Why is the Pound Falling? Understanding the Factors Behind Sterling’s Decline

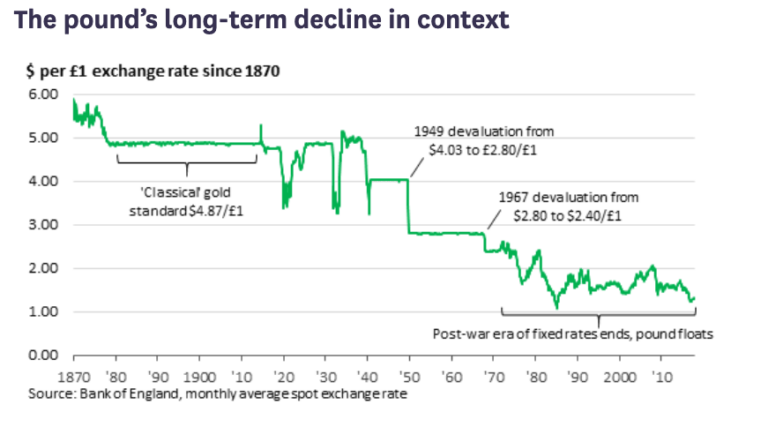

The British pound, often referred to as sterling, is a major global currency. Its value reflects the economic health and stability of the United Kingdom. Recently, the pound has experienced significant volatility and a downward trend against other major currencies like the US dollar and the euro. Understanding why the pound is falling requires a multifaceted analysis encompassing economic indicators, political developments, and global market sentiment.

This article will delve into the key factors contributing to the pound’s depreciation, providing a clear and concise overview of the current situation. We’ll examine the economic pressures, political uncertainties, and global events that are collectively impacting the value of sterling. By understanding these dynamics, individuals and businesses can better navigate the complexities of the foreign exchange market and make informed decisions.

Economic Factors Driving the Pound’s Weakness

Several economic factors are contributing to why the pound is falling. These range from domestic issues like inflation and economic growth to international factors influencing the UK’s trade and investment climate.

Inflation and Interest Rates

Inflation is a key driver of currency value. When inflation rises, the purchasing power of a currency decreases. The UK has been grappling with persistently high inflation, exceeding the targets set by the Bank of England. This high inflation erodes the value of the pound. [See also: UK Inflation Rate Analysis] To combat inflation, central banks typically raise interest rates. Higher interest rates can attract foreign investment, increasing demand for the currency and potentially strengthening it. However, the Bank of England’s approach to interest rate hikes has been perceived by some as cautious, failing to aggressively curb inflation, leading to a lack of confidence in the pound.

Economic Growth and Recession Fears

The UK’s economic growth has been sluggish, and there are growing fears of a recession. Slow economic growth weakens investor confidence and reduces demand for the pound. Concerns about a potential recession further exacerbate the situation, as investors seek safer havens for their capital, often moving away from the pound and towards currencies like the US dollar.

Trade Deficit

The UK has a persistent trade deficit, meaning it imports more goods and services than it exports. This deficit puts downward pressure on the pound, as more pounds are needed to purchase foreign goods and services than are being earned through exports. A large trade deficit indicates that the UK is reliant on foreign capital inflows to finance its consumption, making it vulnerable to currency depreciation if those inflows dry up.

Political Factors Affecting the Pound

Political events and policy decisions can significantly impact currency values. The UK has experienced considerable political instability in recent years, which has contributed to the why the pound is falling.

Brexit and its Aftermath

The decision to leave the European Union (Brexit) has had a profound and lasting impact on the UK economy and the value of the pound. Brexit created uncertainty about the UK’s future trade relationships, investment flows, and regulatory environment. The complexities of negotiating new trade deals and adapting to life outside the EU have weighed heavily on the pound. Lingering concerns about the long-term economic consequences of Brexit continue to contribute to the currency’s weakness. [See also: Brexit Impact on UK Economy]

Government Policy and Fiscal Responsibility

Government policies, particularly those related to fiscal spending and taxation, can influence investor confidence and currency values. Recent government policies, such as unfunded tax cuts, have raised concerns about the UK’s fiscal responsibility and debt sustainability. These concerns have spooked investors and contributed to a sharp decline in the pound. The perception of fiscal irresponsibility can lead to a loss of confidence in the government’s ability to manage the economy, further weakening the currency. The market reaction to these policies demonstrates how sensitive the pound is to perceived mismanagement of the UK’s finances.

Political Instability

Political instability, including frequent changes in leadership and policy direction, can create uncertainty and undermine investor confidence. The UK has experienced a period of political turbulence, with multiple changes in Prime Minister and significant shifts in government policy. This instability makes it difficult for businesses to plan for the future and can deter foreign investment, putting downward pressure on the pound. A stable political environment is crucial for maintaining investor confidence and supporting a strong currency.

Global Factors Influencing the Pound’s Value

The value of the pound is also influenced by global economic and political events. These external factors can amplify the impact of domestic issues and contribute to the why the pound is falling.

Strength of the US Dollar

The US dollar is the world’s reserve currency, and its strength often acts as a counterweight to other currencies. When the US dollar strengthens, other currencies, including the pound, tend to weaken. Factors such as rising US interest rates and strong US economic data can drive demand for the dollar, putting downward pressure on the pound.

Global Economic Slowdown

A global economic slowdown can negatively impact the UK economy and the value of the pound. Reduced global demand for UK exports can worsen the trade deficit and weaken economic growth. Furthermore, a global recession can lead to risk aversion, with investors seeking safer assets like the US dollar, further depressing the pound.

Geopolitical Risks

Geopolitical risks, such as international conflicts and political tensions, can also affect currency values. Uncertainty about the global outlook can lead to risk aversion and a flight to safety, with investors moving away from riskier assets like the pound and towards safer havens like the US dollar or gold. The war in Ukraine, for example, has created significant uncertainty and contributed to the pound’s weakness.

Potential Consequences of a Weak Pound

A weak pound has several potential consequences for the UK economy and its citizens.

- Increased Import Costs: A weaker pound makes imports more expensive, leading to higher prices for consumers and businesses. This can exacerbate inflation and reduce living standards.

- Higher Inflation: As import costs rise, businesses may pass these costs on to consumers, leading to higher inflation. This can erode purchasing power and reduce economic growth.

- Reduced Purchasing Power: A weaker pound reduces the purchasing power of UK consumers when they travel abroad or buy goods and services from overseas.

- Potential Benefits for Exporters: A weaker pound can make UK exports more competitive, potentially boosting export volumes. However, this benefit may be offset by higher import costs for businesses that rely on imported inputs.

What Can Be Done to Strengthen the Pound?

Strengthening the pound requires a combination of policy measures aimed at addressing the underlying economic and political factors contributing to its weakness.

- Tackling Inflation: The Bank of England needs to take decisive action to bring inflation under control. This may involve further interest rate hikes and other monetary policy measures.

- Promoting Economic Growth: The government needs to implement policies that promote sustainable economic growth. This could involve investing in infrastructure, supporting innovation, and reducing regulatory burdens.

- Fiscal Responsibility: The government needs to demonstrate fiscal responsibility by managing its budget effectively and reducing debt. This can help to restore investor confidence and support the pound.

- Political Stability: A stable political environment is crucial for maintaining investor confidence and supporting a strong currency.

- Improving Trade Relationships: The UK needs to strengthen its trade relationships with other countries to boost exports and reduce the trade deficit.

Conclusion: Navigating the Pound’s Challenges

Understanding why the pound is falling requires a comprehensive analysis of economic, political, and global factors. The pound’s weakness reflects a combination of domestic challenges, such as high inflation and slow economic growth, and external pressures, such as the strength of the US dollar and global economic uncertainty. Addressing these challenges requires a coordinated effort from the government and the Bank of England to implement policies that promote economic stability, fiscal responsibility, and investor confidence. While the short-term outlook for the pound remains uncertain, a long-term strategy focused on sustainable economic growth and sound fiscal management is essential for restoring its value and ensuring the UK’s economic prosperity. [See also: Future of the British Pound]

The complexities surrounding the pound’s depreciation highlight the interconnectedness of global finance and the importance of understanding the various factors that influence currency values. Keeping abreast of these developments is crucial for individuals and businesses alike to make informed financial decisions in an increasingly volatile world. The reasons behind why the pound is falling are multifaceted and require constant monitoring and adaptation to the evolving global landscape.