What is Economic Deflation? Understanding Causes, Effects, and Solutions

Economic deflation, a term often whispered in hushed tones in financial circles, refers to a sustained decrease in the general price level of goods and services in an economy. Unlike inflation, where prices rise, deflation sees prices falling. While seemingly beneficial on the surface—who wouldn’t want cheaper goods?—deflation can have significant and often detrimental effects on economic growth. This article delves into the intricacies of deflation, exploring its causes, consequences, and potential solutions.

Understanding Economic Deflation

Deflation is more than just a sale at your favorite store. It’s a macroeconomic phenomenon characterized by a persistent decline in the overall price level. This decline is typically measured using a price index, such as the Consumer Price Index (CPI). A consistent negative CPI reading indicates deflation. It’s crucial to distinguish deflation from disinflation, which is a slowdown in the rate of inflation, not a fall in prices.

How Deflation Works

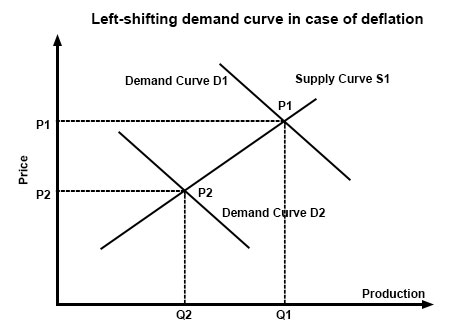

Imagine a world where the price of everything – from groceries to gadgets – keeps getting cheaper. Sounds great, right? However, this scenario can trigger a chain reaction. Consumers, anticipating further price drops, may delay purchases, hoping to snag even better deals later. This decreased demand leads businesses to cut production, potentially resulting in layoffs and reduced wages. As incomes fall, demand weakens further, creating a vicious cycle of falling prices and economic stagnation. This is often referred to as a deflationary spiral. [See also: Understanding Inflation and Its Impact]

Causes of Economic Deflation

Several factors can trigger deflation. Understanding these causes is crucial for policymakers seeking to prevent or mitigate its effects.

Decreased Aggregate Demand

A significant drop in overall demand for goods and services is a primary driver of deflation. This can be caused by various factors, including:

- Economic Recession: During recessions, unemployment rises, incomes fall, and consumer confidence plummets, leading to decreased spending.

- Increased Savings: If consumers become more risk-averse and prioritize saving over spending, demand can decline.

- Government Austerity Measures: Government spending cuts and tax increases can reduce aggregate demand, especially in the short term.

Increased Aggregate Supply

A sudden surge in the supply of goods and services, without a corresponding increase in demand, can also lead to deflation. This can occur due to:

- Technological Advancements: Innovations that boost productivity can increase supply and lower production costs.

- Globalization: Increased international trade can flood markets with cheaper goods, putting downward pressure on prices.

- Increased Competition: Fierce competition among businesses can lead to price wars, driving down prices.

Contraction of the Money Supply

A decrease in the amount of money circulating in the economy can also contribute to deflation. This can happen due to:

- Tight Monetary Policy: Central banks may raise interest rates or reduce the money supply to combat inflation, but this can inadvertently trigger deflation if overdone.

- Banking Crises: Bank failures can reduce lending and credit availability, leading to a contraction in the money supply.

- Debt Deflation: A situation where high levels of debt combined with falling prices exacerbate the debt burden, leading to defaults and reduced spending.

Effects of Economic Deflation

The consequences of deflation can be far-reaching and detrimental to an economy.

Decreased Investment

Businesses are less likely to invest in new projects or expand their operations when prices are falling. This is because they anticipate lower profits in the future, making investments less attractive. Reduced investment can stifle economic growth and innovation. [See also: The Role of Investment in Economic Growth]

Increased Debt Burden

Deflation increases the real value of debt. While the nominal amount of debt remains the same, the value of money increases, making it more difficult for borrowers to repay their debts. This can lead to defaults and financial instability, especially for individuals and businesses with high levels of debt.

Delayed Consumption

As mentioned earlier, consumers tend to postpone purchases when they expect prices to fall further. This delayed consumption reduces demand and can exacerbate the deflationary spiral.

Wage Cuts and Unemployment

Businesses struggling with falling prices may resort to wage cuts or layoffs to reduce costs. This can lead to lower incomes and increased unemployment, further reducing demand and contributing to deflation.

Increased Real Interest Rates

Even if nominal interest rates are low, deflation can lead to high real interest rates (nominal interest rate minus inflation rate). This makes borrowing more expensive, discouraging investment and consumption.

Solutions to Economic Deflation

Combating deflation requires a multifaceted approach involving both monetary and fiscal policies.

Monetary Policy

Central banks can use various tools to stimulate demand and combat deflation:

- Lowering Interest Rates: Reducing interest rates makes borrowing cheaper, encouraging investment and consumption. However, if interest rates are already near zero (the “zero lower bound”), this tool becomes less effective.

- Quantitative Easing (QE): QE involves a central bank injecting liquidity into the economy by purchasing assets, such as government bonds. This increases the money supply and lowers long-term interest rates.

- Negative Interest Rates: Some central banks have experimented with negative interest rates, charging banks for holding reserves at the central bank. The goal is to encourage banks to lend more money.

- Forward Guidance: Central banks can communicate their intentions regarding future monetary policy to influence expectations and encourage spending and investment.

Fiscal Policy

Governments can use fiscal policy to stimulate demand and combat deflation:

- Increased Government Spending: Government spending on infrastructure projects, education, or other areas can boost aggregate demand and create jobs.

- Tax Cuts: Tax cuts can increase disposable income, encouraging consumers to spend more.

- Direct Payments: Governments can provide direct payments to individuals or businesses to stimulate spending.

Other Measures

In addition to monetary and fiscal policies, other measures can be taken to address deflation:

- Debt Relief: Providing debt relief to individuals and businesses can ease their financial burden and encourage spending.

- Structural Reforms: Implementing structural reforms to improve productivity and competitiveness can boost economic growth and help combat deflation.

- Inflation Targeting: Central banks can adopt an inflation target, such as 2%, to provide a clear signal of their commitment to maintaining price stability.

Examples of Deflationary Periods

Throughout history, several countries have experienced periods of deflation. Here are a few notable examples:

The Great Depression (1930s)

The Great Depression was characterized by severe deflation, with prices falling sharply across the globe. This deflation exacerbated the economic downturn, leading to widespread unemployment and hardship.

Japan in the 1990s and 2000s

Japan experienced a prolonged period of deflation in the 1990s and 2000s, often referred to as the “Lost Decade.” This deflation contributed to economic stagnation and hindered Japan’s recovery.

Ireland After the 2008 Financial Crisis

Following the 2008 financial crisis, Ireland experienced a period of deflation as the country struggled with high levels of debt and a struggling economy.

Conclusion

Deflation, while seemingly beneficial on the surface, can have serious consequences for an economy. Understanding its causes, effects, and potential solutions is crucial for policymakers seeking to maintain price stability and promote sustainable economic growth. By implementing appropriate monetary and fiscal policies, governments can mitigate the risks of deflation and foster a healthy economic environment. While the allure of lower prices might be tempting, the long-term implications of unchecked deflation can be devastating. Proactive measures are essential to prevent a deflationary spiral and ensure a stable and prosperous future.