Why is the British Pound (GBP) Falling? Understanding the Factors at Play

The British Pound (GBP), a cornerstone of global finance, has experienced significant volatility and a general downward trend against other major currencies, particularly the US dollar and the Euro, in recent times. Understanding why GBP is falling requires a multifaceted analysis, encompassing economic indicators, political developments, and global market sentiment. This article delves into the key factors contributing to the pound’s weakness, providing a comprehensive overview for those seeking to understand the current state of the UK currency.

Economic Headwinds Weighing on the Pound

Several persistent economic challenges within the UK are exerting downward pressure on the GBP. These include:

Inflation and the Cost of Living Crisis

The UK has been grappling with persistently high inflation, significantly impacting the cost of living for ordinary citizens. While the Bank of England (BoE) has aggressively raised interest rates to combat inflation, the impact on the GBP has been mixed. High inflation erodes the purchasing power of the currency, making it less attractive to foreign investors. The expectation that the BoE may eventually need to pause or even reverse its rate hikes due to economic weakness further undermines the pound.

Recession Fears and Economic Growth

Concerns about a potential recession in the UK are a major driver behind the GBP’s weakness. Economic growth has been sluggish, and various forecasts point to a contraction in the near future. A contracting economy typically leads to a weaker currency as investors seek safer havens with stronger growth prospects. The uncertainty surrounding the UK’s economic outlook makes holding GBP less appealing.

Trade Deficit and Current Account Imbalance

The UK has consistently run a trade deficit, meaning it imports more goods and services than it exports. This imbalance puts downward pressure on the GBP as more pounds are needed to purchase foreign goods. A large current account deficit, which includes the trade balance and other income flows, further exacerbates this issue. [See also: UK Economic Outlook 2024]

Political and Geopolitical Influences

Beyond purely economic factors, political uncertainty and geopolitical events play a significant role in influencing the GBP’s value.

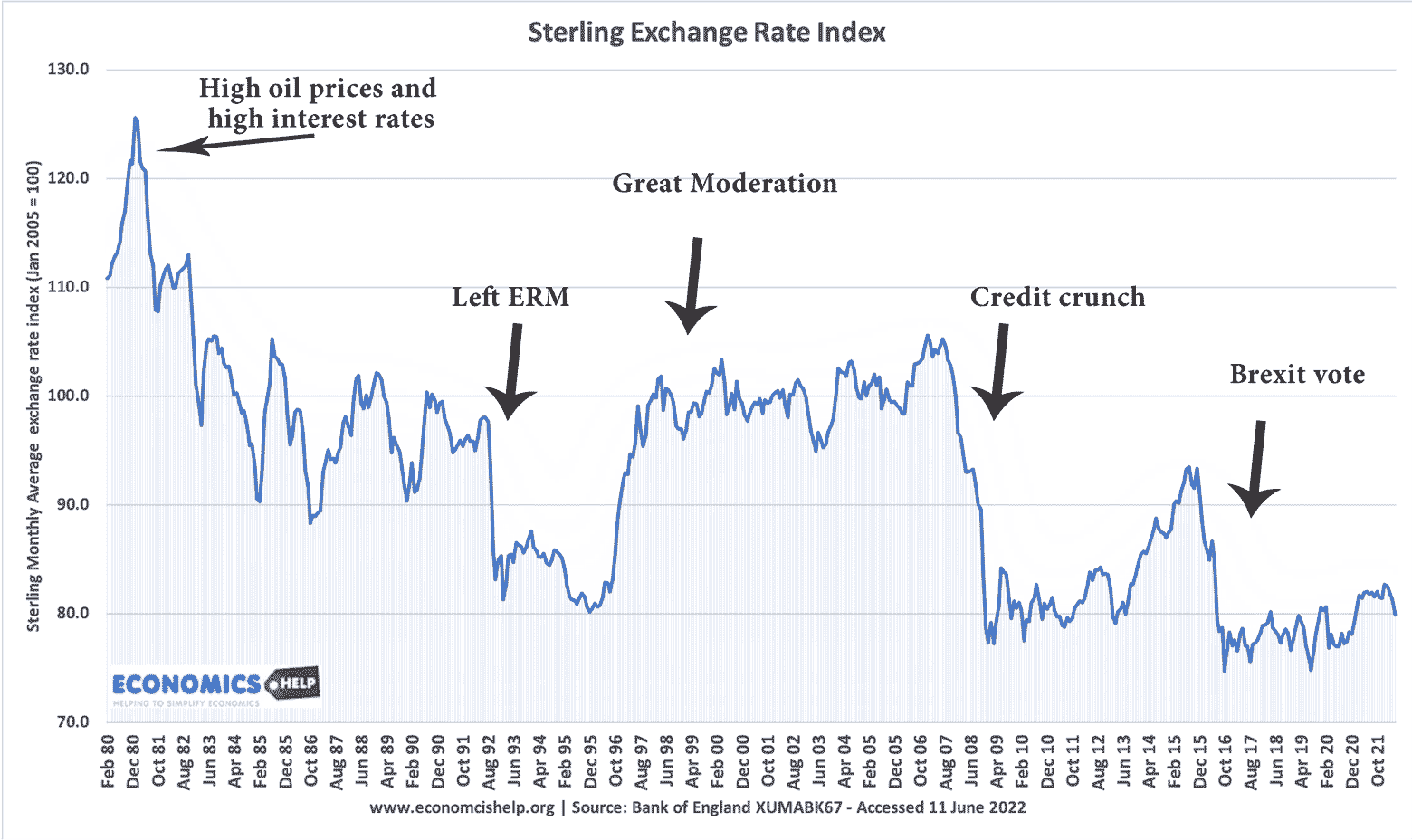

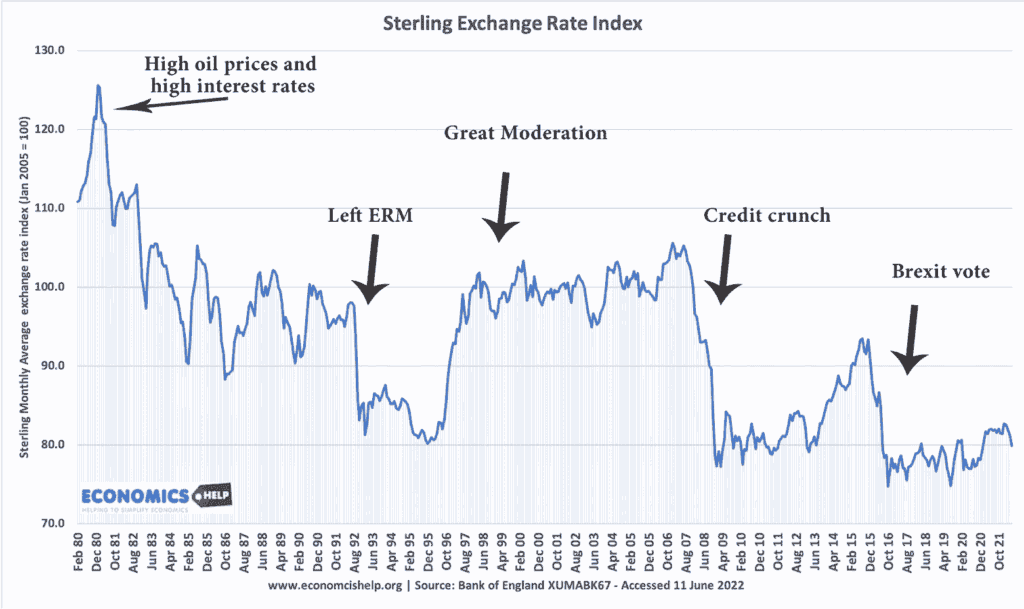

Brexit and its Lingering Effects

The long-term consequences of Brexit continue to weigh on the GBP. The UK’s departure from the European Union has created trade barriers, disrupted supply chains, and increased uncertainty for businesses. While the immediate shock of the Brexit referendum has subsided, the ongoing adjustments and negotiations related to post-Brexit trade deals continue to impact investor sentiment towards the pound. The perception of increased economic risk associated with Brexit contributes to the weakness of the GBP.

Political Instability and Government Policies

Periods of political instability can significantly impact currency values. Changes in government, policy reversals, and uncertainty surrounding future economic direction can all contribute to a weaker GBP. Confidence in the UK’s political leadership and their ability to manage the economy is crucial for maintaining the pound’s strength. Any perceived lack of stability can lead to capital flight and a decline in the currency’s value.

Global Geopolitical Risks

Global events, such as the war in Ukraine and rising geopolitical tensions, can also indirectly impact the GBP. These events often lead to increased risk aversion among investors, who tend to flock to safe-haven currencies like the US dollar. This increased demand for the dollar can further weaken the GBP against the USD. [See also: Impact of Geopolitics on Currency Markets]

Interest Rate Differentials and Monetary Policy

The relative interest rates between the UK and other major economies play a critical role in determining currency values.

Bank of England’s Monetary Policy

The Bank of England’s (BoE) monetary policy decisions, particularly regarding interest rates, have a direct impact on the GBP. When the BoE raises interest rates, it typically makes the pound more attractive to foreign investors seeking higher returns. However, if the BoE is perceived as being too slow to raise rates or if it signals a potential pause in rate hikes, the GBP may weaken. The market’s expectation of future interest rate movements is a key driver of currency valuations.

Interest Rate Differentials with Other Central Banks

The difference in interest rates between the UK and other major economies, such as the United States and the Eurozone, is a crucial factor. If the US Federal Reserve is raising interest rates more aggressively than the Bank of England, it can make the US dollar more attractive relative to the GBP, leading to a decline in the pound’s value. These interest rate differentials influence capital flows and currency valuations.

Market Sentiment and Investor Confidence

Ultimately, the value of the GBP is influenced by market sentiment and investor confidence.

Risk Aversion and Safe-Haven Demand

During times of economic uncertainty or global crises, investors tend to become more risk-averse and seek safe-haven currencies like the US dollar, Swiss franc, and Japanese yen. This increased demand for safe havens can lead to a decline in the value of riskier currencies like the GBP. Market sentiment plays a significant role in driving short-term currency movements.

Speculative Trading and Market Positioning

Speculative trading by hedge funds and other institutional investors can also influence the GBP’s value. Large trading positions based on expectations of future currency movements can amplify price swings. Market positioning, or the net long or short positions held by traders, can provide insights into the prevailing sentiment towards the GBP. [See also: Currency Trading Strategies for Beginners]

Conclusion: Navigating the Challenges Facing the Pound

The falling GBP is a complex issue driven by a confluence of economic, political, and global factors. High inflation, recession fears, Brexit-related uncertainties, and interest rate differentials all contribute to the pound’s weakness. Understanding these factors is crucial for businesses, investors, and policymakers alike. While the future trajectory of the GBP remains uncertain, monitoring these key drivers will provide valuable insights into its potential direction. The strength of the British pound is a reflection of the overall health and stability of the UK economy, and addressing the underlying challenges will be essential for restoring confidence in the currency.

In summary, why GBP is falling can be attributed to a combination of economic headwinds, including inflation and recession risks, political instability stemming from Brexit and government policies, and global factors such as geopolitical tensions and interest rate differentials. The interplay of these elements creates a challenging environment for the British pound.