What Time Does the Market Open? A Comprehensive Guide

Understanding what time the market opens is crucial for anyone involved in trading, investing, or simply following financial news. The opening bell signals the start of the trading day, setting the stage for potential gains and losses. This guide provides a comprehensive overview of market opening times, factors that can affect these times, and why knowing this information is essential for informed decision-making.

Understanding Market Opening Hours

The term “market” can refer to various financial markets, including stock exchanges, bond markets, and foreign exchange (forex) markets. Each market operates with its own specific hours, influenced by geographical location, regulatory requirements, and trading conventions. Knowing what time the market opens in each of these segments is critical for traders and investors.

Stock Exchanges

Stock exchanges are perhaps the most widely recognized financial markets. These exchanges facilitate the buying and selling of stocks (equities) of publicly traded companies. The most prominent stock exchanges include the New York Stock Exchange (NYSE) and the Nasdaq Stock Market in the United States, the London Stock Exchange (LSE) in the United Kingdom, and the Tokyo Stock Exchange (TSE) in Japan.

The standard opening time for the NYSE and Nasdaq is 9:30 AM Eastern Time (ET). This time is consistently observed on regular trading days, Monday through Friday, excluding market holidays. Understanding what time the market opens in New York is critical for North American traders.

Bond Markets

Bond markets involve the trading of debt securities issued by governments, municipalities, and corporations. These markets generally operate with less defined hours compared to stock exchanges. In the United States, the bond market, primarily facilitated by dealers and institutional investors, typically opens earlier than the stock market, around 8:00 AM ET. However, trading activity can occur outside these hours, especially electronically.

Foreign Exchange (Forex) Markets

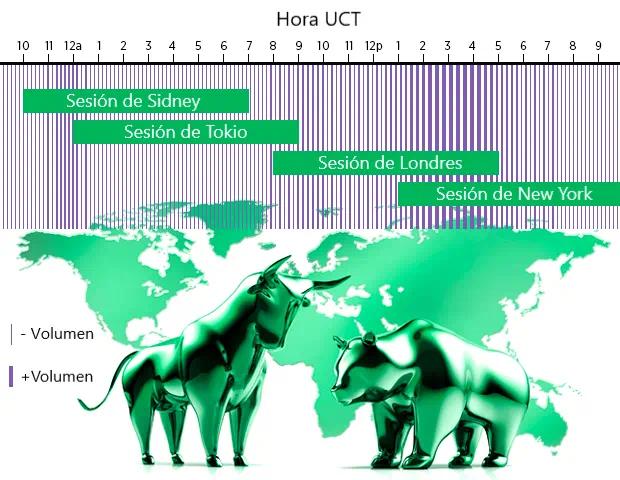

The forex market is decentralized and operates globally, 24 hours a day, five days a week. Trading begins on Sunday evening ET and continues until Friday afternoon ET. Because of its global nature, there isn’t a single “opening” time. However, liquidity and volatility tend to be highest during the overlap of major trading sessions, such as the London and New York sessions. For traders, understanding the dynamics of when major markets open is essential. This will help them decide what time the market opens to best suit their strategy.

Factors Affecting Market Opening Times

While standard market hours are generally consistent, several factors can lead to variations in what time the market opens. These factors include market holidays, special events, and regulatory changes.

Market Holidays

Stock exchanges typically close on designated market holidays, which can vary by country and exchange. In the United States, common market holidays include New Year’s Day, Martin Luther King Jr. Day, Presidents’ Day, Good Friday, Memorial Day, Independence Day, Labor Day, Thanksgiving Day, and Christmas Day. On these days, the market remains closed, and no trading activity occurs. Before any trading, it is crucial to check what time the market opens, especially around holidays.

Early Closures and Delayed Openings

In some cases, markets may close early or experience delayed openings due to unforeseen circumstances. Early closures can occur on the day after Thanksgiving (Black Friday) or the day before Christmas. Delayed openings can result from technical glitches, significant news events, or extreme market volatility. Exchanges will typically announce any changes to trading hours in advance to keep market participants informed.

Economic News Releases

The release of major economic indicators, such as GDP figures, inflation reports, and employment data, can significantly impact market activity. While these releases don’t directly change what time the market opens, they can lead to increased volatility and trading volume around the opening bell. Traders often adjust their strategies based on these releases, anticipating potential market movements.

Why Knowing Market Opening Times Matters

Knowing what time the market opens is essential for several reasons. It allows traders and investors to plan their strategies, execute trades efficiently, and stay informed about market developments.

Strategic Planning

Understanding market hours enables traders to develop and implement effective trading strategies. For example, day traders often focus on the opening hours when volatility and liquidity are typically highest. By knowing what time the market opens, they can capitalize on short-term price movements and execute quick trades. Long-term investors also benefit from knowing market hours, as they can use this information to time their entry and exit points more effectively.

Efficient Trade Execution

Knowing the precise what time the market opens allows traders to execute trades at the most opportune moments. During the opening hours, order flow is often at its peak, leading to tighter bid-ask spreads and better execution prices. Traders who are aware of market hours can take advantage of these favorable conditions to improve their trading performance.

Staying Informed

Market opening times are closely tied to the flow of information and news that can impact trading decisions. By knowing what time the market opens, traders can stay informed about overnight developments, such as economic news releases or corporate announcements, that may affect market sentiment. This information can help them make more informed trading decisions and manage their risk exposure.

Tools and Resources for Tracking Market Hours

Several tools and resources are available to help traders and investors track market hours and stay informed about any changes. These include:

- Exchange Websites: The official websites of stock exchanges, such as the NYSE and Nasdaq, provide detailed information about trading hours, market holidays, and any special announcements.

- Financial News Websites: Reputable financial news websites, such as Bloomberg, Reuters, and the Wall Street Journal, offer real-time updates on market hours and trading conditions.

- Trading Platforms: Many online trading platforms provide built-in tools for tracking market hours and setting alerts for important events.

- Economic Calendars: Economic calendars, available on various financial websites, list the dates and times of major economic news releases, which can impact market activity.

Conclusion

Knowing what time the market opens is a fundamental aspect of trading and investing. Understanding market hours allows traders to plan their strategies, execute trades efficiently, and stay informed about market developments. While standard market hours are generally consistent, various factors can lead to variations, making it essential to stay updated and informed. By leveraging available tools and resources, traders can navigate the markets with greater confidence and make more informed decisions. Whether you are a seasoned trader or a novice investor, understanding what time the market opens can significantly enhance your trading success.

Keeping abreast of market schedules, including knowing what time the market opens, is not merely a logistical detail; it’s a strategic imperative. It enables proactive decision-making, risk management, and ultimately, a more informed and successful engagement with the financial markets. Always verify the opening times, especially during holiday periods or when unusual market conditions prevail.

So, before you gear up for your next trading session, make sure you know what time the market opens. Your portfolio will thank you for it.

[See also: Day Trading Strategies for Beginners]

[See also: Understanding Stock Market Volatility]

[See also: How to Read Financial News]