What is a Cross Trade? Understanding International Stock Transactions

In the world of global finance, understanding different types of transactions is crucial for investors and market participants. One such transaction is a cross trade, also known as a cross order or a matched order. This article will delve into what a cross trade is, how it works, its potential benefits and drawbacks, and the regulations surrounding it.

Defining a Cross Trade

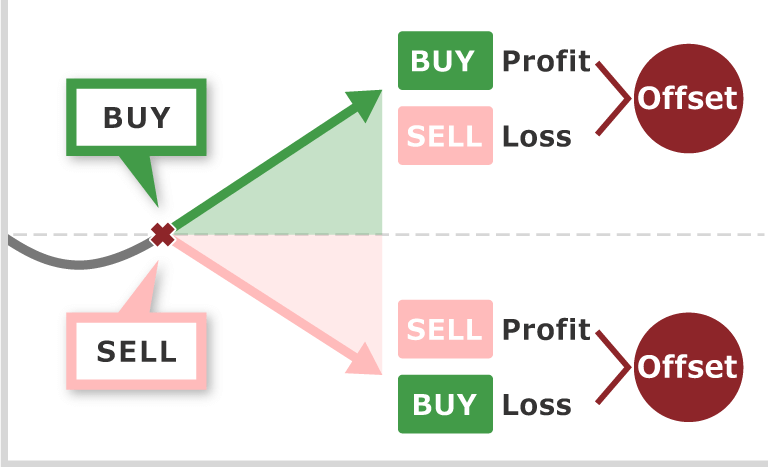

A cross trade occurs when a broker or investment firm executes buy and sell orders for the same security or commodity, effectively acting as both the buyer and the seller in the transaction. This typically happens within the same firm, without the order being exposed to the open market. In essence, the firm matches a client’s buy order with another client’s sell order for the same asset at a similar price.

To put it simply, imagine John wants to sell 100 shares of Company XYZ, and Sarah wants to buy 100 shares of Company XYZ. Both John and Sarah are clients of the same brokerage firm. Instead of sending these orders to the public exchange, the brokerage firm can match John’s sell order with Sarah’s buy order, resulting in a cross trade.

How a Cross Trade Works

The mechanics of a cross trade involve several steps. First, the brokerage firm identifies matching buy and sell orders for the same security. Next, the firm ensures that the price at which the cross trade is executed is fair and reasonable, often benchmarked against the prevailing market price. Finally, the trade is executed internally, and the transaction is reported to the relevant regulatory authorities.

Consider this example: A large institutional investor wants to liquidate a significant position in a particular stock. Rather than flooding the market with a large sell order, which could depress the price, the investor might instruct their broker to find matching buy orders. The broker, through its internal network, identifies several clients who are interested in buying the stock. The broker then executes a cross trade, matching the sell order with the buy orders at a negotiated price. This avoids significant market impact and allows the institutional investor to exit their position discreetly.

Benefits of Cross Trades

Cross trades offer several potential benefits to both the brokerage firm and its clients:

- Reduced Market Impact: By executing trades internally, cross trades can minimize the impact on the overall market price. This is particularly beneficial for large orders that could otherwise cause significant price fluctuations.

- Faster Execution: Cross trades can often be executed more quickly than traditional market orders, as they bypass the need for external order routing and matching.

- Lower Transaction Costs: In some cases, cross trades may involve lower transaction costs compared to market orders, as they may not be subject to exchange fees or brokerage commissions.

- Increased Privacy: Cross trades can provide greater privacy for clients, as the details of the transaction are not publicly disclosed. This can be particularly important for institutional investors who want to avoid revealing their trading strategies.

For example, a hedge fund might use a cross trade to quietly accumulate a large position in a stock without alerting other market participants to their intentions. This allows the hedge fund to avoid paying a premium for the stock as demand increases.

Drawbacks and Risks of Cross Trades

Despite their potential benefits, cross trades also carry certain risks and drawbacks:

- Potential for Conflicts of Interest: There is a risk that the brokerage firm may prioritize its own interests or the interests of certain clients over others when executing cross trades. For example, the firm might execute a cross trade at a price that is more favorable to one client than the other.

- Lack of Transparency: The lack of transparency in cross trades can make it difficult to determine whether the execution price is fair and reasonable. This can lead to concerns about price manipulation or other unethical practices.

- Regulatory Scrutiny: Cross trades are subject to close regulatory scrutiny, as they can be used to circumvent market regulations or engage in illegal trading activities.

- Best Execution Concerns: Brokers have a duty to provide best execution for their clients’ orders. It may be argued that a cross trade does not always achieve best execution compared to sending the order to the open market.

Consider a scenario where a brokerage firm executes a cross trade at a price that is slightly below the prevailing market price. While the seller may be satisfied with the execution, the buyer could argue that they could have obtained a better price by placing an order on the open market. This highlights the importance of ensuring that cross trades are executed at fair and reasonable prices.

Regulations Governing Cross Trades

Given the potential for abuse, cross trades are subject to strict regulations in most jurisdictions. These regulations are designed to ensure that cross trades are executed fairly and transparently, and that they do not violate market integrity.

Some common regulatory requirements for cross trades include:

- Disclosure: Brokerage firms are typically required to disclose to their clients that they may execute cross trades on their behalf.

- Price Transparency: Firms must ensure that the price at which a cross trade is executed is fair and reasonable, often by benchmarking it against the prevailing market price.

- Priority Rules: Regulations often specify that client orders must be given priority over the firm’s own orders when executing cross trades.

- Record Keeping: Brokerage firms are required to maintain detailed records of all cross trades, including the identities of the clients involved, the execution price, and the rationale for the trade.

- Compliance Oversight: Firms must have robust compliance procedures in place to monitor cross trade activity and prevent potential abuses.

For example, in the United States, the Securities and Exchange Commission (SEC) has specific rules governing cross trades by broker-dealers. These rules are designed to prevent conflicts of interest and ensure that clients receive fair treatment. Similarly, in Europe, the Markets in Financial Instruments Directive (MiFID II) imposes strict requirements on firms executing cross trades.

Examples of Cross Trades in Practice

Cross trades are used in a variety of contexts, including:

- Block Trades: Cross trades are often used to execute large block trades, where a significant number of shares or contracts are traded at once. [See also: What is a Block Trade?]

- Index Rebalancing: When an index is rebalanced, cross trades can be used to facilitate the buying and selling of securities to align portfolios with the new index composition.

- Mergers and Acquisitions: In mergers and acquisitions, cross trades can be used to transfer shares between the acquiring and acquired companies.

- Employee Stock Option Plans: Cross trades can be used to facilitate the exercise of employee stock options, where employees buy shares of their company’s stock.

For instance, during an index rebalancing, a fund manager might need to sell shares of a company that is being removed from the index and buy shares of a company that is being added. A cross trade can help the fund manager execute these trades quickly and efficiently, minimizing market impact.

The Future of Cross Trades

As financial markets become increasingly complex and globalized, cross trades are likely to remain an important tool for institutional investors and brokerage firms. However, it is also likely that regulations governing cross trades will continue to evolve, as regulators seek to address potential risks and abuses.

Technological advancements, such as the rise of algorithmic trading and high-frequency trading, may also impact the use of cross trades. These technologies could potentially make it easier to identify and execute cross trades, but they could also create new opportunities for market manipulation and other unethical practices.

Conclusion

In conclusion, a cross trade is a type of transaction where a broker or investment firm executes buy and sell orders for the same security internally. While cross trades offer potential benefits such as reduced market impact and faster execution, they also carry risks such as conflicts of interest and lack of transparency. Strict regulations are in place to govern cross trades and ensure they are conducted fairly. Understanding what a cross trade is and how it works is essential for anyone involved in the financial markets.

By understanding the nuances of cross trade execution, investors can better navigate the complexities of the market and make more informed decisions. Furthermore, a clear understanding of regulations surrounding a cross trade ensures compliance and ethical trading practices.

Therefore, continue to educate yourself on market mechanisms like the cross trade to enhance your financial literacy and investment acumen.