regulation, and ethical conduct in the world of finance. [See also: Understanding Different Types of Bonds] [See also: Tax Implications of Bond Investments] [See also: Risks Associated with Investing in Bonds]