What is Liquidity Sweep in Trading? A Comprehensive Guide

In the dynamic world of trading, understanding the nuances of market behavior is crucial for success. One such concept that traders should be familiar with is the liquidity sweep. This guide provides a comprehensive overview of what a liquidity sweep is, how it works, and its implications for traders.

Understanding Liquidity in Trading

Before diving into liquidity sweeps, it’s essential to understand the concept of liquidity itself. Liquidity refers to the ease with which an asset can be bought or sold without causing a significant change in its price. A highly liquid market has many buyers and sellers, allowing for quick and efficient transactions. Conversely, an illiquid market has fewer participants, making it harder to execute trades without affecting the price.

Liquidity is measured by:

- Bid-ask spread: The difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask). A narrower spread indicates higher liquidity.

- Trading volume: The number of shares or contracts traded in a given period. Higher volume generally indicates higher liquidity.

- Market depth: The ability of a market to absorb large orders without causing significant price movements.

What is a Liquidity Sweep?

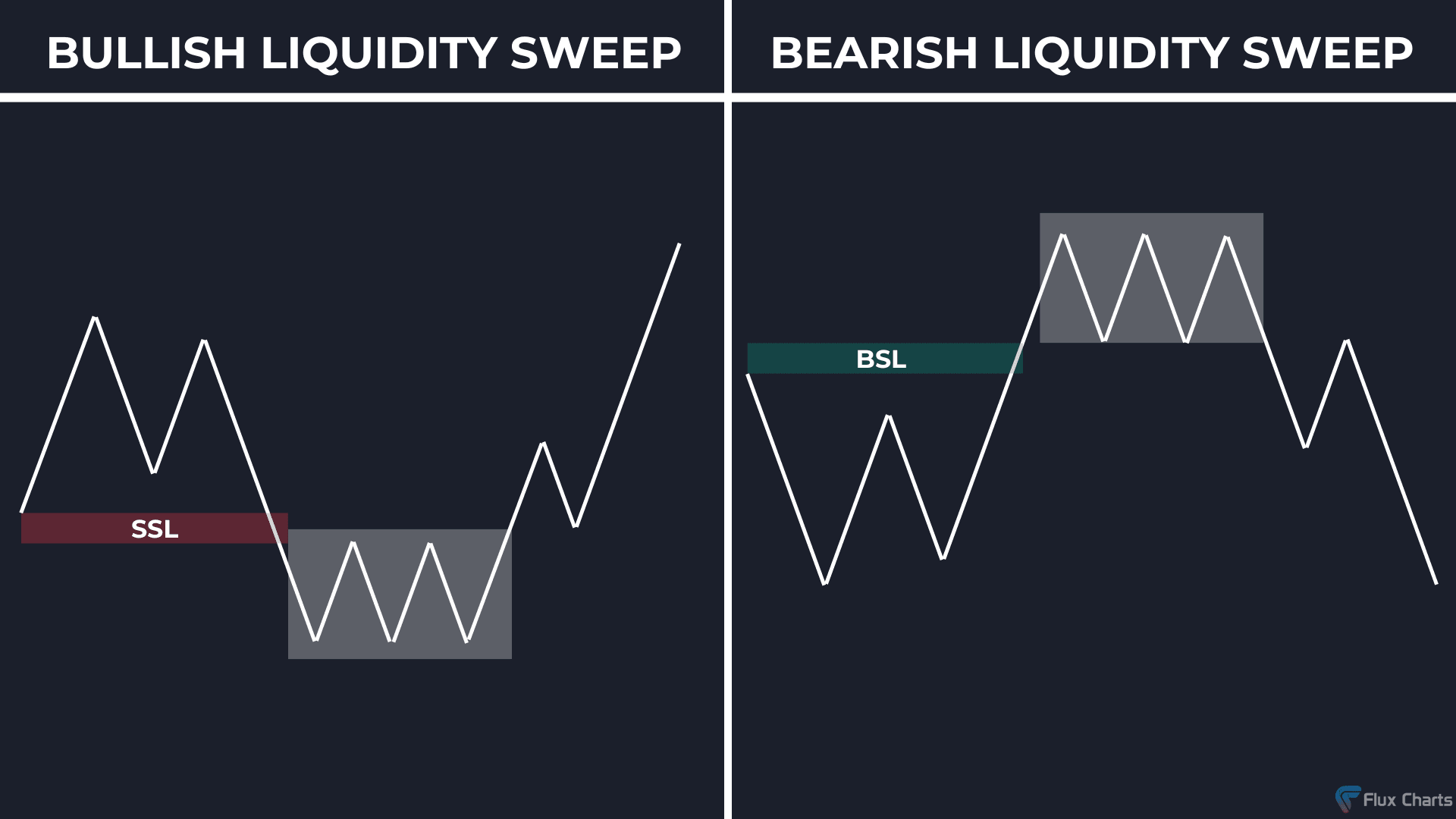

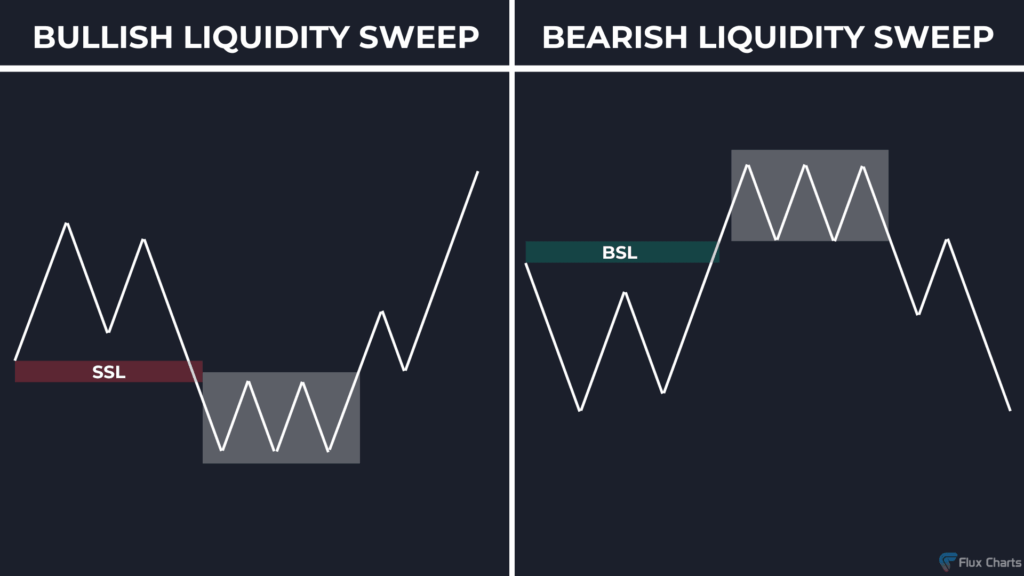

A liquidity sweep is a rapid and aggressive price movement that aims to trigger stop-loss orders and take out resting orders at specific price levels. It’s a technique often employed by large institutional traders or market makers to accumulate positions or manipulate the market temporarily. The primary goal of a liquidity sweep is not necessarily to establish a new trend but rather to exploit existing order clusters.

Imagine a scenario where many traders have placed stop-loss orders just below a key support level. A large trader might execute a significant sell order, driving the price down to trigger those stop-loss orders. Once these orders are triggered, the price may quickly rebound, leaving many traders stopped out of their positions. This is a classic example of a liquidity sweep.

How Does a Liquidity Sweep Work?

The mechanics of a liquidity sweep involve several key steps:

Identification of Liquidity Pools

Large traders or market makers analyze order books and market depth charts to identify areas where significant clusters of stop-loss orders or resting orders are located. These areas, often near key support and resistance levels, represent potential liquidity pools.

Initiation of the Sweep

Once a liquidity pool is identified, the trader initiates a large order in the opposite direction of the anticipated price movement. For example, if the pool is below a support level, the trader will execute a large sell order.

Triggering of Orders

The large order triggers the stop-loss orders or resting orders within the liquidity pool. This sudden influx of orders exacerbates the price movement, creating a cascade effect.

Price Reversal

After the targeted orders have been triggered, the trader may close their position, allowing the price to rebound. This rebound can be swift, leaving many traders who were stopped out feeling frustrated and confused.

Why Do Liquidity Sweeps Happen?

Liquidity sweeps occur for several reasons, often related to market manipulation or strategic positioning:

- Profit Taking: Large traders may use liquidity sweeps to trigger stop-loss orders and buy back assets at lower prices, effectively profiting from the forced selling.

- Position Accumulation: By triggering stop-loss orders, large traders can accumulate a significant position without significantly impacting the price.

- Market Manipulation: In some cases, liquidity sweeps are used to create artificial volatility and exploit the resulting price movements. This is often considered unethical and may be illegal, depending on the jurisdiction.

Identifying Liquidity Sweeps

Identifying a liquidity sweep in real-time can be challenging, but there are several clues that traders can look for:

- Sudden Price Spikes: A rapid and unexpected price movement, especially near key support or resistance levels, can be a sign of a liquidity sweep.

- High Volume: An unusually high trading volume accompanying the price spike may indicate that a large number of orders are being triggered.

- Quick Reversal: A rapid price reversal following the spike is a strong indication that a liquidity sweep has occurred.

- Order Book Analysis: Monitoring the order book can reveal large orders being placed and removed quickly, which may be indicative of a liquidity sweep.

Strategies to Protect Yourself from Liquidity Sweeps

While it’s impossible to completely avoid liquidity sweeps, there are several strategies that traders can use to mitigate their impact:

Wider Stop-Loss Placement

Placing stop-loss orders too close to key support or resistance levels makes them vulnerable to liquidity sweeps. Consider placing your stop-loss orders further away from these levels to provide a buffer against temporary price fluctuations.

Avoid Obvious Stop-Loss Locations

Large traders often target areas where they know many stop-loss orders are located. Avoid placing your stop-loss orders in these obvious locations. Instead, consider using more sophisticated techniques, such as trailing stop-loss orders or volatility-based stop-loss orders.

Use Limit Orders

Instead of relying solely on market orders, consider using limit orders to enter and exit positions. Limit orders allow you to specify the price at which you are willing to trade, which can help you avoid being caught in a liquidity sweep.

Monitor Market Depth

Paying attention to market depth charts can provide valuable insights into the distribution of orders. This can help you identify potential liquidity pools and avoid placing your orders in these areas.

Diversify Your Trading Strategy

Relying on a single trading strategy can make you more vulnerable to liquidity sweeps. Consider diversifying your trading strategy to include a mix of different approaches.

Stay Informed

Keeping up-to-date with market news and economic events can help you anticipate potential periods of high volatility and adjust your trading strategy accordingly. [See also: Economic Indicators for Traders]

Liquidity Sweep vs. Stop Hunting

It’s important to differentiate a liquidity sweep from stop hunting, although the terms are often used interchangeably. Stop hunting is a more general term referring to the practice of deliberately driving the price to trigger stop-loss orders. A liquidity sweep is a specific type of stop hunting that involves a rapid and aggressive price movement targeting a specific liquidity pool. [See also: Understanding Stop Hunting in Forex]

Examples of Liquidity Sweeps

Example 1: A stock is trading near a support level of $50. Many traders have placed stop-loss orders just below this level at $49.90. A large trader executes a significant sell order, driving the price down to $49.80, triggering the stop-loss orders. The price then quickly rebounds back above $50.

Example 2: In the forex market, the EUR/USD currency pair is trading near a resistance level of 1.1000. Numerous traders have placed sell orders at 1.1010. A large trader executes a large buy order, pushing the price up to 1.1020, triggering those sell orders. The price then swiftly drops back below 1.1000.

The Ethical Implications of Liquidity Sweeps

The ethical implications of liquidity sweeps are a subject of debate. While some argue that they are simply a part of market dynamics, others view them as a form of market manipulation. The key distinction often lies in the intent and scale of the activity. If a trader is simply trying to profit from normal market fluctuations, their actions may be considered acceptable. However, if a trader is deliberately manipulating the market to exploit other participants, their actions may be deemed unethical and potentially illegal. Regulatory bodies like the SEC and ESMA monitor market activity to detect and prevent such manipulative practices.

Conclusion

Understanding what a liquidity sweep is and how it works is essential for traders looking to navigate the complexities of the market. By recognizing the signs of a liquidity sweep and implementing strategies to protect themselves, traders can mitigate their risk and improve their overall performance. While liquidity sweeps can be frustrating, they are a reality of the trading world, and being prepared is the best defense. By staying informed, employing sound risk management techniques, and continuously refining their trading strategies, traders can increase their chances of success in the long run. The concept of a liquidity sweep is vital for any serious trader to grasp.