What is the Difference Between Stakeholders and Shareholders? A Clear Explanation

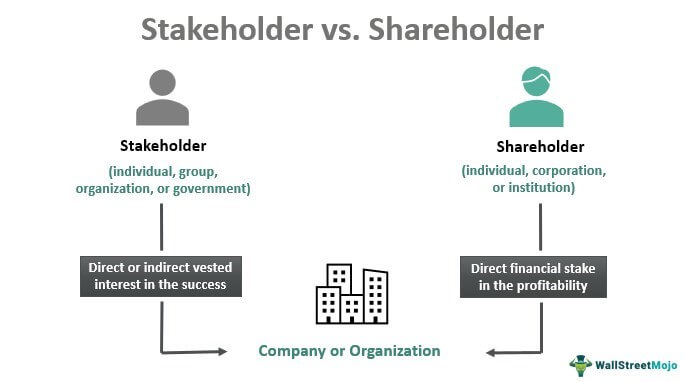

In the business world, understanding the nuances between different roles is crucial for effective communication and strategic decision-making. Two terms that often get used interchangeably, but shouldn’t, are stakeholders and shareholders. While both are connected to a company, their relationship and interests differ significantly. This article provides a clear explanation of what is the difference between stakeholders and shareholders, exploring their roles, responsibilities, and impact on an organization.

Defining Stakeholders

A stakeholder is any individual, group, or organization that has an interest in the success of a business. This interest can be financial, emotional, or even communal. Stakeholders are affected by the company’s actions, policies, and overall performance. This broad definition encompasses a wide range of individuals and entities.

Examples of stakeholders include:

- Employees: Concerned with job security, wages, and working conditions.

- Customers: Interested in product quality, pricing, and customer service.

- Suppliers: Dependent on the company for consistent business and timely payments.

- Communities: Affected by the company’s environmental impact and community involvement.

- Governments: Concerned with regulatory compliance, taxes, and economic impact.

- Creditors: Banks or other financial institutions that have lent money to the company.

The key characteristic of a stakeholder is their vested interest, which can be either positively or negatively impacted by the company’s actions. A company failing to meet environmental regulations, for example, would negatively impact the community stakeholders.

Defining Shareholders

A shareholder, also known as a stockholder, is an individual, company, or institution that owns at least one share of a company’s stock. By owning stock, shareholders become part-owners of the company and are entitled to a portion of its assets and profits. Their primary interest is generally financial.

Shareholders invest capital into the company with the expectation of receiving a return on their investment. This return can come in the form of dividends (a portion of the company’s profits) or through an increase in the stock price, which allows them to sell their shares for a profit.

Shareholders have certain rights, including:

- Voting rights: Shareholders can vote on important company matters, such as electing board members and approving mergers or acquisitions.

- Access to information: They are entitled to receive financial reports and other information about the company’s performance.

- Right to dividends: If the company declares dividends, shareholders are entitled to receive their share.

- Right to sue: Shareholders can sue the company if they believe it has acted illegally or in a way that harms their interests.

Key Differences: Stakeholders vs. Shareholders

The central difference between stakeholders and shareholders lies in their relationship to the company and their primary motivations. Here’s a breakdown:

- Relationship: Shareholders are owners of the company, while stakeholders have an interest in the company’s performance but are not necessarily owners.

- Motivation: Shareholders are primarily motivated by financial gain, while stakeholders have a broader range of interests, including financial, social, and environmental concerns.

- Impact: Both can impact a company, but stakeholders can be affected by the company’s actions, even if they don’t directly invest in it.

- Scope: The category of stakeholders is far broader than that of shareholders. All shareholders are stakeholders, but not all stakeholders are shareholders.

To further illustrate what is the difference between stakeholders and shareholders, consider a scenario where a company decides to close a factory. The shareholders might be concerned about the potential impact on the company’s stock price. However, the employees who lose their jobs, the suppliers who lose a major customer, and the local community that suffers from job losses are all stakeholders who are directly affected by the decision.

The Importance of Balancing Stakeholder and Shareholder Interests

Companies today recognize the importance of balancing the interests of both stakeholders and shareholders. While maximizing shareholder value has traditionally been the primary goal, there’s a growing understanding that neglecting stakeholder interests can ultimately harm long-term profitability and sustainability. [See also: Corporate Social Responsibility]

A company with a strong reputation for treating its employees well, providing excellent customer service, and being environmentally responsible is more likely to attract and retain customers, employees, and investors. This, in turn, can lead to increased profitability and shareholder value.

Conversely, a company that prioritizes short-term profits at the expense of stakeholder interests can face negative consequences, such as boycotts, lawsuits, and damage to its reputation. These consequences can ultimately hurt the company’s bottom line and reduce shareholder value.

Therefore, successful companies strive to create a win-win situation where both stakeholders and shareholders benefit. This requires a long-term perspective and a commitment to ethical and sustainable business practices. Understanding what is the difference between stakeholders and shareholders is the first step in crafting such a strategy.

Stakeholder Engagement

Effective stakeholder engagement is crucial for companies seeking to balance the diverse interests of their stakeholders. This involves actively listening to stakeholder concerns, communicating transparently about company decisions, and incorporating stakeholder feedback into strategic planning. [See also: Importance of Ethical Business Practices]

Methods of stakeholder engagement can include:

- Surveys and focus groups to gather stakeholder opinions.

- Public forums to discuss company policies and practices.

- Regular communication with stakeholder groups through newsletters, websites, and social media.

- Establishing advisory boards comprised of stakeholder representatives.

By actively engaging with stakeholders, companies can build trust, improve their reputation, and make more informed decisions that benefit both stakeholders and shareholders. Remember that understanding what is the difference between stakeholders and shareholders is paramount to effective engagement.

Examples in Practice

Consider Patagonia, the outdoor clothing company. They have built a strong brand by prioritizing environmental sustainability and ethical labor practices. This focus on stakeholder interests has not only resonated with customers but has also attracted investors who value socially responsible companies. Their commitment to stakeholders ultimately benefits their shareholders by creating a loyal customer base and a positive brand image.

Another example is Unilever, which has committed to sustainable sourcing and reducing its environmental impact. This commitment has helped them attract and retain customers who are increasingly concerned about environmental issues. By prioritizing stakeholder interests, Unilever has been able to create long-term value for its shareholders.

The Future of Stakeholder and Shareholder Relations

As businesses face increasing pressure to address social and environmental challenges, the importance of balancing stakeholder and shareholder interests will only continue to grow. Companies that can effectively manage their relationships with both groups will be best positioned for long-term success. [See also: ESG Investing Trends]

The traditional focus on maximizing shareholder value is evolving into a broader focus on creating value for all stakeholders. This requires a shift in mindset and a commitment to building a more sustainable and equitable business model. Understanding precisely what is the difference between stakeholders and shareholders is a cornerstone of this evolution.

Conclusion

What is the difference between stakeholders and shareholders? In summary, while all shareholders are stakeholders, the reverse is not true. Shareholders are owners focused primarily on financial returns, while stakeholders have a broader interest in the company’s overall performance and impact. Recognizing and managing the interests of both groups is crucial for long-term business success. By prioritizing both stakeholders and shareholders, companies can build a more sustainable and prosperous future. The key takeaway is that understanding what is the difference between stakeholders and shareholders is vital for any business leader.