What is Deflation in Economics? Understanding the Causes, Effects, and Risks

Deflation, in simple terms, is the opposite of inflation. It’s a sustained decrease in the general price level of goods and services in an economy. While it might seem appealing to pay less for everything, deflation can have serious consequences for economic growth and stability. Understanding what is deflation in economics, its causes, effects, and the risks it poses is crucial for policymakers, businesses, and individuals alike.

Defining Deflation: A Closer Look

Deflation occurs when the inflation rate falls below 0%, indicating that the purchasing power of money is increasing over time. This means that you can buy more goods and services with the same amount of money than you could before. While this might sound like a good thing, deflation can actually be a sign of underlying economic problems.

To truly grasp what is deflation in economics, it’s essential to differentiate it from disinflation. Disinflation refers to a slowdown in the rate of inflation, meaning prices are still rising, but at a slower pace. Deflation, on the other hand, means prices are actually falling.

Causes of Deflation

Several factors can contribute to deflation. Understanding these causes is crucial for predicting and mitigating its potential impact:

- Decreased Aggregate Demand: This is perhaps the most common cause of deflation. When overall demand for goods and services falls, businesses are forced to lower prices to attract customers. This can be triggered by factors such as a recession, a decrease in consumer confidence, or a contraction in government spending.

- Increased Aggregate Supply: If the supply of goods and services increases significantly without a corresponding increase in demand, prices will fall. This can happen due to technological advancements, increased productivity, or deregulation.

- Contraction of the Money Supply: A decrease in the amount of money circulating in the economy can also lead to deflation. This can happen if the central bank tightens monetary policy by raising interest rates or reducing the money supply.

- Debt: High levels of debt, both public and private, can contribute to deflation. When individuals and businesses are heavily indebted, they may cut back on spending to repay their debts, leading to a decrease in demand and lower prices.

- Globalization: Increased global competition can put downward pressure on prices as businesses compete to offer the lowest prices.

Effects of Deflation: The Downward Spiral

While lower prices might seem beneficial at first, deflation can have a number of negative consequences for the economy:

- Decreased Consumer Spending: When consumers expect prices to fall further, they may postpone purchases, hoping to get a better deal in the future. This decrease in spending can further depress demand and exacerbate deflation.

- Increased Debt Burden: Deflation increases the real value of debt, making it more difficult for borrowers to repay their loans. This can lead to defaults and bankruptcies, which can further destabilize the economy.

- Reduced Business Investment: Businesses are less likely to invest in new projects when they expect prices to fall, as they anticipate lower profits. This can lead to decreased productivity and slower economic growth.

- Wage Decreases: In a deflationary environment, businesses may try to cut costs by reducing wages. This can lead to decreased consumer spending and further deflation.

- Increased Real Interest Rates: Deflation increases the real interest rate (the nominal interest rate minus the inflation rate). This can make it more expensive for businesses and individuals to borrow money, further hindering economic growth.

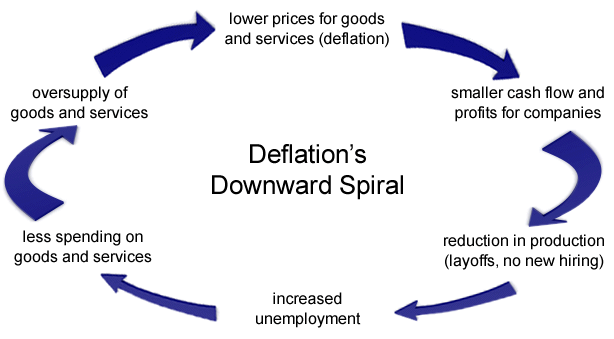

The Risks of Deflation: A Vicious Cycle

The most significant risk associated with deflation is the potential for a deflationary spiral. This occurs when falling prices lead to decreased demand, which in turn leads to further price decreases, creating a vicious cycle that can be difficult to break. This spiral can lead to a prolonged period of economic stagnation or even recession.

Japan experienced a prolonged period of deflation in the 1990s and early 2000s, known as the “Lost Decade.” This period was characterized by falling prices, stagnant economic growth, and high levels of debt. The experience of Japan highlights the dangers of deflation and the challenges of escaping a deflationary spiral.

Combating Deflation: Policy Responses

Policymakers have several tools at their disposal to combat deflation:

- Monetary Policy: Central banks can lower interest rates to encourage borrowing and spending. They can also engage in quantitative easing, which involves injecting money into the economy by purchasing assets.

- Fiscal Policy: Governments can increase spending or cut taxes to stimulate demand. This can help to offset the negative effects of deflation.

- Structural Reforms: Implementing structural reforms that increase productivity and competitiveness can also help to combat deflation.

- Inflation Targeting: Central banks can adopt an inflation target, typically around 2%, to help anchor inflation expectations and prevent deflation.

Examples of Deflation in History

Several historical episodes of deflation provide valuable insights into its causes and consequences:

- The Great Depression (1930s): The Great Depression was characterized by severe deflation, which exacerbated the economic downturn. Falling prices led to decreased demand, increased debt burdens, and widespread bankruptcies.

- Japan’s Lost Decade (1990s-2000s): As mentioned earlier, Japan experienced a prolonged period of deflation that led to stagnant economic growth and high levels of debt.

- The Long Depression (1873-1879): This period of economic contraction in the late 19th century was also marked by significant deflation.

Is Deflation Always Bad?

While deflation is generally considered to be harmful to the economy, there are some limited circumstances in which it might be less problematic. For example, if deflation is caused by a significant increase in productivity, it could lead to higher real incomes and improved living standards. However, even in these cases, deflation can still pose risks if it leads to decreased spending and increased debt burdens.

Deflation vs. Stagflation

It’s important to distinguish deflation from stagflation, another challenging economic scenario. Stagflation is characterized by slow economic growth and high inflation, creating a difficult situation for policymakers. While deflation involves falling prices, stagflation involves rising prices alongside economic stagnation.

[See also: Understanding Inflation and Its Impact on the Economy]

Conclusion: Understanding the Complexities of Deflation

What is deflation in economics? It is a complex phenomenon with potentially serious consequences for economic growth and stability. While lower prices might seem appealing, deflation can lead to decreased spending, increased debt burdens, reduced business investment, and a deflationary spiral. Policymakers must be vigilant in monitoring economic conditions and taking appropriate measures to prevent and combat deflation. Understanding the causes and effects of deflation is crucial for making informed decisions about economic policy and personal finance. The key takeaway is that while moderate inflation is generally considered healthy for an economy, deflation poses a significant threat to economic well-being. By implementing appropriate monetary and fiscal policies, governments can mitigate the risks of deflation and promote sustainable economic growth. Furthermore, being aware of what is deflation in economics can help individuals and businesses make sound financial decisions during periods of economic uncertainty. Remember, a little bit of knowledge about what is deflation in economics can go a long way in protecting your financial future.