What Is The Difference Between Stakeholders and Shareholders? A Clear Explanation

In the world of business and finance, understanding the nuances between different roles and relationships is crucial. Two terms that often come up, and sometimes get confused, are ‘stakeholders’ and ‘shareholders.’ While both are important to a company’s success, they have distinct roles, interests, and levels of involvement. This article will provide a clear explanation of what is the difference between stakeholders and shareholders, exploring their respective rights, responsibilities, and impacts on an organization.

Defining Stakeholders

A stakeholder is any individual, group, or organization that has an interest in or is affected by a business and its operations. Stakeholders can be internal, such as employees, managers, and owners, or external, such as customers, suppliers, creditors, the local community, and even the government. The defining characteristic of a stakeholder is that they are impacted by the company’s decisions and actions, and in turn, they can influence the company’s outcomes.

Examples of Stakeholders

- Employees: Directly impacted by job security, wages, and working conditions.

- Customers: Concerned with product quality, pricing, and customer service.

- Suppliers: Interested in maintaining a stable business relationship and receiving timely payments.

- Creditors: Focused on the company’s ability to repay debts.

- Local Community: Affected by the company’s environmental impact, job creation, and community involvement.

- Government: Concerned with regulatory compliance, tax revenue, and economic stability.

Defining Shareholders

A shareholder, also known as a stockholder, is an individual, group, or organization that owns shares of stock in a company. Shareholders are partial owners of the company and have a financial interest in its performance. Their primary goal is typically to see the value of their investment increase over time, either through stock appreciation or dividend payments.

Rights of Shareholders

- Voting Rights: Shareholders typically have the right to vote on important company matters, such as electing board members and approving major corporate actions.

- Dividends: Shareholders may receive a portion of the company’s profits in the form of dividends.

- Access to Information: Shareholders are entitled to receive financial reports and other information about the company’s performance.

- Right to Sue: Shareholders have the right to sue the company if they believe it has acted illegally or against their interests.

- Claim on Assets: In the event of liquidation, shareholders have a claim on the company’s assets after all debts have been paid.

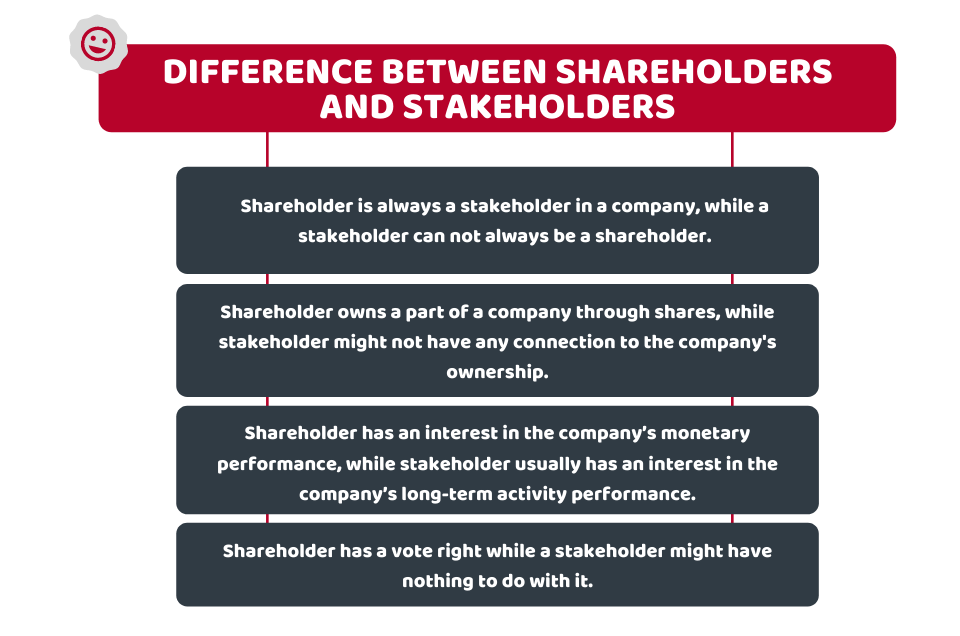

Key Differences: Stakeholders vs. Shareholders

The primary difference between stakeholders and shareholders lies in their relationship to the company and their motivations. Here’s a breakdown of the key distinctions:

| Feature | Stakeholder | Shareholder |

|---|---|---|

| Relationship to Company | Has an interest in the company’s performance and is affected by its actions. | Owns shares of stock in the company. |

| Motivation | Varied, including financial, social, and ethical concerns. | Primarily financial gain through stock appreciation or dividends. |

| Level of Influence | Can influence the company through various means, such as boycotts, lobbying, or employee activism. | Influences the company through voting rights and shareholder resolutions. |

| Financial Risk | May face financial risks indirectly, such as job loss or reduced business opportunities. | Faces direct financial risk through the potential loss of investment. |

| Legal Rights | May have some legal rights depending on their specific relationship to the company (e.g., employees have employment rights). | Has specific legal rights as a shareholder, such as voting rights and the right to sue. |

Overlapping Interests and Potential Conflicts

While there are clear differences between stakeholders and shareholders, their interests can sometimes overlap. For example, employees who are also shareholders have a dual interest in the company’s success. Similarly, customers may become loyal shareholders if they believe in the company’s products or services.

However, conflicts can also arise. A company’s focus on maximizing shareholder value may come at the expense of other stakeholders. For example, cost-cutting measures that increase profits for shareholders may lead to job losses for employees or lower quality products for customers. Balancing the needs of all stakeholders is a significant challenge for corporate management.

The Importance of Stakeholder Engagement

Increasingly, companies are recognizing the importance of engaging with all stakeholders, not just shareholders. This involves actively listening to their concerns, addressing their needs, and incorporating their perspectives into decision-making processes. Stakeholder engagement can lead to a variety of benefits, including:

- Improved Reputation: Companies that are seen as responsible and responsive to stakeholder concerns are more likely to have a positive reputation.

- Increased Customer Loyalty: Customers are more likely to support companies that align with their values.

- Reduced Risk: Engaging with stakeholders can help companies identify and mitigate potential risks, such as environmental damage or labor disputes.

- Enhanced Innovation: Stakeholders can provide valuable insights and ideas that can lead to new products, services, and processes.

- Improved Financial Performance: While it may seem counterintuitive, prioritizing stakeholder interests can actually lead to improved financial performance in the long run.

The Rise of Stakeholder Capitalism

The traditional view of corporate governance has long focused on maximizing shareholder value. However, there is a growing movement towards stakeholder capitalism, which emphasizes the importance of creating value for all stakeholders, not just shareholders. This approach recognizes that companies have a broader responsibility to society and that their long-term success depends on building strong relationships with all those who are affected by their operations.

The Business Roundtable, a group of CEOs from some of the world’s largest companies, has publicly endorsed stakeholder capitalism, stating that companies should commit to delivering value to customers, investing in employees, dealing fairly with suppliers, supporting the communities in which they operate, and generating long-term value for shareholders. This shift in perspective reflects a growing awareness that companies have a crucial role to play in addressing social and environmental challenges.

Examples in Practice: Stakeholder vs. Shareholder Focus

To further illustrate what is the difference between stakeholders and shareholders in practice, consider these examples:

- Shareholder-Focused Company: A company that prioritizes short-term profits above all else. This might involve aggressive cost-cutting measures, even if it means sacrificing employee benefits or product quality. The primary goal is to increase the stock price and pay out dividends to shareholders.

- Stakeholder-Focused Company: A company that invests in its employees through training and development programs, supports local communities through charitable donations, and prioritizes sustainable business practices. While profitability is still important, it is not the sole focus. The company aims to create value for all stakeholders, believing that this will ultimately lead to long-term success.

The Future of Corporate Governance

The debate over what is the difference between stakeholders and shareholders and which group should be prioritized is likely to continue. However, the trend towards stakeholder capitalism suggests that companies are increasingly recognizing the importance of balancing the needs of all stakeholders. This requires a shift in mindset, as well as changes in corporate governance structures and performance metrics. Companies that can successfully navigate this evolving landscape will be best positioned to thrive in the long run. [See also: Corporate Social Responsibility]

Understanding what is the difference between stakeholders and shareholders is paramount for anyone involved in or affected by business. It allows for more informed decision-making, clearer communication, and a more nuanced understanding of the complex dynamics at play within organizations. As the business world continues to evolve, a stakeholder-centric approach is likely to become increasingly important for achieving sustainable success and creating a positive impact on society.

Ultimately, the key takeaway is that while shareholders are important owners with specific financial interests, stakeholders encompass a much broader group of individuals and entities whose well-being is intertwined with the company’s success. Recognizing and addressing the needs of all stakeholders is not just ethically sound, but also strategically advantageous in today’s interconnected world. Companies that understand and embrace this difference between stakeholders and shareholders are more likely to build lasting value and contribute to a more sustainable and equitable future.

In conclusion, the difference between stakeholders and shareholders is significant. Shareholders are investors seeking financial return, while stakeholders have a broader interest in the company’s performance and impact. A company that effectively manages its relationships with both stakeholders and shareholders is poised for long-term success. The debate surrounding stakeholders and shareholders is ongoing, but the importance of considering all parties is undeniable. Understanding this difference between stakeholders and shareholders is crucial for navigating the complexities of the modern business world. As we move forward, the focus on balancing the needs of stakeholders and shareholders will continue to shape the future of corporate governance. The difference between stakeholders and shareholders is not just a semantic one; it represents a fundamental shift in how we view the role of business in society. The difference between stakeholders and shareholders is a concept that every business leader should understand and embrace. A clear understanding of what is the difference between stakeholders and shareholders will lead to more responsible and sustainable business practices. The difference between stakeholders and shareholders influences every aspect of a company’s operations. Understanding the difference between stakeholders and shareholders is essential for making informed investment decisions. Ignoring the difference between stakeholders and shareholders can have serious consequences for a company’s reputation and financial performance.