What Time Does the Market Open? A Comprehensive Guide

Understanding what time the market opens is crucial for anyone involved in trading or investing. Knowing the precise opening hours allows traders to plan their strategies, execute timely trades, and stay ahead in the fast-paced world of finance. This guide provides a comprehensive overview of market opening times across different exchanges, factors influencing these times, and tips for maximizing your trading opportunities. Whether you are a seasoned investor or a beginner, understanding what time the market opens is a fundamental aspect of successful trading.

Understanding Market Opening Hours

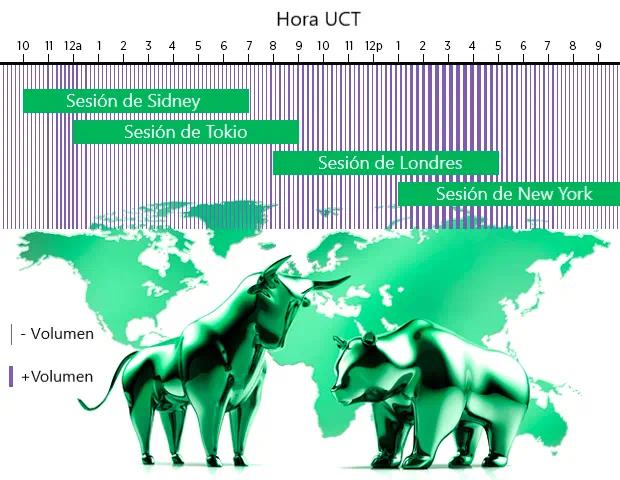

The global financial markets operate across various time zones, leading to different opening and closing times for stock exchanges around the world. These hours are typically set by the exchange itself and can be influenced by local customs, holidays, and economic factors. Knowing what time the market opens in different regions is essential for global investors.

Major Stock Exchanges and Their Opening Times

Here’s a look at the opening times of some of the world’s major stock exchanges, providing a clear picture of what time the market opens in these key financial hubs:

- New York Stock Exchange (NYSE): Opens at 9:30 AM Eastern Time (ET).

- NASDAQ: Also opens at 9:30 AM Eastern Time (ET).

- London Stock Exchange (LSE): Opens at 8:00 AM Greenwich Mean Time (GMT).

- Tokyo Stock Exchange (TSE): Opens at 9:00 AM Japan Standard Time (JST).

- Shanghai Stock Exchange (SSE): Opens at 9:30 AM China Standard Time (CST).

- Hong Kong Stock Exchange (HKEX): Opens at 9:30 AM Hong Kong Time (HKT).

These opening times represent the start of regular trading hours. Pre-market and after-hours trading sessions often exist, offering opportunities to trade outside these standard times.

Factors Influencing Market Opening Times

Several factors can influence what time the market opens. These include:

- Local Holidays: Exchanges typically close on public holidays specific to their region.

- Economic Events: Major economic announcements can sometimes lead to adjusted opening times to allow for orderly market reactions.

- Technical Issues: In rare cases, technical glitches can delay the opening of a market.

- Geopolitical Events: Significant global events can also impact market hours.

Traders should always check the exchange’s official website for the most up-to-date information on opening times, especially during holidays or periods of significant economic or political uncertainty.

Why Knowing Market Opening Times Matters

Understanding what time the market opens is more than just a matter of knowing the schedule; it’s a critical element of successful trading. Here’s why:

Strategic Planning

Knowing what time the market opens allows traders to plan their strategies effectively. They can prepare their orders, analyze market data, and anticipate potential price movements before the opening bell. This preparation can give them a significant advantage.

Timely Execution of Trades

The opening minutes of the market often see high volatility and trading volume. Traders who know what time the market opens can capitalize on these early movements, executing their trades at optimal prices. Missing the opening bell can mean missing valuable opportunities.

Risk Management

Understanding what time the market opens is also crucial for risk management. Traders can set stop-loss orders and take-profit levels based on the expected market behavior at the opening. This helps to protect their investments and limit potential losses.

Global Market Awareness

For those trading in international markets, knowing what time the market opens in different regions is essential. This allows them to synchronize their trading activities and take advantage of global market trends. For example, a trader in New York might want to monitor the opening of the London Stock Exchange to inform their trading decisions.

Tips for Trading at the Market Opening

Trading at the market opening can be both exciting and profitable, but it also comes with its own set of challenges. Here are some tips to help you navigate the opening bell successfully:

Prepare in Advance

Before what time the market opens, take the time to analyze market data, review economic news, and identify potential trading opportunities. Having a clear plan in place will help you make informed decisions and avoid impulsive trades.

Monitor Pre-Market Activity

Pay attention to pre-market trading activity, which can provide valuable insights into the likely direction of the market at the opening. Pre-market trading often reflects overnight news and global market movements.

Use Limit Orders

Consider using limit orders to ensure that you buy or sell at your desired price. Limit orders can help you avoid getting caught up in the volatility of the opening and ensure that your trades are executed at a favorable price.

Manage Your Risk

Set stop-loss orders to protect your investments and limit potential losses. The opening minutes of the market can be unpredictable, so it’s important to have a risk management strategy in place.

Stay Informed

Keep up-to-date with the latest market news and economic developments. Being well-informed will help you make better trading decisions and adapt to changing market conditions. Knowing what time the market opens is just the first step; staying informed is crucial for long-term success.

The Impact of Pre-Market and After-Hours Trading

While understanding what time the market opens is vital, it’s also important to consider the impact of pre-market and after-hours trading sessions. These sessions offer opportunities to trade outside of regular market hours, but they also come with their own set of risks and considerations.

Pre-Market Trading

Pre-market trading typically occurs before the official opening of the market. It can provide valuable insights into the likely direction of the market at the opening, as it often reflects overnight news and global market movements. However, pre-market trading can also be more volatile and less liquid than regular trading hours.

After-Hours Trading

After-hours trading takes place after the market has officially closed. It can be useful for reacting to news and events that occur outside of regular trading hours. However, like pre-market trading, after-hours trading can be more volatile and less liquid.

Both pre-market and after-hours trading sessions can be influenced by factors such as earnings announcements, economic data releases, and geopolitical events. Traders who participate in these sessions should be aware of the increased risks and take appropriate precautions.

Tools and Resources for Tracking Market Opening Times

Numerous tools and resources are available to help traders track market opening times and stay informed about market events. These include:

- Financial News Websites: Websites like Bloomberg, Reuters, and MarketWatch provide up-to-date information on market hours and economic news.

- Exchange Websites: The official websites of stock exchanges typically provide detailed information on opening times, holidays, and other market-related information.

- Trading Platforms: Many trading platforms offer real-time market data and alerts, helping traders stay informed about market opening times and important events.

- Economic Calendars: Economic calendars provide a schedule of upcoming economic data releases, which can impact market movements.

By utilizing these tools and resources, traders can stay informed and make better trading decisions. Knowing what time the market opens is just one piece of the puzzle; staying informed is crucial for long-term success.

Conclusion

In conclusion, understanding what time the market opens is fundamental for anyone involved in trading or investing. Knowing the precise opening hours allows traders to plan their strategies, execute timely trades, and manage their risk effectively. By staying informed, preparing in advance, and utilizing the available tools and resources, traders can navigate the market opening successfully and capitalize on opportunities. Whether you are a seasoned investor or a beginner, understanding what time the market opens is a critical aspect of successful trading. Remember to always verify the information with the specific exchange as times can vary.

[See also: Stock Market Basics for Beginners]

[See also: Understanding Market Volatility]

[See also: Risk Management Strategies for Traders]