What is Deflation Economics? Understanding Its Causes, Effects, and Implications

Deflation economics refers to a sustained decrease in the general price level of goods and services in an economy. It’s essentially the opposite of inflation. While seemingly beneficial at first glance – things get cheaper! – deflation can signal underlying economic problems and often leads to a vicious cycle of decreased demand and production. Understanding deflation economics is crucial for investors, policymakers, and anyone interested in the health of the global economy.

This article delves into the intricacies of deflation economics, exploring its causes, effects, and potential solutions. We’ll examine historical examples, analyze the impact on various sectors, and discuss the policy responses governments and central banks might employ to combat deflation. By the end, you’ll have a comprehensive understanding of what deflation economics entails and its far-reaching consequences.

Understanding the Basics of Deflation

At its core, deflation represents a persistent decline in the Consumer Price Index (CPI), a measure of the average change over time in the prices paid by urban consumers for a basket of consumer goods and services. A single price drop in one sector doesn’t constitute deflation; it’s a broad-based, sustained decrease across the economy.

What Causes Deflation?

Several factors can trigger deflation. Here are some of the most common:

- Decreased Aggregate Demand: If overall demand for goods and services falls sharply, businesses may be forced to lower prices to attract customers. This can stem from a recession, reduced consumer confidence, or a decline in government spending.

- Increased Productivity: Technological advancements or increased efficiency can lead to a surplus of goods and services. When supply outstrips demand, prices tend to fall.

- Contraction of the Money Supply: If the amount of money circulating in the economy decreases, there’s less money available to purchase goods and services, leading to lower prices. This can happen when central banks tighten monetary policy or when banks reduce lending.

- Debt: High levels of debt can discourage spending and investment, contributing to decreased demand and potentially triggering deflation. Consumers burdened with debt may prioritize paying it down rather than purchasing goods and services.

- Global Factors: Increased competition from foreign producers or a global economic slowdown can also put downward pressure on prices.

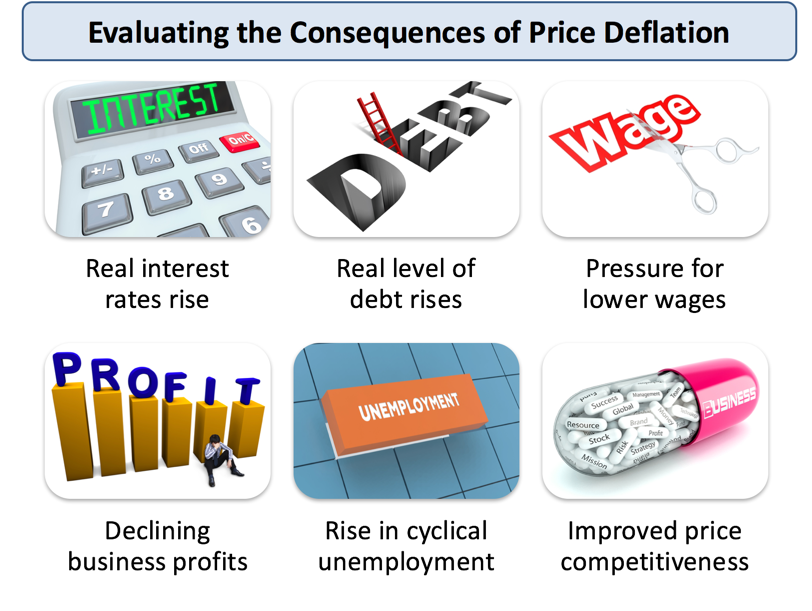

The Effects of Deflation

While lower prices might seem like a good thing, deflation often has negative consequences for the economy:

- Decreased Spending: Consumers may postpone purchases, expecting prices to fall further in the future. This decreased spending further reduces demand and exacerbates the deflationary spiral.

- Increased Debt Burden: While the nominal value of debt remains the same, the real value of debt increases as prices fall. This makes it more difficult for individuals and businesses to repay their debts, potentially leading to defaults and bankruptcies.

- Reduced Investment: Businesses may delay investments, anticipating lower profits due to falling prices. This can lead to job losses and further economic contraction.

- Increased Real Interest Rates: Even if nominal interest rates are low, the real interest rate (nominal interest rate minus inflation rate) can be high during deflation, making borrowing more expensive and discouraging investment.

- Wage Cuts: As businesses struggle to maintain profitability, they may resort to wage cuts, further reducing consumer spending and demand.

Historical Examples of Deflation

Several historical episodes illustrate the detrimental effects of deflation:

- The Great Depression (1930s): A severe economic downturn characterized by widespread deflation, high unemployment, and bank failures. Falling prices discouraged spending and investment, prolonging the depression.

- Japan’s Lost Decade (1990s): After a period of rapid economic growth, Japan experienced a prolonged period of deflation and economic stagnation. Falling asset prices and a reluctance to spend contributed to the downturn.

- The 2008 Financial Crisis: While not a sustained period of deflation, the financial crisis led to a sharp drop in demand and prices in some sectors, raising concerns about a broader deflationary spiral.

Combating Deflation: Policy Responses

Governments and central banks have several tools at their disposal to combat deflation:

- Monetary Policy: Central banks can lower interest rates to encourage borrowing and spending. They can also engage in quantitative easing (QE), which involves injecting money into the economy by purchasing government bonds or other assets.

- Fiscal Policy: Governments can increase spending or cut taxes to stimulate demand. Infrastructure projects and tax rebates can boost economic activity.

- Wage and Price Controls: In extreme cases, governments may consider implementing wage and price controls to prevent further declines. However, these measures are often controversial and can have unintended consequences.

- Managing Expectations: Central banks can communicate their commitment to price stability and their willingness to take action to prevent deflation. This can help to manage expectations and encourage spending.

The Role of Central Banks

Central banks play a crucial role in managing deflation. They are responsible for maintaining price stability and promoting full employment. By carefully monitoring economic indicators and adjusting monetary policy, central banks can help to prevent deflation from taking hold.

One of the challenges for central banks is that nominal interest rates cannot fall below zero (the zero lower bound). This limits their ability to stimulate the economy during periods of severe deflation. In such cases, unconventional monetary policies, such as quantitative easing, may be necessary.

The Importance of Fiscal Policy

Fiscal policy can also play a vital role in combating deflation. Government spending on infrastructure, education, and research can boost demand and create jobs. Tax cuts can also stimulate spending by putting more money in the hands of consumers and businesses. However, it’s crucial for governments to manage their debt levels responsibly to avoid creating long-term fiscal problems. [See also: Government Debt and Economic Growth]

The Impact of Deflation on Different Sectors

Deflation can have varying impacts on different sectors of the economy:

- Manufacturing: Falling prices can squeeze profit margins for manufacturers, leading to reduced production and job losses.

- Retail: Retailers may struggle to maintain sales as consumers postpone purchases, expecting prices to fall further.

- Real Estate: Deflation can lead to falling property values, making it more difficult for homeowners to repay their mortgages.

- Financial Sector: Banks may face increased loan defaults as borrowers struggle to repay their debts.

The Future of Deflation

The risk of deflation remains a concern in many developed economies. Factors such as aging populations, high debt levels, and technological disruption could contribute to persistent downward pressure on prices. Central banks and governments need to remain vigilant and prepared to take action to prevent deflation from becoming entrenched.

Understanding deflation economics is crucial for navigating the complexities of the modern global economy. By understanding its causes, effects, and potential solutions, we can better prepare for and mitigate the risks associated with this challenging economic phenomenon.

Conclusion

In conclusion, deflation economics is a complex issue with far-reaching consequences. While lower prices may seem appealing, sustained deflation can lead to decreased spending, increased debt burdens, and reduced investment. Governments and central banks must work together to implement effective policies to combat deflation and promote sustainable economic growth. Continuous monitoring of economic indicators and proactive policy responses are essential to prevent deflation from undermining economic stability. The study of deflation and deflation economics continues to be a critical area of focus for economists and policymakers worldwide. [See also: Understanding Inflation and Its Impact]