What is a Liquidity Sweep in Trading? A Comprehensive Guide

In the dynamic world of trading, understanding various market phenomena is crucial for making informed decisions. One such phenomenon is the liquidity sweep. This article delves into what a liquidity sweep is, how it works, its implications, and how traders can potentially use this information to their advantage. We’ll explore different aspects of liquidity sweeps, providing a comprehensive understanding of this important trading concept.

Understanding Liquidity in Trading

Before diving into the specifics of a liquidity sweep, it’s essential to understand the broader context of liquidity in trading. Liquidity refers to the ease with which an asset can be bought or sold without significantly affecting its price. A highly liquid market has many buyers and sellers, leading to tighter bid-ask spreads and smoother transactions. Illiquid markets, on the other hand, have fewer participants, wider spreads, and the potential for significant price slippage.

Order books play a crucial role in determining liquidity. The order book is a real-time list of all outstanding buy (bid) and sell (ask) orders for a particular asset. It provides insights into the supply and demand dynamics at different price levels. Traders use the order book to gauge market sentiment and identify potential areas of support and resistance.

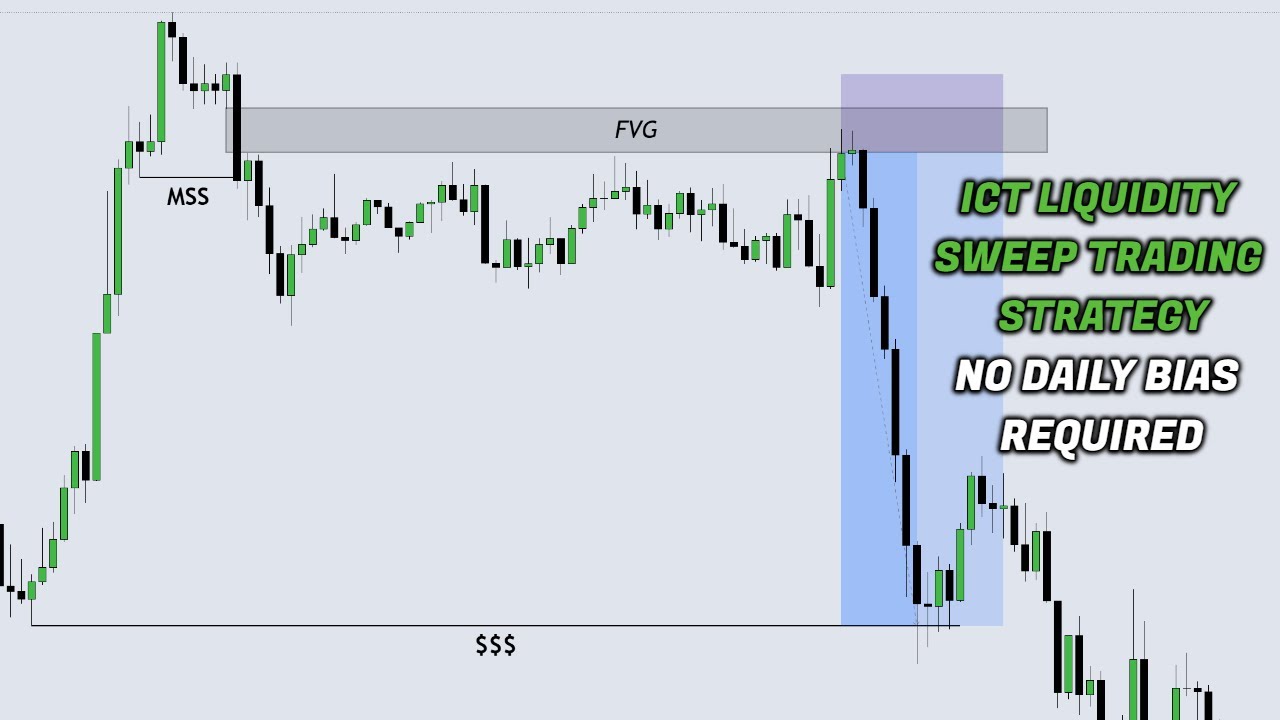

Defining a Liquidity Sweep

A liquidity sweep occurs when a large market order (or a series of smaller orders) rapidly consumes all available liquidity at a specific price level, triggering a cascade of stop-loss orders and further accelerating the price movement. It’s essentially a forceful clearing out of resting orders, often leaving a vacuum behind.

Think of it like this: Imagine a dam holding back water. The dam represents a price level with a significant number of buy or sell orders. A liquidity sweep is like opening the floodgates, causing a rapid surge of orders that overwhelm the dam and send a wave of price movement in one direction.

How a Liquidity Sweep Works

The process typically unfolds as follows:

- Accumulation of Orders: A large number of buy or sell orders accumulate at a particular price level. This could be due to traders placing stop-loss orders, limit orders, or simply a concentration of market participants anticipating a price reversal.

- Trigger Event: A large market order, or a series of smaller orders, is executed at or through the price level where the accumulated orders reside. This initial push acts as a catalyst.

- Stop-Loss Activation: As the price moves through the level, stop-loss orders are triggered, adding to the selling (or buying) pressure. Stop-loss orders are designed to limit potential losses, but in a liquidity sweep, they can exacerbate the price movement.

- Cascade Effect: The activation of stop-loss orders triggers further selling (or buying), creating a cascade effect. The price accelerates rapidly as more and more orders are executed.

- Vacuum Creation: After the liquidity sweep, a vacuum is often left behind, meaning there are few remaining orders at the swept price level. This can lead to continued momentum in the direction of the sweep, or potentially a sharp reversal if the move was overextended.

Identifying Liquidity Sweeps

Recognizing a liquidity sweep in real-time can be challenging, but there are certain indicators traders can look for:

- Sudden Price Spike: A rapid and unexpected price movement, often accompanied by increased volume.

- Break of Key Levels: The price breaks through significant support or resistance levels with unusual force.

- Increased Volatility: A sharp increase in price volatility, as measured by indicators like the Average True Range (ATR).

- Order Book Analysis: Observing the order book for a sudden depletion of orders at a specific price level.

Implications of Liquidity Sweeps

Liquidity sweeps can have significant implications for traders:

- Stop-Loss Activation: Traders who have placed stop-loss orders near the swept level may be prematurely stopped out of their positions, resulting in losses.

- Missed Opportunities: The rapid price movement can lead to missed opportunities for traders who are waiting for a specific price level to enter or exit a trade.

- Increased Risk: Liquidity sweeps can increase the risk of trading, especially for those using high leverage.

- Potential for Profit: Experienced traders can potentially profit from liquidity sweeps by anticipating the move and positioning themselves accordingly.

Strategies for Trading Around Liquidity Sweeps

While predicting liquidity sweeps with certainty is impossible, traders can employ strategies to mitigate risk and potentially capitalize on these events:

- Wider Stop-Loss Placement: Placing stop-loss orders further away from key levels can help avoid being prematurely stopped out by a liquidity sweep. However, this also increases the potential loss if the trade goes against you.

- Reduced Leverage: Using lower leverage can reduce the impact of a liquidity sweep on your account.

- Confirmation Signals: Waiting for confirmation signals after a potential liquidity sweep before entering a trade. This could include candlestick patterns, volume analysis, or other technical indicators.

- Order Book Analysis: Monitoring the order book for signs of order accumulation and potential sweep zones.

- Trading the Reversal: Some traders attempt to profit from the reversal that often follows a liquidity sweep. This requires careful timing and a good understanding of market dynamics.

Liquidity Sweep vs. Fakeout

It’s important to distinguish between a liquidity sweep and a fakeout. A fakeout is a temporary price movement that appears to break through a key level but then quickly reverses. While both involve price action around significant levels, the underlying intent and outcome differ.

A liquidity sweep is driven by a genuine desire to clear out resting orders and push the price in a specific direction. A fakeout, on the other hand, is often designed to trap traders into taking positions in the wrong direction, before reversing and moving in the opposite direction.

The key difference lies in the follow-through. A liquidity sweep typically results in sustained momentum in the direction of the sweep, while a fakeout results in a quick reversal.

Real-World Examples of Liquidity Sweeps

Liquidity sweeps can be observed across various markets, including:

- Forex: Currency pairs are often subject to liquidity sweeps due to the high leverage and large trading volumes.

- Cryptocurrencies: The volatile nature of cryptocurrencies makes them particularly susceptible to liquidity sweeps.

- Stocks: While less frequent than in forex or crypto, liquidity sweeps can occur in stocks, especially during periods of high volatility or earnings announcements.

Analyzing historical charts and order book data can help traders identify past liquidity sweeps and learn to recognize the patterns associated with them. [See also: Understanding Market Volatility]

The Role of Market Makers

Market makers play a crucial role in providing liquidity to the market. They quote bid and ask prices for assets and stand ready to buy or sell at those prices. However, market makers can also contribute to liquidity sweeps by pulling their orders or widening spreads during periods of high volatility.

Understanding the behavior of market makers can provide valuable insights into potential liquidity sweep zones. [See also: The Impact of High-Frequency Trading]

Conclusion

A liquidity sweep is a powerful market phenomenon that can significantly impact trading outcomes. By understanding how liquidity sweeps work, recognizing their signs, and implementing appropriate risk management strategies, traders can navigate these events more effectively and potentially even profit from them. While predicting them with certainty is impossible, a solid understanding of order book dynamics, price action, and market sentiment can significantly improve a trader’s ability to identify and react to liquidity sweeps. Remember to always prioritize risk management and trade responsibly. The key takeaway is that understanding what a liquidity sweep is, is crucial for any serious trader looking to navigate the complexities of the market.